Employer Ambassador presentation slide deck

Elevate your presentation game with our Employer Ambassador slide deck. Crafted to impress, persuade, and inform, this dynamic resource is your key to delivering impactful presentations that resonate with your audience. From compelling visuals to strategic content, this deck is designed to help you

5 views • 19 slides

SBRP SUPPLEMENTAL RETIREMENT BENEFIT

Supplementation retirement benefit (SBRP) is a defined benefit providing lifetime income separately managed by SBCTC. Eligibility requirements include age, years of service, and disability retirement provisions. Calculations are complex and based on retirement age, years of service, goal income, and

0 views • 26 slides

Workplace Violence Prevention Regulations and Employer Training

Learn about workplace violence prevention regulations, employer training, coverage under the regulations, definition of workplace violence, steps to develop a written policy statement, and conducting a risk evaluation to determine risk factors. This comprehensive guide aims to help public employers

1 views • 22 slides

Understanding Pensions in Lloyds Banking Group

Pensions in Lloyds Banking Group offer tax-efficient ways of saving for colleagues' long-term futures through Defined Contribution and Defined Benefit schemes. The schemes are set up under trust to separate them from the employer and obtain tax reliefs. Trustees hold and administer assets for the be

1 views • 12 slides

Employer Incentives for Hiring People with Disabilities

Learn about the various employer incentives available to promote the hiring and retention of individuals with disabilities, including tax credits like the Work Opportunity Tax Credit (WOTC). Hiring people with disabilities not only brings financial benefits but also enhances diversity, morale, produ

1 views • 18 slides

Understanding Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with unpaid, job-protected leave for specified family and medical reasons. This training covers employer coverage, employee eligibility, qualifying reasons for leave, basic provisions of the law, employer requi

1 views • 31 slides

Insights on Outdoor Heat Exposure: OSHA Data Collection Pilot 2022

The Occupational Safety and Health Administration (OSHA) conducted a Data Collection Pilot from June to September 2022 to quantify outdoor heat exposure and assess employer heat illness prevention programs. Key findings include identifying elements of successful prevention programs, comparing workpl

0 views • 22 slides

Recruitment Firms Never Underestimate the Power of Employer Branding

Unlock the potential of employer branding with Alliance Recruitment Agency. Enhance your appeal to top talent and establish industry leadership. Ready to elevate your brand? Contact us today to get started.\n\nMore Information:\nVisit: \/\/ \/recruitment-agency\/

0 views • 5 slides

Innovative Strategies in Employer Outreach for Educational Institutions

Explore effective employer outreach approaches and outcomes for educational institutions in New Mexico, focusing on employer relations, skills match gap closure, advisory councils, program development examples, and successful student placements in relevant roles. Discover how connecting employers to

0 views • 47 slides

Understanding Labour Relations in Entrepreneurship

This module delves into the intricacies of labour relations within entrepreneurship. Topics covered include collective bargaining, mediation, arbitration, and applicable labour legislation for small businesses. The importance of good labour relations and disciplinary actions for code violations are

0 views • 18 slides

Understanding Vicarious Liability in Labour Law

Vicarious liability in labour law holds employers responsible for the wrongful acts of their employees. The employer may be liable if the act was authorized, necessary for the job, capable of being ratified, and falls within the scope of employment. Various factors must be considered to establish vi

2 views • 34 slides

HR Consulting Firms_ The Art of Building a Strong Employer Brand

HR Consulting Firms_ The Art of Building a Strong Employer Brand

0 views • 4 slides

Understanding Professional Employer Organizations (PEOs)

A Professional Employer Organization (PEO) offers small businesses comprehensive HR solutions including payroll, benefits, tax administration, and more. Through a co-employment relationship, PEOs share employer responsibilities and provide expertise in managing complex HR matters, allowing businesse

0 views • 11 slides

Public Perceptions of Housing Benefit Tax in Papua New Guinea

The research conducted at the University of Papua New Guinea in 2018 focused on the public perceptions surrounding housing benefit tax in the country. The study highlighted changes in taxable values of employer-provided housing, justifying tax adjustments, tax measures introduced in budget documents

0 views • 16 slides

Empowering Employers with Discovery Primary Care Solutions

A comprehensive overview of Discovery Primary Care, a unique healthcare product designed to provide employers with affordable quality private healthcare for their employees and families. The product offers two benefit options, Primary Care Activate and Primary Care Advanced, along with the option to

