Understanding Financial Disclosure and Lifestyle Audits Frameworks

The financial disclosure framework was introduced in 2016 by the Minister for the Public Service and Administration to manage conflict of interest situations in the public service. Designated employees disclose their financial interests annually via the eDisclosure system, and these disclosures are

1 views • 11 slides

Enhancing Accountability and Scrutiny: Progress and Impact Assessment

The National Audit Office (NAO) in the UK is focused on improving support for effective accountability and scrutiny. They conducted over 400 audits, certified trillions in public income and expenditure, and engaged with Parliament through evidence sessions and reports. The NAO measures success again

2 views • 13 slides

Enhancing Public Financial Management Through External Audits

Strengthen the performance of the Public Financial Management system by utilizing external audits and international standards. Main entry points for SAIs, diagnostic tools, and challenges in assessing PFM are discussed. Learn how to effectively use diagnostic tools to complement audit work and addre

0 views • 8 slides

401(k) Basics, Part 4 Notes to Financial Statements & Current Topics

Explore the details of ERISA Section 103(a)(3)(C) audits versus non-Section 103(a)(3)(C) audits, including topics such as statutory and regulatory basis, reporting, financial statement disclosures, DOL proposed changes, and more. Learn about key parties, internal controls, investment considerations,

3 views • 115 slides

Class 2 Permit Modification Request

This Permit Modification Request (PMR) aims to transition audit scheduling for site recertification from an annual to a graded approach, incorporating DOE Orders and Quality Assurance program requirements. The PMR consolidates scheduling information, reduces redundancy, and clarifies subsequent audi

3 views • 22 slides

Utilizing Audits for Antimicrobial Stewardship in General Practice

The importance of audits in antimicrobial stewardship is highlighted in this informative content covering topics like why audit and feedback are crucial, sources of prescribing data, available audit tools, practical tips, and a case study showcasing the positive impact of audits in UTI management. T

10 views • 40 slides

Understanding Post-Election Risk-Limiting Audits in Indiana

Indiana's post-election audits, overseen by the Voting System Technical Oversight Program, utilize statistical methods to verify election outcomes, ensuring accuracy and reliability in the electoral process. The VSTOP team, led by experts in various fields, conducts audits based on Indiana Code IC 3

0 views • 12 slides

Role of Supreme Audit Institution of the Philippines in Employing Artificial Intelligence to Fight Corruption

The Supreme Audit Institution of the Philippines (SAI-PHL) is utilizing technology, including artificial intelligence, to enhance its audit processes and combat corruption effectively. Through initiatives like understanding IT systems and conducting computer-assisted audits, SAI-PHL is embracing dig

0 views • 12 slides

Understanding GMP Audits in Construction: Navigating Client Expectations

This presentation at the National Association of Construction Auditors' virtual conference focuses on helping clients grasp the key objectives and processes of Guaranteed Maximum Price (GMP) audits. Dave Potak, a seasoned professional, will share insights on managing client expectations, best practi

0 views • 18 slides

Understanding Single Audits for Federal Fund Compliance

Explore the process and requirements of single audits for federal fund compliance, including when they are required, the responsibilities involved, and the importance of OMB Compliance Supplement. Learn how single audits provide assurance to federal agencies about fund usage compliance and the stand

1 views • 33 slides

Major Accounting Issues Affecting Private Clubs and Not-for-Profit Entities

Condon O'Meara McGinty & Donnelly LLP discusses current accounting issues impacting private clubs, including ASU 2016-14 on not-for-profit financial statements, ASC 606 revenue recognition, ASC 842 on accounting for leases, and ASC 715 on compensation retirement benefits. The presentation covers rea

0 views • 49 slides

Understanding Post-Election Audits for Registrars of Voters

Post-election audits are essential for ensuring the accuracy and functionality of optical scan voting machines. This process involves randomly selecting voting districts for hand count audits to assess machine performance. The chain of custody must be strictly maintained for ballots and equipment. M

0 views • 18 slides

Common Failures in Tax Audits and Best Judgment Assessments

Weaknesses in tax audits and best judgment assessments can result in serious consequences for tax entities. Issues such as poor audit practices by consultants and inaccuracies in best judgment approaches can lead to legal disputes and financial losses. Understanding these common points of failure is

