Experience The Purity Tuberose Essential Oil Pure Therapeutic Aromatherapy 30 Ml

Health Benefits of Tuberose Essential Oil\n\nThe various medicinal properties of this essential oil are as follows.\n\nAphrodisiac: Justifying its romantic and sensual names that include \u201cNight Queen\u201d and \u201cMistress of the Night\u201d, this oil behaves as an aphrodisiac. It is commonly

0 views • 4 slides

Buy Kitchen Plastic Cooking Manual Hand Oil Pump (Multicolor,Pack Of 1)

Effortless Cooking Elegance: Manual Hand Oil Pump\nSimplify Your Culinary Adventures with the Kitchen Plastic Cooking Oil Pump\nIntroducing the Manual Hand Oil Pump, a versatile and efficient kitchen companion that adds a touch of elegance to your cooking routine. Crafted from durable plastic, this

0 views • 3 slides

Challenges and Opportunities for Reforms of Non-Oil Revenues Administration in South Sudan

The presentation highlights the reliance on oil revenues in South Sudan and the need for reforms in non-oil revenue administration. It discusses sources of non-oil revenue, factors hindering revenue mobilization, and opportunities for reforms to diversify the economy. The objectives of non-oil reven

3 views • 23 slides

South Sudan's Non-Oil Revenue Mobilization Challenges

South Sudan faces significant challenges in generating non-oil revenues, with a heavy reliance on personal income tax and limited utilization of other tax sources. The volatile nature of oil revenues underscores the importance of diversifying revenue streams for sustainable economic growth. Comparis

3 views • 12 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Understanding Oil and Water Interaction in Environmental Science

Explore the complex relationship between oil and water, including the challenges of containing oil spills and the use of innovative oil-absorbing polymers. Learn why oil and water don't mix due to their differing polarities and discover how polymer technology like Enviro-Bond 403 plays a crucial rol

4 views • 7 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Can we replace palm oil with something else?

In this lesson, we delve into the world of oil-producing crops and investigate potential substitutes for palm oil. Through engaging slides and discussions, we compare different types of oils, assess the sustainability of canola and soybean oil as alternatives, and examine the productivity of main ve

0 views • 13 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

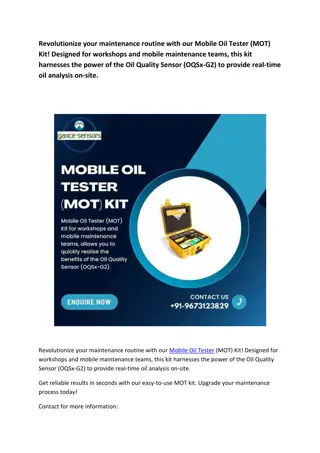

Revolutionize your maintenance routine with our Mobile Oil Tester (MOT) Kit!

\nRevolutionize your maintenance routine with our Mobile Oil Tester (MOT) Kit! Designed for workshops and mobile maintenance teams, this kit harnesses the power of the Oil Quality Sensor (OQSx-G2) to provide real-time oil analysis on-site. \nGet reliable results in seconds with our easy-to-use MOT k

2 views • 2 slides

10 Reasons to Hire Through Oil & Gas Recruitment Agencies

Struggling to find top talent in the competitive Oil & Gas industry? Discover 10 reasons why partnering with Oil & Gas Recruitment Agencies is your key to success. Learn how they unlock wider talent pools, reduce costs, and streamline your hiring process. Attract the best & brightest minds for your

0 views • 4 slides

The Best Odie's Natural Oil for Enhancing Wood Furniture Beauty

Wood furniture has a timeless appeal, adding warmth and elegance to any space. To maintain and enhance its beauty, using the right oil finish is crucial. Among the various products available, Odie\u2019s Natural Oil stands out as one of the best natural oils for wood furniture. This blog will delve

1 views • 4 slides

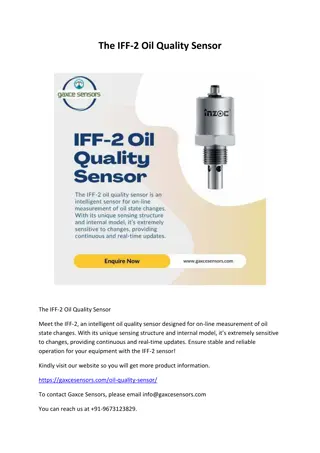

The IFF-2 Oil Quality Sensor

\nThe IFF-2 Oil Quality Sensor \nMeet the IFF-2, an intelligent oil quality sensor designed for on-line measurement of oil state changes. With its unique sensing structure and internal model, it\u2019s extremely sensitive to changes, providing continuous and real-time updates. Ensure stable and reli

1 views • 2 slides

Understanding Oil-Water Interaction and Oil Absorbing Polymers

Explore the intricacies of why oil and water don't mix, the challenges faced in containing oil spills, and the innovative solution of oil-absorbing polymers like Enviro-Bond 403. Discover the science behind non-polar substances, hydrophobicity, and the role of polymers in environmental protection.

