Impact of NVIDIA Stock Surge on Mutual Funds and Passive Funds Exposure

NVIDIA's stock surged by 16% following strong financial performance, impacting various mutual funds and passive funds. Mutual funds like Motilal Oswal, Mirae, and Franklin have significant exposure to NVIDIA, while non-broad-based passive funds also hold substantial positions. The exposure of broad-

4 views • 10 slides

Overview of COVID Relief Funds for K-12 Education Programs ESSER & ARP ESSER

This presentation provides a comprehensive look at the ESSER II and ARP ESSER programs, offering guidance on program compliance and the creation of work plans to enhance understanding. Delving into the purpose and outcomes, it aims to increase awareness of program requirements and gather insights on

3 views • 48 slides

Budget Basics for Department Chairs - Understanding Funds and Processes

This document provides essential information on budget basics for department chairs, covering topics such as types of funds (state and auxiliary), fiscal authority, budget reconciliation, procard and purchasing procedures, and timeline for budget processes. It outlines different funds like General F

0 views • 18 slides

Overview of Indian Securities Market and SEBI

Explore the Indian Securities Market and the role of SEBI in regulating it. Learn about key concepts such as primary and secondary markets, investor rights, mutual funds, and investor grievance redressal. Understand the structure of the market and the prerequisites for buying and selling shares. Dis

0 views • 56 slides

Fund Accounting Entities and Definitions Explained

Explore the world of fund accounting entities and definitions, including the roles of various funds such as General Fund, Debt Service Funds, Capital Projects Funds, Food and Community Service Funds, Custodial Fund, and Trust Funds. Learn about the unique characteristics and regulations that govern

0 views • 39 slides

Understanding Private vs. Public Saving and Financial Market Dynamics

Explore the concepts of private and public saving in relation to national income, expenditure, and government fiscal policies. Delve into the analysis of saving, investment, financial markets, and the impact of real interest rates on loanable funds. Gain insights into the relationships between savin

0 views • 36 slides

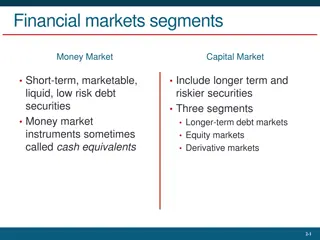

Understanding the Relationship Between Capital Market and Money Market

The relationship between the capital market and money market is significant as they are interconnected in various ways. Both markets cater to different fund requirements, but share common features such as inter-related interest rates, common institutions, similar users of funds, and common investors

0 views • 6 slides

Macroeconomic Theory of the Open Economy by Udayan Roy

This presentation discusses key concepts related to the open economy, such as net exports equaling net capital outflow, national saving equaling domestic investment plus net capital outflow, the loanable funds theory of the real interest rate, and the relationship between saving, investment, and net

0 views • 31 slides

Overview of Indian Capital Market and Financial Institutions

The Indian Capital Market comprises securities market and financial institutions, facilitating the trading of government securities, industrial securities, and providing medium to long-term funds. Financial intermediaries like merchant bankers, mutual funds, and venture capital companies contribute

0 views • 5 slides

Understanding Market Sharing Cartels in Oligopolistic Markets

Perfect collusion in oligopolistic markets often involves market-sharing cartels, where member firms agree to share the market while allowing some degree of freedom in their decisions. This can be done through non-price competition or quota agreements. Non-price competition cartels involve setting a

8 views • 8 slides

Understanding Mutual Funds: A Comprehensive Guide

This presentation provides an educational overview of mutual funds, covering topics such as what mutual funds are, how to invest in them, the structure of mutual funds, the role of Asset Management Companies (AMCs), and how mutual funds work. It also explores the classification of mutual funds, inve

0 views • 24 slides

Chamberlain H.S. Title I Meeting 2021-2022 Overview

Chamberlain High School's annual Title I meeting presentation provides information on Title I funds, parent and family engagement plans, and ways for parents to get involved. Learn about Title I, parent rights, the school compact, available funds, and how you can help decide how funds are spent. Don

1 views • 10 slides

Understanding Capital Market and Its Significance

Capital market refers to the market for long-term finance where financial assets like Shares, Debentures, and Bonds are traded. It plays a vital role in mobilizing funds for companies and governments, facilitating capital formation, and promoting economic growth. The classification includes Industri

