CAPITAL STRUCTURE

Capital structure refers to the mix of a firm's capitalization, including debt, preference share capital, equity share capital, and retained earnings. Choosing the right components of capital is crucial based on the organization's function and risk level. Different patterns/forms of capital structur

1 views • 6 slides

Theories of Capital Structure and their Applications

The theories of capital structure explore the relationship between debt and equity in a firm's financing decisions. By optimizing the mix of debt and equity, a company can minimize its cost of capital and maximize its value. The Net Income Approach highlights the benefits of using debt to lower the

1 views • 7 slides

Factors Influencing Economic Growth: Human Capital and Capital Goods

Factors such as investment in human capital, capital goods, natural resources, and entrepreneurship play a crucial role in determining a country's economic growth. Human capital encompasses the skills and abilities of workers, while capital goods are the tools and equipment used to produce goods and

2 views • 28 slides

Aditya Birla Capital Scholarship for Classes 1 to 8.

The Aditya Birla Capital Scholarship is run by the Aditya Birla Capital Foundation and is designed to help students in Classes 1 to 12 and undergraduates with financial aid for their education. The program provides a one-time scholarship of up to INR 60,000 to cover academic expenses. \nTo Know More

0 views • 5 slides

Aditya Birla Capital Scholarship for Classes 9 to 12.

The Aditya Birla Capital Scholarship:\nThe Aditya Birla Capital Scholarship, run by the Aditya Birla Capital Foundation, aims to help students in school and college by offering financial aid and educational support. The scholarship provides up to INR 60,000 (one-time) for academic expenses, and st

1 views • 5 slides

Mutual Capital Investment Fund: Addressing Capital Needs in the Insurance Community

Mutual Capital Investment Fund, LLC, aims to provide capital to mutual insurance companies facing capital needs without converting to stock form or selling minority interests. Led by Mutual Capital Group, the Fund seeks commitments up to $100 million and offers a unique investment opportunity for mu

0 views • 8 slides

Types of Securities: Owned Capital vs Borrowed Capital in Business Financing

Owned capital, contributed by owners, provides permanent risk capital to a business with high returns but lacks withdrawal flexibility. Borrowed capital, obtained through loans, offers fixed-period finance with tax advantages and flexible repayment options, but involves fixed interest payments and i

1 views • 9 slides

Indoor Cycling: Hand Positions and Core Movements Guide

Indoor cycling involves different hand positions for various riding scenarios, focusing on rider posture and performance. The guide covers Hand Positions 1, 2, and 3, emphasizing relaxation, stability, and intensity adjustment. Additionally, it details core movements like Seated Flats, Standing Flat

8 views • 23 slides

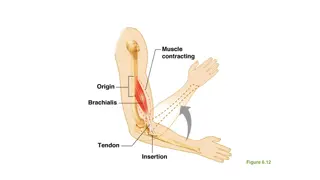

Comprehensive Guide to Body Movements and Special Movements

Explore different types of ordinary body movements such as flexion, extension, abduction, adduction, and circumduction, along with special movements like dorsiflexion, plantar flexion, inversion, eversion, supination, and pronation. Engage with detailed descriptions and visual representations of eac

2 views • 15 slides

Understanding Social Movements: History and Impact

Exploring the background and significance of social movements, this content delves into the evolution of society through various movements like the anti-slavery movement and labor movement. It discusses the types of movements, leaders, followers, tactics, and ways in which social movements can face

3 views • 21 slides

Understanding International Capital Structure and Cost of Capital

Explore the concept of international capital structure and its impact on the cost of capital, including discussions on cost of equity, investment decisions, market segmentation, and cross-border financing. Learn how firms can lower their cost of capital through internationalization strategies, such

0 views • 19 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

2 views • 5 slides

Understanding Capital IQ: A Comprehensive Overview

Explore the world of Capital IQ through this detailed guide covering its history, products on WRDS, unique features, and comparison with other data services. Learn about the extensive financial information, real-time market data, structured datasets, and people intelligence provided by Capital IQ. D

