Innovative ESOP Program for Disabled Citizens in Restaurant Management

Disabled citizens in Michigan are offered training in culinary arts and management through programs run by institutions like the Michigan Disability Commission and community colleges. Jack in the Box is hiring disabled citizens and veterans to manage restaurants under a unique ESOP program. The ESOP.S Corporation model allows for community involvement and homeownership initiatives, benefiting both employees and the business. By partnering with local entities and leveraging ESOP structures, the program aims to create sustainable opportunities for disabled individuals in the restaurant industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

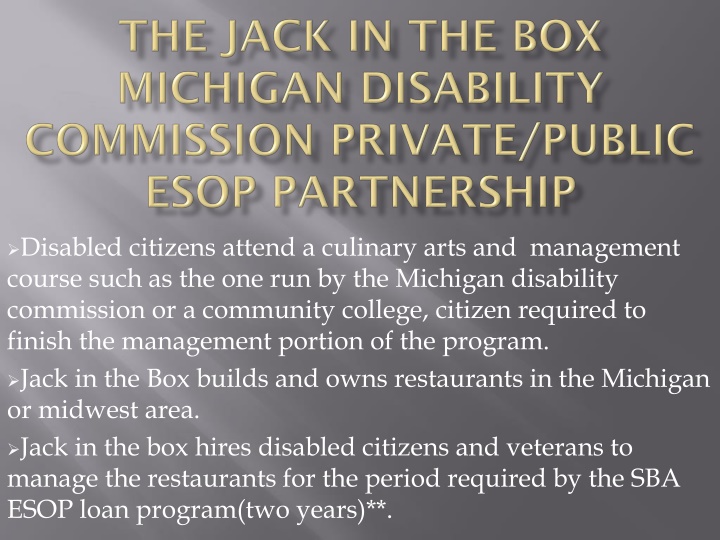

Disabled citizens attend a culinary arts and management course such as the one run by the Michigan disability commission or a community college, citizen required to finish the management portion of the program. Jack in the Box builds and owns restaurants in the Michigan or midwest area. Jack in the box hires disabled citizens and veterans to manage the restaurants for the period required by the SBA ESOP loan program(two years)**.

Any citizen could use the ESOP S corporation as a template for their acquisition. If feasible the citizen agrees to head office operations in the community. Steven Rappolee is the managing ESOP S Corporation partner, and owns 19% of the first restaurant, with the ESOP owning 81%. 19% is below the SBA ESOP loan requirement for a collateral requirement. Each additional Jack in the Box restaurant would be owned by the ESOP and an additional disabled manager, Manager possibly becomes a S corporation partner. The ESOP would acquire the SBA loan to purchase the Jack in the Box corporate stores.

An ESOP S Corporation may have up to 100 S Corporation partners! Some stores could have a disabled owner or S Corporation partner working alongside a Manager who is covered by the ESOP in the event one person is more disabled then the other. Restaurants with high turnover in employees will present a ESOP repurchase obligation challenge!* A well marketed and communicated ESOP education program should reduce turnover.

The ESOP S corporation will match 20 cents an hour with any local government and/or charity for a down payment fund on a house. The ESOP S corporation would like to have a data base of section 8 voucher holders who could benefit from restaurant management training and recruitment by us. It is this that would place an employee into a home ownership program. Studies show home ownership goes up in ESOP employee groups and I believe makes for a more long term employee.

This might have to be another separate ESOP S Corporation! An alternative to the above idea is that Jack in the Box sells half interest in many corporate stores to the ESOP S corporation and it self is a S Corporation partner. As the ESOP pays down its dept it gradually buys out Jack in the Box corporate stores as a franchisee. http://quickref.sbagateway.com/sop50105/50- 105c_ch03_01_collateral_504_loans.htm http://businesswealthsolutions.net/application/ass ets/pdfs/Basic_Fiduciary_Guidance.pdf

http://www.michigan.gov/documents/Self- Employment-Broch_98247_7.pdf http://www.michigan.gov/documents/mdcd/mcti- catalog-08_257906_7.pdf http://www.stclairfoundation.org/uploads/main/g rant_app.pdf Pay for the part ESOP legal paper work to be held in ownership by the community development corporation which is a nonprofit. http://www.edascc.com/directors.php pay for part of the ESOP legal plan and administer its use by local citizens. http://www.sc4 Help citizens utilize the ESOP*