Federal Grants Management: Opportunities, Best Practices, and Lessons Learned

Explore federal grants management opportunities, best practices, and lessons learned through an insightful presentation by John H. Hageman from Hagerty Consulting. Learn about the federal funding landscape, Detroit's grants management reform, and key elements for successful grant management. Discove

0 views • 26 slides

Relevance of Countercyclical Fiscal Policy and Fiscal Acyclicality

This literature review examines the effectiveness of countercyclical fiscal policies in stabilizing output and enhancing welfare, with a focus on the correlation between public spending cycles and GDP cycles. The study analyzes examples from Sweden and Argentina to showcase the impact of fiscal poli

2 views • 29 slides

Updates on NIH Grants Policy and Fiscal Changes for 2023

Stay informed about the latest NIH grants policy updates for 2023, including fiscal changes, salary cap adjustments, and revised requirements for biographical sketches. It's essential to adhere to the updated formats to avoid delays in funding consideration. Additionally, be aware of the new notific

0 views • 38 slides

Understanding Tax Reporting for Fellowship Grants at UC

This presentation addresses tax reporting issues associated with fellowship grants for UC graduate students. It explains the treatment of fellowship grants for income tax purposes, distinguishing between compensatory and non-compensatory grants. It also clarifies the taxable and nontaxable aspects o

0 views • 43 slides

Understanding the Notice of Award in Grants Management

Dive into the essentials of the Notice of Award (NoA) in grants management, covering its significance, contents, upcoming changes, and components including award data, fiscal information, grant payment details, and more. Gain insights into the key aspects of the NoA to navigate successfully through

1 views • 49 slides

Student Budgeting Advice Service Information Session

Student Budgeting Advice Service provides one-to-one support for university students to manage their finances effectively. They offer guidance on fees, grants, and social welfare entitlements, along with information on internal and external financial supports. The service also assists students in un

1 views • 21 slides

Enhancing Fiscal Policy Planning through Public Participation and Transparency

Explore the importance of public participation and meaningful transparency in fiscal policy planning and public expenditure management. Learn about the GIFT Network, its champions and stewards, and how fiscal transparency and public participation can lead to improved fiscal and development outcomes

0 views • 22 slides

School-Based Financial Management and Fiscal Responsibility in Education Governance

School-Based Financial Management and Fiscal Responsibility is crucial for the effective operation of educational institutions. With the implementation of shared governance principles and fiscal autonomy under the School-Based Management System (SBM), schools can efficiently manage their financial r

0 views • 15 slides

Grants Support Committee Update May 2018

The Grants Support Committee provided updates on activities from November 2017 to May 2018, including virtual meetings, revised terms of reference, and collaboration on EU-funded projects. The committee established a document repository for key documents and produced a Grants Report detailing active

0 views • 8 slides

Fiscal Policy Guidance for State Long-Term Care Ombudsmen

Overview of the fiscal management responsibilities for State Long-Term Care Ombudsmen under the Older Americans Act requirements. Covers topics such as fiscal management, funding allocations, state plan requirements, and fiscal responsibilities. Details the OAA and LTCOP rule provisions related to f

6 views • 22 slides

Principles of Fiscal Deficits and Debt Management According to Kalecki

Economist Kalecki advocated for a permanent regime of fiscal deficits to manage public debt, emphasizing the importance of debt management for liquidity in the financial system. His principles involve splitting the government budget into functional and financial parts, each influencing aggregate dem

0 views • 6 slides

Year-End Closing Checklist for School Fiscal Services

Review key areas such as tax revenue, grants, grant revenue, lease rental fund revenue, accruals, deferred outflow, liabilities, and deferred inflow to properly prepare for the year-end closing in school fiscal services. Ensure accuracy in financial records and compliance with regulations for a smoo

0 views • 21 slides

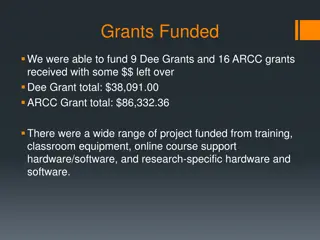

Funding Summary for Dee and ARCC Grants

A total of 9 Dee Grants and 16 ARCC Grants were successfully funded, with a surplus budget remaining. The Dee Grant total amounted to $38,091.00, while the ARCC Grant total reached $86,332.36. Projects funded included training, classroom equipment, online course support hardware/software, and resear

