Comprehensive Overview of Security Risk Analysis and Management

Explore the essential aspects of security risk analysis and management, including risk identification, assessment, and control techniques within an Information Security (InfoSec) context. Learn about the purpose of risk management, steps involved in a risk management plan, asset identification and c

0 views • 22 slides

Understanding Risk Management in Environmental Geography and Disaster Management

Risk management in environmental geography and disaster management involves assessing the potential losses from hazards, evaluating vulnerability and exposure, and implementing strategies to mitigate risks. It includes calculating risk, dealing with risk through acceptance, avoidance, reduction, or

1 views • 10 slides

Introduction to Flood Risk Assessment with HEC-FDA Overview

This presentation delves into flood risk assessment using HEC-FDA software, covering topics such as defining flood risk, components of uncertainty, consequences of flood risk, and methods to assess flood risk including hydrology, hydraulics, geotechnical, and economics. It explores the intersection

6 views • 39 slides

Understanding Market Risk and Risk Management Techniques

Market risk arises from adverse price movements in the market that can lead to financial losses for organizations. Techniques such as standard deviation, Value at Risk (VAR), and Stress Testing are used to measure and manage market risk effectively. VAR helps quantify potential losses and their like

7 views • 12 slides

Operational Risk Assessment for Major Accident Control: Insights from IChemE Hazards 33 Conference

This content provides valuable insights into the importance of Operational Risk Assessment (ORA) in managing major accident risks in high hazard industries. It covers the necessity of ORA, identifying changes, risk assessment, and key success factors. Real-life examples like the Buncefield Terminal

0 views • 22 slides

Understanding Agricultural Risk Management in the Face of Natural Disasters

Exploring the impact of natural disasters on agricultural economics, this content delves into the challenges faced by farmers and the approaches available for managing risks. From analyzing the Billion-Dollar Disasters in the US to discussing private and public risk management provisions, the conten

3 views • 20 slides

Understanding Country Risk Analysis in International Business

Country risk analysis is crucial for multinational corporations (MNCs) to assess the potential impact of a country's environment on their financial outcomes. It includes evaluations of political and economic risks in foreign operations. Sovereign risk, political risk characteristics, and factors are

1 views • 61 slides

Understanding Risk and Return in Corporate Finance

Exploring risk and return in market history is crucial for determining appropriate returns on assets. By analyzing dollar returns, percentage returns, holding period returns, and capital market returns, investors can grasp the risk-return tradeoff. Lessons from capital market return history emphasiz

4 views • 18 slides

Enhancing Zoonotic Disease Risk Communication in Public Health Emergencies

Explore the significance of adopting a One Health approach to zoonotic disease risk assessment and communication in the context of emergency health situations. The session emphasizes core capacities required by the International Health Regulations (IHR) 2005, effective risk communication processes,

2 views • 13 slides

Understanding Probabilistic Risk Analysis: Assessing Risk and Uncertainties

Probabilistic Risk Analysis (PRA) involves evaluating risk by considering probabilities and uncertainties. It assesses the likelihood of hazards occurring using reliable data sources. Risk is the probability of a hazard happening, which cannot be precisely determined due to uncertainties. PRA incorp

1 views • 12 slides

Project Risk Management Fundamentals: A Comprehensive Overview

Project risk management involves minimizing potential risks and maximizing opportunities through processes such as risk management planning, risk identification, qualitative and quantitative risk analysis, risk response planning, and risk monitoring and control. Quantitative risk analysis assesses t

0 views • 41 slides

Fundamentals of Portfolio Management and Risk Aversion in Investing

Portfolio theory is based on the principles of maximizing returns for a given risk level, considering all assets owned. Investors typically exhibit risk aversion, preferring lower risk assets for similar returns. Risk is defined as future outcome uncertainty. Markowitz Portfolio Theory highlights th

1 views • 17 slides

Principles of Risk Management in Therapeutic Innovation

European Patients Academy emphasizes the importance of risk management in therapeutic innovation. Understanding the balance between benefits and risks, implementing risk management strategies for all medicines, and identifying different types of risks are crucial for ensuring patient safety and publ

0 views • 13 slides

Risk Management Strategies in Organizational Security

Exploring risk management in organizational security, this study guide delves into resiliency, automation strategies, policies, and procedures to reduce risk. It covers threat assessments, computing risk assessments, qualitative vs. quantitative risk measurements, and actions based on risk assessmen

1 views • 19 slides

Comprehensive Overview of Market Risk Management Framework in Financial Institutions

Explore the detailed presentation from the MEFMI seminar on Market Risk in September 2017, covering topics like Risk Management Framework, Investment Policy and Objectives, Reserves Structure, Portfolio Managers, Market Risk, and Currency Risk Management strategies.