0 views • 7 slides

Insights on Effective Employer Mentoring for School-employer Engagement

Discover valuable lessons and evidence-based strategies on employer mentoring in schools, focusing on personal and career development. Explore the impact of mentoring, the rationale behind it, and how it can positively influence behavior, attainment, and progression of young individuals. Gain insigh

0 views • 15 slides

Understanding SEPTA Key Advantage Program

SEPTA Key Advantage is an employer-based benefit program that utilizes the SEPTA Key card, offering the "All Access" feature for convenient transportation across various SEPTA services. The program has different tiers for enrollment based on the size of the company, ensuring coverage for eligible em

0 views • 12 slides

Introduction to Lead Employer and the 2016 Junior Doctors Contract

Acute DGH Trust is a leading employer for Junior Doctors in the UK, responsible for over 4,700 trainees across multiple regions. They are currently implementing the new Junior Doctor 2016 contract with a focus on supporting trainees through their employment lifecycle. The transition to Lead Employer

0 views • 20 slides

Overview of Indian Oil Corporation Limited Employee Benefits Scheme

Indian Oil Corporation Limited provides various employee benefits schemes including the Superannuation Benefit Fund Scheme and Post-Retirement Medical Benefit Facility. The scheme, introduced in 1987, offers benefits to both officers and non-officers. Over the years, it has evolved from a Defined Be

0 views • 18 slides

Protecting Your Business with Key Person Cover from Fidelity Life

Key Person Cover from Fidelity Life provides financial protection for businesses by helping replace key staff members unable to work due to sickness or injury. Established businesses and newly self-employed individuals can benefit from this cover, with options for benefit amounts, waiting periods, a

0 views • 12 slides

Benefit Only/Shell Agency Benefit Coordinator Overview

This overview provides insights into the Benefit Only/Shell Agency benefit coordination process, covering topics such as new employee notifications, benefit enrollment processes, open enrollment, troubleshooting, and more. It also highlights the project timeline and scope for implementing Workday HC

0 views • 24 slides

Understanding Marginal Analysis in Economic Decision-Making

Marginal analysis involves comparing Marginal Benefit with Marginal Cost to determine the optimal quantity for an activity. If Marginal Benefit is greater than Marginal Cost, there is a Net Marginal Benefit; if it's less, there's a Net Marginal Cost. The principle helps weigh costs and benefits befo

0 views • 14 slides

Overview of Benefit-Cost Analysis in Policy Decision Making

This chapter delves into benefit-cost analysis as an essential tool in policy evaluation. It outlines the steps involved in conducting a benefit-cost analysis, emphasizes the significance of defining and quantifying policy problems, and highlights the importance of identifying the seriousness of soc

0 views • 40 slides

Affordable Care Act (ACA) 1094/1095 Reporting Guidelines

Affordable Care Act (ACA) requires employers to report information to the IRS regarding individual and employer responsibilities under the ACA. The reporting includes details on individual responsibility, employer responsibility, exemptions, and reporting requirements for different types of employer

0 views • 52 slides

Simplifying Employer Reporting for Improved EI Benefit Delivery

This presentation covers the current administrative burdens on employers regarding the production and usage of Records of Employment (ROEs). It highlights challenges faced by small and large employers, provides recommendations for simplification, and suggests changes in ROE requirements and the Reas

1 views • 23 slides

Financial Reporting Changes for Employer Retirement System

Transition to the new employer portal, requirements for employer portal design, audit approach memo, GASB Statement 68 report details, government employer participation issues, net pension liability reporting, and fiduciary net position changes are highlighted in this collection of information for p

0 views • 40 slides

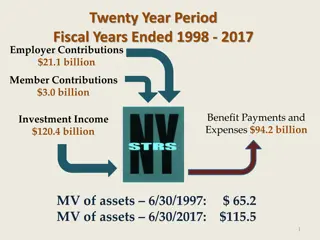

NYSTRS Financial Performance Overview 1998-2017

NYSTRS experienced significant growth over a twenty-year period, with employer contributions totaling $21.1 billion, member contributions at $3.0 billion, benefit payments and expenses reaching $94.2 billion, and investment income amounting to $120.4 billion. The breakdown of income sources reveals

