Buy Al Fakher Double Pomme Wholesale Pack of 1 Kg

Discover the allure of Al Fakher Double Pomme Shisha:\nDual Apple Fusion: Savour the perfect blend of sweet and tangy apples, tantalising your taste buds.\nLong-Lasting Enjoyment: With a generous 1 Kg pack, experience extended sessions of aromatic pleasure.\n\nSmooth Smoking Experience: Fine-cut tob

5 views • 3 slides

SUR-TOITURE ET DOUBLE TOIT

Producing shade, reducing heat flux, and saving energy through the use of double roofs and over-roofs. Double roof systems involve installing a new roof over an existing one with proper insulation, while over-roofs create a protective layer above the original roof. These techniques significantly low

1 views • 11 slides

Understanding Taxes: An Overview of Taxation Principles and Collection in Ireland

This content covers the fundamental aspects of taxation, including its definition, purpose, principles (fairness, certainty, efficiency, convenience), and tax collection in Ireland by the Revenue Commissioners. It explores key concepts related to taxation and aims to enhance understanding of tax sys

2 views • 26 slides

Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

Vertical Machining for Precision Crafting with with Used Titan SC33 Double Colum

Searching for top-tier used Titan SC33 Double Column Vertical Borer? Delve into our stock at Mudar M Metalworking Machine Tools Trading!\n\nUnearth premium pre-owned equipment like the Used Titan SC33 Double Column Vertical Borer in our collection.\n\nFrom used boring machines to used sheet-metalwo

2 views • 8 slides

Stay Ahead in NRI Taxation in England with Bharat's Lower Tax Service

Stay ahead of the curve in NRI taxation in England with Bharat's Lower Tax Service. Our specialised solutions cater to the unique tax needs of Non-Resident Indians, ensuring compliance and maximising returns. With expert guidance and personalised strategies, navigate the complexities of cross-border

7 views • 3 slides

nritaxationbharat_blogspot_com_2024_05_nri_income_tax_return

Mastering NRI Taxation: Guidelines for Delhi Residents\" offers comprehensive insights into navigating the complexities of taxation for Non-Resident Indians (NRIs) residing in Delhi. This resource provides expert guidance on understanding tax laws, claiming exemptions, and optimizing deductions spec

3 views • 3 slides

Double Pole Double Throw Micro Switches Market Industry Analysis and Forecast 2032

The global double pole double throw micro switches market size was USD XX Billion in 2023 and is projected to reach USD XX Billion by 2032, expanding at a CAGR of XX % during 2024\u20132032

0 views • 6 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Double Opening Jewellery Box

The Double Opening Jewellery Box by Papers Gallery is a luxurious and stylish option for storing your jewelry. These boxes are made from high-quality rigid cardboard material and feature a center opening design with double doors.

1 views • 3 slides

Understanding Principles of Taxation

Principles of taxation, including concepts such as public revenue, sources of revenue, types of taxes (direct and indirect), and non-tax revenue, are essential for students of commerce to grasp. Taxation serves as a means for the government to collect revenue for the common good through compulsory c

0 views • 12 slides

Understanding Double Entry Accounting System in Finance

There are two commonly known systems of accounting - single entry system and double entry system. Double entry system is the basis of modern day accounting and ensures accuracy by recording every transaction with dual aspects of debit and credit. By maintaining personal and impersonal accounts, it h

1 views • 7 slides

Understanding Types of Heterosis and Predicting Performance of Double Cross Hybrids

Heterosis, also known as hybrid vigor, plays a crucial role in plant breeding. This article delves into different types of heterosis, including average, heterobeltiosis, economic, standard, and negative heterosis. It further discusses the prediction of performance in double cross hybrids involving f

1 views • 9 slides

Exploring Taxation Acts and Their Impact on Revolutionary Sentiments

The provided content delves into historical taxation acts, including their specifics and potential implications on the onset of the American Revolution. It also draws parallels to modern-day examples of product taxation, prompting reflection on the fairness and consequences of such levies. The disco

4 views • 6 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

Double Double Decker Bus Perfect for Large Groups

Take a trip down memory lane in a vintage double-decker bus with Barleybus.com. Visit barleybus.com today to reserve your one-of-a-kind trip!

3 views • 1 slides

Taxation Procedures and Authorities

Explore the principles and application of taxation laws, tax provisions, duties of tax authorities, and obligations during taxation procedures. Learn about the essential role of tax authorities in determining facts crucial for legitimate decision-making, benefiting taxpayers diligently, and conducti

0 views • 35 slides

Brazilian Tax System and International Tax Treaties Overview

The Brazilian tax system follows guidelines set by the Federal Constitution, with taxation principles, authority, limitations, and revenue distribution. The country has various sources of tax law, including treaties, laws, and customs. Existing bilateral double taxation treaties with countries like

3 views • 9 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Best Window Repairs in Melling Mount

Are you looking for the Best Window Repairs in Melling Mount? Then contact Universal Double Glazing Repairs. They specialize in providing high-quality glazing services. Their expertise includes double-glazing repairs, domestic glazing, double-glazing

0 views • 6 slides

Understanding the Double Bind: Challenges for Women of Color in STEM

The Double Bind concept explores the challenges faced by women of color in science, technology, engineering, and mathematics (STEM) fields. Highlighted in two key documents from 1976 and 2011, it reveals how women of color often experience exclusion and biases due to their race and gender. Recommend