0 views • 16 slides

Recent Developments in Commodity Market Ecosystem and Global Competitiveness of Nigeria

The recent report from the last CMC meeting highlights the significance of developing the commodities market and the ecosystem's composition. It identifies multiple benefits of a thriving commodities market and discusses the evolution of commodity trading markets globally, continentally, and in Nige

0 views • 6 slides

Understanding Risk: Definitions and Concepts Explored

Delve into the world of risk with definitions ranging from baseline and absolute risk to relative risk, providing insights into how we perceive and manage uncertainties in various aspects of life. Explore the nuances of risk through engaging activities and gain a deeper understanding of statistical

0 views • 22 slides

Understanding Market Research for Business Success

Market research is crucial for businesses to gather information about their target market, customer needs, competition, and market trends. Primary and secondary research methods, market share analysis, demand assessment, and calculating market size are key aspects discussed in this content. Various

1 views • 5 slides

Understanding Markowitz Risk-Return Optimization

Modern portfolio theory, introduced by Harry Markowitz, aims to maximize expected return while managing risk. Efficient portfolios are represented by points on the efficient frontier, diversifying investments for optimal risk-return trade-offs. The risk-expected return relationship is depicted graph

0 views • 16 slides

Understanding Risk Concepts and Management Strategies in Finance

Explore the essential concepts of risk in finance, such as risk definition, risk profiles, financial exposure, and types of financial risks. Learn about risk vs. reward trade-offs, identifying risk profiles, and tools to control financial risk. Understand the balance between risk and return, and the

0 views • 18 slides

Risk Management in Information Technology Project

Project risk is any potential event that can harm a project's success. Risk management involves identifying, analyzing, and responding to risks throughout the project's lifecycle to safeguard its objectives. The process includes risk identification, analysis of probability and consequences, risk mit

0 views • 16 slides

Risk and Return Assessment in Financial Management

This comprehensive presentation explores the intricacies of risk and return assessment in the realm of financial management. Delve into understanding risk concepts, measuring risk and return, major risk categories, and the impact of risk aversion on investment decisions. Gain insights into the manag

0 views • 62 slides

Risk Management and Security Controls in Research Computing

The European Grid Infrastructure (EGI) Foundation conducts risk assessments and implements security controls in collaboration with the EOSC-hub project. The risk assessments involve evaluating threats, determining likelihood and impact, and recommending treatment for high-risk threats. Results from

0 views • 13 slides

Risk Management & MPTF Portfolio Analysis at Programme Level for UN Somalia

This session delves into the world of risk management and portfolio analysis at the programme/project level, specifically focusing on the Risk Management Unit of the United Nations Somalia. It covers enterprise risk management standards, planned risk management actions, the role of RMU, joint risk m

0 views • 30 slides

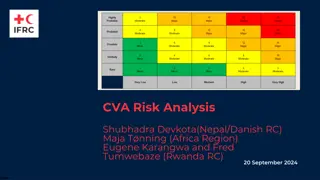

Comprehensive CVA Risk Analysis and Management Overview

This detailed document delves into the importance of CVA Risk Analysis, introducing the CVA risk register and outlining the identification, mitigation, and management of risks. It emphasizes understanding root causes and gaining confidence in filling the Risk Register. Additionally, it discusses the

0 views • 12 slides

Managing Project Risk to Reduce Construction Claims

Construction projects face risks such as escalating costs, incomplete plans, and design issues. Managing project risk is crucial to avoid adverse impacts and maximize opportunities for successful project outcomes. This presentation by Laurie Dennis covers the definition of project risk, importance o

