Is the U.S Approaching Another Regional Bank Crisis

The U.S. Regional Bank Sector is under scrutiny amid concerns of a potential crisis, notably highlighted by New York Community Bancorp's (NYCB) recent challenges. NYCB's stock hit a 27-year low following revelations of undisclosed credit loss provisions, leading to shareholder lawsuits.

2 views • 7 slides

Capital Structure

An appropriate capital structure aims to maximize shareholder return, minimize financial risk, provide flexibility, ensure debt capacity is not exceeded, and maintain shareholder control. The optimum capital structure achieves a balance of equity and debt to maximize firm value.

1 views • 5 slides

Understanding Leverage and Operating Leverage in Financial Management

Leverage in financial management refers to using assets or funds with fixed costs to analyze the impact of debt and equity mix on shareholder returns and risk. Operating leverage focuses on leveraging fixed operating costs to amplify profit changes with sales variations, measured by the degree of op

2 views • 6 slides

Challenges and Negotiations Surrounding Companies Amendment Bills

The Select Committee on Trade and Industry addressed issues such as outdated legislation affecting South Africa's business environment. Negotiations at Nedlac resulted in compromises between business and labor interests. Criticisms were raised regarding corporate transparency, executive pay discrepa

0 views • 17 slides

Zoya Food Industry PLC - Creating Delicious Snacks in East Africa

Zoya Food Industry PLC is a company based in Pakistan and Ethiopia, specializing in the processing, manufacturing, and sale of Bubble Gums and Snacks under various brand names. With a focus on creating great-tasting, healthy, and organic snacks, the company aims to provide superior products and serv

1 views • 7 slides

University of Toledo Office of Community Engagement and Strategic Partnerships Presentation

Ms. Valerie Simmons-Walston, Special Advisor for Community Engagement and Strategic Partnerships, presents the University of Toledo's commitment to community engagement, its core values, and President Postel's vision for adapting and evolving to positively impact students, faculty, staff, and the co

4 views • 19 slides

Business to Business Marketing

Exploring the significance of corporate social responsibility, sustainability, and ethical frameworks in B2B strategic decision-making. Understanding shareholder, customer, supplier, and relationship values in business marketing strategy formulation. Differentiating between formal planned strategy a

6 views • 13 slides

Buyback of Shares in India under Companies Act & Tax Consideration

Explore the intricacies of share buybacks in India, from regulatory compliance under the Companies Act to tax considerations under the Income-tax Act. Discover how companies navigate legal frameworks to optimize surplus cash, enhance shareholder value, and strengthen promoter holdings through strate

6 views • 4 slides

Comparative Corporate Governance and Financial Goals in Multinational Business

Understanding the dynamics of Comparative Corporate Governance and Financial Goals in Multinational Enterprises (MNEs), exploring the significance of Shareholder Wealth Maximization, Stakeholder Capitalism, and the impact of cultural, governance, and financial differences on global financial managem

0 views • 20 slides

Financial Impacts of Electric Vehicles on Utility Ratepayers and Shareholders

Analysis funded by the U.S. Department of Energy examines the effects of electric vehicle adoption on utility finances, including ratepayer and shareholder impacts. The study delves into customer EV adoption, utility revenue collection, and investment value. Various charging strategies and utility c

0 views • 21 slides

Understanding Employee Engagement and its Impact on Workplace Performance

Employee engagement is crucial for organizational success as it reflects the emotional connection employees have with their work. It involves high levels of energy, dedication, and absorption at work, leading to enhanced productivity, performance, and a positive work environment. Engaged employees a

2 views • 34 slides

Understanding IPOs and the Primary Market

Explore the world of Initial Public Offerings (IPOs) in the primary market, covering topics such as application processes, shareholder rights, price discovery, and more. Learn about the objectives of the primary market, types of issuers and issues, utilization of funds, and the difference between pr

0 views • 49 slides

Understanding Different Types of Business Meetings in Corporate Governance

Directors of a company hold board meetings to exercise powers and functions efficiently. These meetings ensure effective supervision of the company. Board meeting procedures, quorum requirements, and delegation of powers to committees of directors are discussed. Class meetings for specific sharehold

