Presentation to the Portfolio Committee

Overview of the state of governance in the higher education sector, including key roles, institutional statutes, and the composition of councils. Highlights include the regulations under the Higher Education Act and the publication dates of institutional statutes for various universities. Emphasis i

2 views • 83 slides

Relevance of Countercyclical Fiscal Policy and Fiscal Acyclicality

This literature review examines the effectiveness of countercyclical fiscal policies in stabilizing output and enhancing welfare, with a focus on the correlation between public spending cycles and GDP cycles. The study analyzes examples from Sweden and Argentina to showcase the impact of fiscal poli

2 views • 29 slides

Interpretation of Statutes and Articles: Taxation, Corporate Laws, Writ Remedies

Understanding the interpretation of statutes, articles of the Indian Constitution in relation to taxation, corporate laws for practicing members, and utilizing writ remedies before the High Court and Supreme Court. Exploring the scope of writs for enforcing fundamental rights, constitutional rights,

10 views • 38 slides

Overview of Utah's Budget for FY 2024-2025

Utah's budget for the fiscal year 2024-2025 is outlined with details on revenue sources, budget priorities, special funding, long-term fiscal health, and budget process changes. The budget allocations cover various sectors including education, transportation, law enforcement, social services, and mo

0 views • 32 slides

Understanding Mandatory and Directory Statutes: A Legal Overview

Mandatory statutes compel specific actions with no discretion allowed, making non-compliance potentially void. Directory statutes outline procedures without affecting substantial rights, with compliance regarded as a matter of convenience. The interpretation of these statutes rests on legislative in

1 views • 18 slides

Principles of Public Participation in Fiscal Policy

The work by GIFT focuses on developing principles for public participation in fiscal policy, emphasizing the importance of citizen engagement beyond mere disclosure. These principles aim to enhance accountability, uphold citizens' rights, and improve policy quality through inclusiveness and openness

0 views • 17 slides

Gender-Responsive Fiscal Policies and Female Labor Force Participation

Despite persistent gender gaps in labor force participation and wages, various fiscal policy measures have been adopted globally since the mid-1980s to address these disparities. Understanding the impact of gender-responsive fiscal policies on female labor force participation, economic growth, incom

0 views • 23 slides

Fiscal Responsibility Act & Sustainable Development Nexus

Sustainable development integrates environmental health with economic progress. Achieving SDGs requires fiscal responsibility at all levels of governance. Subnational fiscal irresponsibility impacts national growth. It is crucial to manage public resources effectively to attain sustainable developme

0 views • 48 slides

Interpreting Taxing Statutes: Key Principles and Indian Supreme Court Decisions

Understanding taxing statutes is crucial to comprehend the imposition of taxes. This overview delves into the definition of taxing statutes, the general rules of interpretation, strict constructions, and key principles. The discussion also touches upon significant decisions by the Indian Supreme Cou

2 views • 10 slides

Financial Responsibility and Procurement Training Overview

This overview covers key aspects of financial responsibility, procurement training, and fiscal roles within a university setting. It emphasizes protecting university resources, ensuring compliance with laws and regulations, and upholding ethical standards. It discusses the responsibilities and roles

0 views • 33 slides

Aids to Interpretation: Understanding the Purpose and Types

Interpretation of statutes involves uncovering legislative intent. Internal aids (such as titles and preambles) and external aids help judges apply statutes accurately. Key factors include short and long titles, preamble statements, and substance over form. Case examples illustrate how titles can sh

0 views • 68 slides

Enhancing Fiscal Policy Planning through Public Participation and Transparency

Explore the importance of public participation and meaningful transparency in fiscal policy planning and public expenditure management. Learn about the GIFT Network, its champions and stewards, and how fiscal transparency and public participation can lead to improved fiscal and development outcomes

0 views • 22 slides

School-Based Financial Management and Fiscal Responsibility in Education Governance

School-Based Financial Management and Fiscal Responsibility is crucial for the effective operation of educational institutions. With the implementation of shared governance principles and fiscal autonomy under the School-Based Management System (SBM), schools can efficiently manage their financial r

0 views • 15 slides

Fiscal Policy Guidance for State Long-Term Care Ombudsmen

Overview of the fiscal management responsibilities for State Long-Term Care Ombudsmen under the Older Americans Act requirements. Covers topics such as fiscal management, funding allocations, state plan requirements, and fiscal responsibilities. Details the OAA and LTCOP rule provisions related to f

