Effective Budgeting and Forecasting Practices for Improved Resource Allocation

Understand the key differences between budgeting and forecasting, why they are essential, and where these processes are carried out. Learn about historical forecasting methods, the introduction of the Budgeting and Forecasting Tool (BFT) for increased efficiency, and the importance of BFT reporting

2 views • 31 slides

Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

Demand Estimation and Demand Forecasting

Demand estimation and forecasting are crucial processes for businesses to predict future demand for their products or services. Demand estimation involves analyzing the impact of various variables on demand levels and pricing strategies, while demand forecasting helps in planning production, new pro

1 views • 7 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

Demand Forecasting in Cargo Transport by Revenue Technology Services

Demand forecasting in cargo transport plays a crucial role in ensuring efficient and reliable logistics operations. Revenue Technology Services (RTS), a leader in cargo solutions, offers innovative forecasting tools that help businesses navigate the complexities of supply chain management. With the

1 views • 6 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Understanding Economic Forecasting with Simulation Models

Explore the concept of economic forecasting using multi-equation simulation models, focusing on producing data that follows estimated equations rather than estimating model parameters. Learn about endogenous and exogenous variables, the importance of assumptions in forecasting, and the use of simula

0 views • 38 slides

Operations Planning and Control: Forecasting Methods Overview

Forecasting is a crucial process in operations management, involving the estimation of future events based on past and present information. This chapter covers the significance of forecasts, characteristics of forecasting, role in decision-making, various forecasting methods (qualitative and quantit

3 views • 74 slides

Understanding the Importance of Business Forecasting

Business forecasting involves predicting future trends based on past and present data to make informed decisions and allocate resources strategically. By utilizing quantitative and qualitative forecasting methods, organizations can adapt their business strategies, maximize resources, and stay compet

0 views • 9 slides

Efficient Cash Flow Forecasting for Government Financial Management

Efficient cash flow forecasting is vital for government financial management to ensure budget targets are achieved, expenditures are smoothly financed, and potential problems are detected early. By forecasting daily cash flows, governments can manage their cash efficiently, optimize cash balances, r

0 views • 36 slides

Understanding Sri Lanka's Inland Revenue Act No. 24 of 2017

This content delves into the key aspects of the Inland Revenue Act No. 24 of 2017 in Sri Lanka, covering chargeability of income tax, imposition of income tax, definitions, sources of income, assessable income for residents and non-residents, income tax payable, and income tax base. It provides valu

0 views • 93 slides

Strategic Tourism Demand Forecasting Methods

The chapter delves into qualitative and quantitative approaches for tourism demand forecasting, including the Delphi method and executive opinion juries. It explores advanced forecasting methods and the application of big data analytics in the tourism industry. The focus is on generating expert opin

1 views • 39 slides

Understanding Demand Forecasting for Better Business Planning

Demand forecasting is a crucial aspect of business decision-making, allowing organizations to estimate future demand for their products or services. Dr. Pooja Singh, an Assistant Professor at Chhatrapati Shahu Ji Maharaj University in Kanpur, explains the art and methods of demand forecasting, its u

0 views • 9 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Seasonal Forecasting: Temperature and Precipitation Outlooks

Explore the world of seasonal forecasting through this presentation, covering topics such as the definition of seasonal forecast, sources of predictability, real-time forecasting over the Arctic, and the importance of ensembles in forecasting accuracy. Discover how seasonal outlooks play a crucial r

1 views • 24 slides

Financial Forecasting: Short vs Long Term Strategies

Explore the differences between short and long-term financial forecasting in this informative presentation. Understand the importance of accurate forecasting for guiding policy decisions, strategic planning, and maintaining fiscal discipline. Learn about forecasting methodologies, managing expenditu

0 views • 43 slides

Basic Forecasting Tutorial with EViews

EViews provides a powerful forecasting tool for obtaining forecasts from estimated models. This tutorial covers basic procedures for forecasting, including static vs. dynamic forecasts, forecast evaluation, errors and variances, forecasting with exogenous variables, and forecasting with auto-series.

1 views • 56 slides

Understanding the Forecasting Process with Dr. Mohammed Alahmed

Dr. Mohammed Alahmed provides a comprehensive guide to the forecasting process, covering problem definition, gathering information, model selection, evaluation, and more. The content highlights key steps such as specifying objectives, identifying time dimensions, and evaluating forecasting models fo

0 views • 42 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Exploring Immigration's Impact on Income Inequality

The presentation delves into the relationship between immigration and income inequality, analyzing data on income distributions among voters, non-voting citizens, and non-citizens in PA. It discusses the log-normal distribution as an approximation for income distribution and examines the ratio of me

0 views • 16 slides

Occupational Forecasting and Industry Projections in Louisiana

Occupational Forecasting and Industry Projections in Louisiana are crucial for workforce planning and economic development. The process involves annual projections by industry and occupation, updated with new demand and wage data. The Occupational Forecasting Conference, overseen by key stakeholders

0 views • 14 slides

SUFG Stakeholder Workshop Insights on Utility Forecasting and Evaluation

Stakeholder feedback from the ENERGY CENTER State Utility Forecasting Group (SUFG) workshop highlights considerations for improving load forecasting techniques, including the use of binary variables, end-use models, state-level data access, and economic model adjustments. Insights on electricity pri

0 views • 47 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Exploring Modern Forecasting Methods in Fashion and Megatrends

Delve into the world of fashion forecasting and megatrends, understanding the significance of long-term forecasting in decision-making for the textile and apparel industry. Discover the methodology, evolution, and key concepts of trendspotting, style eruptions, and the process of long-term forecasti

1 views • 19 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

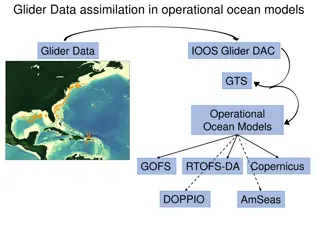

Operational Ocean Modeling and Forecasting Systems

This content provides an overview of various operational ocean modeling and forecasting systems, including data assimilation processes, glider data, surface and subsurface data sources, forecasting models for hurricanes, and NOAA's hurricane forecasting models. It covers a range of technologies and

0 views • 16 slides

Adapting DWP Forecasting for Covid-19 Challenges Using Hybrid Dynamic Microsimulation Approach

DWP adapted its forecasting for Covid-19 challenges by implementing a hybrid dynamic microsimulation approach at the IMA Conference in Dec '20. The organization's strong track record in microsimulation includes developments in AnyLogic translation, working age modeling, and forecasting. The plan inv

0 views • 11 slides

Advancing the Living with a Star Program: Science Goals and Community Priorities

The Living with a Star (LWS) program, led by a dedicated steering committee, aims to provide yearly reports, set long-term visions, and address key science topics in solar and space physics. The community priorities include enabling discovery and addressing societal needs, emphasizing the importance

0 views • 11 slides

Advances in Operational Air Quality Forecasting and Data Assimilation

Key observations and advancements in operational air quality forecasting and data assimilation were highlighted in sessions featuring prominent experts from various organizations like ECMWF/CAMS, GAFIS, NOAA, and ECCC. Topics discussed ranged from progress and challenges in air quality forecasting i

0 views • 12 slides

Implementation Plan for Food Security Forecasting Model in AFSIS Project

This project led by Shoji Kimura aims to promote food security through the development of a forecasting model within the ASEAN Food Security Information System (AFSIS). The plan involves creating supply and demand forecasting information, training on forecasting methods, developing the F Model, and

0 views • 18 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides