2023 Tax Legislation Overview

The presentation by National Treasury and SARS outlines the 2023 tax bills and legislative process. It covers adjustments in values, updates on tax rates, implementation of carbon tax, incentive reviews, and more. The content details various tax bills, including the Rates Bill, Revenue Laws Amendmen

2 views • 80 slides

Understanding Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Enhancing Tax Compliance: Factors, Audit, and Investigation" (56 characters)

Exploring factors influencing taxpayer behavior towards tax compliance, this study delves into the impact of tax audit and investigation procedures on adherence to tax laws at both corporate and individual levels. Previous research gaps are identified and addressed to provide a comprehensive underst

1 views • 20 slides

Impact of Pillar Two on Corporate Tax Incentives Post-Pillar Two

This presentation by Prof. Dr. Vikram Chand discusses the impact of Pillar Two on corporate tax incentives, focusing on the scope, ETR calculation mechanism, and overall assessment. It covers different types of tax incentives, such as immediate expensing and deductions, and explains how Pillar Two a

4 views • 29 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Corporate Travel Solutions

Travelopro offers end-to-end corporate travel bookings and solutions, enabling smooth and cost-effective business and corporate executive travel by air. For corporate travelers, the corporate travel agent services must ensure that travelers face no difficulties during the entire duration of their tr

2 views • 15 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Computation of Machine Hour Rate: Understanding MHR and Overhead Rates

Computation of Machine Hour Rate (MHR) involves determining the overhead cost of running a machine for one hour. The process includes dividing overheads into fixed and variable categories, calculating fixed overhead hourly rates, computing variable overhead rates, and summing up both for the final M

4 views • 18 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

2024 UAE Corporate Tax Registration Deadlines: Key Dates to Remember

Stay compliant with UAE corporate tax regulations by keeping track of the 2024 registration deadlines. NH Management provides a comprehensive overview of essential deadlines for UAE corporate tax registration, ensuring your business meets all require

2 views • 9 slides

Corporate Tax Association 2018 GST & Indirect Tax Corporate Intensive Conference

This year's Corporate Tax Association 2018 conference in Melbourne focuses on providing corporate indirect tax professionals with technical updates and hands-on experience of the latest in indirect tax technology and robotic process automation. The event includes sessions on GST cases, international

1 views • 4 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

The Design of the Tax System: An Overview

This chapter explores the design of the tax system in the US, discussing how the government raises revenue, its efficiency, and fairness. It delves into historical perspectives, Benjamin Franklin's views on taxes, government revenue trends, federal income tax rates, and government spending. The cont

2 views • 43 slides

Legislative Actions and Structural Changes in Budget and Tax Policies 2015-2016

The Task Force on Structural Changes in Budget and Tax Policy focused on significant legislative actions and structural adjustments in the 2015-2016 sessions. Major changes included expanding the sales tax base, revising corporate income tax definitions, proposing a constitutional amendment, and mod

0 views • 6 slides

Workshop on Sales Tax Laws on Services Part 1: Provincial Withholding Sales Tax on Services

This workshop conducted by Asif S. Kasbati covers topics such as Provincial Withholding Sales Tax in Sindh and Punjab, exemption and reduced rates in SST and PST, federal withholding sales tax, withholding agents, and the mechanism of withholding sales tax under SST and PST for different categories

0 views • 68 slides

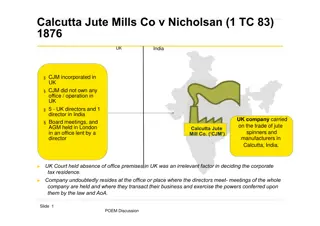

Landmark POEM Cases on Corporate Tax Residence

Landmark court cases - Calcutta Jute Mills Co. v. Nicholsan, Cesena Sulphur Company v. Nicholsan, and De Beers Consolidated Mines Ltd. v. Howe - highlight key factors determining corporate tax residence. Each case emphasizes the importance of where directors meet, transact business, and exercise pow

0 views • 11 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

The Case for Tax Reform: Challenges and Solutions

Exploring the need for tax reform and the obstacles hindering its implementation, this article delves into the complexities of effective personal income tax rates, changing tax brackets, and the factors contributing to lower effective rates compared to statutory rates. It also highlights the loophol

0 views • 25 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Understanding Tax Implications on Investors and Investment Strategies

Explore how the recent tax bill impacts investors, comparing corporate and individual tax rates, investment strategies in corporate form, tax implications of interest income and capital gains, considerations for qualifying dividends, long-term gains, REITs, MLPs, and private REIT structures. Learn a

0 views • 23 slides

DEBRA Initiative: Mitigating Tax-Induced Debt-Equity Bias in Corporate Investment

DEBRA is an EU proposal to address the bias towards debt financing over equity in corporate investment decisions by allowing deductibility of notional interest on equity. The initiative aims to create a level playing field, encourage equity-based investments, and combat tax avoidance practices. By h

0 views • 9 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Understanding Corporate & Dividend Tax in Oil & Gas Industry

Explore the computation of Corporate & Dividend Tax in the oil & gas sector, based on Indonesian regulations. Learn about the background, calculation methodology, and taxation process, including income tax, costs deductions, taxable income, and entitlement approach for tax calculation.

0 views • 10 slides

Recent Tax Developments 2016 Presentation Summary

This presentation highlights recent tax developments in 2016, covering topics such as legislative amendments, recent cases of interest, update on voluntary disclosures and Panama Papers, proposed legislative amendments at the federal level, selected corporate tax rates, and new corporate tax rates f

0 views • 95 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Updates on Calendar Year 2024 UI Employer Tax Rates Recalculation

The Division of Unemployment Insurance in Maryland has recalculated the tax rates for Calendar Year 2024, extending pandemic relief and ensuring no employer faces a tax rate increase. The reissued rates, based on recent experiences, aim to provide stability and lower costs for employers. Employers c

0 views • 14 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Analysis of The Fair Share Act Oil Tax Ballot Initiative Presentation

The presentation discusses the proposed changes to Alaska's petroleum revenue taxes, focusing on royalties, production tax, property tax, and corporate income tax. It evaluates the impact on net income derivation, current tax versus initiative tax structures, and additional provisions like unit crit

0 views • 28 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)