Course Overview: E/Digital Government at UIN SUSKA Riau

Explore the E/Digital Government course offered by the Saide Dept. of Information Systems at UIN SUSKA Riau. The course covers topics such as digital government landscape, historical perspectives, e-government evolution, and digital transformation. Gain insights into digital government maturity mode

2 views • 24 slides

Global Concerns: Climate Change, Inequality, and Influence on Government

Climate change and inequality are identified as top global concerns, with a link to government influence and favoritism highlighted. The connection between people's worries worldwide showcases a concerning asymmetrical influence that relates to issues like waste in government spending and vested int

4 views • 22 slides

Understanding the Circular Flow in a Three-Sector Economy

In a three-sector economy, the circular flow of income involves households, firms, and the government sector. The government acts as both a firm and a consumer, producing goods and services while also spending on consumption. The flow of income includes transfer payments, factor payments, taxes, sub

5 views • 5 slides

2024 Health Benefits Enrollment Information for Commonwealth of Virginia

The 2024 Open Enrollment for Health Benefits and Flexible Spending Accounts in the Commonwealth of Virginia is scheduled from May 1 to May 15. This period allows individuals to make decisions regarding health plans, flexible spending accounts, and other benefit options. Changes made during this time

0 views • 39 slides

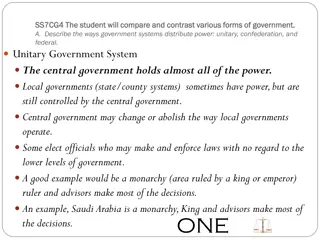

Comparison of Government Systems: Unitary, Confederation, and Federal

The comparison of unitary, confederation, and federal government systems highlights how power is distributed between central and local authorities. In a unitary system, the central government holds most power, while local governments have limited autonomy. In confederation, local governments retain

0 views • 37 slides

Government Jobs for Civil Engineers In Tamil Nadu Mkce

Government Jobs for Civil Engineering:\nGovernment Jobs for Civil engineering is a versatile field that offers a plethora of career opportunities,\nincluding lucrative options in the government sector. In India, various government departments and agencies actively recruit civil engineering graduates

0 views • 2 slides

Principles Governing Public Expenditure: Canons of Public Spending

Public expenditure refers to expenses incurred by government authorities for maintaining governance and societal well-being. The canons of public expenditure guide governmental spending by emphasizing social benefits, efficiency, proper sanctioning, and fiscal prudence to avoid deficits.

3 views • 26 slides

Understanding the Foundation of US Government: The Constitution and its Principles

The Constitution of the United States outlines key principles governing the government, including popular sovereignty, republicanism, limited government, federalism, separation of powers, checks and balances, and individual rights. It establishes six goals for the US government and delineates the po

2 views • 12 slides

Irish Government Children Expenditure Study 2019

The Irish Government's Department of Children and Youth Affairs conducted a pilot study in 2019 to analyze the expenditure on children. The report aims to develop a methodology for transparent assessment of spending on children to ensure it meets their current and future needs. Key findings indicate

4 views • 4 slides

Understanding Taxes and Government Spending: A Comprehensive Overview

This comprehensive overview delves into the fundamental concepts of taxes and government spending. It covers topics such as the definition of taxes, the power of Congress to tax, limits on taxation, tax structures, characteristics of a good tax, and the burden of taxes. Exploring these concepts prov

1 views • 29 slides

Importance of Moderation in Spending and Consumption

The content emphasizes the significance of moderation in spending, as highlighted by a Noble Hadith, encouraging controlled spending and rationalized consumption. It warns against extravagance and advocates for balanced use of resources. By practicing moderation in food, drink, and clothing, individ

2 views • 19 slides

Understanding Government Support Agreements in Infrastructure Projects

Government support agreements play a crucial role in infrastructure projects by outlining various forms of support provided by the government to ProjectCo. These agreements help allocate risks appropriately, ensure credit enhancement, and provide direct or indirect support. However, hindrances such

1 views • 15 slides

Understanding Levels of Government in Canada

A representative democracy in Canada consists of various levels of government, including federal, provincial, municipal, and Indigenous governments. Elected representatives at each level make policy decisions and pass laws on behalf of the citizens. The federal government is led by the Prime Ministe

0 views • 18 slides

Program Budgeting and Performance Indicators in Government Budgeting Process

Program budgeting involves designing methodology, cooperation with budget users, establishing connections with strategic documents, planning, approval, and execution of budgets to enhance transparency, prioritization, and spending performance in government budgeting. It aims to improve understanding

3 views • 30 slides

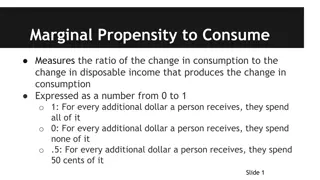

Understanding Marginal Propensity to Consume and Save

Marginal Propensity to Consume (MPC) and Marginal Propensity to Save (MPS) measure the ratios of change in consumption and saving to change in disposable income respectively. The relationship between MPC and MPS shows that they equal 1 when combined, with the remainder being saved. The multiplier ef

