City Finance 101: Financial training for elected and appointed officials

A comprehensive training program designed to equip elected and appointed officials with the necessary knowledge and tools for effective financial management in their communities. Learn about fund accounting, budgeting, fund categories, revenues, expenditures, transfers, and best practices in city fi

8 views • 18 slides

DEPARTMENT OF HEALTH AND SOCIAL SERVICES

An overview of the benchmark trend in health care spending in Delaware for the year 2021. It includes data collected from various sources and highlights changes in total health care expenditures, COVID-19 relief payments, per capita spending, quality benchmarks, and more.

5 views • 14 slides

Public Works

The Department Director's proposed budget presentation for the FY 23-24, highlighting the resources, expenditures, and changes in the Public Works division. Learn about the department overview, mission, and divisional details. Explore the budget details and the impact of the American Rescue Plan Act

0 views • 26 slides

Top Business Expense Management Solutions Companies

The integration of technology and changing company priorities are influencing the business expense management process in the US. Automation and artificial intelligence (AI) are critical in streamlining these transformations and automating receipt processing and data entry tasks. It speeds up process

2 views • 6 slides

Maximizing Expenditures for 2024-2027 Financial Period

Explore WMO's Strategic Plan 2030 and objectives for the 76th Executive Council session, focusing on enhancing services, Earth system observations, and climate information. Highlighted areas include sustainable infrastructure investment, policy-relevant science, and inclusive participation. Embrace

2 views • 41 slides

2022/23 Second Interim Budget & Financial Report Overview

This report provides important updates on the district's financial status and budget revisions for the 2022/23 fiscal year. It includes details on revenue sources, grant awards, and expenditures, highlighting key figures and changes. The report focuses on the district's ability to meet financial obl

0 views • 18 slides

What is the monthly income of a hotel owner

Determining the monthly payment of a hotel owner can be fairly intricate and variable, as it counts on considerable elements such as the size and location of the hotel, its occupancy rate, average room rates, functioning expenditures, and other revenue rivulets such as food and potable usefulness, m

1 views • 4 slides

What is the monthly income of a hotel owner in India

Determining the monthly payment of a hotel owner can be fairly intricate and variable, as it counts on considerable elements such as the size and location of the hotel, its occupancy rate, average room rates, functioning expenditures, and other revenue rivulets such as food and potable usefulness, m

1 views • 4 slides

Costing Out Approaches

Costing out approaches and studies have been developed to ensure schools and districts have adequate resources to meet state education standards. Implementing these approaches involves professional judgment, evidence-based benchmarks, and data requirements. Using multiple approaches allows for trian

0 views • 12 slides

Understanding Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

Empowering Excellence, Advancing Equity,and Expanding Impact

Michigan State University's strategic plan for 2030 focuses on empowering excellence, advancing equity, and expanding impact. The vision includes significantly expanding opportunity, advancing equity, and fostering a vibrant, caring community. The plan outlines core values such as collaboration, equ

0 views • 15 slides

Overview of GSA SmartPay Fleet Management Essentials

The GSA SmartPay program enables over 560 federal government agencies to access charge card products and services through a master contract. Agencies can issue task orders with no direct fees, potentially earning refunds. The program includes fleet card services with fixed pricing and options extend

3 views • 71 slides

United Nations Development Programme - Financial Overview 2022

This document provides a detailed financial overview of the United Nations Development Programme's multi-country Western Pacific HIV, TB, and Malaria Program for the year 2022. It includes budget allocations, expenditures, grant information, sub-recipient performance, and reprogramming activities. T

0 views • 10 slides

State Budget Outlook Multiyear Trend Analysis by Chris Cremin - Nov. 1, 2023

Analysis of Oklahoma's state budget outlook, including revenue and expenditure projections for the current fiscal year and the next two years. The report covers recurring revenue trends, major fund details, authorized expenditures, and budget outlook trends.

2 views • 13 slides

Senneville Municipality Financial Report 2023-2024

Strategic Vision 2021-2025 outlines Senneville's mission to provide a safe community life. The report discusses market volatility, expenses distribution, local expenditures, and budget comparisons. Public security and general administration make up significant portions of expenses.

