Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

Low Pay Household Estimates in Rural India

Analysis of data from the Periodic Labour Force Survey reveals estimates of households with monthly per capita earnings below a threshold in Rural India. The study, presented by Vasavi Bhatt, focuses on the characteristics of low earnings households and highlights the importance of decent work and i

1 views • 8 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

Contrasting Characteristics of Developed and Developing Countries

Developed countries are characterized by high per capita income, strong GDP growth, and advanced standards of living, while developing countries exhibit lower income levels, high population growth, and challenges in technology and infrastructure. The differences extend to economic, demographic, tech

1 views • 7 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Understanding Economic Development: Concepts and Measures

Economic development goes beyond just economic growth and encompasses social and monetary progress. It involves factors like job creation, technological advancements, standard of living, per capita income, and more. Measurements include GNP, GNP per capita, welfare, and social indicators. Developmen

0 views • 8 slides

Understanding Global Economic Disparities and Growth Trends

Explore the significant differences in living standards and economic growth rates across countries, from advanced economies like the UK to middle-income nations like Mexico and low-income countries like Mali. Real GDP per capita, life expectancy, literacy rates, and growth data provide insights into

0 views • 27 slides

Overview of Modern Business Environment in Indian Economy

Modern business in the Indian economy is characterized by large size, oligopolistic nature, diversification, global presence, technology orientation, and changing government regulations. The Indian economy features a mixed economy with both private and public enterprises, low per capita income, uneq

0 views • 14 slides

Understanding GDP and Economic Indicators

Evaluating the economy involves analyzing total income per person, comparing revenue and spending, and examining GDP per capita. GDP, a key economic indicator, reflects the total market value of goods and services produced in a country. Rich data sources like World Bank provide insights into various

0 views • 27 slides

Understanding Sri Lanka's Inland Revenue Act No. 24 of 2017

This content delves into the key aspects of the Inland Revenue Act No. 24 of 2017 in Sri Lanka, covering chargeability of income tax, imposition of income tax, definitions, sources of income, assessable income for residents and non-residents, income tax payable, and income tax base. It provides valu

0 views • 93 slides

International Economic Indicators Comparison

The data presented includes GDP per capita rankings for various countries in 2015, showcasing the economic status of nations like Qatar, Norway, and the United States. It also illustrates the growth in GDP per capita from 2006 to 2015, with countries like China and India showing significant progress

2 views • 21 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

Assessment of Various Income Types for Residents and Non-Residents

The solution presented details the assessment of different types of income for residents, non-residents, and non-ordinary residents as per Income Tax laws. It covers scenarios like salaries drawn outside India, profits earned abroad, dividends received, and more. The scope of taxable income based on

0 views • 14 slides

Understanding Regional Disparities: Causes and Impacts in India

Regional disparities in India are evident through differences in income, education, health services, and industrialization levels among regions. Historical, geographical, economic, and governance factors contribute to these disparities, impacting overall economic growth. Measures such as analyzing p

0 views • 12 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

CSU Travel Policy: Per Diem Implementation Guidelines

In this detailed guide, learn about the implementation of per diem in CSU Travel Policy, reasons for moving from actuals to per diem, coverage areas, GSA rates, and the benefits of per diem over receipts. Get insights into complying with federal guidelines, avoiding tax implications, and the per die

0 views • 23 slides

Overview of Development Economics and Goals

Development economics is a branch of economics that focuses on improving the economies of developing countries by targeting factors such as health, education, working conditions, and policies. It involves macroeconomic and microeconomic analysis to enhance domestic and international growth. Differen

1 views • 11 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Malaysia's Comprehensive Development Planning Strategies

Malaysia's experience in compiling statistics for development planning is highlighted through the high-level seminar and workshop on the ACSS Strategic Plan 2016-2020. The country's development plans include the 11th Malaysia Plan, Government Transformation Programmes, New Economic Model, and Econom

