Military & Overseas Voting: Special Forms and Deadlines Explained

Military and overseas voters have special forms and deadlines under the Uniformed and Overseas Citizens Voting Act (UOCAVA) and the Military & Overseas Voters Act (MOVE). These laws allow these voters to register and vote absentee in federal elections using forms like the Federal Post Card Applicati

0 views • 25 slides

2024 Health Benefits Enrollment Information for Commonwealth of Virginia

The 2024 Open Enrollment for Health Benefits and Flexible Spending Accounts in the Commonwealth of Virginia is scheduled from May 1 to May 15. This period allows individuals to make decisions regarding health plans, flexible spending accounts, and other benefit options. Changes made during this time

0 views • 39 slides

Federal Grant Funding: Uniform Guidance for Procurement of Goods or Services

When purchasing goods or services, especially with federal grant funding, the process is subject to the Federal Uniform Guidance (UG) and University procurement procedures. The UG outlines different thresholds for procurement, such as Micro-Purchase, Small Purchase, and Competitive Formal Solicitati

0 views • 30 slides

Understanding the Federal Reserve System and Monetary Policy

Delve into the history, structure, and functions of the Federal Reserve System, including its role in implementing monetary policy to stabilize the economy. Explore the establishment of the Federal Reserve Act of 1913, the structure of the Federal Reserve, and its pivotal role in serving the governm

0 views • 35 slides

Understanding Federal Consistency in Coastal Zone Management

This presentation serves as an introduction to Federal Consistency in the context of Coastal Zone Management, emphasizing the importance of compliance with enforceable policies outlined in the Coastal Zone Management Act. It highlights the role of the Division of Coastal Resources Management (DCRM)

1 views • 13 slides

Importance of Moderation in Spending and Consumption

The content emphasizes the significance of moderation in spending, as highlighted by a Noble Hadith, encouraging controlled spending and rationalized consumption. It warns against extravagance and advocates for balanced use of resources. By practicing moderation in food, drink, and clothing, individ

2 views • 19 slides

Understanding 18 U.S.C. 209 and Its Impact on VA Research Personnel

DOJ guidance has clarified the application of 18 U.S.C. 209 to VA employees receiving compensation from non-Federal entities for research. This law prohibits Federal employees from receiving any form of compensation from non-Federal entities for services expected as Government employees. The webinar

0 views • 20 slides

Understanding Federalism in the United States

Explore the different types of governmental systems and the distribution of power between the federal and state governments. Learn about the advantages of federalism, how Texas utilizes federal funding, and the evolution of cooperation and coercion within the federal system over time. Dive into conf

7 views • 17 slides

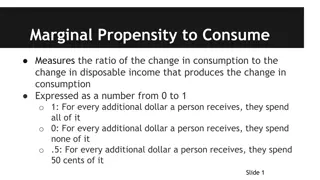

Understanding Marginal Propensity to Consume and Save

Marginal Propensity to Consume (MPC) and Marginal Propensity to Save (MPS) measure the ratios of change in consumption and saving to change in disposable income respectively. The relationship between MPC and MPS shows that they equal 1 when combined, with the remainder being saved. The multiplier ef

7 views • 5 slides

Behavioral Life-Cycle of Saving and Spending in Finance

Explore the behavioral aspects of saving and spending in the life-cycle theory of finance. Learn how individuals reconcile conflicts between saving and spending desires through mental accounting, self-control, and framing. Discover the various sources and uses of spending, including luxury items and

0 views • 18 slides

Understanding Federal Awards Procurement Standards

Explore the Uniform Rules-Federal Awards Procurement Standards under 2 C.F.R., addressing common federal findings, state versus non-federal entities, and state compliance requirements. The information provided delves into the purpose of procurement standards and the importance of adhering to federal

1 views • 48 slides

Updates on Tourism Electronic Card Transactions (TECTs) and Spending Trends

Changes to the Tourism Electronic Card Transactions (TECTs) have been made, including the reinstatement of the international category and implementation adjustments for domestic spend. The Australian market has been split out within the international category. Caution is advised when interpreting TE

0 views • 10 slides

Understanding the Federal System in American Law

The American legal system is rooted in a division of powers between the States and the Federal government. Federal law fills gaps and complements State laws, with Federal courts having jurisdiction over disputes involving different States or Federal issues. The Constitution and Bill of Rights protec

0 views • 23 slides

Managing Finances in the United States: Creating a Spending Plan

Explore the importance of creating a spending plan to cover basic living needs, care for family, purchase desired items, and manage financial obligations or debts. Learn about different types of expenses, frequency of occurrence, and how to start creating a personalized spending plan based on your i