0 views • 30 slides

Santa Monica College 2023-2024 Budget Overview

Santa Monica College's budget for 2023-2024 presents a recap of changes from the tentative projections, detailing revenue, expenditures, surplus/deficit, and ending fund balance. The systemwide budget and state adopted budget for 2023-2024 are also discussed, highlighting economic challenges and imp

7 views • 37 slides

North Reading Police Department FY25 Budget Proposal Overview

The North Reading Police Department's FY25 budget proposal outlines various grants and expenditures for training, equipment, and community programs. Key elements include grants for 911 training, body-worn cameras, mental health training, and drug prevention initiatives. The proposal also details bud

7 views • 13 slides

Understanding the Circular Flow in a Three-Sector Economy

In a three-sector economy, the circular flow of income involves households, firms, and the government sector. The government acts as both a firm and a consumer, producing goods and services while also spending on consumption. The flow of income includes transfer payments, factor payments, taxes, sub

5 views • 5 slides

Same Day Loans Online A Reliable Financial Aid Source

Any same day loans online between $100 and $1000, with a flexible repayment period of 2-4 weeks, are deemed available to all customers. In addition, the funds can be used for a variety of financial obligations, like covering your child's tuition or school expenses, medical expenses, power bills, foo

2 views • 1 slides

Quick Course on Setting up Fund Accounting in QuickBooks Pro for Municipalities

Discover how to set up fund accounting in QuickBooks Pro for municipalities using class tracking features. Learn to define funds, track balances for revenues and expenditures, and create new revenue accounts. Explore examples of recording revenue and managing expenditures effectively.

0 views • 19 slides

Overview of Food Price Trends and Consumer Expenditures in the US

The presentation highlights the consumer spending on food, food price trends over time, 2021 food prices, and forecasts for 2022 in a historical context. It emphasizes that U.S. consumers spent 12% of their expenditures on food in 2020, aligning with historical averages. Food price inflation remaine

0 views • 21 slides

Overview of Ontario's Expenditures and Revenues

Ontario's projected expenditures for 2018-2019 are around $158 billion, with 30 ministries grouped into six major sectors. The top spending sectors include Health, Education, Other Programs, and Interest on Debt. Revenue sources for the same fiscal year are projected to be approximately $152 billion

7 views • 16 slides

Provincial Treasury Process for Dealing with Irregular Expenditures

The Provincial Treasury outlines the process for handling irregular expenditures, including the definition of irregular expenditure, regulations introduced, legal opinions, and duties of Accounting Officers (AOs) and Authorized Officials (AAs) to prevent and address irregularities. Various steps and

0 views • 12 slides

Colorado Expenditures on the Medically Indigent Presentation

The presentation focuses on Colorado's expenditures for the medically indigent, conducted by Yondorf & Associates. It outlines the background of the expenditures project, preliminary findings, and possible policy implications. The project aims to estimate current spending on Coloradans who cannot af

0 views • 12 slides

Evaluation Process for AAU Membership and Indicators

AAU evaluates universities for membership based on research and education profiles. Non-member universities exceeding standards may be invited to join, while current members falling below may face review. The process involves membership and phase 1 indicators, federal R&D expenditures, and expenditu

0 views • 12 slides

Missouri HealthNet Pharmacy Program and Budget Update Summary

The Missouri HealthNet Pharmacy Program and Budget Update for July 2023 provides detailed insights into the enrollees, expenditures, and services covered. It highlights the distribution of enrollees among different categories such as children, custodial parents, pregnant women, elderly, and disabled

0 views • 9 slides

Musculoskeletal Disorders in Norway: Statistics and Analysis

This information provides an in-depth look at musculoskeletal disorders in Norway, including disease categories, public expenditures, burden of disease, DALYs by ICD10 chapters, health expenditures, productivity loss, deaths, and YLDs in 2013. The data sheds light on the prevalence, impact, and dist

0 views • 9 slides

UC Merced Entertainment Policy Overview for Catering Recharges

University of California, Merced's entertainment policy (BUS-79) outlines expenditures for business meetings, entertainment, and other occasions, including guidelines for catering recharges. The policy covers purposes, maximum rates, general limitations, approval of expenditures, exceptions, busines

