Functions of SEBI: Protective, Regulatory, Development

SEBI, the Securities and Exchange Board of India, performs various functions to protect investors, regulate the market, and promote development. Its protective function includes prohibiting insider trading and price rigging, and promoting fair practices. Its regulatory function involves establishing

9 views • 5 slides

Understanding the Role and Qualifications of Independent Directors in Company Governance

Independent directors play a crucial role in corporate governance by providing unbiased oversight and strategic guidance. They are required to meet specific qualifications and criteria as per the Companies Act and SEBI regulations. The process of defining, appointing, and functioning of independent

0 views • 20 slides

SEBI Issues Guidelines for Draft Offer Documents and Returning Draft Documents

SEBI plays a crucial role in regulating the securities market and safeguarding investor interests. Among its many responsibilities, SEBI oversees the issuance of offer documents by companies looking to raise funds through public offers.\n\nSEBI to ensures that the offer documents filed by the issuer

7 views • 4 slides

Understanding Producer Responsibility in UK: Regulations for Sustainable Vaping

Producer Responsibility in the UK entails businesses taking accountability for the environmental impact of their products, including packaging, electrical equipment, batteries, and end-of-life vehicles. This responsibility extends to vapes as they fall under the Waste Electrical and Electronic Equip

0 views • 10 slides

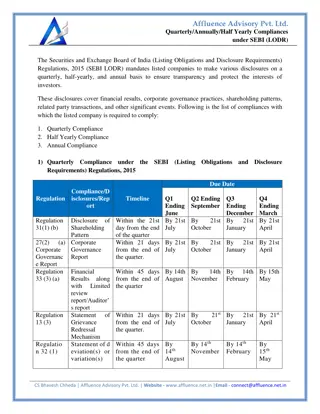

Quarterly-Annually-Half Yearly Compliances under SEBI LODR

The SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 mandate that listed companies must adhere to a strict schedule of disclosures on a quarterly, half-yearly, and annual basis. These requirements include financial results, corporate governance reports, shareholding patterns,

0 views • 4 slides

Concept of Senior Management & Its Disclosures in Annual Reports

The document outlines the definitions, roles, and disclosure requirements for senior management under SEBI LODR regulations in the annual report for FY 2023-24. Senior management includes core management team members below the CEO\/MD, functional heads, CFO, and Company Secretary. Key updates includ

0 views • 4 slides

SEBI's Role in Investor Protection and Stock Market Regulation

Securities and Exchange Board of India (SEBI) plays a crucial role in safeguarding investor interests and ensuring fair practices in the Indian stock market. By promoting transparency, enforcing regulations, and regulating market intermediaries, SEBI aims to maintain market integrity, protect invest

0 views • 23 slides

Foreign Investments in India: Legal Framework and Investment Routes

Key statutes applicable for foreign investors in India include FEMA, SEBI regulations, and legislations governing securities markets. Foreign investments avenues in India include FDI, FVCI, FPI, NRI investments through SEBI approval or automatic approval route. Foreign Portfolio Investors (FPIs) and

1 views • 54 slides

Signing of Board’s report and financial statement – Companies Act and SEBI

Section 134(1) of the Companies Act, 2013 outlines specific guidelines for signing a board's report. This article delves into the various scenarios based on company structure, ensuring you understand who is required to sign. Stay informed and complia

0 views • 4 slides

Overview of Indian Securities Market and SEBI

Explore the Indian Securities Market and the role of SEBI in regulating it. Learn about key concepts such as primary and secondary markets, investor rights, mutual funds, and investor grievance redressal. Understand the structure of the market and the prerequisites for buying and selling shares. Dis

0 views • 56 slides

Insights into India's Venture Capital Industry Growth and Potential

Explore the growth and challenges of the Indian Venture Capital industry, including the role of SEBI regulations, investment routes, organization structures for VCFs, and the country's potential in commercializing research and scientific knowledge. Discover the significant increase in registered Ven

0 views • 25 slides

Guidelines and Regulations for Mutual Fund Investments in India

SEBI, the regulatory authority in India, aims to protect investors by simplifying mutual fund schemes and promoting transparency. Guidelines cover structure, categorization, and investment regulations for equity, debt, balanced, and solution-oriented funds.