0 views • 5 slides

Enhancing Employer Engagement Through Quality Programs

Explore strategies for successful employer engagement through quality programs in this insightful panel presentation. Gain valuable insights on fostering partnerships, setting goals, overcoming challenges, and enhancing peer-to-peer engagement. Meet experienced panelists and learn about initiatives

0 views • 52 slides

Employer Satisfaction Survey 2015-2016: Key Findings and Analysis

This report presents key findings from the Employer Satisfaction Survey 2015-2016, which gathered feedback from over 60,000 employers who received training funded by the Skills Funding Agency. The survey reflects positive employer satisfaction levels with the training providers, particularly in the

0 views • 50 slides

Migraine Wellness Initiative Tactics for Workplace Advocacy

This document outlines a set of tactics for the Migraine Wellness Initiative to present to an employer partner. The focus is on raising awareness about migraines, reducing associated stigma, educating employees, and driving meaningful change in the workplace through engagement strategies and initiat

0 views • 7 slides

Importance of Employer Engagement in Education for Young Adults' Career Development

Young adults' perceptions of workplace exposure through school-mediated programs play a crucial role in their transition to the labor market. This text discusses the significance of employer engagement in education, emphasizing the benefits of work experience, career guidance, and school-age employe

0 views • 29 slides

Comprehensive Overview of Employer Advisory Group Focus on ERM

Employer Advisory Group focuses on Enterprise Risk Management (ERM) to streamline pension plan administration through an online system for efficient reporting, maintenance, and compliance with state laws. The ERM timeline, key features like employer management, member management, and wage & contribu

0 views • 17 slides

Overview of J1 Student Program and Summer Work Travel (SWT)

Explore the J1 Student Program presented by Tiffanie Butzen, focusing on why they are called J1 students, the different program categories, and the Summer Work Travel (SWT) program for foreign university students. Discover the goals of the program and steps to becoming a host employer, emphasizing c

0 views • 14 slides

Revitalizing the UFCW Minneapolis Pension Plan

UFCW Minneapolis Pension Plan faced a financial crisis, leading to benefit cuts and unaffordable employer contributions. Through strong leadership and negotiations, a new funding plan was implemented, freezing the legacy plan and introducing a Variable Annuity Pension Plan (VAPP). This innovative de

0 views • 8 slides

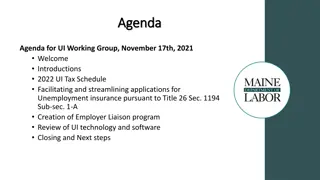

Enhancing UI Application Process for Unemployed Workers and Employers

The agenda for the UI Working Group meeting on November 17th, 2021, focuses on optimizing the UI tax schedule for 2022, creating an employer liaison program, reviewing UI technology, and discussing methods to improve the application process for unemployment insurance benefits. Key points include the

0 views • 24 slides

Understanding Affiliated Company Liability and Employer Relationships in Labor Law

This session provides insights into affiliated company liability under labor and employment laws, discussing the implications, risks, and legal standards relevant to determining single employer status. It covers scenarios where separate entities may be treated as one employer, highlighting factors s

0 views • 28 slides

Addressing the Issue of Unauthorized Migration Through Employer Sanctions

The discussion highlights the importance of enforcing employer sanctions as a strategy to reduce unauthorized migration. It emphasizes the need for national ID cards, strict enforcement of employer sanctions, and implementing an automated entry-exit system. By holding employers accountable and reduc

0 views • 11 slides

Analysis of H-1B Data Trends and Employer Statistics

Explore the trends in H-1B petitions approved, median annual compensation, and requests for evidence (RFEs) for H-1B completions. Understand the distinction between new/initial employment and continuing employment, calculate approval and denial rates, and access data from fiscal years FY 2009 to FY

0 views • 6 slides

Updates on Calendar Year 2024 UI Employer Tax Rates Recalculation

The Division of Unemployment Insurance in Maryland has recalculated the tax rates for Calendar Year 2024, extending pandemic relief and ensuring no employer faces a tax rate increase. The reissued rates, based on recent experiences, aim to provide stability and lower costs for employers. Employers c

0 views • 14 slides

Understanding the Alternate Employer Endorsement in Workers' Compensation

Explore the concept of the Alternate Employer Endorsement (also known as WC 00 03 01 A), which pertains to a dual relationship between a general employer and a special employer in workers' compensation scenarios. Learn about the implications of shared employees, control issues, legal cases, waiver o

0 views • 28 slides