2023 Tax Legislation Overview

The presentation by National Treasury and SARS outlines the 2023 tax bills and legislative process. It covers adjustments in values, updates on tax rates, implementation of carbon tax, incentive reviews, and more. The content details various tax bills, including the Rates Bill, Revenue Laws Amendmen

2 views • 80 slides

Understanding Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Enhancing Tax Compliance: Factors, Audit, and Investigation" (56 characters)

Exploring factors influencing taxpayer behavior towards tax compliance, this study delves into the impact of tax audit and investigation procedures on adherence to tax laws at both corporate and individual levels. Previous research gaps are identified and addressed to provide a comprehensive underst

1 views • 20 slides

Lowering the Burden: Tax Deduction Strategies for NRIs in England from India

Discover efficient tax deduction strategies tailored for Non-Resident Indians (NRIs) residing in England but originating from India. Our comprehensive guide, 'Lowering the Burden,' explores nuanced tax-saving approaches, ensuring NRIs maximize benefits while meeting legal obligations. From understan

4 views • 3 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Understanding Post-Election Risk-Limiting Audits in Indiana

Indiana's post-election audits, overseen by the Voting System Technical Oversight Program, utilize statistical methods to verify election outcomes, ensuring accuracy and reliability in the electoral process. The VSTOP team, led by experts in various fields, conducts audits based on Indiana Code IC 3

0 views • 12 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Understanding International Inheritance Tax Rules

In the realm of international property and succession law, different legal systems like Common Law and Civil Law govern how inheritance tax applies to individuals with assets in multiple countries. For French residents, navigating French succession tax on worldwide assets is crucial, while non-Frenc

2 views • 27 slides

Understanding GMP Audits in Construction: Navigating Client Expectations

This presentation at the National Association of Construction Auditors' virtual conference focuses on helping clients grasp the key objectives and processes of Guaranteed Maximum Price (GMP) audits. Dave Potak, a seasoned professional, will share insights on managing client expectations, best practi

0 views • 18 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Common Failures in Tax Audits and Best Judgment Assessments

Weaknesses in tax audits and best judgment assessments can result in serious consequences for tax entities. Issues such as poor audit practices by consultants and inaccuracies in best judgment approaches can lead to legal disputes and financial losses. Understanding these common points of failure is

0 views • 12 slides

Understanding Wireless Security Audits and Best Practices

Explore the world of security audits with a focus on wireless networks. Learn about the types of security audits, best practices, and the steps involved. Discover the importance of systematic evaluations, identifying vulnerabilities, establishing baselines, and compliance considerations. Dive into t

0 views • 14 slides

Understanding Departmental Audits in GST

Departmental audits in GST involve the examination of records, returns, and other documents to verify the correctness of turnover declared, taxes paid, refunds claimed, and input tax credit availed. This audit ensures compliance with the provisions of the CGST Act, 2017. Types of audits under GST in

7 views • 27 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Worried About IRS Audits? Here’s How SAI CPA Services Can Help You Avoid Them!

IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported in

3 views • 2 slides

Understanding Single Audits in Federal Grant Programs

Audits play a crucial role in ensuring accountability in Federal grant programs. Single Audits, being the most common type, combine financial and compliance audits into one report. Learn about threshold determinations, risk-based approaches, and key changes in the Uniform Guidance through this compr

0 views • 26 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Safety Management Overview and Audits Report

Explore a detailed report on safety management practices, audits findings, and actionable insights in the BSEE office. Learn about prior audits, SEMS evaluations, CAP verification, and more. Dive into SEMS subpart O audits and API RP 75 guidelines for a comprehensive understanding of safety protocol

0 views • 18 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Recent Developments in State and Local Tax Litigation

Explore recent significant litigation cases in state and local tax law, including rulings on sales/use/lease taxes, exclusions for specific purchases, and tax audits. The cases discussed cover various tax-related disputes and decisions made by the Louisiana Supreme Court, shedding light on the evolv

0 views • 22 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Understanding the Impact of Audits on Post-Audit Tax Compliance

Audits have direct and indirect effects on taxpayers, influencing compliance behaviors. While more audits generally lead to increased compliance, outcomes can be ambiguous, with some studies showing a decline in post-audit compliance. Behavioral responses to tax audits are driven by perceived risks

0 views • 15 slides

Impact of Audits on Tax Compliance: Insights from Research Studies

Studies conducted by researchers such as Erich Kirchler have explored the impact of audits on tax compliance. While audits generally have a positive effect on compliance, there are cases where they can backfire, leading to unintended consequences. High auditing levels may not always deter tax evasio

0 views • 14 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

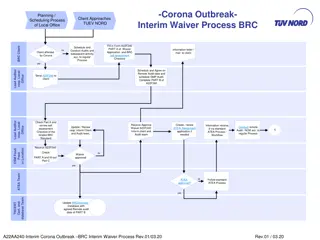

Interim Waiver Process for BRC Audits During Corona Outbreak

This content outlines the interim waiver process and scheduling procedures for local office client audits during the Corona outbreak. It includes steps for completing waiver applications, conducting remote audits, and handling certification extensions. The document also provides guidelines for remot

0 views • 11 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Supporting SAIs in Auditing SDGs: Reflections and Plans

SAIs play a crucial role in auditing SDGs to ensure high-quality audits of partnerships. Various SAIs and funding partners are actively involved in supporting this initiative. The story so far includes audits of preparedness and implementation of SDGs, with performance audits supporting 73 SAIs and

0 views • 14 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Food Industry Perspective on 3rd Party Audits and Regulatory Inspections

Overview of regulatory inspections and 3rd party audits in the food industry from the perspective of Tim Ahn, Global Director of Quality & Food Safety at Mars Chocolate. The content covers the importance of inspections, differences between inspections and audits, and the role of audits in driving qu

0 views • 12 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)