6 views • 22 slides

Understanding Fiscal Policy: A Comprehensive Overview

Fiscal policy involves changes in government spending and taxes to influence macroeconomic objectives like employment, price stability, and economic growth. It includes expansionary and contractionary policies to manage aggregate demand and stabilize the economy. This overview covers types of fiscal

0 views • 24 slides

Principles of Fiscal Deficits and Debt Management According to Kalecki

Economist Kalecki advocated for a permanent regime of fiscal deficits to manage public debt, emphasizing the importance of debt management for liquidity in the financial system. His principles involve splitting the government budget into functional and financial parts, each influencing aggregate dem

0 views • 6 slides

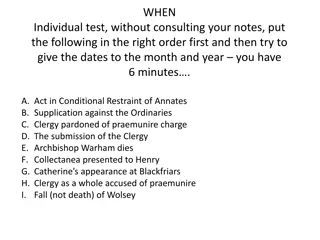

The Reformation Parliament and the Break with Rome

The Reformation Parliament played a crucial role in enforcing the break with Rome through various key statutes, such as the Act in Restraint of Appeals in 1533. This pivotal legislation not only granted Henry VIII the power to decide marriage cases within the realm but also made a radical statement

4 views • 12 slides

Examination of Interim Fiscal Policy Paper for Financial Year 2019-2020

An independent auditor's report on the interim fiscal policy paper laid before the Houses of Parliament, confirming compliance with the requirements of the FAA Act. The report assesses the components, conventions, and assumptions underlying the paper for fiscal responsibility, macroeconomic framewor

1 views • 15 slides

Discontinuance of Utility Service and Wastewater Lien Process in Cities and Towns (June School 2013)

The process of discontinuing utility services, particularly water and wastewater services, due to nonpayment of charges is outlined in statutes such as IC 8-1.5-3-4 and IC 36-9-23-6. The statutes provide guidelines for discontinuing water service to consumers or properties after a specified period o

0 views • 20 slides

Butte County Office of Education Fiscal Oversight Role Overview

The Assembly Bill (AB) 1200 provides insights into the fiscal oversight role of Butte County Office of Education (BCOE). It outlines the responsibilities of local boards of education, BCOE as an intermediary agent, and the creation of the Financial Crises and Management Assistance Team (FCMAT) in 19

0 views • 12 slides

Analysis of Wisconsin Statutes in Finding Aids for Institutional Records

In this analysis, various finding aids for institutional records in Wisconsin are examined, highlighting the use of state statutes as legal justifications for privacy and access restrictions. The study delves into the consequences and implications of citing irrelevant statutes and showcases the dist

0 views • 13 slides

Update on IAOS Statutes and EXCO Code of Conduct by Nancy McBeth, May 2024

In May 2024, Nancy McBeth updated the IAOS Statutes and endorsed the EXCO Code of Conduct, incorporating changes to align with Dutch law and IAOS procedures. The key updates include proposed major changes in statutes clarifying the relationship between ISI and IAOS, membership simplification, and EX

0 views • 5 slides

California's Fiscal Outlook Presentation to California School Boards Association

California's fiscal outlook was presented to the California School Boards Association by the Legislative Analyst's Office in December 2016. The report highlights a decrease in revenues and expenditures for the 2016-17 fiscal year, leading to a revised reserve down by $1 billion. However, the state i

0 views • 22 slides

AmeriCorps California Volunteers Fiscal Training Conference 2017 Details

In July 2017, the AmeriCorps Grantee Training Conference took place, focusing on fiscal procedures, compliance, desk reviews, and monitoring. The conference covered topics such as improper payments elimination, common audit findings, and the fiscal desk review process implemented by California Volun

2 views • 22 slides

Fiscal Year 2023 Budget Overview

The content presents detailed information on the fiscal year 2023 budget, including budget cycles, comparisons between fiscal years, source of funds, expenditure plans, and top projects for the Consolidated Municipal Agency (CMA). It covers budget development processes, funding sources, expenditure

0 views • 11 slides

Timely Reporting Requirements for Traffic Convictions in Oklahoma

Court clerks in Oklahoma are mandated by both state statutes and federal regulations to promptly report convictions related to traffic violations. Oklahoma State Statutes require all convictions to be submitted within 5 days, while federal regulations stipulate that convictions must be entered withi