7 views • 5 slides

Behavioral Life-Cycle of Saving and Spending in Finance

Explore the behavioral aspects of saving and spending in the life-cycle theory of finance. Learn how individuals reconcile conflicts between saving and spending desires through mental accounting, self-control, and framing. Discover the various sources and uses of spending, including luxury items and

0 views • 18 slides

Updates on Tourism Electronic Card Transactions (TECTs) and Spending Trends

Changes to the Tourism Electronic Card Transactions (TECTs) have been made, including the reinstatement of the international category and implementation adjustments for domestic spend. The Australian market has been split out within the international category. Caution is advised when interpreting TE

0 views • 10 slides

Open Government Data and Sustainable Development Goals

Open government data and sustainable development goals go hand in hand, promoting transparency, accountability, and access to public information. Openness in data allows for universal participation, interoperability, and value creation. By striving for sustainable development and embracing open gove

2 views • 24 slides

The Design of the Tax System: An Overview

This chapter explores the design of the tax system in the US, discussing how the government raises revenue, its efficiency, and fairness. It delves into historical perspectives, Benjamin Franklin's views on taxes, government revenue trends, federal income tax rates, and government spending. The cont

2 views • 43 slides

Managing Finances in the United States: Creating a Spending Plan

Explore the importance of creating a spending plan to cover basic living needs, care for family, purchase desired items, and manage financial obligations or debts. Learn about different types of expenses, frequency of occurrence, and how to start creating a personalized spending plan based on your i

0 views • 14 slides

Financial Overview of IARC-ERDC Spending and Project Plan by Michael Geelhoed

Delve into the detailed breakdown of spending, challenges, progress, and future steps outlined in the IARC-ERDC Spending and Project Plan presented by Michael Geelhoed. The plan includes cost allocations for various components like RF Coupler, SRF Gun, Cryostat, and more, as well as projections and

0 views • 5 slides

Overview of U.S. Prescription Drug Spending and Medicare Part D

U.S. prescription drug spending data from 2005 to 2025 shows trends in various payer contributions, with predictions for future years. Medicare Part D's drug spending is broken down, revealing top drugs and rebate percentages. The total Medicare spending in 2015 and average annual growth in Medicare

0 views • 10 slides

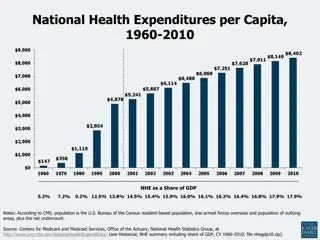

Overview of U.S. Health Care Expenditure Trends

Analysis of U.S. health care expenditure trends from 1960 to 2010, including per capita spending, share of GDP, concentration of spending in different income brackets, growth rates compared to GDP, and impact of cost on access to care. Data reveals the increasing financial burden on individuals, dis

0 views • 6 slides

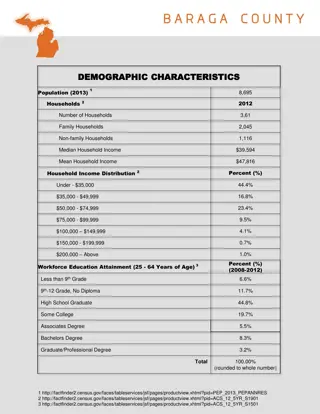

Demographic and Government Overview of L'Anse and Baraga, Michigan

An overview of the demographic characteristics and government structures of L'Anse and Baraga, Michigan. The population, household statistics, income distribution, and workforce education levels are highlighted for L'Anse. The city government structures of L'Anse and Baraga, including village truste

1 views • 10 slides

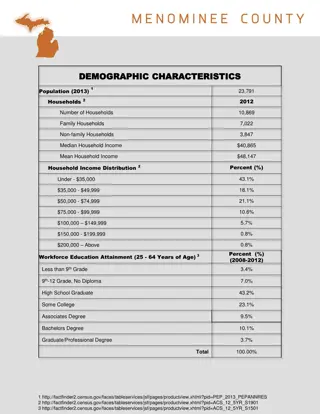

Demographic and Government Overview of Menominee, Michigan

Menominee, Michigan, has a population of 23,791 as of 2013, with a median household income of $40,865. The city government is structured with a mayor and city council, while the county government is led by a board chairman and commissioners. The state government representation includes state senator

1 views • 11 slides

Defense Travel Management Office - Rental Car Program Overview

The Defense Travel Management Office (DTMO) oversees the U.S. Government Rental Car Program for various departments including the Department of Commerce and Department of Defense. The program covers the period from January to December 2020 and provides insights into quarterly spending, total spendin

0 views • 8 slides

Integrating Spending Reviews into the Budget Cycle: Best Practices and Recommendations

