Understanding Taxes: An Overview of Taxation Principles and Collection in Ireland

This content covers the fundamental aspects of taxation, including its definition, purpose, principles (fairness, certainty, efficiency, convenience), and tax collection in Ireland by the Revenue Commissioners. It explores key concepts related to taxation and aims to enhance understanding of tax sys

2 views • 26 slides

Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

Tamil Nadu Forest Uniformed Service Recruitment Committee (TNFUSRC)

Tamil Nadu Forest Uniformed Service Recruitment Committee (TNFUSRC)\nThe Tamil Nadu Forest Uniformed Services Recruitment Committee (TNFUSRC) is an organization responsible for recruiting candidates for various uniformed services positions within the Tamil Nadu Forest Department.\nSelection process

0 views • 5 slides

California Forest Improvement Program (CFIP) Overview

The California Forest Improvement Program (CFIP) aims to promote investments in forestlands to ensure timber supplies, employment, and economic benefits while enhancing the forest resource. Funding sources, program objectives, eligibility requirements, and reimbursement details are covered in the pr

1 views • 22 slides

Stay Ahead in NRI Taxation in England with Bharat's Lower Tax Service

Stay ahead of the curve in NRI taxation in England with Bharat's Lower Tax Service. Our specialised solutions cater to the unique tax needs of Non-Resident Indians, ensuring compliance and maximising returns. With expert guidance and personalised strategies, navigate the complexities of cross-border

7 views • 3 slides

nritaxationbharat_blogspot_com_2024_05_nri_income_tax_return

Mastering NRI Taxation: Guidelines for Delhi Residents\" offers comprehensive insights into navigating the complexities of taxation for Non-Resident Indians (NRIs) residing in Delhi. This resource provides expert guidance on understanding tax laws, claiming exemptions, and optimizing deductions spec

3 views • 3 slides

Principles of Advanced Forest Management

Explore sustainable forest management theories, inventory methods, yield regulation approaches, and project planning for effective decision-making in forest resource management. Delve into the principles of forest management, land classification, growth projection, yield prediction, and sustainable

0 views • 26 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Understanding Principles of Taxation

Principles of taxation, including concepts such as public revenue, sources of revenue, types of taxes (direct and indirect), and non-tax revenue, are essential for students of commerce to grasp. Taxation serves as a means for the government to collect revenue for the common good through compulsory c

0 views • 12 slides

Exploring Taxation Acts and Their Impact on Revolutionary Sentiments

The provided content delves into historical taxation acts, including their specifics and potential implications on the onset of the American Revolution. It also draws parallels to modern-day examples of product taxation, prompting reflection on the fairness and consequences of such levies. The disco

4 views • 6 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

Taxation Procedures and Authorities

Explore the principles and application of taxation laws, tax provisions, duties of tax authorities, and obligations during taxation procedures. Learn about the essential role of tax authorities in determining facts crucial for legitimate decision-making, benefiting taxpayers diligently, and conducti

0 views • 35 slides

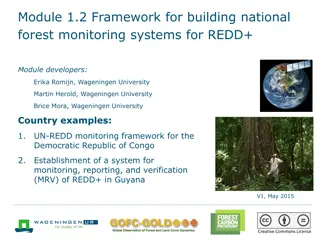

Framework for Building National Forest Monitoring Systems for REDD+

This module outlines a comprehensive framework for developing national forest monitoring systems for REDD+ initiatives. It covers key components such as satellite land monitoring, national forest inventories, greenhouse gas reporting, emission factors, and integrated monitoring systems focusing on c

0 views • 14 slides

Community-Based Data Collection and Forest Management for REDD+ Initiatives

Participatory approaches in forest management by local communities have shown success in conservation efforts. Ownership, long-term commitment, and social pressures play key roles. Additionally, secondary uses of the forest, carbon assessment by communities, supplementary data collection, and effici

0 views • 12 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

The Legend of Sherwood Forest: From Royal Hunting Reserve to Nature Reserve

Sherwood Forest, once a royal hunting reserve in the 10th Century, is renowned for its association with the legendary figure Robin Hood. The forest provided cover for both hunting and outlaws, eventually becoming a nature reserve attracting millions of visitors annually. Despite its reduced size fro