0 views • 14 slides

Understanding Federal Fund Exchange Training Program

The Federal Fund Exchange program allows Local Public Agencies to exchange federal obligation authority for state funds, reducing time-consuming federal-aid project requirements. Benefits include flexibility in project selection, wider scopes, and avoiding restrictive federal provisions. Eligible pr

0 views • 27 slides

Financial Overview of IARC-ERDC Spending and Project Plan by Michael Geelhoed

Delve into the detailed breakdown of spending, challenges, progress, and future steps outlined in the IARC-ERDC Spending and Project Plan presented by Michael Geelhoed. The plan includes cost allocations for various components like RF Coupler, SRF Gun, Cryostat, and more, as well as projections and

0 views • 5 slides

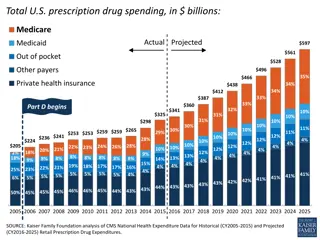

Overview of U.S. Prescription Drug Spending and Medicare Part D

U.S. prescription drug spending data from 2005 to 2025 shows trends in various payer contributions, with predictions for future years. Medicare Part D's drug spending is broken down, revealing top drugs and rebate percentages. The total Medicare spending in 2015 and average annual growth in Medicare

0 views • 10 slides

NARFE Membership: Protecting Federal Benefits & Enhancing Retirement Security

NARFE, the association for federal employees and retirees, is dedicated to safeguarding federal workers' benefits and providing valuable resources for maximizing their retirement savings. Through advocacy and informational resources, NARFE helps federal employees navigate changes in federal policies

0 views • 11 slides

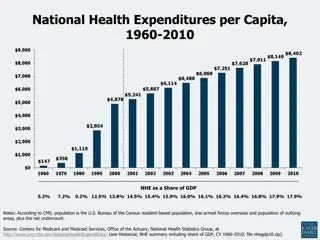

Overview of U.S. Health Care Expenditure Trends

Analysis of U.S. health care expenditure trends from 1960 to 2010, including per capita spending, share of GDP, concentration of spending in different income brackets, growth rates compared to GDP, and impact of cost on access to care. Data reveals the increasing financial burden on individuals, dis

0 views • 6 slides

Federal Depository Library Program: Providing Access to Government Information

The Federal Depository Library Program (FDLP) offers free government materials to libraries, ensuring public access to federal information. Established in 1813, the program disseminates resources across 1150 federal libraries, promoting transparency and accountability. Selective depository libraries

0 views • 20 slides

Maryland Pandemic Relief Spending Summary May 2021

Maryland Department of Budget & Management's report reveals a pandemic relief spending of over $60 billion, comprising Federal Non-Grant Funding of $36.2 billion and Federal Grant Funding of $23.8 billion. The funds were allocated for various purposes such as state tax relief, state grant funding, a

0 views • 16 slides

Wheatland-Chili's Federal COVID Relief Funds Spending Plan

Wheatland-Chili School District has outlined its spending plan for Federal COVID relief funds, including details on CRRSA and ARP allocations. The plan focuses on addressing various needs such as COVID safety measures, educational resources and support, staff professional development, mental health

0 views • 30 slides

President Trump's $1.5 Trillion Infrastructure Plan: Key Points for Counties

President Trump introduced a $1.5 trillion federal infrastructure package with a focus on regulatory reform, aiming to stimulate new investment, shorten project approval times, and address rural infrastructure needs. The plan includes $200 billion in new federal spending, leveraging funds for projec

0 views • 21 slides

Reconciling CIP Budget Narratives & Spending Overview

Detailed information on reconciling CIP budget narratives and spending, including the agenda, fiscal timelines, federal funds timeline, annual budget narrative, reconciliation basics, and ensuring alignment with personnel costs. Tips provided on reconciling, identifying errors, and planning for carr

0 views • 12 slides

Integrating Spending Reviews into the Budget Cycle: Best Practices and Recommendations

To integrate spending reviews effectively into the budget cycle, align the process with the budget calendar, ensure consistency with medium-term frameworks, and incorporate outcomes into budget decisions. Countries like Australia, the UK, Ukraine, Italy, and Slovakia have institutionalized spending

0 views • 11 slides

Understanding the US Federal Budget Process

Explore the intricate details of the US federal budget process, including budget formulation, presentation, and execution. Learn about discretionary spending, agency budget development, and the multi-year budget trend. Discover the authority for the US budget as outlined in the US Constitution. Unve

