Purpose And SARS Vision 2024

Automated refunds and drawbacks system of the South African Revenue Service (SARS). It explains the purpose, SARS Vision 2024, challenges with the current process, new refund and drawback process, benefits, and transitional arrangements.

1 views • 21 slides

Living Off-Campus as a Scholar

Explore the financial aid options available for students at Indiana University Bloomington, including details on the 21st Century Scholars Program, non-tuition aid, semester refund estimates, and the Covenant award. Learn how these resources can support your education and living expenses as a schola

0 views • 32 slides

Unlock Your Beauty_ Prismos Beauty Offers Premium Products and Collaboration Opportunities in Jubilee Hills(21_03_2024)

Unlock Your Beauty: Prismos Beauty Offers Premium Products and Collaboration Opportunities in Jubilee Hills\n\nIn the heart of Jubilee Hills, where sophistication meets luxury, lies a haven for beauty enthusiasts: Prismos Beauty. Nestled amidst the bustling streets, Prismos Beauty stands out as the

2 views • 2 slides

Nevada Department of Taxation Compliance Division Audit Process Overview

Responsible for ensuring taxpayer compliance with various taxes, the Nevada Department of Taxation Compliance Division conducts audits locally and nationwide. From refund verification to audit selection criteria, learn about the audit process, taxes audited, time periods, initial contact procedures,

5 views • 18 slides

How do I Chnage My Flight on Air France

Depending on the fare category and booking circumstances, Finnair has different cancellation policies. If a reservation is made at least one week in advance of departure, passengers may typically cancel their tickets within 24 hours of making the reservation without incurring fees. After this time,

0 views • 6 slides

How Can I Cancel My KLM Flight After Booking?

If a flight is canceled within 24 hours of booking, KLM Airlines offers a full refund. Flexible tickets are fully refundable for cancellations made after this time, but limited tickets may have costs or are not refundable. In line with this , KLM Flight Cancellation Policy travelers may choose to ge

1 views • 5 slides

How Can I Cancel my Delta Airline flight

Travelers on Delta Airlines can cancel their tickets and get a full refund within 24 hours of making the reservation. If a non-refundable ticket is canceled within 24 hours, the cost can be applied to another trip, deducted from the cancellation fee. Delta Airlines Flight Cancellation Policy If tick

8 views • 5 slides

What is the Process For Breeze Airways Flight Cancellation

With Breeze Airways, you may cancel without taking any chances. If you do so within 24 hours of making your reservation and the scheduled flight is at least 7 days away, you can receive a full refund. Tickets may be returned for travel credits, even if many companies don't offer a refund policy. Com

1 views • 5 slides

How Do I Cancel My Air Canada Flight After Booking

To cancel your Air Canada flight after booking, log in to your Air Canada account and navigate to the \"Manage Bookings\" section. Enter your booking reference number and passenger details to access your reservation. Select the flight you wish to cancel and follow the prompts to finalize the cancell

0 views • 5 slides

How Can I cancel my Finnair Air flight within 24 hours of booking?

To cancel your Finnair Air flight within 24 hours of booking, you can typically do so online through their website or by contacting their customer service. Make sure to check Finnair Flight Cancellation Policy for any specific guidelines or fees applicable. Provide your booking details and follow th

1 views • 7 slides

CTFC - leading Premium Fancy API provider in Bangladesh

\nAre you trying to find the best leading Premium Fancy API provider in Bangladesh? Top-notch, dependable, and secure APIs are available from CTFC to improve your betting platform. Experience quick real-time data, minimal latency, and wide market coverage with our premium offerings. Improve your be

2 views • 3 slides

CTFC Premium Fancy API Provider in Bangladesh

\nAre you trying to find the best leading Premium Fancy API provider in Bangladesh? Top-notch, dependable, and secure APIs are available from CTFC to improve your betting platform. Experience quick real-time data, minimal latency, and wide market coverage with our premium offerings. Improve your be

0 views • 8 slides

Clover Flex Annual Security Awareness Training for Point of Service Collections Staff

Welcome to the Clover Flex Annual Security Awareness Training for Point of Service Collections Staff! This training module covers essential activities involving the Clover Flex, such as processing sales, voids, refunds, running reports, managing settings, and relocating the device. Learn how to hand

0 views • 13 slides

Customised Printed Premium Corrugated Flat Pack Packaging Box by papers gallery

Papers Gallery offers Customized Printed Premium Corrugated Flat Pack Packaging Boxes, perfect for various business needs. These boxes are designed to provide durability and premium aesthetics, ideal for enhancing product presentation and protection

