Understanding Medicare and Long-Term Care Coverage Options

Health Insurance Counseling and Advocacy Program (HICAP) and Legal Assistance for Seniors (LAS) offer free services to help seniors understand and navigate Medicare, long-term care, and related legal issues. LAS supports seniors' independence and dignity by providing assistance with government benef

2 views • 67 slides

Medicare Advantage Plan Payment Rate Trends Over the Past Decade

Analyzing the annual percentage changes in national per capita Medicare Advantage growth rates over the past decade reveals fluctuations in payment rates, with an average annual growth rate of 2.87%. The data reflects the evolving landscape of Medicare Advantage plan payments and policy updates. Thr

0 views • 5 slides

Medicare Advantage Enrollment Trends and Payment Mechanisms

Medicare Advantage enrollment has significantly increased in the past decade, with payments being determined by benchmarks, bids, and quality incentives. The prevalence of chronic conditions is comparable between Traditional Medicare and Medicare Advantage, excluding Special Needs Plans. Dual-eligib

2 views • 5 slides

Navigating Medicare: Your Rights and Options

Understand the ins and outs of Medicare, your entitlements, and how to cover out-of-pocket costs. Learn about the basics of Medicare, your enrollment options, and the importance of timely enrollment. Discover the four parts of Medicare and the role of Medigap insurance.

0 views • 24 slides

Seniors' Experiences with Medicare Marketing and Fraud

During Medicare open enrollment, seniors age 65 and older receive numerous solicitations about plan choices through phone calls, mailings, emails, and advertisements. The frequency of these marketing efforts varies, with some seniors reporting misleading information and fraudulent practices by marke

1 views • 10 slides

Can Medicare Beneficiaries Afford Their Health Care? Findings from Commonwealth Fund 2023

Americans with Medicare face challenges affording health care, with many struggling to pay for essential health services. The Commonwealth Fund 2023 survey reveals that a significant portion of Medicare beneficiaries find it difficult to afford health care costs, leading to delays in necessary care

1 views • 10 slides

PROPERTY TAXES 101

Property taxes in Ohio are levied in mills, with a mill equaling $1 in taxes for every $1,000 of assessed property value. The base tax of 10 mills is applied to all residents, with additional taxes requiring voter approval. House Bill 920 controls property tax growth, ensuring revenue remains steady

0 views • 10 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Understanding Taxes and Government Spending: A Comprehensive Overview

This comprehensive overview delves into the fundamental concepts of taxes and government spending. It covers topics such as the definition of taxes, the power of Congress to tax, limits on taxation, tax structures, characteristics of a good tax, and the burden of taxes. Exploring these concepts prov

1 views • 29 slides

Medicare Prescription & Outpatient Drugs Data Analysis October 2022

Enrollment in Medicare stand-alone prescription drug plans slightly declined between 2020 and 2021. The rates of enrollment vary between rural and urban states, with higher enrollment in rural states with low Medicare Advantage rates. Across counties, enrollment in prescription drug plans ranges fro

1 views • 13 slides

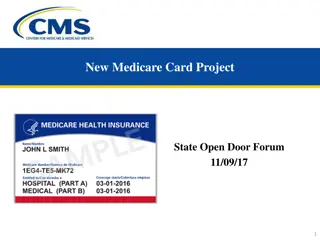

Important Updates on the New Medicare Card Project

The New Medicare Card Project is nearing completion, with significant changes coming into effect from January 1, 2020. Beneficiaries are advised to use their new Medicare cards, protect their Medicare number, and take necessary steps to ensure smooth transitions. Key points reinforce the importance

0 views • 19 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Understanding Retirement Benefits: Social Security and Medicare Overview

This content provides valuable information from an open forum on retirement benefits, covering topics such as Social Security, Medicare, and what happens to benefits when leaving a job. It includes details on Social Security retirement benefits based on age, statements, contact info, and an overview

0 views • 37 slides

Understanding Social Security and Medicare in Advanced Financial Algebra

Social Security and Medicare are essential components of financial planning, providing income for retirees and healthcare coverage for seniors. Learn how these programs work, calculate payroll withholdings, and explore piecewise functions related to Social Security taxes. Dive into real-world exampl

