Mandatum AM Senior Loan Strategy

This pre-contractual disclosure outlines the Mandatum AM Senior Loan Strategy, which promotes environmental and social characteristics in its investment basket. Investments are monitored based on the UN Global Compact principles and the carbon footprint is measured and disclosed annually. Mandatum i

2 views • 5 slides

Understanding Risk Management in Environmental Geography and Disaster Management

Risk management in environmental geography and disaster management involves assessing the potential losses from hazards, evaluating vulnerability and exposure, and implementing strategies to mitigate risks. It includes calculating risk, dealing with risk through acceptance, avoidance, reduction, or

1 views • 10 slides

Introduction to Flood Risk Assessment with HEC-FDA Overview

This presentation delves into flood risk assessment using HEC-FDA software, covering topics such as defining flood risk, components of uncertainty, consequences of flood risk, and methods to assess flood risk including hydrology, hydraulics, geotechnical, and economics. It explores the intersection

6 views • 39 slides

The Ultimate Guide to the Best Investment Plans

Investment planning is essential for achieving financial stability and growth. It involves the strategic allocation of resources into various investment vehicles to meet specific financial goals. Whether you are saving for retirement, your child's education, or looking to grow your wealth, having a

0 views • 6 slides

The Ultimate Guide to Choosing the Best Investment Plan

Investing is a crucial component of building long-term wealth and securing financial stability. However, with a myriad of investment options available, selecting the best investment plan can be overwhelming. This comprehensive guide will help you understand different types of investment plans, their

0 views • 6 slides

Operational Risk Assessment for Major Accident Control: Insights from IChemE Hazards 33 Conference

This content provides valuable insights into the importance of Operational Risk Assessment (ORA) in managing major accident risks in high hazard industries. It covers the necessity of ORA, identifying changes, risk assessment, and key success factors. Real-life examples like the Buncefield Terminal

0 views • 22 slides

Understanding Country Risk Analysis in International Business

Country risk analysis is crucial for multinational corporations (MNCs) to assess the potential impact of a country's environment on their financial outcomes. It includes evaluations of political and economic risks in foreign operations. Sovereign risk, political risk characteristics, and factors are

0 views • 61 slides

Project Risk Management Fundamentals: A Comprehensive Overview

Project risk management involves minimizing potential risks and maximizing opportunities through processes such as risk management planning, risk identification, qualitative and quantitative risk analysis, risk response planning, and risk monitoring and control. Quantitative risk analysis assesses t

0 views • 41 slides

Customised Investment Portfolios at West Indies Stockbrokers Limited

Explore Customised Investment Portfolios (CIPs) offered by West Indies Stockbrokers Limited, comprising primarily of Exchange Traded Funds (ETFs) providing access to global stock and bond markets. Learn about ETFs, market indices, benefits of investing in CIPs, and portfolio performance. Make inform

0 views • 24 slides

Technical Appraisal of Infrastructure Development Project

A detailed discussion on the investment project cycle, investment project appraisal, technical appraisal with components and techniques, and decision factors. Includes a case study on Rural Connectivity Improvement Project (RCIP). Raises critical questions regarding design, engineering, organization

0 views • 40 slides

Role of Securities Firms and Investment Banks in Financial Markets

Securities firms and investment banks play a vital role in facilitating the transfer of funds between suppliers and users in financial markets with efficiency and low costs. Investment banks assist businesses and governments in raising funds through securities issuance, while securities firms aid in

0 views • 26 slides

Business Investment Opportunities- Best Investment Options in India 2024 for Hig

Find effective Business investment opportunities and investment fundamentals with CreditQ, your trusted business platform. Review the key investing plan considerations. For smart and effective generating wealth, balance return expectations, risk tole

2 views • 9 slides

Stock Pitch Competition: Crafting a Winning Investment Thesis

Prepare for a stock pitch competition with the Exeter Student Investment Fund by understanding what makes a strong investment thesis, the importance of catalysts, and how to differentiate your insight for a mispriced stock. Learn the key components of a pitch, from industry and company overview to v

0 views • 14 slides

Comprehensive Overview of Market Risk Management Framework in Financial Institutions

Explore the detailed presentation from the MEFMI seminar on Market Risk in September 2017, covering topics like Risk Management Framework, Investment Policy and Objectives, Reserves Structure, Portfolio Managers, Market Risk, and Currency Risk Management strategies.