0 views • 9 slides

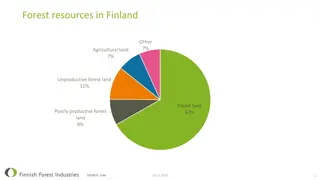

Overview of Forest Resources in Finland

Forest resources in Finland consist of various types of land, with forest land being the most dominant at 67%. Pine and spruce are the most common tree species, making up 80% of the total volume. Private forest owners own a significant portion of forest land at 60%. The growth of Finnish forests is

2 views • 6 slides

Forest Resources and Challenges in India: A Detailed Overview

India's forest resources face challenges due to degradation, impacting the economy and environment. The country produces a range of forest products, with forestry contributing to GDP. However, unsustainable practices such as excessive fuelwood consumption pose threats. Non-wood forest products are s

0 views • 48 slides

Conservation Efforts and Threats to Biodiversity at Nolde Forest

Nolde Forest State Park, established by hosiery baron Jacob Nolde in the early 1900s, is a lush coniferous forest now dedicated to environmental education. The park faces threats to biodiversity such as natural disasters, invasive species, and human activity. Hurricane Sandy's impact in 2012 and the

2 views • 13 slides

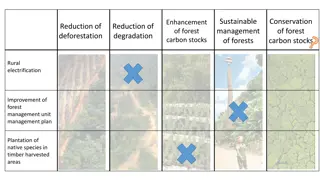

Sustainable Forest Management for Carbon Conservation and Biodiversity Enhancement

Sustainable forest management practices focused on conservation and enhancement of forest carbon stocks, reduction of deforestation and degradation, rural electrification, and improvement of forest management unit plans. Initiatives include assessment of forest resources, capacity building for field

1 views • 4 slides

Białowieża Forest: Europe's Last Primeval Forest

Białowieża Forest, the largest natural forest complex in the Central European Lowlands, is a treasure trove of diverse forest communities and abundant wildlife. Protected since ancient times, it faces threats like the European spruce bark beetle. Ecologists advocate for forest conservation to pres

0 views • 13 slides

Understanding Deer Impact on Forest Regeneration

Explore the collaborative deer management outreach initiative focused on maintaining healthy forests by addressing the impact of white-tailed deer on forest regeneration. Learn about the factors influencing forest health, predicted regeneration of tree species, and survey results on forest regenerat

0 views • 27 slides

Impact Analysis of New Corporate Taxation Regime Under Taxation Laws (Amendment) Ordinance, 2019

The new corporate taxation regime introduced through the Taxation Laws (Amendment) Ordinance, 2019 brings significant changes, including a lower tax rate for domestic companies. The regime allows companies to opt for a 22% tax rate, with implications on exemptions and deductions. Companies opting fo

0 views • 31 slides

Reforming State-Owned Forest Enterprises and Ensuring Ethnic Minority Land Tenure Security in Vietnam

Vietnamese government nationalized agricultural and forest land in the 1950s, impacting ethnic minority groups. Despite attempts to reform state-owned forest enterprises, conflicts over forest land persist. This study examines policies, processes, and conflicts in three provinces to offer recommenda

0 views • 20 slides

Understanding REDD+ and Forest Governance for Sustainable Resource Management

REDD+ stands for Reducing Emissions from Deforestation and forest Degradation, encompassing activities to enhance carbon stocks, conservation, and sustainable forest management. Forest governance plays a crucial role in reducing risks related to land use change, illegal logging, and forest degradati

0 views • 11 slides

Forest and Tree Pests and Diseases Management in Africa

The management of forest pests and diseases in Africa is crucial to safeguard the continent's forests, international trade, and forest products. This presentation provides insights into the occurrence, distribution, economic impacts, and regional cooperation for managing forest pests. Major pests an

0 views • 12 slides

Jerome Smith - Forest Department Director Promoting Bioeconomy in Mountain Areas

Jerome Smith is the Principal Director of Forest Operations in Jamaica, focusing on environmental policies and sustainable forest management. He has spearheaded various programs, including the EU-supported initiative to address climate change challenges through improved forest management in Jamaica.

