Scheme of Arrangement under the Companies Act, 1956

The changes introduced in the existing procedures for stock exchanges and listed companies regarding the scheme of arrangement under the Companies Act, 1956. It covers the submission of draft schemes, display on websites, changes in internal procedures, court process, approval of shareholders, and i

4 views • 16 slides

Overview of PT Mitra Harmoni Insurance Broker

PT Mitra Harmoni Insurance Broker is a leading insurance brokerage company with a history of growth and recognition in the industry. Established in 2007, the company has achieved top rankings and memberships in key associations, demonstrating its commitment to excellence. The company's shareholders,

0 views • 17 slides

High-Quality Small-Cap Gold Explorer in Nevada Investor Overview February 2023

This investor overview highlights a high-quality small-cap gold explorer in Nevada, showcasing key features such as its gold jurisdiction, scalable operations, proven track record, and strategic location in Nevada. The company boasts a successful discovery track record in a district with approximate

0 views • 16 slides

Understanding the Business Environment and its Elements

The business environment encompasses the internal and external factors that impact a firm's operations. It includes customers, suppliers, competitors, shareholders, financial institutions, and employees. To succeed, businesses must adapt to changes in their environment and strive to meet customer ex

9 views • 12 slides

Financial Impacts of Electric Vehicles on Utility Ratepayers and Shareholders

Analysis funded by the U.S. Department of Energy examines the effects of electric vehicle adoption on utility finances, including ratepayer and shareholder impacts. The study delves into customer EV adoption, utility revenue collection, and investment value. Various charging strategies and utility c

0 views • 21 slides

Understanding Primary Market Rights Issue in Securities Market

Rights issue in the primary market allows existing shareholders to purchase additional securities at a discounted price. This presentation covers the overview, types of securities offered, key terms, key documents, application processes, and allotment status. It is intended for educational purposes

0 views • 35 slides

Types of Shares: Ordinary and Preference Shares in Equity Investments

Equity capital in a company is comprised of ordinary and preference shares. Ordinary shares represent full risk and reward for shareholders, who can vote on resolutions and receive dividends. Preference shares offer specific features like cumulative or participating dividends, non-voting rights, and

0 views • 4 slides

Establishment of East India Company: Historical Overview and Legislative Powers

British rule in India started with the trading of spices by European nations in the 15th century. The English East India Company was granted exclusive trading rights in Africa, Asia, and America, eventually becoming a political force. Queen Elizabeth I granted a charter in 1600, giving the Company l

0 views • 5 slides

Liquidation of Companies: Procedures as per IBC 2016

The process of liquidating a company involves collecting and selling its assets to pay off debts, with remaining funds distributed to shareholders. Under the Insolvency and Bankruptcy Code (IBC) 2016, specific procedures must be followed, including initiation by either creditors or debtors within se

0 views • 16 slides

Proper Conduct of Meeting and Voting Rules

Proper conduct of a meeting is essential for ascertaining the sense of the participants. Various methods such as acclamation, voice vote, division, show of hands, ballot, and poll can be used to determine the wishes of members. Rules for voting by equity shareholders, preference shareholders, holder

0 views • 14 slides

Understanding Financial Management Principles

Financial management involves planning, organizing, controlling financial resources, and finding sources for raising funds. It includes functions such as estimating financial requirements, decision-making on capital structure and investment, cash management, and financial controls. The main objectiv

1 views • 25 slides

Understanding Business Organization Objectives

Explore the basic vocabulary of business organizations and learn how to compute financial responsibilities based on ratios and percents. Discover different business structures such as sole proprietorship, partnership, and corporation, and delve into concepts like shares of stock, shareholders, and l

0 views • 9 slides

Understanding Redemption of Preference Shares in Companies

Preference shares in companies offer preferential rights in dividend payments and capital repayment during liquidation. Redemption of preference shares involves returning the preference share capital to the shareholders. This process requires adherence to specific provisions under the Companies Act,

