Capital Structure

An appropriate capital structure aims to maximize shareholder return, minimize financial risk, provide flexibility, ensure debt capacity is not exceeded, and maintain shareholder control. The optimum capital structure achieves a balance of equity and debt to maximize firm value.

1 views • 5 slides

Future Challenges and Opportunities in the Asia-Pacific Region

The rapid acceleration of societal development, as highlighted by Alvin Toffler, coupled with sudden and revolutionary changes in various aspects of human life, presents both prosperity and challenges. The future trends indicate increasing complexity, necessitating collaboration, interdependence, an

1 views • 20 slides

Understanding Interpersonal and Intrapersonal Conflicts in Business Administration

Exploring the differences between interpersonal and intrapersonal conflicts, this presentation delves into the meaning of conflicts, their occurrence, key topics, and resolution strategies. It highlights conflict scenarios in various settings and emphasizes the importance of effective communication

1 views • 11 slides

FPC Annual General Meeting & Shareholder Information Session Summary

The FPC Annual General Meeting featured introductory remarks by Chairman Mr. Michael Gallagher, followed by formal business resolutions and a shareholder information session by Mr. Angus Geddes. Key resolutions included the adoption of the Remuneration Report and the re-election of Director Mr. Mich

0 views • 26 slides

Understanding Conflicts of Interest in Public Service Governance

Preserving the integrity of public service involves actively considering and disclosing conflicts of interest before and after appointment to a board. It is essential to disclose financial benefits, relationships, and interests that may impact decision-making. Proactively managing conflicts of inter

0 views • 11 slides

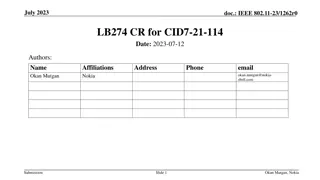

Mechanism Proposal to Avoid IRM Conflicts in IEEE 802.11 Networks

This document presents a proposal to tackle IRM collision and conflict issues in IEEE 802.11 networks, particularly focusing on addressing scenarios where multiple non-AP STAs select the same IRM. The document outlines the importance of avoiding IRM conflicts, introduces the concept of IRM Recap, an

0 views • 12 slides

Understanding Dividend Policy and Share Repurchase in Corporate Finance

Firms in corporate finance make decisions on dividend payouts and share repurchases, impacting company value and shareholder returns. Dividends are payments to shareholders, while share repurchases involve buying back company stock. Companies can choose between these methods based on various factors

1 views • 29 slides

Disclosure Slide Templates for ACCME/ANCC Accredited Conferences

These disclosure slides are designed for presentations at ACCME/ANCC Accredited Conferences. They include templates for disclosing conflicts of interest, grant/research support, speaker bureau affiliations, consultant roles, major shareholder status, off-label medication discussions, and more. Use t

1 views • 4 slides

Conflict of Interest Guidelines Learning Module

This learning module created by the Dominion Leadership and Development Committee explores conflicts of interest in the context of organizational decision-making. It defines conflicts of interest, outlines when conflicts arise, and differentiates between real, potential, and apparent conflicts. Addi

5 views • 8 slides

John Proctor's Conflicts in "The Crucible

John Proctor in "The Crucible" faces conflicts with Abigail Williams, his society in Salem, and his inner demons due to his adultery. These conflicts drive the plot and showcase the struggle between personal integrity and societal expectations in a strict theocracy. Proctor's internal turmoil over h

0 views • 10 slides

Empowering Organizations Through Ombuds: Conflict Resolution and Confidential Support

Ombuds are independent conflict facilitators who provide confidential and neutral support to individuals within organizations. They help address a variety of issues such as harassment, unfair treatment, and interpersonal conflicts. Ombuds empower individuals to navigate conflicts safely and offer se

0 views • 11 slides

Literary Analysis in "The Crucible": Allusions and Conflicts in Acts 1 and 2

Explore the use of allusions and conflicts in Acts 1 and 2 of "The Crucible." Uncover the significance of biblical allusions, historical contexts, and internal and external conflicts within the play. Delve into character dynamics, societal tensions, and the interplay of literary elements in this cla

0 views • 13 slides

Resolving Conflicts in Family Businesses: Insights and Strategies

Family businesses are common in India, but conflicts often arise due to differing opinions among family members. This article explores the characteristics of family businesses, common conflicts, and resolutions. Learn how lack of shared vision, succession issues, and power struggles impact family bu