0 views • 11 slides

Understanding the Primary Market and Its Functions

The primary market, also known as the new issue market, is where industrial securities are issued for the first time to the public. It plays a crucial role in mobilizing savings and channelizing them for productive purposes. Through processes like IPOs and FPOs, companies raise capital for various n

0 views • 7 slides

Guide to Allocating Title I Funds to Schools - June 2018

Federal Title I, Part A funds are vital for districts with high numbers of children from low-income families. This guide outlines the process of selecting Title I schools and allocating funds based on poverty percentage and school performance. Key steps include obtaining the district's Title I alloc

5 views • 14 slides

Understanding Financial Management of Special Education Programs

Federal IDEA Part B funds support special education programs, helping LEAs implement IDEA. These funds must be used for allowable purposes like special education services, appropriate technology, and early intervening services. It's essential to use IDEA Part B funds to pay for excess costs and supp

1 views • 105 slides

Managing Student Extracurricular Funds in School System

Student extracurricular funds play a critical role in supporting organized student activities beyond the regular curriculum. Trustees have the authority to establish and manage these funds following specific guidelines outlined in the regulatory framework. The funds are meant to benefit students, an

0 views • 56 slides

Maximizing Title IV Part A Funds for Well-Rounded Education

The Title IV Part A program focuses on providing well-rounded education opportunities to students. Districts receiving over $30,000 must conduct a needs assessment and allocate at least 20% of funds for well-rounded activities. Funds can be maximized by collaborating with outside organizations such

0 views • 18 slides

Understanding Mutual Fund Investments: A Comprehensive Overview

Mutual funds are a popular investment choice that offer pooled diversification, professional money management, and various services. This article discusses the attractions and drawbacks of mutual fund ownership, essential characteristics of open-end funds, closed-end funds, and investment trusts. It

0 views • 43 slides

Overview of Compensation Funds in Belgium

The presentation details various compensation funds in Belgium, including their definitions, reasons for creation, key aspects, and pros and cons. It covers funds such as the Belgian Common Guarantee Fund, Victim Compensation Fund, Asbestos Compensation Fund, and more. Each fund serves specific purp

0 views • 22 slides

Understanding Fund Codes and Types at Southern Oregon University

Fund codes at Southern Oregon University categorize money sources and restrictions. General Funds support academic programs, while Agency Funds are for individual benefits. Internal Service Funds serve departments, Designated Funds are isolated operations, and Auxiliary Funds support non-instruction

0 views • 16 slides

Understanding Market Research for Business Success

Market research is crucial for businesses to gather information about their target market, customer needs, competition, and market trends. Primary and secondary research methods, market share analysis, demand assessment, and calculating market size are key aspects discussed in this content. Various

1 views • 5 slides

Comprehensive Guide to Emergency Funds and Victim Support Services in New Mexico

The Crime Victims Reparation Commission (CVRC) in New Mexico provides assistance to victims of violent crimes, offering emergency funds and support services statewide. Learn about different types of emergency funds available, such as those for survivors of sexual violence and human trafficking crisi

0 views • 14 slides

Understanding Braiding Federal Funds for Educational Initiatives

Explore the concept of braiding federal funds for educational initiatives, including coordinating funds, requirements, continuous improvement, and questions to consider. Learn about the importance of aligning funds with program requirements, understanding the distinction between braiding and blendin

0 views • 16 slides

Analysis of Investor Search Results in Aerospace Investment Funds (June-July 2020)

A detailed analysis was conducted targeting investment funds interested in aerospace projects. The search focused on founders and C-level employees of funds from the USA and Europe, resulting in contacting 69 investment funds and 580 C-level employees. The three-touch system approach was employed to

0 views • 7 slides

Overview of Compensation Funds in France and Germany

Prof. Dr. Jonas Knetsch from the University of Reunion Island explores the topic of compensation funds in France and Germany, highlighting the diversity and classification of these funds. The presentation covers various groups of compensation funds, including those for traffic accidents, medical inc

0 views • 23 slides

Understanding Fund Accounting in School Districts

Explore the world of fund accounting in school districts through an in-depth look at different fund types, their definitions, and the regulations governing them. Learn about the unique characteristics of instructional funds, debt service funds, capital projects funds, food and community service fund

