ECC Social Value Reporting and Evaluation Framework

Essex County Council (ECC) has implemented a robust Social Value Reporting and Evaluation framework based on the Local Government Association's National TOMs method. This framework categorizes and assesses social value contributions in two parts - Value Score and Supporting Statement Score - to deri

3 views • 16 slides

Optimal Capital Structure and Value Maximization in Traditional Approach

The traditional approach to finance emphasizes achieving the optimal capital structure by balancing debt and equity to minimize the Weighted Average Cost of Capital (WACC) and maximize the firm's overall value. By understanding the relationship between the cost of debt and equity, financial leverage

3 views • 6 slides

Capacity Building of the Firm

Transitioning a firm into a smart firm involves proactive strategies like finding new team members ahead of need, cross-training existing members, and embracing emerging technologies such as AI and data analytics. Staying organized, automating processes, and tapping into evolving practices are cruci

0 views • 22 slides

About page

About AEGLE MARMELOS Law Firm:\n\u2022 Dedication to Legal Excellence: . Aegle Marmelos is committed to providing top-tier services in Criminal, Writs, Family, Civil, and Company Law, ensuring robust courtroom representation for our clients\n\u2022 Inspiration from the Bael Fruit: Our firm's name,

1 views • 4 slides

Optimization of Order Size for a Small Manufacturing Firm

A small manufacturing firm purchasing 3400 pounds of chemical dye per year seeks to minimize total costs by optimizing order sizes. With initial conditions and pricing details provided, calculations for order sizes at different price points are considered to determine the most cost-effective solutio

2 views • 11 slides

Finding Financial Wizards: A Guide to Choosing the Right CFO Recruiting Firm

In the competitive landscape of finance, selecting the right CFO recruiting firm is paramount. These firms specialize in sourcing top-tier finance executives, offering industry expertise, extensive networks, and proven methodologies. By considering factors like industry specialization, track record,

4 views • 6 slides

Understanding Financial Leverage and Its Implications

Financial leverage refers to a firm's ability to use fixed financial costs to amplify the impact of changes in earnings before interest and tax on its earnings per share. It involves concepts like EBIT, EBT, preference dividends, and tax rates, and can be measured through the degree of financial lev

1 views • 7 slides

Understanding Accounting Ratios and Partner Admission in a Partnership Firm

Accounting ratios play a crucial role in assessing a firm's efficiency and profitability, especially during reconstitution due to partner admission in a partnership. New profit-sharing ratios and sacrificing ratios are key factors that need to be determined in the process. This involves adjusting pr

1 views • 10 slides

Understanding the Value of Money and Standards

The value of money refers to its purchasing power, which is influenced by the price level of goods and services. Different standards, such as wholesale, retail, and labor, help measure the value of money. Money can have internal and external value, affecting domestic and foreign transactions. The Qu

0 views • 62 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

3 views • 5 slides

Price-Output Determination Under Low-Cost Price Leadership

Economists have developed models on price-output determination under price leadership, with assumptions about leader and follower behavior. In this scenario, two firms, A and B, with equal market share and homogeneous products, navigate pricing strategies based on cost differentials. Firm A, with lo

1 views • 7 slides

Understanding Non-Firm Quantities in Electricity Markets

Non-Firm Quantities in electricity markets involve units with non-firm access not being compensated for their non-firm capacity not getting accommodated on the system. The concept of Firm Access Quantity plays a key role in determining compensation levels for units, with differences in implementatio

0 views • 6 slides

Strategic Consulting and Innovation Firm for Growth and Sustainability

GNBVC is a dynamic consulting firm founded by industry veteran Manoj Mishra, offering a comprehensive range of services from management consulting to innovation management and start-up guidance. With a strong commitment to CSR, GNBVC partners with SMEs and large corporations across various industrie

0 views • 10 slides

Comprehensive Business Profile of a Leading Auditing Firm Established in 1997

Established in 1997, this second-tier registered public accounting and auditing firm has achieved significant accolades, including being accredited as a JSE-registered auditor and reporting accountant. With a dedication to uplifting previously disadvantaged individuals, the firm holds a level 2 BBBE