0 views • 6 slides

Emerging Markets Investors Alliance and GIFT: Promoting Fiscal Transparency

The Emerging Markets Investors Alliance, in partnership with GIFT (Global Initiative for Fiscal Transparency), aims to educate institutional investors about fiscal transparency and facilitate investor advocacy with governments. Through roundtable discussions and engagements with finance ministers, t

0 views • 5 slides

Understanding Fiscal Reports and Budgeting Process

Dive into the world of fiscal reports and budgeting with a presentation led by Stephanie Dirks. Explore the Budget Code Story, different types of reports, and examples of Fiscal 04 & Fiscal 06 reports. Learn about Fund allocations, Object Codes, and responsible oversight of funds. Get insights into

0 views • 17 slides

Building Financial Systems Around Fiscal Data in Early Childhood Programs

Understand the importance of fiscal data in program management, identify key fiscal data elements, address policy questions, and learn from a state's cost study design. Explore the significance of fiscal data for decision-making, policy development, and program management, with a focus on revenue so

0 views • 31 slides

Global Practices in Fiscal Rule Performance

The study explores the implementation and impact of fiscal rules on macro-fiscal management, focusing on international experiences. It discusses the presence and compliance with fiscal rules, highlighting differences in pro-cyclicality among small and large countries. The rise in adoption of nationa

0 views • 23 slides

Understanding Fiscal Notes in Government Legislation

Fiscal notes are essential documents accompanying bills affecting finances of state entities. They detail revenue, expenditure, and fiscal impact, requiring a 6-day processing timeline. The need for a fiscal note may be determined by legislative services, committees, sponsors, or agencies. The proce

1 views • 30 slides

Fiscal Note Preparation Process and Guidelines

Fiscal notes are essential for bills affecting state finances. This includes the total processing time, exceptions, and what to do if there is disagreement on the fiscal note. The process involves multiple steps, including drafting, review, and resolution of disagreements. The President of the Senat

0 views • 29 slides

Wisconsin Public Health Statutes Overview

Explore Wisconsin's public health history, statutes, and administrative rules, including the formation of the State Board of Health, consolidation of public health statutes in 1993, and the statutory duties of local boards of health. Learn about the chapters covering administration, communicable dis

0 views • 16 slides

Legal Analysis of Williams Case and Statutes

Group analysis of the Williams case involving the Children Act of 1989, exploring which statute applies to the parents, whether it applies to both parents, and deliberating on the appropriate punishment. In-depth examination of the facts and statutes to determine the legal implications for the parti

0 views • 29 slides

Criminal Statutes Related to False Filings on the SOS Business Registry

A compilation of criminal statutes related to false filings on the Secretary of State (SOS) Business Registry, including acts such as causing false documents to be filed, perjury in the second degree, false swearing, abuse of public records, and offering false instruments for recording. These statut

0 views • 6 slides

Understanding Government Tools for Economic Stability

The government uses fiscal and monetary policies to stabilize the economy. Fiscal policy involves Congress's actions through government spending or taxation changes, while monetary policy is driven by the Federal Reserve Bank. Discretionary fiscal policy involves new bills designed to adjust aggrega

0 views • 36 slides

Understanding Labor Standards Statutes on Federal Government Contracts

Explore the interaction of labor standards statutes like the SCA and DBA on federal government contracts. Learn about general principles, contracts requiring SCA or DBA, differences between SCA maintenance and DBA repair work, important considerations for DBA and SCA coverage, and specific guideline

0 views • 30 slides

Understanding Statutes: An Overview by Anusha M.V., Assistant Professor

This collection of images provides an insightful overview of statutes, covering their definition, creation process, commencement, operation, presumption against retrospective operation, repeal, and consequences of repeal. It explains the key aspects of statutes in a clear and concise manner.

0 views • 60 slides

Updates to CLUSTER Consortium Regulations and Statutes

This document outlines the proposed changes to the internal regulations and statutes of the CLUSTER Consortium. It includes amendments such as removing the concept of departments, combining task forces and workgroups, revising the auditing process, updating membership requirements, and adjusting fee

0 views • 6 slides

Key Considerations for Prosecutors in Sentencing Procedures

Understanding sentencing memoranda, unique statutes, and the responsibilities related to mentally ill defendants, prosecutors must factor in crime details, criminal history, victim impact, mitigating factors, and additional penalties. The court's discretion in imposing deadly weapon enhancements and

0 views • 9 slides