0 views • 36 slides

Changes to Smart Schools Investment Plan

The Smart Schools Bond Act has brought changes to the Smart Schools Investment Plan, including new requirements for nonpublic educational technology loans and updates to sections concerning school connectivity and classroom learning technology. Districts are now required to differentiate loanable an

0 views • 23 slides

Theories of Interest in Microeconomics II

Explore various theories of interest in economics, including the Classical Theory, Liquidity Preference Theory by Keynes, Productivity Theory, Abstinence Theory, Time-Preference Theory, Fisher's Time Preference Theory, and the Loanable Fund Theory. These theories offer different perspectives on the

0 views • 6 slides

Understanding the Loanable Funds Market and Interest Rates

In the loanable funds market, equilibrium interest rates are determined by the interaction of supply and demand. Businesses decide to borrow based on the rate of return, affecting the quantity of loanable funds demanded. Lenders, driven by profit opportunities, supply funds at varying interest rates

0 views • 11 slides

Possibilities for Venture Capital Funds in Republic of Serbia

The paper discusses the differences between investment funds, venture capital funds, and private equity, the determinants influencing the development of these funds, and the current state of venture capital in Serbia. It also touches upon legal regulations impacting these funds and explores various

0 views • 10 slides

Overview of Money Market Instruments

This detailed content provides an insight into various money market instruments such as Treasury Bills, Certificates of Deposit, Commercial Paper, Bankers' Acceptances, and Eurodollars. Each instrument's features including issuer, denomination, maturity, liquidity, default risk, interest type, and t

0 views • 29 slides

Water Infrastructure Financing in Utah: Overview of Revolving Loan Funds

Utah's water infrastructure financing system is managed through revolving loan funds established by the Board of Water Resources. These funds date back to 1947 and have been consistently funded from various sources to support projects related to water supply, flood control, and dam safety. The progr

0 views • 12 slides

Workshop on EU Funds for Quality: Building Capacity and Identifying Needs

The workshop "EU Funds for Quality" focuses on enhancing social service providers' capacity to access EU funds. Featuring speakers from various organizations, the event includes presentations, discussions on challenges faced by social services, barriers to accessing EU funds, training needs, and exp

0 views • 4 slides

Management of Funds from the 2010 Deepwater Horizon Oil Spill in Texas

Texas has access to funds from the Deepwater Horizon Oil Spill through the Gulf Environmental Benefit Fund, Natural Resource Damage Assessment, and the RESTORE Act. The National Fish and Wildlife Foundation allocates funds for Texas projects, while BP provides funding for early restoration projects.

0 views • 33 slides

Understanding BCG Matrix: Market Growth and Relative Market Share

BCG Matrix, developed by Bruce Henderson of the Boston Consulting Group, categorizes business units into Question Marks, Stars, Cash Cows, and Dogs based on market growth and relative market share. Market share and market growth are crucial factors in determining a company's position in the market.

0 views • 31 slides

Difference Between Capital Market and Money Market: A Comprehensive Overview

The capital market and money market serve different purposes in the financial world. While the capital market provides funds for long-term investments in securities like stocks and debentures, the money market deals with short-term borrowing and lending of funds. The capital market acts as a middlem

0 views • 4 slides

Guidelines for Managing Activity Funds in Educational Institutions

Managing activity funds in educational institutions involves clear responsibilities for various personnel including the campus principal, bookkeeper, and club sponsor. It outlines proper procedures for collecting, disbursing, and accounting for funds, emphasizing safekeeping and adherence to policie

0 views • 18 slides

Utilizing ESSER III Funds for Educational Enhancement and Infrastructure Development

The presentation outlines the allocation of ESSER III funds for addressing learning loss, summer enrichment, after-school programs, and school infrastructure improvements. Highlights include the distribution of federal and state set-asides for various educational initiatives, such as new curriculum

0 views • 9 slides

Managing Pooled Funds in Transportation Research

Handling partners transferring SPR and FHWA funds, setting up pooled funds, engaging partner agencies, managing financial commitments, ensuring project completion within cost and schedule, negotiating agreements, and closing out pooled funds efficiently are key aspects of leading a successful transp

0 views • 7 slides