0 views • 9 slides

Examination of Interim Fiscal Policy Paper for Financial Year 2019-2020

An independent auditor's report on the interim fiscal policy paper laid before the Houses of Parliament, confirming compliance with the requirements of the FAA Act. The report assesses the components, conventions, and assumptions underlying the paper for fiscal responsibility, macroeconomic framewor

1 views • 15 slides

Butte County Office of Education Fiscal Oversight Role Overview

The Assembly Bill (AB) 1200 provides insights into the fiscal oversight role of Butte County Office of Education (BCOE). It outlines the responsibilities of local boards of education, BCOE as an intermediary agent, and the creation of the Financial Crises and Management Assistance Team (FCMAT) in 19

0 views • 12 slides

Icelandic Research Fund 2015: Enhancing Scientific Research and Education

The Icelandic Research Fund (IRF) aims to enhance scientific research and education in Iceland by awarding funding to research projects led by individuals, teams, universities, research institutes, and companies. Principal investigators must have completed graduate studies and experience in running

0 views • 22 slides

California's Fiscal Outlook Presentation to California School Boards Association

California's fiscal outlook was presented to the California School Boards Association by the Legislative Analyst's Office in December 2016. The report highlights a decrease in revenues and expenditures for the 2016-17 fiscal year, leading to a revised reserve down by $1 billion. However, the state i

0 views • 22 slides

AmeriCorps California Volunteers Fiscal Training Conference 2017 Details

In July 2017, the AmeriCorps Grantee Training Conference took place, focusing on fiscal procedures, compliance, desk reviews, and monitoring. The conference covered topics such as improper payments elimination, common audit findings, and the fiscal desk review process implemented by California Volun

2 views • 22 slides

Understanding the Role of Authorized Representatives in Grants Management

Authorized Representatives (AR) play a crucial role in managing grants by overseeing program compliance, decision-making, budget approvals, and reporting requirements. They ensure funds are used appropriately, monitor grantee progress, and implement state and federal regulations to meet program goal

0 views • 28 slides

Fiscal Year 2023 Budget Overview

The content presents detailed information on the fiscal year 2023 budget, including budget cycles, comparisons between fiscal years, source of funds, expenditure plans, and top projects for the Consolidated Municipal Agency (CMA). It covers budget development processes, funding sources, expenditure

0 views • 11 slides

Energy Community Revitalization Program (ECRP) & Infrastructure/Jobs Act Bill Overview

The Energy Community Revitalization Program (ECRP) focuses on funding abandoned mines through federal cleanup programs, state grants, tribal grants, and the Infrastructure and Jobs Act Bill. Funding allocations for orphaned wells, federal grants, and state grants are detailed for FY22. Steps involve

0 views • 9 slides

The Foyle Foundation Grants and Programs Overview

The Foyle Foundation, based in London, funds various grant programs supporting arts, learning charities, and school libraries across the UK. They offer Main Grants Scheme for core remits of Arts or Learning, a Small Grants Scheme for smaller charities, and focus on funding projects that promote fina

0 views • 10 slides

Rotary District 5630 Foundation Grants Overview

Rotary District 5630 offers grants to support projects focused on health, education, poverty alleviation, and peace. District grants are available for local and international projects, with funding sources including club cash, designated funds, and contributions. Rotarian participation and alignment

0 views • 10 slides

Emerging Markets Investors Alliance and GIFT: Promoting Fiscal Transparency

The Emerging Markets Investors Alliance, in partnership with GIFT (Global Initiative for Fiscal Transparency), aims to educate institutional investors about fiscal transparency and facilitate investor advocacy with governments. Through roundtable discussions and engagements with finance ministers, t

0 views • 5 slides

Understanding Fiscal Reports and Budgeting Process

Dive into the world of fiscal reports and budgeting with a presentation led by Stephanie Dirks. Explore the Budget Code Story, different types of reports, and examples of Fiscal 04 & Fiscal 06 reports. Learn about Fund allocations, Object Codes, and responsible oversight of funds. Get insights into

0 views • 17 slides

Jackson State University Grants and Contracts Management Unit Overview

Jackson State University's Division of Business and Finance oversees the Unit of Grants and Contracts Management, dedicated to the financial administration of external grants and contracts. Their mission is to assist Principal Investigators and Funding Agencies in Post Award Administration, ensuring

