IFRS 17 Disclosures Emerging Experience from Europe

Explore the European experience with IFRS 17 standards, impacts on financial reporting, & opportunities for efficiency. Key insights on new perspectives, data demands, and profit analysis.

1 views • 17 slides

Briefing to the Standing Committee on Appropriations on Adjustments Appropriation Bill

The presentation by Ms. Funani Matlatsi, DDG: CFO District Development Model, covers the adjustments in the national expenditure outcome, rationale for unallocated funds, impact on LGES, financial performance of the Municipal Infrastructure Grant, measures to mitigate fund stopping, steps to settle

3 views • 37 slides

International Corporate Reporting

Influential institutional and external factors shape corporate reporting in the USA. The development of accounting regulation, led by bodies like the SEC and FASB, has evolved over the years to ensure financial transparency and accountability. The convergence efforts between FASB and IASB have aimed

0 views • 27 slides

Importance of Financial Reporting as a Catalyst for Growth

Financial reporting frameworks such as International Financial Reporting Standards (IFRS), Generally Accepted Accounting Principles (GAAP), and the role of financial statements play a crucial role in enhancing trust in financial information, reducing information asymmetry, promoting investment, faci

1 views • 90 slides

Delete Inventory Adjustments in QuickBooks Online and Desktop

Delete Inventory Adjustments in QuickBooks Online and Desktop\nDeleting inventory adjustments in QuickBooks is easy. To delete an inventory adjustment in QuickBooks Online, go to \"Inventory\" > \"Inventory Adjustments\", find the adjustment, click it, and choose \"Delete\". For QuickBooks Desktop,

1 views • 4 slides

What is The Cost of IFRS Online Course?

International Financial Reporting Standards (IFRS) are globally recognized accounting standards set by the International Accounting Standards Board (IASB).\nWebsite: \/\/ \/products\/dip-ifrs-acca-uk-instructor-led-online-training

1 views • 6 slides

What Are the Requirements for an ACCA IFRS Certificate

One certificate that makes any Finance professional stand out is the ACCA IFRS Certificate. It holds great value in the finance and accounting industry.

1 views • 14 slides

Workplace Adjustments and Employee Lifecycle Overview

This content discusses the key stages in the employee lifecycle where workplace adjustments may be necessary to support employees effectively. It emphasizes the importance of providing reasonable adjustments as required under the Equality Act 2010, especially during recruitment, induction, performan

3 views • 4 slides

Is Dip IFRS Certificate Useful?

The International Financial Reporting Standards (IFRS) is the global standard for financial reporting.

0 views • 14 slides

Resource Adequacy Load Forecast Adjustments 2023

The document outlines the process of adjusting load forecasts for resource adequacy in 2023, focusing on factors such as IOU service areas, coincidence factors, peak demand estimates, LSE-specific adjustments, demand-side programs, and pro-rata adjustments. It includes detailed data and forecasts fo

1 views • 15 slides

Understanding IFRS 17 Implementation: Key Design Considerations

Implementation of IFRS 17 requires a structured approach in the design phase to avoid disruptions to business operations and financial systems. This article emphasizes the importance of proper planning, assessment, and execution to ensure a smooth transition. Key topics include level of aggregation,

0 views • 28 slides

Understanding IFRS 9 Significant Increase in Credit Risk

Explore the principles and indicators of Significant Increase in Credit Risk (SICR) under IFRS 9, including assessment methods, change in risk of default, and timing considerations. Learn about lifetime expected credit losses, rebuttable presumptions, and common indicators of credit risk escalation

4 views • 19 slides

Overview of Retirement of a Partner and its Effects

Understanding the process of retirement of a partner in a business entity is essential as it involves various adjustments and implications on the firm's financial structure. When a partner retires, it can lead to changes in profit-sharing ratios, adjustments in assets and liabilities, and the treatm

0 views • 15 slides

How Does ACCA IFRS Certification Help with Financial Accounting

Financial professionals must be able to comprehend and use International Financial Reporting Standards (IFRS) in the worldwide commercial world of today.\n