0 views • 8 slides

Forest Taxation and Management Guide for Property Owners

Understand forest use taxation, tax deferral benefits, tree growing practices, harvesting methods, and managing marketable tree species. Learn about property tax deferral programs, conservation management options, and how to navigate forest management requirements in Multnomah Co., Oregon.

0 views • 9 slides

Optimal Sustainable Control of Forest Sector with Stochastic Dynamic Programming and Markov Chains

Stochastic dynamic programming with Markov chains is used for optimal control of the forest sector, focusing on continuous cover forestry. This approach optimizes forest industry production, harvest levels, and logistic solutions based on market conditions. The method involves solving quadratic prog

0 views • 27 slides

Assessing Forest Loss in Protected Areas: A Philippines Case Study

The study assesses forest cover loss in terrestrial protected areas of the Philippines, analyzing the extent and rate of deforestation using Hansen's Global Forest Cover Change datasets. The research aims to understand the drivers of deforestation in protected areas, comparing forest loss in the ent

0 views • 24 slides

Overview of International Taxation in Italian Law

International taxation refers to rules governing tax laws in different countries, covering various aspects such as cross-border trade, investments, and taxation of individuals working abroad. Tax treaties play a crucial role in limiting the taxation power of treaty partners, with over 2,000 bilatera

0 views • 25 slides

Taxation Challenges for Cross-Border Teleworkers Post Covid-19

Challenges in international taxation arise for cross-border teleworkers post-Covid-19, especially regarding the taxation of income from employment under Article 15 of the OECD Model Tax Treaty. Issues such as physical presence, bilateral agreements during the pandemic, and future taxation scenarios

0 views • 7 slides

Understanding Calcium Influence on Earthworm Behavior in Forest Ecosystems

Earthworm biomass dominance by Lumbricus terrestris in the Siemianice Experimental Forest is linked to their high calcium requirements, as indicated by their calciferous glands producing calcium carbonate to regulate blood pH in the face of high soil CO2 levels. The positive relationship between for

0 views • 8 slides

Negative List Based Taxation of Services by S.B. Gabhawalla & Co.

This content delves into the conceptual framework of negative list based taxation of services, including the definition of service, elements such as service territory and value, and the framework dissecting the charge at 12%. It also explains what services are excluded from taxation and provides exa

0 views • 36 slides

GEF Forest Investments and Sustainability Strategies

The Global Environment Facility (GEF) focuses on financing forest projects to address climate change, biodiversity conservation, and land degradation. With a history of investing in forests since 1991, GEF has created programs like GEF-5 SFM/REDD-plus to generate multiple environmental and social be

0 views • 11 slides

Monitoring Forest Cover Disturbances During Natural Hazards by Meteorological Satellites

Ecosystem functioning relies on energy, water, and carbon fluxes regulated by vegetation and soil properties. This study focuses on monitoring forest cover disturbances before, during, and after natural hazards using meteorological satellites. It involves analyzing land surface temperature, evapotra

0 views • 37 slides

Implications of LULUCF Regulation for Swedish Forest Sector

The Swedish Forest Industries Federation discusses the implications of LULUCF regulation on the forest-based sector in Sweden, aiming for a fossil-free welfare state by 2045. The sector plays a vital role in driving growth in the global bioeconomy, with sustainable forest management strategies highl

0 views • 14 slides

Empowering Communities Through Micro Planning for Forest Development

Micro Planning is a community-based process empowering forest-dependent communities to create a roadmap for sustainable development. Joint Forest Management Committees and other bodies organize the preparation of ten-year development plans prioritizing activities for enhanced livelihoods. The proces

0 views • 15 slides

Safeguarding Indigenous Peoples and Forest Communities in REDD+

Exploring traditional forest knowledge and its importance to culture, livelihoods, and conservation efforts. The IUFRO Task Force focuses on preserving traditional knowledge, addressing threats, and identifying opportunities for collaboration with modern forest science. Unique features include susta

0 views • 10 slides