Buy Amazon Seller Account

Buy Amazon Seller Account\nhttps:\/\/usareviewpro.com\/product\/buy-amazon-seller-account\/\nIf you want to expand your business on Amazon and you are new then you can buy Amazon seller or business account which is already doing business on Amazon. We guarantee you 100% secure and transparent Amazon

4 views • 6 slides

Buy Verified Square Account

Buy Verified Square Account\nhttps:\/\/reviewinsta.com\/shop\/buy-verified-square-account\/\nSquare Account is a financial services platform that provides a variety of tools for businesses to manage their finances. With a Square account, users can accept credit and debit card payments, track sales a

3 views • 16 slides

Bank of India

Bank of India (BOI), established in 1906, is a vulnerable and important public sector bank in India that plays a vital role in the nation\u2019s economic growth. With a widespread network of branches and a global presence, BOI offers a diverse range of banking and financial services, embracing digit

3 views • 5 slides

State Bank of India

State Bank of India (SBI) is one of the largest and pioneer public sector banks in India. It was established in 1806 as the Bank of Calcutta, making it one of the oldest commercial banks in the Indian subcontinent. It later merged with the Bank of Bombay and the Bank of Madras in 1921 to form the Im

4 views • 5 slides

Bank of Maharashtra

Bank of Maharashtra(BOM), which was founded in 1935 and is based in Pune, India, operates as a well-known government-owned bank with branches throughout the country. The bank offers various banking services, including digital options for customer convenience. It actively dedicates itself to assistin

1 views • 5 slides

Bank of Baroda

Bank of Baroda also commonly referred to as BOB, is a government-owned financial institution that was founded in 1908 within the Princely State of Baroda. It underwent nationalization on the 19th of July, 1969, along with 13 other significant commercial banks. BOB\u2019s main office is located in Va

1 views • 5 slides

Canara Bank - Probationary Officer recruitment process

Canara Bank is one of the prominent public sector banks in India. Established in 1906. It has a significant presence in the Indian Banking and financial sector. Canara Bank provides a wide range of banking and financial services to its customers, including savings and current accounts, loans, credit

1 views • 5 slides

Union Bank of India

Union Bank of India was established on November 11, 1919, as a limited company with its headquarters located in Mumbai. Union Bank of India stands as a prominent public sector bank, with 76.99 percent of its total share capital held by the Government of India.\nOrganisation of Union Bank of India\nU

1 views • 5 slides

Punjab and SInd Bank

]Punjab and Sind Bank was founded in 1908 and headquartered in New Delhi, is a government-owned bank primarily serving in northern India, especially Punjab. It offers a range of banking services, has a social focus, and actively participates in financial inclusion initiatives.\nOrganization of Punja

2 views • 5 slides

Best site to Buy Amazon Seller Account 2024

Best site to Buy Amazon Seller Account 2024\nIf you want to expand your business on Amazon and you are new then you can buy Amazon seller or business account which is already doing business on Amazon. We guarantee you 100% secure and transparent Amazon seller account. If an Amazon account owner want

14 views • 18 slides

Buy Amazon Seller Account

Buy Amazon Seller Account\nIf you want to expand your business on Amazon and you are new then you can buy Amazon seller or business account which is already doing business on Amazon. We guarantee you 100% secure and transparent Amazon seller account. If an Amazon account owner wants to sell his acco

14 views • 17 slides

Benefits of applying for NCF Unnati Scholarship for students

\u2022\tGive copies of the organization\u2019s rules and regulations, showing how it\u2019s structured and who is authorized to handle the bank account,\n\u2022\tShare a bank passbook copy with the organization\u2019s name, account number, and IFSC Code,\n\u2022\tProvide audited financial statements

4 views • 5 slides

How to Resolve QuickBooks Bank Feed Issues_ A Comprehensive Guide

Resolve QuickBooks Bank Feed issues effortlessly with our expert guide. Learn step-by-step solutions to tackle common problems such as missing transactions, connection errors, and incorrect data imports. Whether you're using QuickBooks Desktop or Online, our comprehensive resource covers everything

2 views • 4 slides

BENEFITS OF A FINANCIAL ACCOUNT

It's more important than ever to be good with money right now. You need a bank account to keep track of your money, get rich, and reach your financial goals. Every level of income earner should open a bank account for many reasons. No matter where y