0 views • 16 slides

Understanding Deadlock in Shareholders Disputes

Shareholders disputes leading to deadlock can be legally complex, potentially resulting in the winding up of a company. The concept of deadlock encompasses functional deadlock, based on the shareholders' inability to cooperate effectively, and irretrievable breakdown of trust and confidence. Differe

3 views • 16 slides

Sample Slide Format for COI Disclosure at Academic Meetings

This presentation provides a sample slide format for disclosing conflicts of interest (COI) at academic meetings. It includes guidelines for using Form 1-A when no conflicts exist and for using Form 1-A when conflicts need to be disclosed. The format also covers details about financial interests and

0 views • 5 slides

Understanding Ethics Laws in Public Service

Ethics laws in public service, such as the Ethics in Public Service Act in Washington state, aim to ensure state officers and employees uphold the highest ethical standards in conducting public duties. These laws set out standards to prevent conflicts of interest, secure privileges impartially, rest

0 views • 19 slides

Sustainability in Supply Chain Management: Key Considerations and Benefits

Sustainable supply chain management is crucial for meeting sustainability criteria while staying competitive and addressing customer needs. It encompasses activities from raw materials to end-users, impacting aspects like product design, recycling, risk management, and shareholder value. By promotin

0 views • 20 slides

Overview of Kankara School Children Kidnapping in Katsina State

Evaluating the security challenges in Northwestern Nigeria, focusing on the kidnapping incidents, this paper discusses the historical context of conflicts, the impact of Boko Haram insurgency, and the recent Kankara school children abduction in Katsina State. It explores the geographical and socio-d

0 views • 23 slides

Resolving Gear Conflicts Through Acoustic Technology

Novel approach using acoustic modems to mark the location of fishing gear and enable communication between fixed and mobile fishermen, addressing gear conflicts in fisheries. The system allows traps and trawls to report positions, owner information, and facilitate enforcement, promoting safe and eff

0 views • 20 slides

Trends, Theories, and Analytical Frameworks in Contemporary Armed Conflicts

This module explores current trends, theories, and analytical frameworks in contemporary armed conflicts, presented by Dr. Pter Kacziba from the Department of Political Science and International Studies at the University of Pcs. The content delves into the complexity of security and peace in an unce

0 views • 15 slides

Practical Tips for ESG Litigation Strategies: Claimants and Defendants

Learn about constructing effective ESG litigation strategies with practical tips for both claimants and defendants. Explore topics such as what ESG litigation entails, jurisdiction issues, and examples of ESG litigation cases. Understand the formats for group actions and shareholder actions, along w

0 views • 14 slides

Union Stewardship in Shareholder Engagement

Janet Williamson, TUC Senior Policy Officer and Trustee of the TUC Pension Fund, emphasizes the importance of stewardship in public debate and policy. The Stewardship Code principles include public disclosure, conflict management, monitoring investee companies, and collective action. Increased union

0 views • 13 slides

Technological Advancement of Warfare and IHL - Changing Dynamics of Conflict in the 21st Century

The world is witnessing a transformation in conflicts due to technological advancements, globalization, and information warfare. From historical changes in warfare to the current impact of internet disruptions and global connectivity, the nature of conflicts and ways of fighting have evolved. This e

0 views • 25 slides

Natural Resources and Conflict: Stakeholders, Scarcity, and Impacts

The interplay between natural resources and conflict is examined, discussing stakeholders involved, potential scarcity conflicts, and the impact of resource abundance on conflict intensity. Examples such as Darfur highlight the complexities of resource-related conflicts. The significance of resource

0 views • 18 slides

Recent Developments in Shareholder Claims and Legal Issues

Explore the latest insights on shareholder claims and legal issues in the banking and financial services sector, including significant litigation cases and key considerations regarding causes of action, reflective loss, procedural routes, and privilege challenges. Stay informed about important judgm

1 views • 86 slides

Religious and Social Conflicts Fueling the Rise of Absolutism in Europe

Social, economic, and religious conflicts in Europe played a significant role in the emergence of absolutism where monarchs wielded supreme power without sharing it with legislative bodies. Events like Spain's religious conflicts, Protestantism in England, the Spanish Armada, religious conflict in t