0 views • 19 slides

Analysis of Manipulated Penny Stocks and SEBI Investigation

Detailed analysis of manipulated penny stocks through day-wise share price data and graph verification in Excel. SEBI's interim order against First Financial Services Ltd for market manipulation and misuse of funds. Investigation revealing misuse of preferential allotment funds leading to a substant

0 views • 12 slides

Understanding U.S. Export Control Regulations

U.S. export control regulations are crucial for national security, foreign policy, and economic interests. This includes governing the export of strategic technologies, equipment, hardware, software, and the provision of technical assistance to foreign persons. The regulations aim to prevent the una

0 views • 68 slides

UNR WLTP: Regulations Update for Vehicle Type Approval

This document details the transposition of GTR15 (WLTP) and GTR19 (Evap) into UN Regulations, focusing on the scope, definitions, and application for approval of vehicle categories M1, M2, N1, and N2. It outlines requirements for emissions testing, carbon dioxide, fuel consumption, electric energy c

0 views • 38 slides

Understanding AML Risk Assessments and Due Diligence Regulations

Anti-money laundering (AML) risk assessments and due diligence regulations are crucial for preventing money laundering and terrorist financing. This content discusses the importance of risk assessments, client due diligence, and regulatory compliance in the AML landscape. It emphasizes the need for

0 views • 13 slides

Key Judicial Precedents on Insolvency and Bankruptcy Code, 2016

Key judicial precedents under the Insolvency and Bankruptcy Code, 2016 are discussed, including rulings on insolvency pleas, distribution of profits during Corporate Insolvency Resolution Process (CIRP), obligations of unrelated parties, the 90-day period for filing claims, and the interaction of mo

1 views • 21 slides

Withholding Taxes and Revenue Regulations Overview

The content delves into the concept of withholding taxes, particularly final and creditable withholding taxes, as per Revenue Regulations No. 02-98. It explains the responsibility of withholding agents, the distinction between final and creditable withholding tax systems, and the implications for pa

0 views • 20 slides

Overview of Merchant Banking in India

Merchant banking in India traces back to the early 1960s, with Grindlays Bank pioneering the services in 1967. Over the years, foreign and Indian banks, as well as financial institutions, have ventured into this sector, offering services like managing share issues and providing financial consultanci

0 views • 8 slides

Comprehensive Guide to Valuation requirement under various forum

Explore our comprehensive guide on asset valuation in India, covering essential compliance with RBI, SEBI, FEMA, and Companies Act regulations. Learn about best practices, DCF method, and critical documentation needed for strategic business decisions

0 views • 3 slides

The Hindenburg Case A Lesson in Communication & the Need for SEBI Lawyers

The world of financial markets thrives on information. Investor decisions, market trends, and ultimately, a healthy economic ecosystem rely on accurate and timely communication from companies

0 views • 6 slides

Implementation of Public Servants Business Prohibition Regulations

The presentation outlines the purpose and background of the Revised Determination on Other Remunerative Work to prohibit public servants from conducting business with state organs. It highlights measures in place, statistics on employee compliance, progress reports provided by departments, and the r

0 views • 21 slides

Understanding Related Party Transactions in Corporate Governance

Related Party Transactions (RPT) are vital in today's business world, ensuring transparency and disclosure in transactions involving parties related to the company. This article explores the significance of RPT, definitions under CA 2013 and SEBI LODR 2015, as well as the identification criteria as

0 views • 30 slides

Regulations on 1,2,3-Trichloropropane (1,2,3-TCP) Contaminant Levels

State Water Board conducted a public hearing regarding the regulations on 1,2,3-TCP, a carcinogenic chemical found in groundwater. The proposed regulations aim to set Maximum Contaminant Levels (MCL) and other safety measures to protect public health. Stakeholder meetings and public workshops were h

1 views • 21 slides

Understanding U.S. Export Regulations and Agencies in 2015

Explore the complexities of exporting from the USA in 2015, covering responsibilities of exporters, types of exports, government agencies regulating exports, and an overview of export controls and regulations. Learn about the Bureau of Industry and Security, Directorate of Defense Trade Controls, Of

3 views • 25 slides

Client Code Modification and Tax Evasion: Regulatory Issues in Stock Exchanges

Client Code Modification (CCM) is a service provided by Stock Exchanges to rectify errors in client codes during trading hours, but it has been misused for tax evasion by some brokers. Investigations revealed significant modifications leading to tax evasion. Regulatory bodies like SEBI and CBDT have

0 views • 41 slides

Understanding Export Controls and Regulations in the United States

This content provides insights into export controls and regulations, covering topics such as Federal Export Control restrictions, definitions of U.S. Person and Foreign National, Technology Control Plans, Deemed Export discussions, and oversight by Federal agencies like the Department of Commerce, S

0 views • 20 slides

New Regulations on Neonicotinoids in California: An Overview

The presentation by the California Department of Pesticide Regulations highlights the new regulations on neonicotinoids, systemic pesticides affecting insects' central nervous systems. It provides insights into the history of neonicotinoid use in California, the development of alternative pesticides

