Investment Pool Risk Register Overview

This document provides an overview of the Investment Pool Risk Register as of February 14, 2020, detailing the analysis, identification, assessment, and management of risks shared by the West Midlands Pension Fund and partner funds. It outlines the objectives, mechanisms for risk assessment, and regular review processes to ensure effective risk mitigation strategies are in place.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

INVESTMENT POOL RISK REGISTER 14 February 2020 Jill Davys Assistant Director, Investments and Finance West Midlands Pension Fund

AGENDA Pool Risk Register RECAP Analysing Risk Identifying LGPSC Pool Risks LGPSC Investment Pool Risk Assessment Conclusions and Key Issues 22019

POOL RISK REGISTER RECAP A DEFINITION A tool to document exposure to risks shared by the Company and Partner Funds (both as Client and Shareholder), the impact and likelihood of those risks occurring, and action plans to mitigate such risks 32019

POOL RISK REGISTER RECAP LGPS Central Limited and individual Partner Funds have their own Risk Registers The objective of the Pool Risk Register to identify and manage risks which are common to the development of the Pool and to have a mechanism for identifying potential risks that might affect the progress of investment pooling for LGPS Central Pool Risk Register presented to June 2019 Joint Committee following collaborative development between LGPSC Ltd and working group of Partner Funds Regular Review of Risk Register by Client Oversight Governance Group (COGG); changes agreed between LGPSC Ltd and Partner Funds Six monthly review and consideration by Joint Committee 42019

ASSESSING RISK RECAP Risk Rating Is determined by multiplying the impact of the risk with the likelihood of it occurring (5X5): Pre-Control Risk Is the risk rating prior to any defensive measures being taken Post-Control Risk Is the risk rating following defensive measures being taken Mechanisms for management of risk: Control; Minimise; Eliminate; Transfer; Accept 52019

IDENTIFYING LGPS CENTRAL INVETSMENT POOL RISKS Assess risk post controls Identify risks & categorise Evaluate risk pre-controls What measures can be taken to control/ manage / mitigate risks Owners of risk and actions to be taken Assess level of tolerance towards risk Is risk in-line with tolerance? 72019

IDENTIFYING LGPS CENTRAL POOL RISKS Common areas of risk identification Categorise into high level areas - Resources - Regulatory Environment - Political - Reputational - External and Third Party - Strategic - Investment - Operational and Financial 82019

IDENTIFYING LGPS CENTRAL POOL RISKS & CONTROLS Resource Risks Resource Controls External & Third Party Risks External & Third Party Controls Regulatory Environment Risks Regulatory Environmen t Controls Monitor for wider concentration Concentration of service providers Recruitment & retention / training Inability to attract and retain suitably qualified staff Wider regulatory context Awareness of context in which operate Monitoring and oversight Material failure of provider Budgetary constraints Investment pooling guidance (MHCLG) Responding to consultations Budget setting Annual assurance testing Failure of joint suppliers Succession planning Departure of key personnel Financial services regulation Horizon scanning Market testing on regular basis Further concentration / monopoly Pension / Joint Committee Experience Officer support / training Broader local government regulatory impact Internal readiness to meet changes 92019

IDENTIFYING LGPS CENTRAL POOL RISKS & CONTROLS Reputationa l Risks Reputation al Controls Political Risks Political Controls Investment Risks Investment Controls Mandate monitoring / oversight /action to address performance issues Collaborating more widely / aiming to influence Negative press coverage Changing attitude to pooling Manage expectations Long term returns fail to deliver Wider political risks impacting operating environment Review to ensure remain appropriate Governance challenges Ensuring decision making structures in place and effective Awareness & responding Investment Governance Pooling change management project National and local political changes Adapting and working with changes Partnership working and product development protocol Realistic expectations Product does not meet strategic requirements Changing asset allocation requirements Keep under review / horizon scanning Forward planning/ communication/ partnership working ESG Monitor potential risks Brexit challenges 102019

IDENTIFYING LGPS CENTRAL POOL RISKS & CONTROLS Operational & Financial Risks Operational & Financial Controls Strategic Risks Strategic Controls Collaborative working and common understanding Divergence from strategic objectives Resilience testing / BCP / oversight of providers Cyber or IT attack Product development protocol key touch points Cost sharing agreement breached Delays to product development Partnership working / budget monitoring Reporting group / Joint Committee oversight Partner Funds delay to transition assets Inability to provide timely and comprehensive reporting Products meet strategic requirements Strong control environment / monitoring and oversight by RACC Monitoring and management of cost vs business plan Cost savings not delivered Weak controls environment 112019

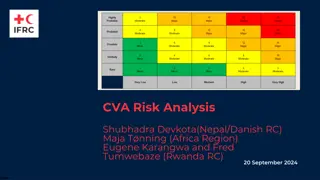

INVESTMENT POOL RISK ASSESSEMENT Risk Pre- Control June 2019 Post-Control June 2019 Pre- Control February 2020 Post-Control February 2020 Resources HIGH MEDIUM HIGH MEDIUM Regulatory Environment HIGH MEDIUM HIGH MEDIUM Political HIGH HIGH HIGH HIGH Reputational HIGH MEDIUM HIGH MEDIUM External & 3rd Party HIGH MEDIUM HIGH MEDIUM Strategic MEDIUM MEDIUM HIGH HIGH Investment HIGH MEDIUM HIGH MEDIUM Financial & Operational HIGH MEDIUM HIGH MEDIUM 13019

KEY ISSUES AND CONCLUSIONS The LGPS Central Pool has put in place an effective tool to identify, measure and monitor risks The Pool recognises those risks where it has little or no influence and those where it can provide a degree of mitigation When evaluating each risk the Pool takes into account its appetite for such risk in order to achieve its objectives It is expected and accepted that there will be a number of high / medium risk areas due to the fact that the Pool is in its early stages of development 15019