0 views • 10 slides

European Political Landscape in the Early 17th Century

Central Europe in 1618 was marked by conflicts and power struggles among various entities such as the Bishopric of Hildesheim and the Duchy of Brunswick-Wolfenbüttel. The inability to achieve peace in 1635 and beyond was fueled by factors such as France's increasing revenue and military spending, f

0 views • 26 slides

Legal Rights and Obligations Regarding Shareholder Meetings

This content discusses the rights and obligations related to shareholder meetings in a legal context. It covers topics such as the chairman's authority to call special meetings, shareholders' voting rights, and the secretary's obligation to provide notice for meetings. The comparison between optiona

0 views • 28 slides

Ethics and Conflicts of Interest in Legal Practice

The content discusses key rules related to conflicts of interest in the legal profession, focusing on the obligations of lawyers towards current and former clients. It explains the situations where conflicts may arise, and the conditions under which a lawyer may or may not represent a client in such

0 views • 36 slides

Religious Conflicts Throughout History

Religion, while promoting peace and tolerance, has also been a source of conflict leading to numerous wars and significant loss of life. This article highlights some of the most notable religious conflicts, including the Crusades, the Lebanese Civil War, and the Sudanese Civil Wars. These conflicts,

0 views • 40 slides

Corporate Governance Structure and Shareholder Interests

The governance structure in business firms aims to address agency problems such as conflicts between owners and managers, controlling and minority shareholders, and different shareholders' constituencies. Various strategies like appointment rights and independent directors help mitigate these confli

0 views • 39 slides

Corporate Governance: Key Concepts and Models

Corporate governance explores mechanisms guiding company control and direction, addressing information asymmetry and agency problems. The shareholder model emphasizes conflicts between owners and managers, while the stakeholder model advocates balancing interests for long-term value creation. Divers

0 views • 20 slides

Maximizing Shareholder Value Creation Through Strategic Business Practices

Explore the concept of shareholder value creation, the importance of generating revenues exceeding economic costs, and meeting shareholders' expectations. Learn about Economic Value Added (EVA), key value drivers, aligning strategy with value creation, and essential factors for overall business succ

0 views • 11 slides

Rethinking Firm Governance Through Property Rights and Stakeholder Theory

Challenging the traditional shareholder-centric view, this study explores how property rights theory and stakeholder theory can offer a more comprehensive perspective on firm governance. It delves into the complexities of value creation, contractual relationships, and diverse stakeholder interests,

0 views • 10 slides

Understanding the New Jersey Oppressed Shareholder Statute

The New Jersey Oppressed Shareholder Statute, N.J.S.A. 14A:12-7, outlines the grounds for oppression in a corporation and the process for a buyout. It allows the Superior Court to appoint a custodian, provisional director, order stock sale, or dissolve the company. Key provisions include shareholder

0 views • 12 slides

India Fellowship Seminar on Participating vs. Non-participating Products

The seminar delved into the role of participating and non-participating insurance products in premium growth, risk management, and creating shareholder value in the long term. It discussed market trends, historical data, and key drivers influencing shareholder value in the Indian insurance industry.

0 views • 21 slides

Overview of Redomiciliation Transactions and Section 7874 Implications

Section 7874 imposes restrictions on domestic corporations becoming owned by foreign entities with the same or similar shareholder base. It outlines tests triggering adverse consequences and discusses self-inversion transactions, tax considerations, and cross-border combinations. Notably, substantia

0 views • 8 slides

Understanding Dividend Policy in Financial Management

Dividend policy plays a critical role in balancing long-term financing and shareholder wealth. It involves determining the distribution of profits among shareholders while retaining earnings for company growth. Approaches like Long Term Financing and Wealth Maximisation influence dividend decisions,

0 views • 24 slides

India Fellowship Seminar: Product Contributions to Growth, Risk Management, and Shareholder Value

India Fellowship Seminar discussed the contributions of participating and non-participating products to premium growth, risk management, and shareholder value. Key topics included market trends, drivers of shareholder value, PAR vs NPAR attractions, creating shareholder value, and risk management st

0 views • 21 slides

Understanding Corporate Governance: Principles, Objectives, and Duties

Corporate governance is a system of principles and practices used to manage conflicts of interest in corporations. It ensures managers act in the best interest of shareholders. Key aspects include objectives to mitigate conflicts, ensure efficient asset use, and common sources of conflict like manag

0 views • 10 slides