0 views • 8 slides

Understanding Internal Reconstruction in Companies

Internal reconstruction in companies involves reorganizing the financial position without liquidation or forming a new entity. It aims to enhance profitability by aligning assets with true values. Methods include altering share capital, changing shareholder rights, and compromising with creditors. N

0 views • 19 slides

Overview of Capital IQ Transcripts: Data Collection and Coverage

The Capital IQ Transcripts package by Wharton Research Data Services provides historical conference call transcripts for approximately 8,000 public companies worldwide, covering various call types including earnings calls, shareholder/analyst calls, M&A calls, and more. The data collection process i

1 views • 15 slides

Financial Planning and Control in Business

Financial planning involves projecting sales, income, and assets to determine the resources needed to achieve goals. Financial control focuses on implementing plans, receiving feedback, and making adjustments. Growth should not be the sole goal; shareholder value creation is key. The percentage of s

0 views • 27 slides

Understanding Ratio Analysis in Financial Statements

Ratio analysis is a crucial process in interpreting financial statements by deriving accounting ratios from the balance sheet and profit and loss account. It involves assessing short-term liquidity, long-term solvency, activity ratios, and profitability ratios. Liquidity ratios like current ratio, q

2 views • 41 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

3 views • 5 slides

FPC Annual General Meeting & Shareholder Information Session Summary

The FPC Annual General Meeting featured introductory remarks by Chairman Mr. Michael Gallagher, followed by formal business resolutions and a shareholder information session by Mr. Angus Geddes. Key resolutions included the adoption of the Remuneration Report and the re-election of Director Mr. Mich

0 views • 26 slides

Understanding Dividend Policy and Share Repurchase in Corporate Finance

Firms in corporate finance make decisions on dividend payouts and share repurchases, impacting company value and shareholder returns. Dividends are payments to shareholders, while share repurchases involve buying back company stock. Companies can choose between these methods based on various factors

1 views • 29 slides

Business Doctors: Workshop on Business Growth Strategies

Explore the transformative workshop on business growth strategies by Business Doctors. Learn to work on your business effectively, setting clear goals, strategies, and action plans. Understand the importance of personal drivers, core values, and market knowledge for business success. Elevate your bu

0 views • 45 slides

Understanding Capital Expenditure Decisions in Financial Management

Capital expenditure decisions involve evaluating long-term investment projects in assets like buildings and machinery to maximize shareholder wealth. This process is crucial for businesses as it helps in increasing output, reducing costs, and providing contemporary goods to meet customer demands, ul

0 views • 16 slides

Sustainability in Supply Chain Management: Key Considerations and Benefits

Sustainable supply chain management is crucial for meeting sustainability criteria while staying competitive and addressing customer needs. It encompasses activities from raw materials to end-users, impacting aspects like product design, recycling, risk management, and shareholder value. By promotin

0 views • 20 slides

Practical Tips for ESG Litigation Strategies: Claimants and Defendants

Learn about constructing effective ESG litigation strategies with practical tips for both claimants and defendants. Explore topics such as what ESG litigation entails, jurisdiction issues, and examples of ESG litigation cases. Understand the formats for group actions and shareholder actions, along w

0 views • 14 slides

Union Stewardship in Shareholder Engagement

Janet Williamson, TUC Senior Policy Officer and Trustee of the TUC Pension Fund, emphasizes the importance of stewardship in public debate and policy. The Stewardship Code principles include public disclosure, conflict management, monitoring investee companies, and collective action. Increased union

0 views • 13 slides

Recent Developments in Shareholder Claims and Legal Issues

Explore the latest insights on shareholder claims and legal issues in the banking and financial services sector, including significant litigation cases and key considerations regarding causes of action, reflective loss, procedural routes, and privilege challenges. Stay informed about important judgm

1 views • 86 slides

Legal Rights and Obligations Regarding Shareholder Meetings

This content discusses the rights and obligations related to shareholder meetings in a legal context. It covers topics such as the chairman's authority to call special meetings, shareholders' voting rights, and the secretary's obligation to provide notice for meetings. The comparison between optiona

0 views • 28 slides

Enhancing Corporate Value Through Insider-Shareholder Collaboration

This study delves into two contrasting models of the corporation - confrontational versus collaborative. It explores how collaboration between insiders and shareholders can lead to increased economic value for the firm, drawing on examples and insights from corporate law, private ordering, and game