0 views • 25 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

3 views • 5 slides

Understanding Corporate Actions: Bonus, Stock Split, and Dividends

Explore the world of corporate actions including bonus issues, stock splits, and dividends in the securities market. Learn about bonus shares, dividend distribution, and their impacts on share prices and financial ratios. Discover the key concepts through informative visuals and explanations, and un

4 views • 16 slides

Understanding Majority Rule and Minority Protection in Company Law

The principle of majority rule applies to company management, where resolutions are passed by simple or three-fourth majority. The rule of supremacy of majority, established in the case of Foss v. Harbottle in 1843, dictates that courts do not typically interfere to protect minority shareholders. Sh

1 views • 11 slides

Understanding Capital Structure: Concepts, Planning, and Importance

Capital structure is crucial for maximizing shareholders' wealth through an optimal mix of equity and debt. Planning involves balancing risk, returns, and financial requirements, considering factors like return, cost, risk, control, flexibility, and capacity. The value of a firm is linked to earning

3 views • 20 slides

Understanding Shares: Types, Characteristics, and Meaning

Shares represent a portion of a company's capital. They are movable property with distinct numbers, issued as share certificates. Registration tracks shareholders' details, rights, and interests, forming part of passive property holdings. Explore equity and preference shares in depth.

3 views • 25 slides

Understanding Dividend Policy and Share Repurchase in Corporate Finance

Firms in corporate finance make decisions on dividend payouts and share repurchases, impacting company value and shareholder returns. Dividends are payments to shareholders, while share repurchases involve buying back company stock. Companies can choose between these methods based on various factors

1 views • 29 slides

Understanding Buyback of Securities and Open Offer of Shares

Buyback of securities is a corporate action where a company repurchases its own shares from existing shareholders, opposite of a public issue. Common reasons include returning surplus cash to shareholders, improving return on equity, and enhancing earnings per share. Conditions for buy-back include

0 views • 32 slides

Understanding Dividend Policy in Financial Management

Dividend policy in financial management involves decisions regarding the distribution of earnings to shareholders and retained earnings. It includes types of dividends, time of payment, and dimensions impacting the policy. Various dividend theories like Modigliani and Miller's Model, Walter's Model,

0 views • 34 slides

Benefits of RUDEVIT Investment: Diverse, Guaranteed, Patriotic, and Impactful

RUDEVIT Investment offers a unique opportunity for diversified, guaranteed investing in various sectors of the economy in Malawi. It de-risks itself through wholly owned subsidiary companies and ensures the technical guarantee of its shareholders. Investing in RUDEVIT promotes patriotism, unity, and

0 views • 5 slides

Negotiation and Drafting Strategies for Joint Ventures & Commercial Contracts

Dive deep into the fundamentals and practical aspects of negotiating and drafting commercial contracts, with a focus on joint ventures and shareholders' agreements. Join Madhavan Srivatsan, a seasoned Corporate Counsel, to enhance your skills in crafting effective contractual agreements for successf

1 views • 50 slides

Understanding Business Environment: Internal and External Factors

The business environment is shaped by a combination of internal and external factors that impact a company's operations. Internal factors like shareholders, management structure, and human resources are under the company's control, while external factors such as economic, social, technological, and

0 views • 12 slides

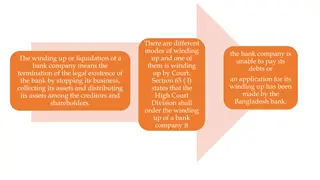

Winding Up of a Bank Company in Bangladesh: Legal Process and Circumstances

The winding up of a bank company in Bangladesh involves terminating its legal existence by ceasing its operations, realizing assets, and distributing them among creditors and shareholders. Section 65(I) of the law empowers the High Court Division to order winding up based on inability to pay debts o

1 views • 8 slides

Requisitioning a Resolution at a GSK Annual General Meeting" (60 characters)

Procedure for requisitioning a resolution at GlaxoSmithKline's Annual General Meeting (AGM) including requirements, eligibility, costs, key dates, and contacts. Shareholders can propose resolutions to address important matters to other shareholders. GSK has specific rules and deadlines for requisiti