1 views • 14 slides

Understanding Impairment of Assets in IFRS for SMEs - 2019

This content discusses the Impairment of Assets in IFRS for SMEs, focusing on determining the true economic benefits of assets for accurate financial representation. It covers exceptions, impairment tests, inventory valuation, and recognizing valuation/impairment losses for inventory categories. A c

1 views • 23 slides

Comprehensive Guide to IFRS 16 Implementation

Leases under IFRS 16 are recognized on the lessee's financial statement, with a single accounting model for most leases. There are exemptions for short-term leases and low-value assets. Lessor accounting remains largely unchanged from IAS 17, with new disclosure requirements. Effective from 1 April

1 views • 48 slides

Financial Accounting IFRS Learning Objectives

This educational material covers Chapter 3 of the Financial Accounting IFRS 3rd Edition by Weygandt, Kimmel, and Kieso. It delves into topics such as adjusting the accounts, time period assumption, accrual basis of accounting, fiscal and calendar years, accrual versus cash-basis accounting, and more

0 views • 20 slides

Main Represented Figures for Quarter Ended March 31, 2017 - Financial Insights

The provided information details the main represented figures for the quarter ended March 31, 2017, focusing on revenue, EBITDA, operating income, net income, investments, cash flow, and financial debt within the context of IFRS adjustments. It also includes a breakdown of revenue by segment for the

5 views • 4 slides

IFRS for SMEs FIA Technical Workshop Summary

This presentation provides an overview of the IFRS for SMEs, focusing on key topics such as qualitative characteristics, inventory, PP&E, intangibles, leasing, and related party disclosures. It also covers the background of the standard, benefits for SMEs, and the transition process to full IFRS. Ad

1 views • 51 slides

Understanding Grant Award Adjustments and Budget Modifications

Grant award adjustments involve modifications to federal awards, such as reallocating funds or changing project scope. Recipients must initiate a Grant Adjustment Notice (GAN) for budget modifications and follow specific guidelines to ensure timely processing and approval. Different criteria apply f

8 views • 6 slides

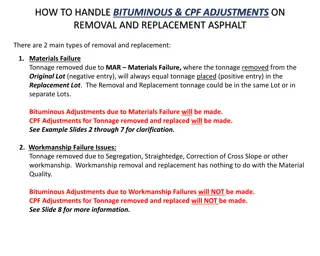

Handling Bituminous & CPF Adjustments on Removal and Replacement of Asphalt

Learn how to manage bituminous and CPF adjustments when removing and replacing asphalt due to materials failure or workmanship issues. Understand the process for adjustments within the same lot or different lots, including entering tonnage, dates, and certifications. Follow step-by-step instructions

0 views • 8 slides

Understanding Financial Accounting Principles in IFRS

Explore key concepts in financial accounting such as time period assumption, accrual basis, adjusting entries, and types of accounting methods. Learn about fiscal vs. calendar years and accrual versus cash-basis accounting in the context of International Financial Reporting Standards (IFRS).

1 views • 20 slides

Understanding IFRS 9 Financial Instruments & Impairment: Key Principles and Impact

Explore the key principles of IFRS 9 Financial Instruments, focusing on classification, measurement, impairment, and expected credit loss overview. Gain insights into the impact on financial statements across different stages, accounting for modifications, and identifying impairment in various finan

0 views • 12 slides

Introduction to the new Student Support Framework

The new student support framework, introduced in September 2022, aims to provide inclusive support for various student groups by streamlining procedures and enhancing accessibility to support services. It covers areas such as extenuating circumstances policy, reasonable adjustments, support to study

0 views • 36 slides

Learn About IAS 1 in ACCA IFRS Certificate Online Classes

A great option for financial professionals looking to improve their abilities and future chances is the ACCA IFRS certification.

1 views • 14 slides

Understanding IFRS 16: Accounting Treatment of Leases

The accounting treatment of leases under IFRS 16 involves recognition, measurement, presentation, and disclosure. IFRS 16 removes the distinction between finance leases and hire purchase contracts, requiring all leases to be capitalized. This standard aims to provide a consistent approach to lease a

1 views • 13 slides

Top 5 Challenges in Preparing for the Dip IFRS Certification Exam

When it comes to expanding one's knowledge of international accounting standards, finance professionals are highly interested in obtaining the Diploma in International Financial Reporting Standards (Dip IFRS) certification.