0 views • 19 slides

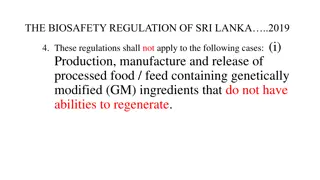

GMO Regulations in Sri Lanka: An Overview of Biosafety and Prohibitions

Sri Lanka's biosafety regulations of 2019 exempt certain cases involving genetically modified (GM) ingredients in processed foods. The regulations outline prohibitions on the import, sale, and distribution of GM organisms as food without approval. Additionally, the regulations address risks in proce

0 views • 12 slides

Enhancing Security and Covenant Monitoring with DLT - Catalyst Trusteeship Limited

SEBI's circular on security creation and covenant monitoring for Non-Convertible Securities (NCS) aims to improve processes through Distributed Ledger Technology (DLT). The circular covers crucial aspects such as asset cover, charge creation, covenant monitoring, and more, applicable from 01.04.2022

0 views • 16 slides

Overview of the Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) was established in 1992 to regulate and promote the development of the securities market. SEBI aims to protect investor interests, prevent malpractices, and ensure a fair and transparent market. Through its objectives, SEBI plays a crucial role in re

0 views • 5 slides

Evolving Investment Adviser Regulations — SEBI Lawyers Analysis of 2020 & Recent

Vaneesa Agrawal, an expert SEBI lawyer highlights that these regulations were designed to ensure transparency, mitigate conflicts of interest, and safeguard client interests by setting clear guidelines for who could provide investment advice and unde

0 views • 6 slides

Evolving Investment Adviser Regulations - SEBI Lawyers Analysis of 2020 & Recent Developments

In a move that has reverberated through India\u2019s financial advisory sector, the Securities and Exchange Board of India (SEBI) has proposed significant amendments to its investment adviser regulations

0 views • 6 slides

Role and Functions of SEBI in Financial Market Regulation

SEBI, the Securities and Exchange Board of India, plays a crucial role in protecting investor interests and ensuring fair practices in the financial market. It carries out protective functions by preventing insider trading and price rigging, promotes fair trade practices, and provides financial educ

0 views • 5 slides

The Role and Purpose of Securities and Exchange Board of India (SEBI)

Established in 1988 by the Government of India, Securities and Exchange Board of India (SEBI) plays a crucial role in regulating the securities market. SEBI aims to promote investor protection, ensure fair practices, and facilitate efficient resource mobilization. By monitoring and enforcing regulat

0 views • 15 slides

Understanding Venture Capital: Key Concepts and Regulations

Venture capital is a form of financing provided to startup companies with high growth potential. It involves high risk and requires a long-term horizon, often coming in various forms like equity, conditional loans, and participation in management. The process includes stages such as seed capital, ex

0 views • 10 slides

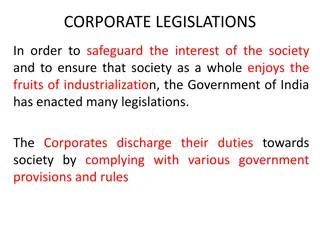

Overview of Corporate Legislation in India for Societal Welfare

The Government of India has enacted various legislations to safeguard societal interests and ensure the benefits of industrialization are enjoyed by all. Corporate entities adhere to these laws for societal well-being, with key acts such as the Companies Act, 1956, and the Securities and Exchange Bo

0 views • 15 slides

Sarsaparilla Dr Sebi | Leafoflifeherbs.com

Sarsaparilla root is one of the top herbal remedies recommended by Dr. Sebi. This powerful herb has a long history of use for a variety of health conditions. Explore Leafoflifeherbs.com for further information.

3 views • 1 slides

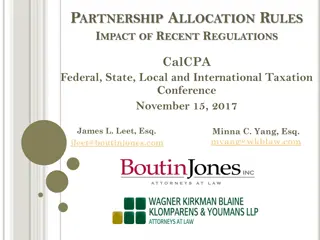

Impact of Recent Regulations on Partnership Allocation Rules

Recent regulations drastically impact partnership allocation rules related to determining partner liabilities, basis, disguised sales, and more. The regulations under IRC 704 have been revised, and changes have been proposed to reduce tax regulatory burden. The 2014 proposed regulations and the 2016

0 views • 43 slides

Annual Audit of PPMs SEBI Lawyers Take On The New Updates

In a significant development for India\u2019s alternative investment landscape, the Securities and Exchange Board of India (SEBI) has introduced mandatory annual audits for Private Placement Memorandums

0 views • 6 slides