0 views • 13 slides

Understanding Foreign Capital and Its Implications on Development

Foreign capital plays a significant role in the development of a country through investments from foreign governments, institutions, and individuals. It encompasses various forms such as foreign aid, commercial borrowings, and investments that contribute to capital formation, technology utilization,

0 views • 19 slides

Understanding Foreign Capital and Its Impact on Development

Foreign capital encompasses investments from foreign governments, private individuals, and international organizations in a country, including aid, commercial borrowings, and foreign investments. It plays a crucial role in capital formation, technology utilization, and development across various sec

0 views • 19 slides

Understanding Risk, Cost of Capital, and Capital Budgeting in Corporate Finance

Explore the concepts of risk, cost of capital, and capital budgeting in corporate finance, including the Capital Asset Pricing Model (CAPM), cost of equity, beta estimation, and cost of capital. Learn how to reduce the cost of capital and understand the impact of reducing the Weighted Average Cost o

0 views • 20 slides

Understanding Multinational Capital Structural Decision

Multinational corporations rely on capital to fund their expansion and projects. Capital structure decisions impact the cost of capital, profitability, and overall value. MNCs face complexities in balancing debt and equity for financing operations, choosing markets and currencies, and internationali

1 views • 37 slides

Demographic Human Capital DGE Model for High-Growth Scenarios in Rwanda

This study focuses on a Demographic Human Capital Dynamic General Equilibrium (D-DGE) model for analyzing high-growth scenarios in Rwanda from 2016 to 2050. It explores the interactions of demographic dynamics, human capital, public infrastructure, and debt within a long-term growth framework. The m

0 views • 28 slides

Understanding the Classification and Importance of Capital in Business

Capital is crucial for businesses, whether for promotion, functioning, growth, or expansion. It can be classified as promotional, long-term, short-term, or development capital. Factors influencing capital requirements include business activity, size, product nature, technology, business cycle, and l

2 views • 13 slides

Role of the Capital Market in Long-Term Development Financing

The presentation by John Robson Kamanga, CEO of Malawi Stock Exchange, delves into the role of capital markets in financing long-term development. Topics covered include defining capital markets, functions of stock exchanges, development finance, areas funded by development finance, the capital mark

0 views • 23 slides

The Critical Role of Human Capital in Economic Growth: A Review

Literature highlights the significance of human capital formation in driving economic growth and achieving macroeconomic objectives. Human capital accumulation enhances productivity, reduces unemployment, poverty, and inequality, underscoring the need for investments in education, health, and job tr

0 views • 25 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

Understanding Recovery Support Services and Building Recovery Capital

Recovery Support Services (RSS) aim to help individuals bridge gaps and maintain long-term recovery by enhancing their Recovery Capital. These services provide resources in various life domains such as employment, housing, social support, and more. Recovery Coaches offer support at different stages

1 views • 10 slides

Fiscal Year 2022 Capital Budget Presentation Overview

In the presentation to the Board of Finance, the Capital Committee outlines the Fiscal Year 2022 draft capital budget, emphasizing the importance of the Capital Improvement Program and the history of the capital program investments. The proposed budget addresses the critical need for reinvestment in

0 views • 11 slides

Understanding Financing Decisions and Capital Funding

Explore the world of financing decisions and capital funding through images and descriptions. Discover how financial systems function, estimate external funds for growth, and learn about debt vs. equity capital. Delve into corporate financing methods, sources of funds, and the importance of raising

0 views • 78 slides

RHD Cost Sharing Review Update 2010: Capital Planning Horizons and Funding Strategies

The RHD Cost Sharing Review Update in 2010 focuses on the status of implementing recommendations from previous reviews regarding capital planning and funding cycles for health authorities and Regional Hospital Districts. It discusses the impact of economic conditions on capital funding, availability

0 views • 11 slides

Development of Methodologically Robust Agricultural Capital Stock Statistics by FAO