0 views • 23 slides

Understanding New Issue Market in Finance

New issue market refers to the sale of securities by a company to the public for the first time. It involves various types/methods like public issues, preferential issues, and rights issues. Public issues include IPOs, FPOs, and FTIs. Preferential issues target select groups, while rights issues inv

0 views • 15 slides

Understanding ESOP Company Governance and Challenging Issues

Explore the roles of key players in ESOP company governance, from shareholders to directors and officers. Learn about the unique challenges faced by ESOP corporations, including tax incentives and trustee responsibilities. Gain insights from interactive examples and discussions on complex ESOP issue

1 views • 13 slides

Understanding the Role of Audit & Supervisory Board Members in Japan

Introduction to the roles and responsibilities of Audit & Supervisory Board Members appointed by shareholders in Japan. Explore the functions, powers, and activities of these members in auditing, supervising, and ensuring corporate governance. Learn about the different types of members and their con

2 views • 9 slides

Understanding Deadlock in Shareholders Disputes

Shareholders disputes leading to deadlock can be legally complex, potentially resulting in the winding up of a company. The concept of deadlock encompasses functional deadlock, based on the shareholders' inability to cooperate effectively, and irretrievable breakdown of trust and confidence. Differe

3 views • 16 slides

Can a company make a bonus issue of preference share

Bonus shares are a common way for companies to reward shareholders, but what if they could issue preference shares instead? Discover how this unique approach can benefit both the company and its equity shareholders, backed by legal provisions. Could

0 views • 2 slides

Understanding Common Stock Basics

Stocks represent ownership in a corporation, with common and preferred stock being the main types. Shareholders or equity owners have ownership rights, including voting at shareholders' meetings and receiving dividends. Common stock can have different classifications like Class A and Class B, each w

1 views • 50 slides

Understanding Common Stocks: Analysis & Valuation

Common stock represents ownership in a company, entitling shareholders to assets and earnings. Shareholders have rights such as electing the board of directors and limited liability. Common stocks are valued based on future cash flows. There are two main types of stocks: common and preferred. Valuat

0 views • 17 slides

Strategic Decision of Share Buyback in Corporate Finance

A buy-back is when a company repurchases its own shares, providing value to shareholders and optimizing its capital structure. It can be done via existing shareholders, the open market, or employee schemes. Changes in tax laws, effective from 1st Oct

0 views • 7 slides

Corporate Governance Structure and Shareholder Interests

The governance structure in business firms aims to address agency problems such as conflicts between owners and managers, controlling and minority shareholders, and different shareholders' constituencies. Various strategies like appointment rights and independent directors help mitigate these confli

0 views • 39 slides

Understanding Capital Structure and Financial Leverage in Corporate Finance

The capital structure of a firm involves deciding on the mix of debt and equity securities to meet financing needs, impacting market value and shareholder wealth. Financial leverage, or gearing, affects shareholders by altering the firm's value through debt-equity substitutions. The optimal policy m

0 views • 31 slides

Understanding Dividend Policy in Financial Management

Dividend policy plays a critical role in balancing long-term financing and shareholder wealth. It involves determining the distribution of profits among shareholders while retaining earnings for company growth. Approaches like Long Term Financing and Wealth Maximisation influence dividend decisions,

0 views • 24 slides

Understanding Different Types of Shares in a Company

Shares in a company represent ownership in its share capital, with different classes like preference shares and equity shares offering varying rights and benefits to shareholders. Preference shares can be further categorized into cumulative, non-cumulative, participating, non-participating, redeemab

0 views • 11 slides

Understanding Annual General Meetings in Company Law

An Annual General Meeting (AGM) is a significant yearly gathering of a company's shareholders where directors present financial reports and shareholders vote on key matters. This article discusses the importance, requirements, procedures, and penalties associated with AGMs in company law, comparing

0 views • 28 slides

Understanding Corporate Governance: Principles, Objectives, and Duties

Corporate governance is a system of principles and practices used to manage conflicts of interest in corporations. It ensures managers act in the best interest of shareholders. Key aspects include objectives to mitigate conflicts, ensure efficient asset use, and common sources of conflict like manag

0 views • 10 slides