0 views • 12 slides

Exploring the Case for Double Marking in GCSE and A-Level Assessments

Delve into the concept of double marking, its significance in educational evaluations like GCSE and A-Level assessments, various methodologies like adjudication, and a hypothetical worked example to illustrate its impact on marks. The study evaluates the proximity to definitive marks under single ma

0 views • 29 slides

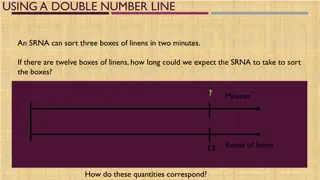

Understanding Double Number Lines for Problem Solving

Utilizing double number lines to solve mathematical problems involving sorting linens, seating residents, and determining visitation rates at a care facility. Each scenario is represented visually on a double number line, aiding in understanding the relationships between quantities and solving for u

0 views • 11 slides

Impact Analysis of New Corporate Taxation Regime Under Taxation Laws (Amendment) Ordinance, 2019

The new corporate taxation regime introduced through the Taxation Laws (Amendment) Ordinance, 2019 brings significant changes, including a lower tax rate for domestic companies. The regime allows companies to opt for a 22% tax rate, with implications on exemptions and deductions. Companies opting fo

0 views • 31 slides

Nevada Department of Taxation Guidelines for Repair and Reconditioning Services

Tax guidelines for repair and reconditioning services in Nevada provided by the Department of Taxation. Covers taxable repair labor, treatment of parts, repairmen as retailers or consumers, fabrication vs. refurbishing labor, painters, polishers, finishers, and replacement parts taxation.

0 views • 11 slides

Understanding Double Patterning Lithography Techniques

Explore the world of lithography with a focus on double patterning techniques. From self-aligned double patterning to chemical vapor deposition methods, this comprehensive overview covers the key concepts, challenges, and solutions in advanced semiconductor manufacturing processes. Dive into the int

0 views • 28 slides

Effective Double-Entry Journaling for Deeper Reading Engagement

Double-Entry Journaling is a powerful method to engage actively with reading, promote deeper comprehension, and facilitate effective study guides. This technique involves dividing a document into two columns, where the left column contains quotes, main ideas, and confusing passages, while the right

0 views • 12 slides

Insights on Double Neutron Star Formation in Our Galaxy

Detailed examination of the formation of double neutron stars in the Milky Way Galaxy, exploring various merging channels, uncertainties in binary evolution, and models compatible with gravitational wave observations. Emphasis on testing and constraining models with Galactic double neutron stars.

0 views • 18 slides

Pitfalls of Real Estate Ownership in Corporations

Ownership of real estate by a C corporation can lead to double taxation issues, making it a less favorable choice. The taxation implications on the sale/liquidation of real estate held by a corporation, whether C or S, can result in high tax rates, reducing the net gains for shareholders. Understand

0 views • 22 slides

Understanding Trigonometric Identities for Double Angles

Special identities like the Pythagorean identity and double angle identities for sine and cosine are explored in this content. The Pythagorean identity states that cosine squared plus sine squared equals one, while the double angle identities provide formulas for cosine of double angles. Through the

0 views • 13 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Economic Porosity and Primitive Capital Accumulation in Mozambique

In this presentation by Carlos Nuno Castel-Branco, the concept of economic porosity and its consequences in Mozambique are examined. The discussion includes the historical rationale for economic porosity, magnitude of economic dynamics, taxation issues, investment patterns, capital flight, and publi

0 views • 36 slides

Overview of International Taxation in Italian Law

International taxation refers to rules governing tax laws in different countries, covering various aspects such as cross-border trade, investments, and taxation of individuals working abroad. Tax treaties play a crucial role in limiting the taxation power of treaty partners, with over 2,000 bilatera

0 views • 25 slides

Taxation Challenges for Cross-Border Teleworkers Post Covid-19

Challenges in international taxation arise for cross-border teleworkers post-Covid-19, especially regarding the taxation of income from employment under Article 15 of the OECD Model Tax Treaty. Issues such as physical presence, bilateral agreements during the pandemic, and future taxation scenarios

0 views • 7 slides

Understanding Permanent Establishments in International Taxation

Permanent establishments play a crucial role in determining tax liabilities for companies operating across borders. In Turkish corporate taxation, limited liability taxpayers are defined by their place of business and permanent representatives. The OECD Model Convention also provides guidelines on w

0 views • 18 slides

Understanding Taxation of Digital Goods and Tangible Personal Property in Alabama

Explore the taxation laws in Alabama regarding the digital delivery of tangible personal property and the classification of tangible personal property in sales tax cases. This content delves into specific court cases, definitions, and perspectives on the taxability of digital goods and software purc

0 views • 10 slides

Negative List Based Taxation of Services by S.B. Gabhawalla & Co.

This content delves into the conceptual framework of negative list based taxation of services, including the definition of service, elements such as service territory and value, and the framework dissecting the charge at 12%. It also explains what services are excluded from taxation and provides exa

0 views • 36 slides

Public Economics Course Summary - EHESS & Paris School of Economics

The Public Economics course at EHESS & Paris School of Economics offers an introduction to taxation history, government intervention theories, and policy incidence across developed and developing countries. The syllabus covers topics like welfare analysis, wealth taxation, and optimal taxation strat

0 views • 11 slides

The Case for Progressive Taxation: Ensuring Equality Through Fair Contributions

Progressive taxation involves higher tax rates for individuals with higher incomes or greater wealth, aiming to bridge economic and gender inequalities. This system can be achieved through well-designed tax scales, exemptions, and thresholds, ultimately contributing to fair distribution of contribut

0 views • 8 slides