1 views • 11 slides

Evolution of Public Policies and Income Patterns: Insights from India

Comprehensive analysis of changing intergenerational support for elderly in India from 2004-05 to 2011-12, alongside initiatives like the Unorganized Sector Workers Social Security Act, the National Rural Employment Guarantee Act, and the National Rural Health Mission. The shift in per capita income

0 views • 15 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Global Perspectives on Poverty and Inequality

Explore dimensions of poverty and inequality worldwide through images and data on living conditions, GDP per capita, household income, and life expectancy in various countries. Learn about income distribution, family living conditions, and the Dollar Street project revealing disparities in lifestyle

0 views • 163 slides

Exploring Immigration's Impact on Income Inequality

The presentation delves into the relationship between immigration and income inequality, analyzing data on income distributions among voters, non-voting citizens, and non-citizens in PA. It discusses the log-normal distribution as an approximation for income distribution and examines the ratio of me

0 views • 16 slides

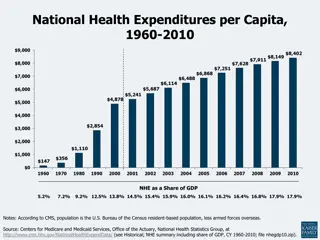

Trends in National Health Expenditures and Care Costs, 1960-2010

National health expenditures per capita and as a share of GDP from 1960 to 2010, along with average annual growth rates, show the evolving landscape of healthcare spending in the U.S. The data reveals changing patterns in healthcare expenditure and outlines the concentration of health care spending

0 views • 20 slides

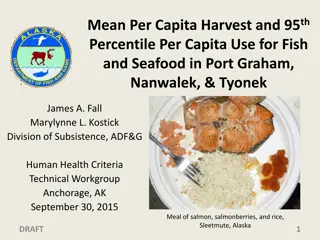

Mean Per Capita Harvest and 95th Percentile Per Capita Use for Fish and Seafood in Alaska

This document provides information on the mean per capita harvest and 95th percentile per capita use for fish and seafood in Port Graham, Nanwalek, Tyonek, and Sleetmute, Alaska. The data is from a technical workgroup report dated September 30, 2015, and includes details on a meal of salmon, salmonb

1 views • 10 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Insights on Individual Income Tax Revenue and Trends

Explore facts and figures related to individual income tax, including sources of revenue, per capita tax payments by state, annual collections, exemptions and credits, and more from various years. Gain insights into tax trends and distributions.

0 views • 9 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

Understanding GDP and its Limitations in Global Economics

The Gross Domestic Product (GDP) measures the monetary value of goods and services produced within a country, reflecting its economic development. However, simply comparing GDP figures may not provide a complete picture. GDP per capita is a better indicator, showing the average wealth per person. De

0 views • 7 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Indian Housing Block Grant 2023 Competitive Priorities

The Fiscal Year 2023 Indian Housing Block Grant (IHBG) Competitive NOFO Training focuses on Soundness of Approach with a maximum of 42 points. Subfactor 3.1 emphasizes IHBG Competitive Priorities, including new housing construction projects, housing rehabilitation projects, acquisition of units, and

0 views • 23 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Income Eligibility Determination Training for PY 2023

Explore the key changes and considerations in income eligibility determination for the upcoming program year 2023, including the use of State Median Income and Federal Poverty Guidelines. Learn about the refined definition of the income eligibility period and the importance of monitoring household i

2 views • 34 slides

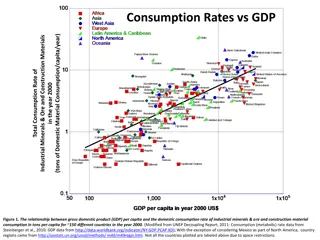

Global Relationship Between GDP per Capita and Mineral Resource Consumption Rates in 2000

The images depict the relationship between GDP per capita and domestic consumption rates of industrial minerals, ore, and construction materials in various countries in the year 2000. The data highlights the varying consumption patterns and their correlation with economic prosperity. Additionally, s

2 views • 10 slides