In November 2015, the Food and Agriculture Organization of the United Nations (FAO) initiated a project to enhance Agricultural Capital Stock statistics, focusing on inclusive and efficient agricultural and food systems. The project involves developing methodologies for measuring capital stock and m

0 views • 38 slides

Estimating the Cost of Capital in Corporate Finance

Explore the process of estimating the cost of capital essential for discounted cash flows models in corporate finance. Learn how to determine the cost of debt, equity capital, and the Weighted Average Cost of Capital (WACC) by combining different sources of financing. Gain insights into capital stru

0 views • 59 slides

Understanding Joint Motion: Osteokinematic and Arthrokinematic Movements

Joint motion involves osteokinematic movements, which are under voluntary control and include flexion, extension, and more. End-feel sensations like bony, capsular, and springy block indicate different joint conditions. Arthrokinematic motion refers to how joint surfaces move during osteokinematic m

0 views • 17 slides

Chile's Regulatory Framework for Capital Movements and Essential Security Measures

Chile's position under the OECD Code of Liberalization of Capital Movements is described along with its commitments in free trade agreements. The regulatory framework for capital movements in Chile allows for liberal participation of foreigners, with certain restrictions in sectors like air transpor

0 views • 21 slides

The Significance of Ethnicity and Race in Social Movements

Exploring the interconnectedness between the social construction of race/ethnicity and social movements, this presentation by Pamela Oliver delves into the relevance of race in both majority and minority movements. It emphasizes how race/ethnicity plays a crucial role in structures of domination, po

0 views • 55 slides

Understanding Multinationals and International Capital Movements in Econ 340

This lecture delves into the terminology and concepts related to multinationals, foreign direct investment (FDI), and international capital movements. It explains the differences between real and financial capital, the history, purposes served by FDI, reasons for FDI, and effects similar to trade an

0 views • 46 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Environmental Movements in India - Overview and Major Movements

Environmental movements in India encompass a range of efforts aimed at conserving the environment, managing natural resources sustainably, and advocating for policy changes. From forest conservation to pollution issues, movements like the Bishnoi and Chipko have made significant impacts on environme

0 views • 24 slides

Understanding Venture Capital: Key Concepts and Regulations

Venture capital is a form of financing provided to startup companies with high growth potential. It involves high risk and requires a long-term horizon, often coming in various forms like equity, conditional loans, and participation in management. The process includes stages such as seed capital, ex

0 views • 10 slides

Understanding Capital Adequacy Ratio (CAR) in Banking

Capital Adequacy Ratio (CAR) is a crucial metric in banking that measures a bank's capital against its risk. Also known as CRAR, it enhances depositor protection and financial system stability worldwide. The CAR formula involves dividing a bank's capital by its risk-weighted assets, comprising tier

0 views • 7 slides

Environmental Movements in India: Lessons for a Sustainable Future

Environmental movements in India have evolved over time, driven by concerns of unbridled resource exploitation and environmental degradation. The emergence of these movements has been marked by a common interest in protecting the environment through policy changes and collective action. With a focus

0 views • 22 slides

Difference Between Capital Market and Money Market: A Comprehensive Overview

The capital market and money market serve different purposes in the financial world. While the capital market provides funds for long-term investments in securities like stocks and debentures, the money market deals with short-term borrowing and lending of funds. The capital market acts as a middlem

0 views • 4 slides

Lessons on Capital Account Liberalization in Latin America: A Historical Overview

Explore the evolution of capital account liberalization in Latin America from 1950 to 2013, highlighting key events such as the Latin American debt crisis, post-crisis capital flows, and regulatory phases. The comparison with emerging market economies sheds light on the region's capital account rest

0 views • 11 slides

Analysis of Labor Movements in the Globalization Era

Contemporary labor movements in the era of globalization differ from previous periods, influenced by factors such as globalization, European integration, the collapse of the socialist system, and economic disparities. The dynamics of migration have evolved, impacting various countries and regions. T

0 views • 29 slides