Iowa League of Cities Membership Webinar June 28, 2023

The key highlights of HF 718 Property Tax Legislation discussed in the Iowa League of Cities Membership Webinar. Division II covers city rate consolidation and mechanisms for levy reduction based on growth triggers. The legislation also introduces homestead credit and exemption provisions for indivi

0 views • 24 slides

Explore the Legacy of Iowa Girls State: History, Founders, and Milestones

Delve into the rich history of Iowa Girls State, a program initiated in 1946 by visionary women to empower high school girls in civic responsibility. Learn about the founding members, key highlights over the years, and the significant milestones that have shaped this esteemed program, including cele

0 views • 49 slides

Property Tax Trends in Indiana: A Historical Overview

The data presented showcases the evolution of property tax trends in Indiana from 1972 to 2023, highlighting Indiana's position in terms of median homeowner property taxes, property tax revenue as a percentage of state income, and comparisons with neighboring states. Indiana shows a significant redu

2 views • 43 slides

Overview of Iowa Supreme Court Attorney Disciplinary Board

The Iowa Supreme Court Attorney Disciplinary Board oversees attorney misconduct cases in Iowa, with 4 prosecutors, a Director of Attorney Discipline, staff, and volunteer board members. Complaints can be made by anyone, commonly related to family law and criminal matters, with no statute of limitati

0 views • 34 slides

PROPERTY TAXES 101

Property taxes in Ohio are levied in mills, with a mill equaling $1 in taxes for every $1,000 of assessed property value. The base tax of 10 mills is applied to all residents, with additional taxes requiring voter approval. House Bill 920 controls property tax growth, ensuring revenue remains steady

0 views • 10 slides

One of the Best service for Property Sales in Finchley

Aaron Shohet Property provides the Best service for Property Sales in Finchley. Their comprehensive services include property management, property valuations, and property sales and lettings. Whether you're looking to buy, sell, or rent property in the Millbrook Park area, their dedicated team is he

0 views • 6 slides

Comprehensive Property Management Services in Waterbury, CT by Idoni Management

Explore the comprehensive property management services offered by Idoni Management in Waterbury, CT. Our expert team provides tailored solutions for property owners, including tenant screening, rent collection, property maintenance, financial reporting, and lease management. Discover why we are the

1 views • 10 slides

Property Tax Trends in Indiana: A Comparative Analysis

Indiana's property tax landscape is examined through the lens of median homeowner property taxes, property tax revenue as a percentage of state income, and historical trends dating back to 1972. The state's ranking in terms of property tax burden, relative to other states, is highlighted, showcasing

0 views • 43 slides

Property Tax Relief Programs in New Jersey

New Jersey offers several property tax relief programs including Legacy Program - ANCHOR, Senior Freeze PTR, and the new program Stay NJ (P.L. 2023, CH. 75). These programs provide benefits to qualified taxpayers, seniors, and homeowners based on income thresholds and residency requirements. Stay NJ

6 views • 14 slides

Vehicle & Asset Management: Surplus Property Distribution to Local Entities

The Surplus Property Program, operated by General Services, manages the redistribution of surplus property purchased with state funding to various entities such as state agencies, local governments, and non-profit organizations. Additionally, the Federal Excess/Surplus Property Program oversees the

0 views • 16 slides

Understanding Taxes and Government Spending: A Comprehensive Overview

This comprehensive overview delves into the fundamental concepts of taxes and government spending. It covers topics such as the definition of taxes, the power of Congress to tax, limits on taxation, tax structures, characteristics of a good tax, and the burden of taxes. Exploring these concepts prov

1 views • 29 slides

Understanding Ad Valorem Taxes and Property Categories

Ad valorem taxes are levied based on property value, with different classes for taxation depending on the type of property. Real property is categorized into urban, rural, suburban, and assessed as of January 1st for the tax year. The taxation formula includes true value, assessment ratio, and milla

1 views • 22 slides

State and Local Partnership in Research for Transportation Development

The Iowa Department of Transportation collaborates with state and local partners through the Iowa Highway Research Board to oversee funding and conduct research programs focusing on various areas including pavement management, bridge standards, and traffic safety. The program involves county enginee

5 views • 13 slides

Understanding Federal Taxes in the United States

Explore the key aspects of federal taxes in the United States, including individual and corporate income taxes, Social Security, Medicare, and unemployment taxes. Learn about tax brackets, withholding, tax returns, and more. Discover the economic importance of taxes and how they support the function