32 views • 3 slides

Understanding Profit and Loss Account in Financial Management

Profit and Loss Account is a crucial financial statement prepared to determine the net profit or loss of a business during a specific accounting period. It involves transferring gross profit or loss from the trading account, recording indirect expenses, including administrative and selling costs, an

0 views • 9 slides

Society Treasurer's Financial Management Guidelines

Responsibilities outlined for the society treasurer include financial management, bank account handling, maintaining proper accounting records, and principles of single-entry bookkeeping. The training emphasizes the importance of accurate record-keeping to avoid financial and legal issues. Detailed

0 views • 43 slides

Understanding the Uniform Bank Performance Report (UBPR)

The Uniform Bank Performance Report (UBPR) is a crucial tool used by regulatory agencies, the public, and bank management to evaluate a bank's performance in areas such as capital, asset quality, earnings, liquidity, and market risk sensitivity. This report provides detailed data on a bank's financi

1 views • 24 slides

Understanding Balance of Payments: Components and Significance

Balance of Payments (BOP) is a comprehensive account of a country's economic transactions with other nations in a given period. It includes receipts and payments for goods, services, assets, and more. BOP consists of the current account, capital account, and official reserve account. The current acc

3 views • 25 slides

Banking Regulations in Bangladesh: A Comprehensive Overview

The Bangladesh Bank Order of 1972 established the central bank, Bangladesh Bank, which regulates banking activities under the Bank Companies Act of 1991. This legislation, along with the Financial Institutions Act of 1993, sets the framework for overseeing bank companies and non-banking financial in

0 views • 27 slides

Tips for a Smooth Corporate Bank Account Opening Process in Dubai

Streamline your corporate bank account opening process in Dubai with our expert tips. Discover how to choose the right bank, understand requirements, and benefit from professional Corporate Bank Account Assistance in Dubai, UAE.

1 views • 9 slides

Overview of Deendayal Antyodaya Yojana National Rural Livelihoods Mission

Deendayal Antyodaya Yojana is a national rural livelihoods mission under the Ministry of Rural Development, Government of India. It focuses on Self-Help Group (SHG) Bank Linkage and Interest Subvention to support rural development. The NRLM SHG Bank Linkage Portal facilitates the monitoring of SHG B

2 views • 39 slides

Introduction and Preparation of Trading Account in Financial Management

Financial statements play a crucial role in understanding a firm's financial position and profitability. They include a Balance Sheet, Profit and Loss Account, and schedules. Trading Account is the initial step in final accounts preparation, focusing on gross profit or loss. It helps determine the p

0 views • 13 slides

Presentation of South African Reserve Bank Amendment Bill to Joint Committee

The Economic Freedom Fighters (EFF) presented the South African Reserve Bank Amendment Bill to amend the current ownership structure allowing private individuals, including foreigners, to own shares in the South African Reserve Bank. The presentation emphasizes the need for legislative actions withi

0 views • 19 slides

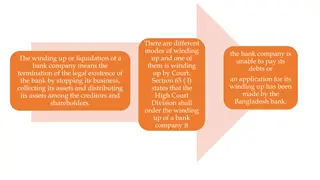

Winding Up of a Bank Company in Bangladesh: Legal Process and Circumstances

The winding up of a bank company in Bangladesh involves terminating its legal existence by ceasing its operations, realizing assets, and distributing them among creditors and shareholders. Section 65(I) of the law empowers the High Court Division to order winding up based on inability to pay debts o

1 views • 8 slides

ADC Bank - SMS Banking Services Information

ADC Bank has been offering SMS banking services for non-financial inquiries since 1925. Customers can request balance inquiries, check recent transactions, and change their mobile PIN through SMS messages. To avail these services, customers need to visit their home branch, complete a form, and follo

0 views • 6 slides

Enhancing Financial Inclusion Through Digital Solutions

This project, implemented by GIZ with funding from the German Federal Ministry for Economic Cooperation and Development, aims to improve access to digital payments and financial services for refugees and low-income Jordanians. Key objectives include increasing the usage of digital financial services

0 views • 11 slides

Experienced Bank Executives in Wisconsin

Mr. Spitz and Mr. Fink are experienced bank executives in Wisconsin with extensive backgrounds in the banking industry. Mr. Spitz, the Founder & CEO of Settlers Bank, has over 30 years of experience ranging from community banking to corporate commercial lending. He is actively involved in his commun