0 views • 24 slides

Leading IP and Commercial Law Firm in India and South Asia

Khurana & Khurana, Advocates and IP Attorneys (K&K), is a prominent full-service Intellectual Property and Commercial Law firm established in 2007. With over 120 professionals across 7 offices in India and affiliate offices in South Asia and the USA, the firm offers comprehensive IP services to a di

0 views • 16 slides

Enhancing Social Value through Strategic Procurement

STAR Procurement, the shared service for multiple councils, emphasizes the importance of Social Value in procurement practices. The Social Value Portal serves as a management tool to measure and demonstrate the benefits of Social Value commitments. Bidders are required to provide quantitative and qu

0 views • 14 slides

Analysis of Failing Firm Defense in Arla-Milko Merger

The Arla-Milko merger, involving two major dairy players in Sweden, raised concerns of monopolistic practices. Parties invoked the failing firm defense, arguing that Milko was on the brink of failure without the merger. The Swedish Competition Authority (SCA) assessed various criteria, ultimately ac

0 views • 12 slides

Integrated Value Creation in Corporate Finance

Explore the concept of integrated value creation in corporate finance, emphasizing the importance of managing for long-term value while incorporating social and environmental goals. Learn about responsible management practices that focus on creating net present value (NPV) through a balance of finan

0 views • 38 slides

Understanding Horizontal Boundaries of Firms in Economics

Exploring the concept of horizontal boundaries in firm behavior, this lecture delves into Long-run Average Cost curve, economies and diseconomies of scale, optimal plant size, and the Minimum Efficient Scale. It discusses how economies of scale affect production costs and the relationship between ma

0 views • 25 slides

Understanding R&D Internationalization through Firm and Patent Data Analysis

Explore the measurement of R&D internationalization by analyzing firm and patent data. Traditional and recent approaches, including combining firm and patent data, offer insights into foreign R&D activities. The International Hierarchical Ownership Model (IHOM) provides a longitudinal view of MNC ow

0 views • 34 slides

Understanding Firm Behavior in Economics

Explore the theory of firm behavior in economics, focusing on the model of a firm's inputs to produce an output, the concept of specialization and diminishing returns, analysis of average and marginal product, graphical representation, and considerations in determining where a firm produces. Learn a

0 views • 60 slides

Understanding Capital Budgeting: Evaluating Investment Criteria

Explore key concepts in capital budgeting such as net present value, payback period, internal rate of return, and more. Learn how to assess investment decisions based on criteria like time value of money, risk, and value creation for the firm. Evaluate advantages and disadvantages of different decis

0 views • 41 slides

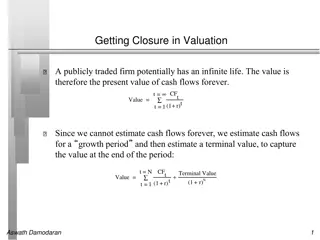

Understanding Terminal Value in Valuation

Valuation of publicly traded firms with potentially infinite lives involves estimating cash flows for a growth period and a terminal value to capture value at the end. The stable growth rate, which cannot exceed the economy's growth rate, plays a crucial role in determining the present value of futu

0 views • 8 slides

Firm-Specific Human Capital and Organizational Incentives in Retail Banking

This study examines the impacts of firm-specific human capital (FSHC) on organizational performance and agency costs in the retail banking industry. Findings suggest a positive association between FSHC and productivity, but also highlight potential risks related to incentive gaming and adverse learn

0 views • 10 slides

Maximizing Customer Value, Satisfaction & Loyalty in Business

Explore the essence of customer value, satisfaction, and loyalty in business success through Dr. Ananda Sabil Hussein's insightful perspective. Learn about customer perceived value, determinants of value, steps in value analysis, loyalty definitions, satisfaction measurements, and the significance o

0 views • 18 slides

Soft Skills Training Program Evaluation at an Indian Garment Firm

This study evaluates the impact of the P.A.C.E. program, focusing on soft skills training at an Indian ready-made garments firm. The research explores the inculcation and productivity-enhancing effects of soft skills in the workplace, questioning the profitability of general training provided by fir

0 views • 29 slides

The Value of Knowledge: A Philosophical Exploration

Exploring the value of knowledge through the lens of Plato's Meno Problem, this text delves into why knowledge is considered more valuable than mere true belief. It discusses Plato's solution to the problem, the secondary and tertiary value problems, and constraints on solutions and strategies in un

0 views • 22 slides

How to Calculate Present Value & Future Value Using Microsoft Excel

Learn how to calculate present value and future value using Microsoft Excel functions such as PV and FV. Understand the syntax, arguments, and examples for determining the value of single amounts, annuities, and lump sums. Step-by-step instructions provided for efficient financial calculations.