To integrate spending reviews effectively into the budget cycle, align the process with the budget calendar, ensure consistency with medium-term frameworks, and incorporate outcomes into budget decisions. Countries like Australia, the UK, Ukraine, Italy, and Slovakia have institutionalized spending

0 views • 11 slides

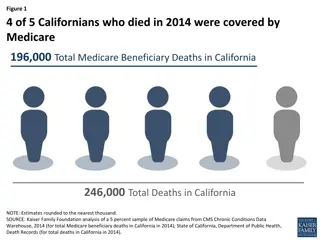

Medicare Trends in End-of-Life Care for Californians

Californians who died in 2014 were analyzed in terms of Medicare coverage, spending at the end of life, and hospice care utilization. The data shows a decrease in the share of total Medicare spending, variations in spending with age, and an increase in hospice use and spending over the years. Furthe

0 views • 6 slides

Understanding TABOR: Taxpayer's Bill of Rights Overview

The Taxpayer's Bill of Rights (TABOR) is a crucial constitutional amendment in Colorado that limits government spending and empowers citizens to vote on expenditure increases. TABOR aims to secure individual freedoms and prevent excessive government control through financial accountability. This bri

0 views • 10 slides

Understanding Eurostat Classification and Government Guarantees in Financial Institutions

In this case study, Eurostat's classification of the MDB outside the general government sector is explored. The focus is on government guarantees, financial intermediary risks, and the implications outlined in the Eurostat Manual on Government Deficit and Debt under ESA 2010. The MDB's position rega

1 views • 30 slides

Understanding Government Tools for Economic Stability

The government uses fiscal and monetary policies to stabilize the economy. Fiscal policy involves Congress's actions through government spending or taxation changes, while monetary policy is driven by the Federal Reserve Bank. Discretionary fiscal policy involves new bills designed to adjust aggrega

0 views • 36 slides

Comprehensive Overview of Medical Spending Accounts for 2024

Explore the details of Medical Spending Accounts (MSA) and Limited-use Medical Spending Accounts for the year 2024, including eligibility, contribution limits, eligible expenses, carryover options, deadlines, and administration fees. Learn how these accounts can help you manage your healthcare expen

0 views • 9 slides

Budget 2023 Summary: Political, Economic, and Fiscal Highlights

The Budget 2023 by Craig Renney in May covers a range of critical areas including Political Background, Economic Outlook, Fiscal Outlook, and Spending Highlights. It reflects the challenges faced by the government amidst an impending election and economic uncertainties. The economic forecast is more

0 views • 11 slides

Wyoming Government Savings and Efficiency Project Status Update

The Wyoming Government Savings and Efficiency Project aims to assist the Governor in implementing cost-saving initiatives authorized by Senate Enrolled Act 70 and supported by the Wyoming Spending and Government Efficiency Commission. The project's financial status, workstream budget details, planne

0 views • 18 slides

Cancer Types Spending in Europe

Learn about the spending on various types of cancer in Europe including breast cancer, colorectal cancer, prostate cancer, lung cancer, ovary cancer, and pancreatic cancer. The information is based on the Comparator Report on Cancer in Europe 2019, which covers disease burden, costs, and access to m

2 views • 7 slides

French Government Rushes Tax Cuts and Minimum Wage Rise Amid Yellow Vest Protests

The French government is pushing through tax cuts and a minimum wage increase to quell the ongoing Yellow Vest protests, which have been dwindling after causing disruptions for a month. President Emmanuel Macron's proposed measures, worth billions of euros, are set for parliamentary discussion and v

0 views • 22 slides

Sustainable Health Care Cost Growth Trends in Oregon, 2020-2021

The Sustainable Health Care Cost Growth Target Program in Oregon aims to regulate the annual per person growth rate of total health care spending. Reports show a 3.5% increase in total health care expenditures per person in 2020-2021. The link between Medicaid enrollment and spending is highlighted,

0 views • 31 slides

Flexible Spending Account Options for 2024

Explore the various Flexible Spending Account options available for 2024, including Medical Spending Account, Limited-use Medical Spending Account, Dependent Care Spending Account, and Pretax Group Insurance Premium feature. Learn about contribution limits, reimbursement deadlines, and enrollment re

0 views • 9 slides

Future Health Spending Trends in Latin America

The content explores the increasing public spending on social sectors, particularly health, in countries like Brazil, Chile, and Mexico. It discusses the growth in health expenditure since 1995 and predicts future trends in health spending based on economic development. The analysis highlights the i

0 views • 17 slides

Analysis of Solar Energy Program Spending and State Allocation Trends

This analysis delves into the spending patterns of state energy programs on solar initiatives, particularly under the American Recovery and Reinvestment Act. It explores the amount of funding invested in solar projects, identifies the top states allocating funds to solar energy, and assesses the ava

0 views • 13 slides