0 views • 7 slides

Student Direct Deposit Setup Instructions

Follow these step-by-step instructions to set up direct deposit for your student accounting account. Start by accessing the Account Inquiry link under My Account, then navigate to the Account Services tab to enroll in Direct Deposit. Enter your Bank ID/Routing and Account number, agree to the terms,

0 views • 6 slides

Raiffeisen Bank International AG: Banking Services and Global Presence

Raiffeisen Bank International AG is a leading corporate and investment bank in Austria, with a strong presence in Central and Eastern Europe (CEE) and expanding focus on Asia. They offer a wide range of financial services, including financing for Czech-Turkish export contracts. With a solid internat

0 views • 14 slides

When is a Fixed Rate Loan Not a Fixed Rate Loan? Dissecting the Swift Report Bank Confidential 1st March 2022

Loans with embedded swaps, such as Fixed Rate Loans (FRL), can present challenges and risks that may make them toxic financial products. Tailored Business Loans (TBLs) were sold by various banks, including high street names like Yorkshire Bank/Clydesdale Bank, RBS/NatWest, Nationwide, Lloyds Bank, H

0 views • 11 slides

Essential Guide to Opening and Managing a Checking Account

Learn the importance of opening a checking account, the process of choosing a bank, criteria to consider, and the steps to open an account. Understand the different services offered by banks and the key factors to keep in mind when selecting a financial institution. Discover the benefits and require

0 views • 39 slides

Overview of Reserve Bank of India Functions and Responsibilities

The Reserve Bank of India serves as the central bank in India, responsible for functions such as issuing bank notes, acting as banker to the government, and serving as the banker's bank. It manages currency chests, handles government finances, and ensures the stability and soundness of the banking s

0 views • 15 slides

Understanding Irregular and Dormant Bank Accounts

Irregular accounts in banks refer to accounts that are not operated regularly, such as dormant, unclaimed, or deceased accounts. When an account holder fails to manage their account properly, it can lead to the account becoming irregular. Dormant accounts are those that have had no financial activit

0 views • 27 slides

Understanding Cash Book, Pass Book, and Bank Reconciliation Statement

In accounting, cash book serves as both journal and ledger, while pass book maintains customer bank accounts. The bank reconciliation statement ensures consistency between customer and bank transactions. The cycle includes subsidiary books, double-entry, trial balance, and financial statements. Cont

0 views • 14 slides

Understanding Income Statements in Financial Accounting

An income statement, comprising of a Trading Account and Profit and Loss Account, is vital for assessing a company's financial performance. It helps determine profits, losses, and overall worth. The Trading Account specifically calculates the gross profit or loss from core activities, while the Prof

0 views • 18 slides

CADCAI Audited Financial Report 2016 Summary & Analysis

The CADCAI Audited Financial Report for 2016 reveals key insights into the organization's financial performance. CADCAI is a not-for-profit organization with income tax exemption and registered GST. The report showcases a current year profit of $14,067 and total retained profit since 1986 of $412,30

0 views • 19 slides

State Bank of India - Annual Convention and Functions Overview

State Bank of India, the largest commercial bank in India, recently held its annual convention to review progress under the RTI Act. The bank, being a central figure in the country's financial sector, engages in various functions including central banking and general banking operations. With an exte

0 views • 14 slides

Legal Battle Over Financial Restrictions: Bank Mellat's Claim History

The case involving Bank Mellat revolves around a financial restrictions order imposed in 2009, leading to a legal battle to recover damages under the Human Rights Act. The bank's original damages claim of $4.3 billion, later reduced to $1.7 billion, cites interference with its possessions due to var

0 views • 28 slides

The Role of Export-Import Bank of India in Promoting International Trade

The Export-Import Bank of India, known as EXIM Bank, is a specialized financial institution wholly owned by the Government of India. It was established in 1981 to provide financial assistance to exporters and importers, promote international trade and investment, and offer various financing programs

0 views • 16 slides

Impact of Negative Nominal Interest Rates on Bank Performance

Negative nominal interest rates, implemented following the financial crisis, have had a limited effect on bank performance globally. While low rates reduce profitability, banks have shown resilience through adjustments in funding allocations and non-interest income sources. Studies suggest that resp

0 views • 34 slides