0 views • 16 slides

Maximizing Shareholder Value Creation Through Strategic Business Practices

Explore the concept of shareholder value creation, the importance of generating revenues exceeding economic costs, and meeting shareholders' expectations. Learn about Economic Value Added (EVA), key value drivers, aligning strategy with value creation, and essential factors for overall business succ

0 views • 11 slides

Rethinking Firm Governance Through Property Rights and Stakeholder Theory

Challenging the traditional shareholder-centric view, this study explores how property rights theory and stakeholder theory can offer a more comprehensive perspective on firm governance. It delves into the complexities of value creation, contractual relationships, and diverse stakeholder interests,

0 views • 10 slides

Understanding the New Jersey Oppressed Shareholder Statute

The New Jersey Oppressed Shareholder Statute, N.J.S.A. 14A:12-7, outlines the grounds for oppression in a corporation and the process for a buyout. It allows the Superior Court to appoint a custodian, provisional director, order stock sale, or dissolve the company. Key provisions include shareholder

0 views • 12 slides

India Fellowship Seminar on Participating vs. Non-participating Products

The seminar delved into the role of participating and non-participating insurance products in premium growth, risk management, and creating shareholder value in the long term. It discussed market trends, historical data, and key drivers influencing shareholder value in the Indian insurance industry.

0 views • 21 slides

Overview of Redomiciliation Transactions and Section 7874 Implications

Section 7874 imposes restrictions on domestic corporations becoming owned by foreign entities with the same or similar shareholder base. It outlines tests triggering adverse consequences and discusses self-inversion transactions, tax considerations, and cross-border combinations. Notably, substantia

0 views • 8 slides

Understanding Dividend Policy in Financial Management

Dividend policy plays a critical role in balancing long-term financing and shareholder wealth. It involves determining the distribution of profits among shareholders while retaining earnings for company growth. Approaches like Long Term Financing and Wealth Maximisation influence dividend decisions,

0 views • 24 slides

Understanding Student Engagement with Augmented Reality Sandbox

Engagement in learning is crucial for student progress, with a focus on how individuals participate in purposeful educational activities. This study explores the use of skin biosensors to measure sympathetic activation as a proxy for engagement in students while using an augmented reality sandbox. T

0 views • 24 slides

Strategic Engagement Workshop for Non-State Organizations

Workshop.Presentation outlining the purpose, agenda, and content of a session focused on supporting non-state organizations in defining their strategies for stronger engagement with the government based on the All Hands On Deck For SDG 4 project. The session covers understanding project learnings, d

0 views • 36 slides

Understanding Student Engagement: Perspectives and Findings

This presentation explores student engagement in higher education, covering definitions from literature, student perspectives, and key findings from a questionnaire. It delves into what constitutes engagement, the characteristics of engaged and disengaged students, and the role of educators in foste

0 views • 17 slides

Comprehensive Stakeholder Engagement Toolkit Orientation and Practice Session

Engage in a detailed session covering the key features of a Stakeholder Engagement Toolkit, including planning for socio-cultural factors, assessing stakeholder knowledge, and facilitating group discussions. Learn how the Toolkit provides guidance for efficient stakeholder engagement, documentation

0 views • 33 slides

India Fellowship Seminar: Product Contributions to Growth, Risk Management, and Shareholder Value

India Fellowship Seminar discussed the contributions of participating and non-participating products to premium growth, risk management, and shareholder value. Key topics included market trends, drivers of shareholder value, PAR vs NPAR attractions, creating shareholder value, and risk management st

0 views • 21 slides

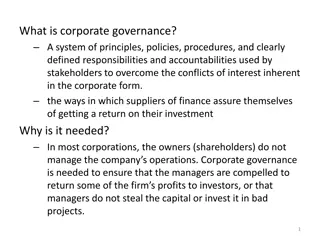

Understanding Corporate Governance: Principles, Objectives, and Duties

Corporate governance is a system of principles and practices used to manage conflicts of interest in corporations. It ensures managers act in the best interest of shareholders. Key aspects include objectives to mitigate conflicts, ensure efficient asset use, and common sources of conflict like manag

0 views • 10 slides