0 views • 12 slides

Building Financial Systems Around Fiscal Data in Early Childhood Programs

Understand the importance of fiscal data in program management, identify key fiscal data elements, address policy questions, and learn from a state's cost study design. Explore the significance of fiscal data for decision-making, policy development, and program management, with a focus on revenue so

0 views • 31 slides

Global Practices in Fiscal Rule Performance

The study explores the implementation and impact of fiscal rules on macro-fiscal management, focusing on international experiences. It discusses the presence and compliance with fiscal rules, highlighting differences in pro-cyclicality among small and large countries. The rise in adoption of nationa

0 views • 23 slides

Understanding Fiscal Notes in Government Legislation

Fiscal notes are essential documents accompanying bills affecting finances of state entities. They detail revenue, expenditure, and fiscal impact, requiring a 6-day processing timeline. The need for a fiscal note may be determined by legislative services, committees, sponsors, or agencies. The proce

1 views • 30 slides

Fiscal Note Preparation Process and Guidelines

Fiscal notes are essential for bills affecting state finances. This includes the total processing time, exceptions, and what to do if there is disagreement on the fiscal note. The process involves multiple steps, including drafting, review, and resolution of disagreements. The President of the Senat

0 views • 29 slides

Update on DSWM Grants Review and Termination

DSWM conducted a review of open grants, identifying discrepancies and off-timeline progress. Internal Audit ensures grant compliance and reimbursement protocol. Terminated grants due to inactivity or failure to meet requirements. Future grant offerings under assessment for the next fiscal year.

0 views • 9 slides

Quarterly Grants Management Symposium Highlights and Insights

The Quarterly Grants Management Symposium hosted by the National Academy of Public Administration & Grant Thornton LLP on January 23, 2020, featured discussions on critical issues in grants management, including compliance, best practices, and fostering knowledge sharing among public and private sec

0 views • 17 slides

Rotary District 7730 Grants Funding Overview for 2020-21

Rotary District 7730 congratulates clubs that have applied for and received District matching grants. The Grants Funding Model outlines fund distribution for the year, emphasizing the importance of giving to receive support. District Designated Fund (DDF) comprises contributions from past Rotary yea

0 views • 15 slides

Intergovernmental Fiscal Relations in South Sudan: A Quest for Justice, Equality, and Prosperity

This paper explores intergovernmental fiscal relations in South Sudan, focusing on decentralization, taxation, spending, grants, equalization, and transfers to oil-producing states. It discusses the importance of fiscal federalism, the evolution of decentralization in Sudan, and the country's depend

0 views • 21 slides

University Land Grants and Dakota Treaty Lands in Minnesota

Explore the history of University land grants in Minnesota, dating back to 1851 and the establishment of the University of the Territory of Minnesota. Learn about the grants allocated for the university's support and expansion, including additional townships and acreages granted over the years. Delv

0 views • 28 slides

Understanding Government Tools for Economic Stability

The government uses fiscal and monetary policies to stabilize the economy. Fiscal policy involves Congress's actions through government spending or taxation changes, while monetary policy is driven by the Federal Reserve Bank. Discretionary fiscal policy involves new bills designed to adjust aggrega

0 views • 36 slides

Castle Cary Town Council Precept Spending Report 23/24

Castle Cary Town Council allocated precept funds to various community projects and services in the 23/24 fiscal year. The spending included grass cutting, property maintenance, grants to local organizations, staffing costs, and funding joint projects with developers. Additionally, large grants were

0 views • 11 slides

Internal Grants Programs Workshop Overview

This workshop conducted by Jason Hale on October 24, 2016, aims to increase awareness of internal grants opportunities and enhance the competitiveness of applications for programs like UM ORSP Travel Grants, SEC Faculty Travel Grants, and ORSP Investment Grants. It provides details on the purpose of

0 views • 46 slides

Improving Local Government Finance Commission through Unconditional Grants

Addressing issues surrounding grants allocation and transparency to enhance local government finance. Efforts include implementing fiscal decentralization architecture, reviewing grants allocation formulae, and prioritizing sustainable financing for local governments.

0 views • 27 slides

NHMRC's New Grant Program: Advancing Clinical Trials and Research Funding

The NHMRC's latest grant program aims to enhance research in healthcare by focusing on clinical trials funding across four key streams: Investigator Grants, Synergy Grants, Ideas Grants, and Strategic and Leveraging Grants. The redistribution of funding will see a significant increase in support for

0 views • 12 slides