1 views • 9 slides

Travel Pay Guidance and Work Schedule Adjustments for Payroll Services

Explore scenarios related to travel pay, holidays, dual employment, and work schedule adjustments in the context of payroll services. Understand how to calculate hours worked, handle holidays, manage overtime, and make scheduling adjustments to avoid overtime. Access additional resources for trainin

0 views • 15 slides

Enhance Your Financial Expertise with MindCypress Diploma in IFRS Classes

Being a part of today's globalized business environment requires the knowledge and application of International Financial Reporting Standards, or IFRS.

1 views • 7 slides

Overview of IFRS Implementation in Japan

The overview of IFRS implementation in Japan includes the voluntary and mandatory phases, benefits for companies, challenges faced during implementation, and future plans for mandatory adoption. The process involves transitioning from Japanese standards to IFRS, with a focus on reducing funding cost

1 views • 16 slides

Why You Should Consider IFRS Certification

Standards like IFRS are thus highly important to gain consistency, transparency, and comparability of financial reports worldwide, especially in this intertwined world.\n

1 views • 6 slides

Understanding Budget Adjustments vs. Budget Amendments in AEL WIOA Summer Institute

Explore the differences between budget adjustments and budget amendments in the context of AEL WIOA Summer Institute's financial processes. Budget adjustments allow for moving a sum less than 20% without an amendment, while budget amendments involve larger changes and require specific approvals. Lea

0 views • 24 slides

Update on Modeling and Coordination Discussions

Weekly coordination calls with Ramboll and discussions with EPA OAQPS leads focused on Regional Haze and modeling adjustments. Final draft of procedures document with visibility projections and glide slope adjustments. Upcoming RTOWG meetings covering methodology, projections, and modeling evaluatio

0 views • 5 slides

Understanding Financial Instruments in IFRS: Key Concepts and Overview

This content provides an overview of financial instruments under IFRS, focusing on their classification as assets, liabilities, or equity. It explains the presentation of compound financial instruments and outlines key concepts related to financial assets, financial liabilities, and equity instrumen

0 views • 28 slides

Adjustments to SmartConnect and Popdock Pricing in AUD, NZD, and CAD Currencies Effective January 4, 2021

Starting January 4, 2021, there will be adjustments to SmartConnect and Popdock pricing in AUD, NZD, and CAD currencies. The pricing changes include SmartConnect monthly subscription plans and 8-year site license models, with different tiers offering various features and support options. Certain ser

0 views • 10 slides

Understanding Federal Partnership Audits and Their Impact on State Revenue Departments

The presentation discusses the impact of federal partnership audits on state revenue departments, emphasizing how states benefit from federal audit efforts. It covers topics such as reporting federal audit adjustments, the background of federal audit adjustments, and the final determination process.

0 views • 51 slides

Understanding District Characteristic Adjustments in Education Funding

Various types of formula adjustments are used to address the diverse costs of education among schools and districts, including district size adjustments, necessarily small schools adjustments, density adjustments, regional cost adjustments, and transportation funding approaches. These adjustments ai

0 views • 11 slides

How IFRS Certification Can Accelerate Your Career Growth

Understanding International Financial Reporting Standards (IFRS) is crucial in today's global business environment.

1 views • 7 slides

How Automatic Adjustments in Microwave Ovens Simplify Cooking

Discover how automatic adjustments in microwave ovens make cooking easier by optimizing time, power, and precision for perfectly cooked meals every time. \/\/lahorecentre.hashnode.dev\/how-automatic-adjustments-in-microwave-ovens-simplify-cooking

7 views • 1 slides

The Future of IFRS The Most Important Knowledge and Skills Needed for the Success of Finance Specialists

In the fast-changing world of global finance, knowledge of IFRS is not a luxury but a must.

0 views • 7 slides