0 views • 26 slides

Alcohol and Cancer Risk: Understanding the Links

Alcohol consumption is linked to an increased risk of various cancers, including mouth, throat, esophagus, breast, liver, and colorectal cancers. Factors such as ethanol, acetaldehyde, nutrient absorption, estrogen levels, and liver cirrhosis play a role in this risk. Even light drinking can elevate

0 views • 17 slides

Comprehensive Guide to Risk Management Processes

Explore the essential aspects of risk management in Chapter 7, covering the risk management process, benefits, risk event graph, and step-by-step procedures for risk identification and assessment. Learn how proactive risk management reduces surprises, enhances control, and improves project performan

0 views • 38 slides

Understanding Risk Concepts in the Mathematics Classroom

Risk is a concept integral to decision-making in various aspects of life. This resource explores how risk is defined in the real world, its relevance in the classroom, and strategies for teaching risk literacy to students. It delves into the multiple definitions of risk, risk analysis, and the emoti

0 views • 62 slides

Risk Analysis in Environmental Management: A Comprehensive Overview

Risk analysis plays a crucial role in environmental management, particularly in assessing potential health hazards and managing associated risks. This process involves risk assessment and risk management, with steps such as hazard identification, exposure assessment, dose-response assessment, and ri

0 views • 27 slides

Advances in Fall Risk Assessment and Management for Older Adults

This presentation delves into updates on the stratification tool for fall risk in community-dwelling older adults, emphasizing the importance of early intervention through opportunistic health visits. It discusses a decision tree model for assessing fall risk, highlighting the significance of histor

0 views • 12 slides

Understanding Organizational Risk Appetite and Tolerance

Explore the development of market risk appetite goals and how to define and establish organizational risk tolerance. Learn about the Classic Simplified View of Risk Tolerance and different methods to determine risk appetite. Discover the importance of assessing market risk impact and aligning risk t

0 views • 8 slides

Developing a Risk Appetite Culture: Importance and Framework

Risk management plays a critical role in the success of corporations, with strategy and risk being intertwined. This presentation delves into definitions of key terms such as risk appetite, the Risk Appetite Cycle, characteristics of a well-defined risk appetite, and the importance of expressing ris

0 views • 31 slides

Security Planning and Risk Management Overview

This content provides an in-depth exploration of managing risk, security planning, and risk appetite in the context of cybersecurity. It covers essential concepts such as risk management process, threat types, risk analysis strategies, vulnerability assessment, and risk mitigation techniques. The ma

0 views • 73 slides

Understanding BCG Matrix: Market Growth and Relative Market Share

BCG Matrix, developed by Bruce Henderson of the Boston Consulting Group, categorizes business units into Question Marks, Stars, Cash Cows, and Dogs based on market growth and relative market share. Market share and market growth are crucial factors in determining a company's position in the market.

0 views • 31 slides

Difference Between Capital Market and Money Market: A Comprehensive Overview

The capital market and money market serve different purposes in the financial world. While the capital market provides funds for long-term investments in securities like stocks and debentures, the money market deals with short-term borrowing and lending of funds. The capital market acts as a middlem

0 views • 4 slides

Risk Factors Analysis: Identifying At-Risk Students Before They Reach Campus

Risk Factors Analysis aims to identify students at risk of attrition before they even arrive on campus by evaluating academic, financial, minority, and first-generation factors. The method involves choosing specific risk factors, tracking historical prevalence, calculating relative risk, and predict

0 views • 15 slides

Enhancing Risk Analysis Quality for Effective Decision-Making

This content delves into improving the quality of analyses supporting risk management, emphasizing the importance of defining analysis quality comprehensively for decision makers, fostering a culture of analysis quality, and ensuring practical application on the ground. The Applied Risk Management S

0 views • 27 slides

Impact of Remittances on International Risk Sharing

Higher remittances in Emerging Market/Developing Economies (EMDEs) between 1990-2018 positively impact risk sharing between consumption and income growth, unlike other types of capital flows. Remittances contribute significantly to enhancing risk-sharing effects, offering about 15% of risk sharing i

0 views • 12 slides

Comprehensive Risk Assessment Training Overview

In this risk assessment training session held on November 23, participants reviewed the process of writing and reviewing risk assessments to enhance the quality of assessments for safer scouting experiences. The training aimed to improve leaders' skills and confidence in risk assessment practices wh

0 views • 37 slides