Understanding Culture, Identity, Bias, and Diversity in the Workplace

This presentation highlights the importance of understanding culture, identity, bias, and their impacts in the workplace. Through courageous conversations and diversity training, participants learn to unpack implicit bias, combat bias, and develop teamwork skills. The session emphasizes staying enga

0 views • 19 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Understanding and Avoiding Bias in Evidence-Based Responses

Recognizing bias in oneself and others is crucial when collecting evidence. Different types of bias, such as confirmation bias, can influence decisions and behaviors significantly. By exploring our own thinking and accessing curated resources to learn about bias, we can develop a deeper understandin

1 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Recognizing Hidden Bias in the Workplace

In the workplace, hidden bias, also known as implicit bias, can significantly impact hiring, employment decisions, and overall workplace dynamics. Deloitte's 2019 State of Inclusion Survey revealed that a substantial percentage of workers experienced bias at least monthly. Hidden biases can be based

3 views • 18 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Overcoming Unconscious Bias in Talent Acquisition Process

Overcoming Unconscious Bias in Talent Acquisition Process emphasizes the importance of addressing unconscious bias in hiring practices through awareness and control. The content delves into defining unconscious bias, its impact on diversity, examples, and strategies for managing bias. The University

0 views • 19 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Understanding and Utilizing Bias in Legal Proceedings

Exploring the complexities of bias in legal settings, this content provides insights on identifying, addressing, and leveraging bias in litigation. From defining various forms of bias to strategies for cross-examination and case presentation, it equips legal professionals with practical knowledge to

0 views • 19 slides

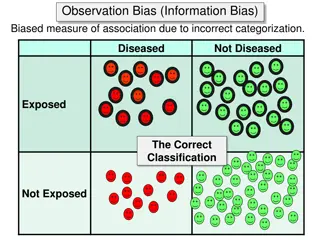

Types of Bias in Epidemiological Studies

Bias in epidemiological studies can arise from misclassification of observations and exposures, leading to incorrect associations between variables. Observation bias, misclassification bias, and non-differential misclassification can impact the accuracy of study results, either minimizing difference

1 views • 11 slides

Understanding Diode Junction Biasing: Zero and Forward Bias Conditions

In the world of electronics, diode junction biasing plays a crucial role. This article delves into the concepts of zero and forward bias conditions for diodes. When a diode is zero-biased, no external potential energy is applied, while in forward bias, a specific voltage is introduced to initiate cu

0 views • 21 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Is Your Analytics Software Lying to You_ How to Spot and Correct Data Bias

Data bias can distort your analytics and lead to misguided decisions. In this blog, learn how to identify common signs of data bias, understand its impacts, and explore effective strategies to correct it. Enhance the accuracy and reliability of your insights with practical tips and advanced tools, e

3 views • 8 slides

Understanding Implicit Bias in Medical Education

Delve into the origins, forms, and manifestations of bias in clinical and medical education settings. Learn strategies to mitigate and address bias through a detailed exploration of terms like System 1 and System 2 thinking, implicit bias, race/racism, sexism, microaggressions, and more. Gain insigh

6 views • 27 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Understanding Transistor Bias Circuits for Linear Amplification

Transistor bias circuits play a crucial role in setting the DC operating point for proper linear amplification. A well-biased transistor ensures the signal variations at the input are accurately reproduced at the output without distortion. Various biasing methods such as Voltage-Divider Bias, Emitte

0 views • 7 slides

Managing Reporting Bias in Systematic Reviews - Strategies and Consequences

Reporting bias poses a significant threat to the accuracy of systematic reviews, with publication bias affecting up to 50% of trials. This bias distorts treatment effect estimates, leading to exaggerated outcomes. Strategies to mitigate reporting bias include searching bibliographical databases, exp

1 views • 17 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Understanding Transition Bias and Substitution Models in Genetics

Transition bias and substitution models, explored by Xuhua Xia, delve into the concepts of transitions and transversions in genetic mutations, the causes of transition bias, the ubiquitous nature of transition bias in invertebrate and vertebrate genes, the mitochondrial genetic code, and RNA seconda

1 views • 25 slides

Gender Bias in STEM Faculty Recruitment

Research indicates that women are underrepresented among STEM faculty members, potentially due to bias in the search process. Studies show evidence of bias against women candidates in male-dominated fields like mechanical engineering, leading to lower hiring rates. Another study revealed bias in fac

0 views • 29 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Addressing Bias-Related Incidents at Concordia University

The report discusses bias reporting at Concordia University, highlighting the importance of understanding and addressing bias-related incidents. It covers examples of bias, distinction between bias incidents and hate crimes, and strategies for response. Presenters from the Office of Multicultural En

0 views • 11 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Addressing the Debt-Equity Bias: DEBRA Initiative Overview

DEBRA initiative aims to mitigate the tax-induced debt-equity bias in corporate investment decisions, reducing risks of insolvency and fostering competitiveness. By neutralizing the bias, it seeks to create a harmonized tax environment, promoting equity-based investments and combating tax avoidance

0 views • 9 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Addressing Implicit Bias in Medical School Admissions

Increased diversity in the healthcare workforce benefits health outcomes, but implicit bias can impact candidate selection in medical school admissions. This advocacy project aims to address implicit bias by developing training sessions for new members of the admissions committee at UNM SOM, focusin

0 views • 9 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Understanding Implicit Bias: Exploring Bias, Stereotypes, and Discrimination

Explore the concept of implicit bias through discussions about prior knowledge, feelings pre and post taking implicit association tests, and how this awareness can be applied beneficially in personal and classroom settings. Definitions of implicit bias, stereotypes, prejudice, and discrimination are

0 views • 21 slides

Understanding Cost Overruns in Projects: Systematic Bias vs. Selection Bias

Cost overruns in projects can be attributed to systematic bias, like optimism bias and strategic misrepresentation, or selection bias where projects with low estimated costs are more likely to be selected leading to underestimation. Mitigating these biases is crucial for accurate project budgeting a

0 views • 21 slides

Understanding Experimenter Bias in Research Studies

Experimenter bias occurs when researchers introduce their own biases into an experiment, potentially impacting the outcome. This bias can manifest in various ways, such as manipulating results or selecting participants who confirm preconceived notions. Through examples in studies about toddler sleep

0 views • 9 slides

Investigating Bias in Newspaper Articles through Natural Language Processing

The project, mentored by Jason Cho and advised by Professor Eric Meyer, focuses on automatic bias detection in newspaper articles. It involves recognizing similar article topics and detecting bias using tools like OpenNLP and Python NLTK. The endeavor aims to uncover words correlated with bias and a

0 views • 5 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)