2 views • 7 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Understanding the Chemistry and Composition of Crude Oil

Crude oil, also known as petroleum, is a complex mixture of hydrocarbons and other compounds like sulfur, nitrogen, and metals. The composition of crude oil includes aliphatics, aromatics, naphthenes, and other elements, each playing a unique role in its properties and characteristics. This article

1 views • 12 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

1 views • 32 slides

Government and Industry Investments Propel Castor Oil Market Forward Despite Sup

Castor Oil Market By Product Type (Cold Pressed Castor Oil, Hydrogenated Castor Oil, Jamaican Black Castor Oil, Dehydrated Castor Oil), By Application (Pharmaceuticals, Lubricants, Food And Beverages, biofuel, Paints and Varnishes, Animal feed), By D

0 views • 4 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Oil Palm Cultivation and Uses in India: A Comprehensive Overview

Oil palm cultivation in India, particularly in the Oilseeds Division of DAC&FW, is detailed, covering economic aspects, requirements for success, different uses of palm oil, global cultivation statistics, and production trends in major countries. The potential benefits of oil palm cultivation, such

0 views • 31 slides

Oil Industry Segment Update and Production Trends Overview

The oil industry segment is experiencing fluctuations in production and prices, as indicated by recent data on WTI and Brent prices, US crude oil production, tight crude oil production, Williston Basin crude oil production, US land rig count for oil, and total US and Canada CBR. The updates highligh

2 views • 9 slides

The Norwegian Perspective on Oil, Politics, and Economy

Exploring the Norwegian perspective on oil, politics, and economy reveals insights into state organization, licensing systems, the oil fund, and economic impacts of the oil industry. Comparisons with other countries like Canada highlight contrasting approaches to oil management. The history of oil p

0 views • 11 slides

Texas Oil & Gas Association Mineral Sub-Committee Annual Property Tax Conference

The Texas Oil & Gas Association Mineral Sub-Committee is organizing its Annual Property Tax Conference on March 7-8, 2024. The committee members will discuss valuation parameters, Circuit Breaker Legislation, and meet with Appraisal Firms to summarize discussions. They will also review Texas Product

0 views • 25 slides

Opportunities and Challenges for Palm Oil in the USA: Insights from Malaysian Palm Oil Council CEO

Explore the evolving landscape of palm oil in the USA through a presentation by Wan Aishah Wan Hamid, CEO of the Malaysian Palm Oil Council. Discover strategic approaches, market insights, and the global dynamics influencing palm oil production and consumption. Gain a deeper understanding of project

0 views • 32 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Factors Affecting Photosynthetic Efficiency in Oil Palm Plantation

All green plants, including oil palm, rely on photosynthesis to convert carbon dioxide and water into carbohydrates using solar radiation. Key factors influencing oil palm productivity include solar radiation availability, radiation absorption by the canopy, conversion efficiency, dry matter partiti

0 views • 20 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Processing of Edible Oil: A Comprehensive Overview

Crude vegetable oil undergoes a refining process before becoming suitable for consumption. This process involves removal of impurities and chemical treatments to ensure high-quality edible oil. Various manufacturing steps are followed to produce refined edible oil, including super cleaning, conto-bl

0 views • 21 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Understanding Corporate & Dividend Tax in Oil & Gas Industry

Explore the computation of Corporate & Dividend Tax in the oil & gas sector, based on Indonesian regulations. Learn about the background, calculation methodology, and taxation process, including income tax, costs deductions, taxable income, and entitlement approach for tax calculation.

0 views • 10 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Analysis of The Fair Share Act Oil Tax Ballot Initiative Presentation

The presentation discusses the proposed changes to Alaska's petroleum revenue taxes, focusing on royalties, production tax, property tax, and corporate income tax. It evaluates the impact on net income derivation, current tax versus initiative tax structures, and additional provisions like unit crit

0 views • 28 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)