0 views • 16 slides

The Boundaries of Investment Arbitration: Crossroads of Trade and Human Rights Law

This material delves into the overlapping realms of investment arbitration, trade law, and European human rights law in investor-state disputes. It examines the use of ECtHR and WTO references in arbitration rulings, the nuances of citation choices, the appeal of juridical rulings, and the comparati

0 views • 18 slides

Financial Planning Essentials: Establishing a Solid Investment Program

Explore the key steps involved in establishing an investment program, including assessing current financial conditions, setting financial goals, budgeting, understanding investment goals, and managing personal debt. Dive into the importance of liquidity, factors influencing investment decisions, and

0 views • 66 slides

Deposit and Investment Risk Disclosures for Accounting Professionals

Experienced Senior Auditor Michelle Kiese from BDO USA, Anchorage Office, discusses GASB 40 amendments and important risk disclosures related to credit risk, custodial credit risk, and concentrations of credit risk for deposit and investment transactions to provide users with valuable information fo

2 views • 17 slides

Insights on Investment Strategies and Trusts in Q1 2016

Delve into the world of investment with insights on market trends, risk assessment, ideal investments in equities and funds, and a focus on closed-end investment trusts in the UK. Explore expert opinions on long-term strategies, asset value discounts, governance principles, and more, all presented i

0 views • 36 slides

Long-Term Investment Decision Making and Financial Feasibility Evaluation

Explore the process of long-term decision-making in corporate strategic decisions, focusing on growth opportunities and financial feasibility evaluations. Learn about investment appraisal methods including Discounted Cash Flow, Net Present Value, and Internal Rate of Return, alongside the importance

0 views • 46 slides

Enhancing Country Platforms for Technical Assistance and Quality Assurance in Investment Strategies

The Second Investors Group in St. Albans, United Kingdom, in February 2016 focused on country platforms, technical assistance, and quality assurance in the context of investment strategies. Key feedback emphasized a bottom-up approach, holistic issue resolution, and defining quality in investment ca

0 views • 16 slides

Understanding Investment Funds: Types, Benefits, and Management

Investment funds offer a way for clients to invest money to meet specific objectives, managed by professionals who select suitable investments based on fund goals. Funds pool money from multiple investors for economies of scale, diversification, and access to professional management. Collective inve

0 views • 11 slides

Understanding and Refining Risk in Investment Planning

Investment planning involves understanding liquidity needs, as exemplified by the LTCM case study in 1998. Refining investment style entails assessing risk as uncertainty and aligning it with individual risk appetite and goal timelines. The analogy of driving helps explain different approaches to ha

0 views • 21 slides

Understanding Risk Concepts and Management Strategies in Finance

Explore the essential concepts of risk in finance, such as risk definition, risk profiles, financial exposure, and types of financial risks. Learn about risk vs. reward trade-offs, identifying risk profiles, and tools to control financial risk. Understand the balance between risk and return, and the

0 views • 18 slides

Risk Management Instruments to Mobilize Private Finance

Risk is a critical factor hindering projects from attracting financial investors and preventing investors from achieving desired returns. Different types of risk such as political, technical, and market risks impact investment decisions. Mitigation instruments are essential to address these risks an

0 views • 19 slides

Risk and Return Assessment in Financial Management

This comprehensive presentation explores the intricacies of risk and return assessment in the realm of financial management. Delve into understanding risk concepts, measuring risk and return, major risk categories, and the impact of risk aversion on investment decisions. Gain insights into the manag

0 views • 62 slides

Risk Management and Security Controls in Research Computing

The European Grid Infrastructure (EGI) Foundation conducts risk assessments and implements security controls in collaboration with the EOSC-hub project. The risk assessments involve evaluating threats, determining likelihood and impact, and recommending treatment for high-risk threats. Results from

0 views • 13 slides

Risk Management & MPTF Portfolio Analysis at Programme Level for UN Somalia

This session delves into the world of risk management and portfolio analysis at the programme/project level, specifically focusing on the Risk Management Unit of the United Nations Somalia. It covers enterprise risk management standards, planned risk management actions, the role of RMU, joint risk m