0 views • 31 slides

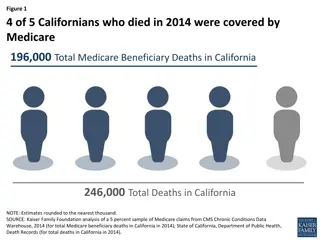

Medicare Trends in End-of-Life Care for Californians

Californians who died in 2014 were analyzed in terms of Medicare coverage, spending at the end of life, and hospice care utilization. The data shows a decrease in the share of total Medicare spending, variations in spending with age, and an increase in hospice use and spending over the years. Furthe

0 views • 6 slides

Recommendations for Enhancing EU Economic Governance and Cohesion Policy

Explore key recommendations from the EU Cohesion Policy Conference in Bratislava and the Federal Ministry of Finance of Germany. Topics include achieving EU-wide benefits from spending, evaluating the Common Agricultural Policy, and improving budget flexibility. These suggestions aim to align EU spe

0 views • 11 slides

Insights on Intergovernmental Funding of Surface Transportation

The interconnected nature of surface transportation funding system is highlighted, showing a decline in overall spending across federal, state, and local governments. Challenges in funding call for dialogue among all levels of government. The data reflects expenditures, funding sources, and the vary

2 views • 11 slides

Understanding Government Tools for Economic Stability

The government uses fiscal and monetary policies to stabilize the economy. Fiscal policy involves Congress's actions through government spending or taxation changes, while monetary policy is driven by the Federal Reserve Bank. Discretionary fiscal policy involves new bills designed to adjust aggrega

0 views • 36 slides

Comprehensive Overview of Medical Spending Accounts for 2024

Explore the details of Medical Spending Accounts (MSA) and Limited-use Medical Spending Accounts for the year 2024, including eligibility, contribution limits, eligible expenses, carryover options, deadlines, and administration fees. Learn how these accounts can help you manage your healthcare expen

0 views • 9 slides

Understanding Single Audit Requirements for Hawaii Child Nutrition Programs 2016

In accordance with federal regulations, non-Federal entities that expend $750,000 or more in Federal funds, including USDA's child nutrition programs, are required to undergo a Single Audit. The audit must be completed within nine months of the organization's fiscal year-end, and the final report mu

0 views • 5 slides

Budget 2023 Summary: Political, Economic, and Fiscal Highlights

The Budget 2023 by Craig Renney in May covers a range of critical areas including Political Background, Economic Outlook, Fiscal Outlook, and Spending Highlights. It reflects the challenges faced by the government amidst an impending election and economic uncertainties. The economic forecast is more

0 views • 11 slides

Understanding Federal Partnership Audits and Their Impact on State Revenue Departments

The presentation discusses the impact of federal partnership audits on state revenue departments, emphasizing how states benefit from federal audit efforts. It covers topics such as reporting federal audit adjustments, the background of federal audit adjustments, and the final determination process.

0 views • 51 slides

Cancer Types Spending in Europe

Learn about the spending on various types of cancer in Europe including breast cancer, colorectal cancer, prostate cancer, lung cancer, ovary cancer, and pancreatic cancer. The information is based on the Comparator Report on Cancer in Europe 2019, which covers disease burden, costs, and access to m

2 views • 7 slides

Sustainable Health Care Cost Growth Trends in Oregon, 2020-2021

The Sustainable Health Care Cost Growth Target Program in Oregon aims to regulate the annual per person growth rate of total health care spending. Reports show a 3.5% increase in total health care expenditures per person in 2020-2021. The link between Medicaid enrollment and spending is highlighted,

0 views • 31 slides

Flexible Spending Account Options for 2024

Explore the various Flexible Spending Account options available for 2024, including Medical Spending Account, Limited-use Medical Spending Account, Dependent Care Spending Account, and Pretax Group Insurance Premium feature. Learn about contribution limits, reimbursement deadlines, and enrollment re

0 views • 9 slides

Future Health Spending Trends in Latin America

The content explores the increasing public spending on social sectors, particularly health, in countries like Brazil, Chile, and Mexico. It discusses the growth in health expenditure since 1995 and predicts future trends in health spending based on economic development. The analysis highlights the i

0 views • 17 slides

Understanding the Federal Features of the Indian Constitution

The Indian Constitution exhibits a unique blend of federal and unitary characteristics, termed as quasi-federal. This constitutional setup grants power to both the center and states, yet allows for central intervention in certain circumstances. The Parliament holds authority over creating new states

0 views • 4 slides

Analysis of Solar Energy Program Spending and State Allocation Trends

This analysis delves into the spending patterns of state energy programs on solar initiatives, particularly under the American Recovery and Reinvestment Act. It explores the amount of funding invested in solar projects, identifies the top states allocating funds to solar energy, and assesses the ava

0 views • 13 slides