0 views • 17 slides

Litchfield Elementary School District Bond Update June 30, 2021

Litchfield Elementary School District provides an update on the 2014 Bond Authorization as of June 30, 2021. The District has issued bonds totaling $35 million with expenditures and available cash detailed. Expenditures include school remodeling, new construction projects, operational expenses, and

0 views • 11 slides

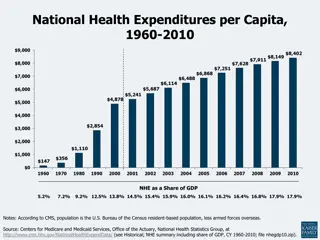

Trends in National Health Expenditures and Care Costs, 1960-2010

National health expenditures per capita and as a share of GDP from 1960 to 2010, along with average annual growth rates, show the evolving landscape of healthcare spending in the U.S. The data reveals changing patterns in healthcare expenditure and outlines the concentration of health care spending

0 views • 20 slides

Audit Report on Adult Corrections Expenditures

Adult corrections expenditures report from the Legislative Audit Bureau highlights trends in inmate population, operating expenditures, employee wages, turnover rates, vacancy rates, and inmate health care management issues. The report identifies areas of growth in corrections spending and offers re

0 views • 14 slides

Essential Guidelines for Documenting University Expenditures during Emergency

Guidelines for documenting essential expenditures at the university during emergencies, emphasizing the categories of essential activities to be maintained such as protecting life, preserving university property, supporting critical services, ensuring continuity of operations, education, student ser

0 views • 17 slides

Medicaid Program Expenditure Analysis August 2022

Analysis of Medicaid program expenditures in August 2022 reveals interesting insights. Total enrollees in August 2022 were 1,358,275 with total expenditures amounting to $304,664,691.2. The report delves into expenditure distribution across various services, top drug classes per fiscal year, and Med

0 views • 12 slides

Chowan County Manager's Recommended Budget 2021-2022 Overview

The Chowan County Manager, Kevin Howard, has recommended a budget for FY 2021-2022 with details on property tax information, general fund revenues, revenue sources, and fund expenditures. The proposed budget includes information on assessed tax values, tax rates, revenue sources, and expenditures by

2 views • 7 slides

Public Housing Capital Fund Management Guidelines

Public Housing Capital Fund Management Guidelines provide detailed instructions for Public Housing Authorities (PHAs) regarding the proper utilization of capital funds, including obligations, expenditures, and modernization projects. PHAs are required to follow HUD regulations, maintain fiscal respo

0 views • 21 slides

Impact of MGNREGA on Private Coaching in West Bengal, India

This study explores the impact of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) on private coaching expenditures in West Bengal, focusing on how participation and earnings under MGNREGA influence decisions related to private tutoring. More than half of households involved in M

0 views • 21 slides

Insights on Intergovernmental Funding of Surface Transportation

The interconnected nature of surface transportation funding system is highlighted, showing a decline in overall spending across federal, state, and local governments. Challenges in funding call for dialogue among all levels of government. The data reflects expenditures, funding sources, and the vary

2 views • 11 slides

Understanding Obligations and Expenditures in Grant Management

Explore the definition and characteristics of obligations in grant management, including the importance of tracking and managing funds responsibly to avoid overages. Learn how purchase orders create obligations and how to report expenditures effectively within the period of availability of funds.

0 views • 28 slides

Financial Policy Recommendations for Accumulated Surplus Management

The council policy recommends retaining an accumulated surplus up to 4% of operating expenditures, with any excess transferred to the Capital Works Reserve. The rationale behind this policy includes ensuring cash flow, setting aside funds for future expenditures, maintaining a rainy day fund, and pr

0 views • 14 slides

2020 Impact Fee Summary Report

The 2020 Impact Fee Annual Report, Traffic Impact Fee Summary, and Park Impact Fee Summary outline the eligible project expenditures, impact fee balances, spending requirements, and more for the year. Key highlights include significant project expenditures, balance allocations, and future spending p

0 views • 6 slides