1 views • 2 slides

Overview of TRAIN Revenue Regulations No. 13-2018 on Value-Added Tax

These regulations under the Tax Reform for Acceleration and Inclusion (TRAIN) Act (RA 10963) focus on Value-Added Tax provisions, amending Revenue Regulations No. 16-2005. They cover zero-rated sales, VAT-exempt transactions, claims for input tax, refund procedures, and more. Conditions for VAT appl

1 views • 54 slides

Understanding Child and Dependent Care Expenses Credit

The Child and Dependent Care Expenses Credit allows taxpayers to reduce their tax liability by a portion of expenses incurred for caring for qualifying persons. Qualifying persons include children under 13, incapacitated spouses or dependents, and certain criteria must be met to claim the credit. Th

8 views • 10 slides

May Trucking Co. v. ODOT - Ninth Circuit Case Analysis

May Trucking Company, an interstate motor carrier, challenged an assessment by the Oregon Department of Transportation (ODOT) for underpaid fuel taxes. The dispute centered on whether fuel consumed during idling should be taxable under the International Fuel Tax Agreement (IFTA). The Administrative

2 views • 9 slides

Admission, Transfer, and Discharge Guidelines for Virtual Resident Family Action Council

Explore essential information on admission procedures, rights, services, and practitioner affiliations for Virtual Resident Family Action Council members. Understand the materials you should receive, refund and bed hold policies, assessments, and resident rights. Be informed before signing any agree

0 views • 52 slides

Changes to Transitional Severe Disability Premium Element in Universal Credit

Responding to a High Court judgment, changes are being made to the Transitional Severe Disability Premium Element in Universal Credit. Claimants qualifying for the Severe Disability Premium will receive additional amounts reflecting other disability premiums from legacy benefits. This adjustment aim

1 views • 7 slides

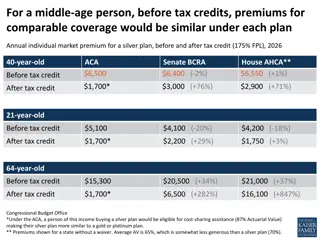

Higher Premium Impact on Older and Low-Income Populations Under BCRA

Premium comparisons reveal that low-income, older adults face substantial increases in premiums under the Senate BCRA compared to the ACA. States with older, lower-income, and rural populations would experience over 100% higher average premiums under the BCRA. The BCRA could result in significant di

2 views • 5 slides

Understanding Holiday Pay Premium for Union Employees

This guide explains the Holiday Pay Premium system for union employees, detailing how hours worked on premium holidays are tracked and paid differently. It covers the introduction of new pay codes, eligible bargaining units, employee examples, timecard management, and important details on how CalTim

1 views • 12 slides

Understanding Transportation Refunds and Inventory Shortages in NC DPI Services

Explore the intricacies of transportation refunds and inventory shortages in North Carolina Department of Public Instruction (NC DPI) Transportation Services led by Derek Graham, Steve Beachum, and Kevin Harrison. Learn about the purpose of PRC 056, special provisions, and why refunds are necessary

1 views • 27 slides

Reforming Automatic Renewal and Continuous Service Offers Act

The bill aims to regulate automatic renewal and continuous service offers by requiring businesses to provide clear terms and obtain customer consent. It includes provisions for free trials, cancellation policies, refund processes, and notification of changes. Exemptions are provided for specific ind

0 views • 7 slides

Enhancing Customer Service with Effective Staffing & Technology

Improving customer service through optimal staffing strategies, technological advancements, and a culture focused on efficient problem-solving rather than call routing. The approach involves recruiting skilled personnel, creating a supportive environment, implementing high-level management plans, an

0 views • 26 slides

Super Premium Sorbet Marketing Plan

Product Description: Super Premium Sorbet offering seven flavors including Chocolate, Cranberry Blueberry, Mango, Raspberry, Strawberry, Orchard Peach, and Zesty Lemon in a 14-ounce container. Marketed as part of the Haagen-Dazs portfolio, available in North America, Asia, South America, and Europe.