0 views • 12 slides

Understanding Wireless Security Audits and Best Practices

Explore the world of security audits with a focus on wireless networks. Learn about the types of security audits, best practices, and the steps involved. Discover the importance of systematic evaluations, identifying vulnerabilities, establishing baselines, and compliance considerations. Dive into t

0 views • 14 slides

Understanding Departmental Audits in GST

Departmental audits in GST involve the examination of records, returns, and other documents to verify the correctness of turnover declared, taxes paid, refunds claimed, and input tax credit availed. This audit ensures compliance with the provisions of the CGST Act, 2017. Types of audits under GST in

7 views • 27 slides

Guidelines for Social Audits under MGNREGA

The legal mandate for social audits under MGNREGA includes the requirement for conducting audits by Gram Sabhas, setting up independent Social Audit Units, and involving Village Social Audit Facilitators. The process involves collating records, conducting beneficiary and work verification, and prese

1 views • 19 slides

Legislative Requirements for Independent System Audits in Local Government

National legislation mandates the establishment of a National Treasury to ensure transparency and expenditure control in all government spheres, including local government. This involves adherence to Generally Recognized Accounting Practice (GRAP OAG), uniform expenditure classifications, and treasu

0 views • 12 slides

Audit Process for Externally Aided Projects in India

Externally Aided Projects (EAPs) in India receive funding from Donor Agencies like the World Bank and ADB. The implementation has evolved with decentralized approaches through SPVs. Separate project accounts and audits are mandatory, with the CAG ensuring expenditure is correct. The audit methodolog

0 views • 11 slides

Understanding Club Financial Statements and Audits

Financial statements are essential tools for understanding a club's financial health. They include the Statement of Financial Position, Revenue and Expenditures, and Cash Flow Statement. Audited statements, prepared by independent accounting firms, ensure accuracy and compliance with legislation. A

0 views • 13 slides

Worried About IRS Audits? Here’s How SAI CPA Services Can Help You Avoid Them!

IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported in

3 views • 2 slides

Understanding Bayesian Audits in Election Processes

Bayesian audits, introduced by Ronald L. Rivest, offer a method to validate election results by sampling and analyzing paper ballots. They address the probability of incorrect winners being accepted and the upset probability of reported winners losing if all ballots were examined. The Bayesian metho

2 views • 7 slides

Understanding Single Audits in Federal Grant Programs

Audits play a crucial role in ensuring accountability in Federal grant programs. Single Audits, being the most common type, combine financial and compliance audits into one report. Learn about threshold determinations, risk-based approaches, and key changes in the Uniform Guidance through this compr

0 views • 26 slides

Safety Management Overview and Audits Report

Explore a detailed report on safety management practices, audits findings, and actionable insights in the BSEE office. Learn about prior audits, SEMS evaluations, CAP verification, and more. Dive into SEMS subpart O audits and API RP 75 guidelines for a comprehensive understanding of safety protocol

0 views • 18 slides

Billing Documentation Guidelines for OSAP Programs

Audits are imminent for OSAP/BHSD programs, emphasizing the importance of proper documentation to ensure compliance and accuracy in billing. Providers must adhere to strict guidelines for submitting audits and desk audits annually, promptly informing OSAP of any staff changes. The documentation cove

0 views • 25 slides

Powercor Industry Forum Audit Results and Trends Analysis

Audit results and trends analysis reveal that there were 256 audits completed, with 50 being re-audits. Additional resources were acquired to meet industry demand, but audit volumes in Q4 did not meet forecast. Turnaround times improved with the deployment of more auditor resources. Trends show issu

0 views • 8 slides

Local Government Audit Outcomes Analysis as of February 2013

The Auditor-General of South Africa plays a crucial role in ensuring oversight, accountability, and governance in the public sector by conducting audits. This analysis reveals varying audit outcomes across provinces, highlighting the need for focused actions to improve audit results and promote clea

0 views • 22 slides

Understanding SAS 99 and Fraud Consideration in Financial Audits

This presentation delves into SAS 99, highlighting the importance of considering fraud in financial statement audits. It explains the impact of SAS 99 on auditors, emphasizes management's role in preventing and detecting fraud, and discusses the Fraud Triangle and types of fraud addressed by SAS 99.