0 views • 10 slides

Overview of Social Security and Health Care System in Turkey

The social security system in Turkey comprises three main organizations: Social Insurance Institution (SGK/SSK), Social Security Institution for the Self-employed (Bag-Kur/SISE), and Pension Fund for Civil Servants (Emekli Sandigi). Hospitals in Turkey are dispersed among various social security and

7 views • 42 slides

Scott Joyce: Your Go-To Expert for Medicare 101 in St. Louis

Medicare 101 St. Louis, is a comprehensive introduction to the Medicare program, designed to educate you on the various parts of Medicare, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (pr

3 views • 2 slides

Understanding Federal Taxes in the United States

Explore the key aspects of federal taxes in the United States, including individual and corporate income taxes, Social Security, Medicare, and unemployment taxes. Learn about tax brackets, withholding, tax returns, and more. Discover the economic importance of taxes and how they support the function

1 views • 15 slides

Evolution of Legal Process Taxes in County Clerk Offices

Explore the historical progression of legal process taxes related to marriage licenses, property conveyance, and other transactions as mandated by KRS 142.010. Delve into the changes in tax rates and base over time, along with the reliance on these taxes for revenue generation. The receipts of legal

0 views • 9 slides

The Impact of Cigarette Taxes and Indoor Air Laws on Prenatal Smoking and Infant Death

This study examines the effects of cigarette taxes and indoor air laws on prenatal smoking and infant death. It discusses how cigarette taxes can increase smoking cessation during pregnancy and reduce the probability of smoking, while comprehensive smoking bans can decrease the likelihood of smoking

1 views • 27 slides

Overview of U.S. Prescription Drug Spending and Medicare Part D

U.S. prescription drug spending data from 2005 to 2025 shows trends in various payer contributions, with predictions for future years. Medicare Part D's drug spending is broken down, revealing top drugs and rebate percentages. The total Medicare spending in 2015 and average annual growth in Medicare

0 views • 10 slides

Prescription Drug Coverage in Medicare Enrollees with Chronic Kidney Disease

This report delves into the sources and parameters of prescription drug coverage in Medicare enrollees with chronic kidney disease (CKD) for the years 2010 to 2015. It explores the trends in Medicare Part D enrollment, out-of-pocket costs, and catastrophic coverage benefits. The data presented sheds

0 views • 20 slides

DePauw University Medicare Benefits Program Overview

This presentation details the DePauw University Medical & Rx Benefits Program for Medicare retirees, presented by Justin Goodwin from Amwins Group Benefits. It covers the agenda for the day, introduction to the program, information about Amwins Group Benefits, DePauw University's role in the Medicar

0 views • 39 slides

Navigating Medicare and Employer Insurance Overlap

Individuals near Medicare eligibility while working or retired often seek HR guidance. However, HR may lack expertise on Medicare interaction, leading to gaps in coverage, penalties, and limitations. To avoid these issues, it's crucial to understand the client's employment status, Medicare eligibili

0 views • 36 slides

Comprehensive Overview of CompanionCare Medicare Supplement Plan

Explore the benefits and coverage provided by the CompanionCare Medicare Supplement Plan effective January 1, 2021. Learn about the plan's offerings, enrollment criteria, and details on Medicare co-pays, coinsurance, and out-of-pocket expenses. Gain insights into who is eligible, moving to Companion

0 views • 12 slides

Understanding Medicare Coverage and Benefits for 2022

Explore key aspects of Medicare including eligibility, coverage, costs, and additional options for more coverage. Get insights on Medicare Part D, what Medicare covers, and what it doesn't. Find details on benefit decisions for individuals aged 65 and above, actively working retirees, and surviving

0 views • 10 slides

The Impact of Retiree Health Costs on Medicare and Medicaid Programs

This content discusses how retiree health costs affect individuals and government programs, specifically focusing on the rising Medicare and Medicaid spending projections. It highlights the challenges posed by out-of-pocket expenses for retirees and the gaps in Medicare coverage that contribute to h

0 views • 11 slides

Understanding Medicare Reimbursement and Inpatient Services in Short Stay Acute Care Facilities