0 views • 30 slides

Alcohol and Cancer Risk: Understanding the Links

Alcohol consumption is linked to an increased risk of various cancers, including mouth, throat, esophagus, breast, liver, and colorectal cancers. Factors such as ethanol, acetaldehyde, nutrient absorption, estrogen levels, and liver cirrhosis play a role in this risk. Even light drinking can elevate

0 views • 17 slides

Mastering Your Investment Goals: A Comprehensive Guide

This comprehensive guide on investing covers setting appropriate goals, understanding key investment characteristics, working with professionals, safeguarding against scams, assessing risk tolerance, and aligning personal values with investment choices. Learn to define and prioritize your financial

0 views • 42 slides

Understanding Investment Policy Statements in Portfolio Management

Investment Policy Statements (IPS) are crucial documents that outline the financial objectives, risk tolerance, and constraints of an investor-adviser relationship. It guides portfolio construction, monitoring, and review, ensuring a mutually agreed basis for decision-making. Constructing an effecti

0 views • 15 slides

Understanding Risk Concepts in the Mathematics Classroom

Risk is a concept integral to decision-making in various aspects of life. This resource explores how risk is defined in the real world, its relevance in the classroom, and strategies for teaching risk literacy to students. It delves into the multiple definitions of risk, risk analysis, and the emoti

0 views • 62 slides

High-Risk Newborn Nursing Care and Factors

Maternal and neonatal nursing specialties focus on providing care for high-risk newborns and their families, who face conditions endangering the neonate's survival. Factors contributing to high-risk newborns include high-risk pregnancies, maternal medical illnesses like diabetes, labor complications

0 views • 25 slides

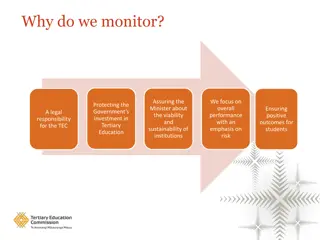

Effective Monitoring and Investment Relationship in Tertiary Education Institutions

Assurance of viability and sustainability of institutions, focusing on overall performance and risk assessment, safeguarding government investments in tertiary education, ensuring positive student outcomes, and fulfilling legal responsibilities for the Tertiary Education Commission. Monitoring activ

0 views • 6 slides

Investment Pool Risk Register Overview

This document provides an overview of the Investment Pool Risk Register as of February 14, 2020, detailing the analysis, identification, assessment, and management of risks shared by the West Midlands Pension Fund and partner funds. It outlines the objectives, mechanisms for risk assessment, and reg

0 views • 13 slides

Understanding Organizational Risk Appetite and Tolerance

Explore the development of market risk appetite goals and how to define and establish organizational risk tolerance. Learn about the Classic Simplified View of Risk Tolerance and different methods to determine risk appetite. Discover the importance of assessing market risk impact and aligning risk t

0 views • 8 slides

Developing a Risk Appetite Culture: Importance and Framework

Risk management plays a critical role in the success of corporations, with strategy and risk being intertwined. This presentation delves into definitions of key terms such as risk appetite, the Risk Appetite Cycle, characteristics of a well-defined risk appetite, and the importance of expressing ris

0 views • 31 slides

Security Planning and Risk Management Overview

This content provides an in-depth exploration of managing risk, security planning, and risk appetite in the context of cybersecurity. It covers essential concepts such as risk management process, threat types, risk analysis strategies, vulnerability assessment, and risk mitigation techniques. The ma

0 views • 73 slides

Risk Factors Analysis: Identifying At-Risk Students Before They Reach Campus

Risk Factors Analysis aims to identify students at risk of attrition before they even arrive on campus by evaluating academic, financial, minority, and first-generation factors. The method involves choosing specific risk factors, tracking historical prevalence, calculating relative risk, and predict

0 views • 15 slides

High-Risk Meeting: Identification and Care Coordination for Vulnerable Children and Families

The high-risk sub-committee is tasked with identifying children and families at high risk and developing a care coordination plan for their benefit. The meeting agenda includes reviewing the high-risk framework, discussing results and impacts, reflecting on successes and challenges, setting meeting

0 views • 12 slides

Comprehensive Risk Assessment Training Overview

In this risk assessment training session held on November 23, participants reviewed the process of writing and reviewing risk assessments to enhance the quality of assessments for safer scouting experiences. The training aimed to improve leaders' skills and confidence in risk assessment practices wh

0 views • 37 slides