1 views • 15 slides

Evolution of Legal Process Taxes in County Clerk Offices

Explore the historical progression of legal process taxes related to marriage licenses, property conveyance, and other transactions as mandated by KRS 142.010. Delve into the changes in tax rates and base over time, along with the reliance on these taxes for revenue generation. The receipts of legal

0 views • 9 slides

The Impact of Cigarette Taxes and Indoor Air Laws on Prenatal Smoking and Infant Death

This study examines the effects of cigarette taxes and indoor air laws on prenatal smoking and infant death. It discusses how cigarette taxes can increase smoking cessation during pregnancy and reduce the probability of smoking, while comprehensive smoking bans can decrease the likelihood of smoking

1 views • 27 slides

Open Meetings & Public Records: Iowa's COVID-19 Guidelines

Explore guidelines by the Iowa Public Information Board for conducting open meetings and managing public records during COVID-19. Understand the importance of transparency in government operations. Learn how to provide public notice, conduct meetings, and ensure accessibility in compliance with Iowa

0 views • 20 slides

2017 Retail Cuts Iowa 4-H/FFA Meat Judging Contest - Image Gallery

Showcasing a collection of images from the 2017 Retail Cuts Iowa 4-H/FFA Meat Judging Contest, this gallery provides visual insights into the competition. The images capture various aspects of the contest, offering a glimpse into the world of meat judging in Iowa. From different cuts of meat to the

0 views • 32 slides

Understanding Iowa's Open Meetings and Open Records Laws

Explore the significance of open government in Iowa through insightful quotes from historical figures like Thomas Jefferson, Patrick Henry, and James Madison. Learn about the history, purpose, and application of Iowa's Sunshine Laws promoting transparency and accountability in government operations.

0 views • 54 slides

Overview of Property Tax Trends and Analysis

Explore in-depth insights into property tax trends, challenges, and exemptions, with a focus on state-by-state comparisons and significant features like circuit breakers. Gain valuable information on the growth of property taxes in New England and the economic perspectives shaping state and local ta

0 views • 32 slides

Overview of Advanced Registered Nurse Practitioner Roles in Iowa

The presentation explores the roles and responsibilities of Advanced Registered Nurse Practitioners (ARNPs) in Iowa, focusing on the granting of practice authority by the Iowa Board of Nursing, independent practice within recognized specialties, prescription authority, and certification requirements

0 views • 13 slides

Iowa Legal Aid: Free Legal Assistance for Low-Income Iowans

Iowa Legal Aid offers free legal assistance to low-income Iowans, covering a range of civil legal issues such as family law, housing, consumer rights, and more. Services are provided through regional offices across Iowa, with easy application processes and multilingual support available. Learn how t

1 views • 26 slides

Composition of Ohio's State and Local Taxes Revealed

Ohio relies heavily on sales taxes for state and local government tax revenue. In FY 2019, Ohio's combined state and local tax revenue sources included property taxes, individual income tax, and sales taxes. Sales taxes accounted for the highest percentage of revenue, followed by property taxes and

0 views • 4 slides

Understanding State and Local Sales and Income Taxes

Delve into the intricacies of state and local sales and income taxes in Lecture 10 of State and Local Public Finance. Explore topics such as efficiency, equity, administrative issues, design of federal tax, link to state income taxes, and design of local income taxes. Uncover how sales taxes create

0 views • 42 slides

Examining College Transition Challenges Among Iowa High School Graduates

Iowa SLDS delves into the challenges faced by Iowa high school graduates in transitioning to college. Topics include enrollment cliffs, factors contributing to summer melt, and initiatives to improve college transition and career counseling.