Short stay acute care facilities, also known as hospitals, play a critical role in delivering inpatient and outpatient services to patients. Understanding Medicare reimbursement policies, such as billing for Medicare Part A (IPPS) for inpatient services and Medicare Part B (OPPS) for outpatient serv

0 views • 35 slides

Understanding Medicare Advantage Plans - Overview & Benefits

Dive into the comprehensive overview of Medicare Advantage Plans, covering the history of Medicare, Medicare ABCDs, enrollment periods, service areas, and product details for 2022. Learn about the different parts of Medicare, including Part A which covers inpatient care, Part B for physician service

0 views • 31 slides

Composition of Ohio's State and Local Taxes Revealed

Ohio relies heavily on sales taxes for state and local government tax revenue. In FY 2019, Ohio's combined state and local tax revenue sources included property taxes, individual income tax, and sales taxes. Sales taxes accounted for the highest percentage of revenue, followed by property taxes and

0 views • 4 slides

Understanding State and Local Sales and Income Taxes

Delve into the intricacies of state and local sales and income taxes in Lecture 10 of State and Local Public Finance. Explore topics such as efficiency, equity, administrative issues, design of federal tax, link to state income taxes, and design of local income taxes. Uncover how sales taxes create

0 views • 42 slides

Medicare Beneficiary Identification Initiative Overview

The Social Security Number Removal Initiative (SSNRI) aims to enhance Medicare beneficiary protection by replacing SSN-based Health Insurance Claim Numbers with new Medicare Beneficiary Identifiers (MBIs). This initiative mandates the issuance of redesigned Medicare cards by April 2019, minimizing i

0 views • 16 slides

Importance of Recurrent Property Taxes for Fiscal Sustainability

Recurrent property taxes play a crucial role in enhancing fiscal sustainability by reducing dependency on inter-governmental transfers, increasing local government accountability, and promoting equity in taxation. This article discusses the benefits of recurring property taxes, emphasizes the need f

0 views • 19 slides

Understanding the Role of Medicare Beneficiary Ombudsman

Explore the vital role of the Medicare Beneficiary Ombudsman in addressing beneficiary inquiries, providing education, and recommending improvements in Medicare administration. Discover when to contact the Ombudsman for systemic issues, research topics, or feedback on Medicare experiences, including

0 views • 14 slides

Handling Medicare Set-Asides: Key Considerations and Compliance Updates

This comprehensive guide covers essential aspects of managing Medicare Set-Asides, including eligibility criteria, confirming Medicare status, compliance with the Medicare Secondary Payer Act, potential penalties for errors in reporting, and strategies to avoid violating the MSP statute. Stay inform

0 views • 59 slides

Understanding Medicare: A Guided Tour for Beneficiaries

Explore Medicare eligibility, enrollment, benefits, and more in this comprehensive program designed for beneficiaries, advocates, and curious citizens. Get informed, engage effectively, and seek expert help to navigate the Medicare system with confidence. Join us on December 5, 2023, for a guided to

0 views • 68 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

Property Taxes and Local Decision-Making in Texas

Texas relies on property taxes and sales taxes as major revenue sources for state and local government funding. The majority of property taxes fund public schools, with the burden increasing due to unfunded mandates from the Texas Legislature. Student funding is impacted by property value growth, be

0 views • 24 slides

Understanding Medicare: Coverage Options and Enrollment Details

Medicare is a federal health insurance program catering to individuals aged 65 and older, those with certain disabilities, end-stage renal disease, or ALS. It offers different coverage options including Part C Medicare Advantage Plans. Enrollment details, premiums, and benefits such as hospital insu

0 views • 55 slides

Trends in Iowa Property Taxes: Past and Future

Property taxes in Iowa have decreased as a source of local revenue over the years. The decline is more significant when looking at own-source revenue excluding state and federal grants. Other revenue sources like charges and sales taxes have become more important. Different trends are observed for c

0 views • 18 slides

Revamping Medicare Card System for Improved Security

The Medicare Access and CHIP Reauthorization Act of 2015 initiated a project to replace Social Security Number-based Health Insurance Claim Numbers with unique Medicare Beneficiary Identifiers. The primary goal is to reduce beneficiary vulnerability to identity theft. The project involves operationa

0 views • 27 slides