0 views • 14 slides

Exploring Land Value Return and Recycling for Transportation Funding

With transportation investment needs surpassing available resources, investigating the potential of land value return and recycling as a revenue source can benefit public agencies. This involves recovering and reusing a portion of the increased land value generated by public investment in transporta

0 views • 33 slides

Management Considerations for Starting a New Law Firm

Exploring the essential aspects of starting a new law firm, this content delves into reasons for venturing out on your own, preparations required, financial considerations, office space decisions, and potential challenges. It also offers insights into developing a business plan, seeking financial su

0 views • 15 slides

Maximizing Shareholder Value Creation Through Strategic Business Practices

Explore the concept of shareholder value creation, the importance of generating revenues exceeding economic costs, and meeting shareholders' expectations. Learn about Economic Value Added (EVA), key value drivers, aligning strategy with value creation, and essential factors for overall business succ

0 views • 11 slides

Rethinking Firm Governance Through Property Rights and Stakeholder Theory

Challenging the traditional shareholder-centric view, this study explores how property rights theory and stakeholder theory can offer a more comprehensive perspective on firm governance. It delves into the complexities of value creation, contractual relationships, and diverse stakeholder interests,

0 views • 10 slides

Understanding Trade in Value-Added (TiVA) and Global Value Chains

Trade in Value-Added (TiVA) offers crucial insights into the complexities of global value chains and economic globalization. By shifting focus from gross trade statistics to value creation along supply chains, TiVA helps in formulating better policies and addressing systemic risks associated with ma

0 views • 22 slides

Understanding Capital Structure and Financial Leverage in Corporate Finance

The capital structure of a firm involves deciding on the mix of debt and equity securities to meet financing needs, impacting market value and shareholder wealth. Financial leverage, or gearing, affects shareholders by altering the firm's value through debt-equity substitutions. The optimal policy m

0 views • 31 slides

Economic Foundations of Imperialism: Exploitation and Value Transfer

Imperialism primarily functions as an economic mechanism for exploiting value rather than seeking political dominance. The transfer of value occurs through mechanisms like unequal exchange, global value chain flows, and capital flows, leading to the long-term appropriation of value by imperialist na

0 views • 28 slides

Analysis of Domestic Value-Added in China's Exports by Firm Ownership

This study delves into the distribution of domestic value-added in China's exports based on firm ownership types. By decomposing gross exports into domestic and foreign value-added, it aims to understand how value is distributed among different factor owners to quantify the generated gross national

0 views • 22 slides

Understanding Absolute Value Equations and Inequalities

In this lesson, students will learn to solve absolute value equations and inequalities both algebraically and graphically. The concept of absolute value, which represents the distance between a number and zero on the number line, is explained through examples and solutions. The importance of using g

0 views • 43 slides

What Documents Are Needed for Firm Registration

If you\u2019re planning to register a partnership firm, knowing the required documents is an important first step. Here\u2019s a comprehensive guide to the documents you\u2019ll need for firm registration in India.\n

1 views • 3 slides

Business Model Reporting for Value Creation

Integrated Reporting (IR) plays a crucial role in forging business partnerships and facilitating sound decision-making. Understanding the organizational business model is essential for long-term sustainability and value creation. The global approach to business model reporting encompasses business s

0 views • 42 slides

India Fellowship Seminar: Product Contributions to Growth, Risk Management, and Shareholder Value

India Fellowship Seminar discussed the contributions of participating and non-participating products to premium growth, risk management, and shareholder value. Key topics included market trends, drivers of shareholder value, PAR vs NPAR attractions, creating shareholder value, and risk management st

0 views • 21 slides