0 views • 16 slides

Common Mistakes in Expense Reports that Delay Refunds

In submitting expense reports, several common mistakes can lead to delays in receiving refunds. Issues such as missing receipts, incorrect documentation, inadequate information, and incorrect claim submissions can all hinder the reimbursement process. This guide outlines key errors to avoid when pre

0 views • 11 slides

Latest Amendments Under Refund FA 2022 and Inverted Duty Structure in GST Law

Latest amendments under Refund FA 2022 include extension of time limit for filing refunds, addressing inverted duty structure issues, and procedural changes for various refund scenarios under GST law. The amendments aim to streamline refund processes and provide relief to taxpayers. The changes also

0 views • 59 slides

USCIS Premium Processing Changes under HR 8337

Updates under HR 8337 introduce changes to USCIS premium processing, including fee increases to $2,500 for certain visa categories, expansion of premium processing to H4, L2, EAD, COS, and extensions, and regulations for determining premium processing fees. The bill aims to stabilize USCIS operation

1 views • 9 slides

Analysis of Implication of Changing UPR Accounting Method in General Insurance

This presentation discusses the impact of changing the method of accounting for Unearned Premium Reserve (UPR) in a general insurance company in India. The analysis explores the implications on earnings, premium and claim liabilities, profit/loss, and solvency due to transitioning from the 1/365th m

0 views • 38 slides

Improving Attainment and Progress of Disadvantaged Pupils in Sheffield

Attainment and progress of disadvantaged pupils in Sheffield show an improving trend across key stages, although the gaps between disadvantaged and non-disadvantaged students are not closing fast enough. Data suggests that disadvantaged pupils with low prior attainment are making better progress in

0 views • 29 slides

Effective Use of Pupil Premium for Closing Achievement Gaps

Addressing the effective utilization of pupil premium to enhance academic achievement and bridge disparities, the content highlights strategies, statistics, and key findings regarding the impact on both highly able and disadvantaged students. Insights from Sir John Dunford's keynote speech at the Au

0 views • 49 slides

Key Issues in Shipbuilding Law

The classic problem in shipbuilding law arises when a buyer seeks refunds either from the shipyard under the shipbuilding contract (SBC) or from the guarantor under a Refund Guarantee (RG), and the shipyard alleges illegality or matters contrary to public policy. The complexities of English law on i

0 views • 62 slides

Dealing with IRS Assessments: Options for Challenging Unfair Tax Claims

Learn how to address erroneous IRS assessments through various options like audit reconsideration, doubt-as-to-liability, offers in compromise, refund litigation, and bankruptcy. Make an informed choice based on factors like refund eligibility, ability to pay, receipt of the Notice of Deficiency, an

0 views • 5 slides

PEIA Updates and Clarifications: Important Changes for Plan Year 2024

Senate Bill 268 brings significant changes to the PEIA effective July 1, 2023, impacting spouse surcharges, premium splits, and provider reimbursements. Plan Year 2024 introduces financial plan adjustments, premium increases, and benefits modifications, emphasizing employer premium hikes and mandato

0 views • 12 slides

PTA Financial Guidance on Fund Handling and Event Management

Learn about important financial considerations for PTAs, including handling restricted funds, managing event postponements, refund policies, and budget amendments. Ensure compliance with regulations and best practices to effectively allocate resources for the benefit of school programs and projects.

0 views • 13 slides

GST Refund Procedure and Guidelines

Introduction to GST refunds focusing on refund of accumulated credit under GST for zero-rated supplies, the procedure for claiming refund of accumulated ITC, and filing and obtaining GST refund. It covers the eligibility criteria, required documents, formula for calculating refund amount, and step-b

0 views • 7 slides

Understanding Bonus Systems and Premium Refunds in Insurance

Bonus systems in insurance reward policyholders with fewer claims in the past by offering premium refunds. Various models are used to calculate premium refunds, factoring in individual claim history or overall portfolio performance. This article explores common solutions such as premium refunds base

0 views • 26 slides

Strategies for Enhancing Extended Producer Responsibility System in Bulgaria

Korea-Bulgaria Knowledge Sharing Program focused on sharing strategies to enhance Bulgaria's Extended Producer Responsibility (EPR) system. The program discusses the current status, performance evaluation, issues, and recommendations related to the EPR system in Korea. It covers topics like beverage

0 views • 38 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Purchase Spotify Premium from KeyShop to enjoy limitless music and uninterrupted streaming (1)

KeyShop now offers Spotify Premium, which will enhance your music experience. Savor the unrestricted ability to stream millions of songs, albums and podcasts. Spotify Premium provides the most individualized listening experience based on your tastes

1 views • 2 slides