0 views • 8 slides

Importance of Recurrent Property Taxes for Fiscal Sustainability

Recurrent property taxes play a crucial role in enhancing fiscal sustainability by reducing dependency on inter-governmental transfers, increasing local government accountability, and promoting equity in taxation. This article discusses the benefits of recurring property taxes, emphasizes the need f

0 views • 19 slides

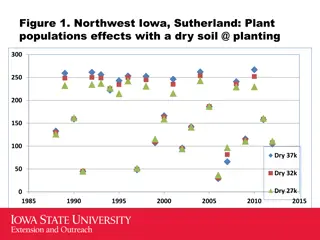

Analysis of Plant Populations Effects in Various Regions of Iowa

The figures depict the impact of plant populations on yield in different regions of Iowa under dry soil conditions. The data spans several years, showing trends in plant populations and corresponding yields over time. Each figure focuses on a specific region, providing insights into agricultural pra

0 views • 8 slides

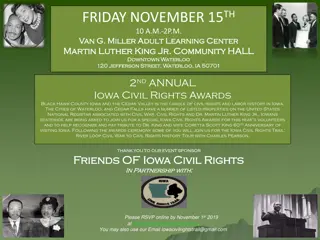

Celebrating Iowa's Civil Rights Legacy: 2nd Annual Awards Event

Join the 2nd Annual Iowa Civil Rights Awards event in Black Hawk County to honor volunteers and pay tribute to Dr. Martin Luther King Jr. and wife Coretta Scott King. The event includes an awards ceremony and a Civil Rights Trail tour to commemorate the 60th anniversary of Dr. King's visit to Iowa.

0 views • 5 slides

Understanding Property Tax Capitalization in Public Finance

Explore the concept of property tax capitalization, its implications for public policy, and how it impacts property value. Learn how property taxes influence housing prices and the valuation of assets, and delve into the relationship between property taxes and the value of housing services. Discover

0 views • 50 slides

Understanding the Law of Property: Concepts and Rights

This material explores the fundamental concepts of the Law of Property, covering topics such as the concept of patrimony, property rights, and the objects of property. It delves into the origins and legal implications of patrimonial and extra-patrimonial rights, shedding light on the significance of

0 views • 40 slides

Understanding Property Transfer Taxes and Fees in the EU

Explore the intricacies of property transfer taxes and municipal user fees, advantages and disadvantages, types of property transfer taxes within the EU, taxpayer classifications, and more in this comprehensive presentation.

1 views • 20 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

Property Taxes and Local Decision-Making in Texas

Texas relies on property taxes and sales taxes as major revenue sources for state and local government funding. The majority of property taxes fund public schools, with the burden increasing due to unfunded mandates from the Texas Legislature. Student funding is impacted by property value growth, be

0 views • 24 slides

Understanding Property Reassessment and its Impact on the Community

Property reassessments aim to ensure fair distribution of tax burdens among property owners. They help adjust property values to reflect current market conditions, preventing inequities in tax distribution. Reassessments do not increase overall tax revenues; instead, they aim to distribute taxes equ

0 views • 17 slides

Supporting Iowa Communities: A Look at Iowa Shares

Iowa Shares is a federation of Iowa charities established in 1992 to raise funds for diverse social action organizations. They focus on issues like human rights, sustainable agriculture, and animal welfare. Donors can choose specific organizations to support, ensuring their donations make a differen

0 views • 12 slides

Trends in Iowa Property Taxes: Past and Future

Property taxes in Iowa have decreased as a source of local revenue over the years. The decline is more significant when looking at own-source revenue excluding state and federal grants. Other revenue sources like charges and sales taxes have become more important. Different trends are observed for c

0 views • 18 slides

Racial Disparities in Iowa's Criminal Justice System: A Deep Dive

Examine the stark racial disparities in Iowa's criminal justice system, spanning from incarceration rates to felony and misdemeanor convictions. Despite slightly lower per capita incarceration rates compared to the national average, Iowa faces significant challenges in addressing the overrepresentat

0 views • 10 slides

Small Business Taxation Overview for Iowa Entrepreneurs

Discover key steps for starting your business with a tax focus in Iowa, including business structure determination, EIN acquisition, tax treatment selection, eligibility for S-Corp status, and tracking financial metrics. Learn about different types of small business taxes, such as federal and state

0 views • 10 slides

Iowa County Property Tax Analysis FY11

Analysis of property tax rates and amounts per capita in Iowa's largest counties for Fiscal Year 2011, highlighting Scott County's rankings among urban and rural areas. The data shows Scott County with comparatively lower property tax rates, positioning it favorably within the state.

0 views • 16 slides

Enhance Iowa Statewide Marketing Update and Campaign Overview

Update on the IHUM Statewide Marketing efforts focusing on the Enhance Iowa website targeting Iowans seeking employment. The plan includes a digital and social media campaign, regional marketing plans coordination, and marketing ideas to promote IHUM signature programs to TAA-eligible, unemployed, u

0 views • 8 slides