1 views • 41 slides

Essentials of Site Audits for Global HIV & TB Programs

Understanding the purpose, stages, and requirements of site audits is vital for ensuring accuracy and reliability in test results for Global HIV & TB programs. From identifying improvement areas to implementing corrective actions, this content provides a comprehensive guide for conducting effective

0 views • 14 slides

Conducting Surveillance of CNS Providers

Conducting surveillance of CNS providers involves audits and inspections to ensure compliance with regulatory requirements and maintain safety standards. Various types of audits, such as pre-certification and post-certification audits, are conducted by qualified CNS oversight inspectors to identify

0 views • 48 slides

Academic Audit and Importance in the Commerce Department at Shankarlal Khandelwal Arts, Science and Commerce College, Akola

The Department of Commerce (English Medium) at Shankarlal Khandelwal Arts, Science and Commerce College in Akola conducts academic audits to enhance academic standards. These audits analyze faculty and student performance, costs, and outcomes, aiding in continual improvement. The department focuses

0 views • 29 slides

Understanding the Impact of Audits on Post-Audit Tax Compliance

Audits have direct and indirect effects on taxpayers, influencing compliance behaviors. While more audits generally lead to increased compliance, outcomes can be ambiguous, with some studies showing a decline in post-audit compliance. Behavioral responses to tax audits are driven by perceived risks

0 views • 15 slides

Financial Literacy Empowerment in Eastern and Southern Africa

Developing countries in Eastern and Southern Africa are prioritizing financial education to empower consumers in making sound financial decisions. Financial literacy enhances financial inclusion, stability, and economic growth. It involves awareness, knowledge, skills, attitudes, and behaviors essen

0 views • 23 slides

Impact of Audits on Tax Compliance: Insights from Research Studies

Studies conducted by researchers such as Erich Kirchler have explored the impact of audits on tax compliance. While audits generally have a positive effect on compliance, there are cases where they can backfire, leading to unintended consequences. High auditing levels may not always deter tax evasio

0 views • 14 slides

Financial Literacy and Education Commission: Coordinating Federal Efforts

Financial capability empowers individuals to manage financial resources effectively, make informed choices, avoid pitfalls, and improve their financial well-being. The Financial Literacy and Education Commission (FLEC) works to improve the financial literacy of individuals in the United States throu

0 views • 16 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Guide to Accessing and Creating Degree Audits for Doctoral Students

Learn how to access and create degree audits as a doctoral student using the online platform. Follow step-by-step instructions to view course history, set academic goals, create audits, and add goals to your audit list. Understand the different components of the current audit page and how to navigat

0 views • 26 slides

Comprehensive Guide to Government Financial Management

This comprehensive guide, presented by the FGFOA Technical Resources Committee, covers topics such as accounting principles for local governments, annual financial audits, financial reporting, budgeting, and capital assets valuation rules. It explains the importance of audits in maintaining public t

0 views • 31 slides

Performance Review 2018/2019 Auditor General's Department, Jamaica

The performance review of Auditor General's Department, Jamaica for 2018/2019 showcases various audits such as financial statements, compliance, and information technology. It includes details on targets achieved, audits executed, certificates issued, and ongoing work. The reports indicate the progr

0 views • 17 slides

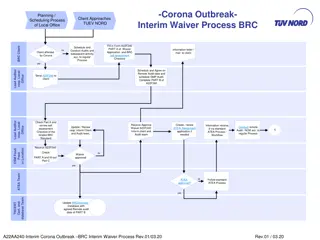

Interim Waiver Process for BRC Audits During Corona Outbreak

This content outlines the interim waiver process and scheduling procedures for local office client audits during the Corona outbreak. It includes steps for completing waiver applications, conducting remote audits, and handling certification extensions. The document also provides guidelines for remot

0 views • 11 slides

Supporting SAIs in Auditing SDGs: Reflections and Plans

SAIs play a crucial role in auditing SDGs to ensure high-quality audits of partnerships. Various SAIs and funding partners are actively involved in supporting this initiative. The story so far includes audits of preparedness and implementation of SDGs, with performance audits supporting 73 SAIs and

0 views • 14 slides