Internal Ism auditor

Amidst the maritime industry's stringent safety regulations, the Internal ISM Auditor Micro Credit Course aims to equip participants with the necessary auditing skills to ensure compliance with the ISM Code. This course delves into the importance of internal audits for ship safety, emphasizing the s

0 views • 29 slides

Class 2 Permit Modification Request

This Permit Modification Request (PMR) aims to transition audit scheduling for site recertification from an annual to a graded approach, incorporating DOE Orders and Quality Assurance program requirements. The PMR consolidates scheduling information, reduces redundancy, and clarifies subsequent audi

3 views • 22 slides

Utilizing Audits for Antimicrobial Stewardship in General Practice

The importance of audits in antimicrobial stewardship is highlighted in this informative content covering topics like why audit and feedback are crucial, sources of prescribing data, available audit tools, practical tips, and a case study showcasing the positive impact of audits in UTI management. T

10 views • 40 slides

Understanding Post-Election Risk-Limiting Audits in Indiana

Indiana's post-election audits, overseen by the Voting System Technical Oversight Program, utilize statistical methods to verify election outcomes, ensuring accuracy and reliability in the electoral process. The VSTOP team, led by experts in various fields, conducts audits based on Indiana Code IC 3

0 views • 12 slides

Bureau of Public Procurement in Jalingo, Taraba State - Ensuring Transparency and Accountability

The Bureau of Public Procurement in Jalingo, Taraba State aims to harmonize government policies, ensure probity and transparency, and promote fair and competitive practices in procurement. Established under the Taraba State public procurement law, the bureau monitors procurement activities, formulat

1 views • 12 slides

Role of Supreme Audit Institution of the Philippines in Employing Artificial Intelligence to Fight Corruption

The Supreme Audit Institution of the Philippines (SAI-PHL) is utilizing technology, including artificial intelligence, to enhance its audit processes and combat corruption effectively. Through initiatives like understanding IT systems and conducting computer-assisted audits, SAI-PHL is embracing dig

0 views • 12 slides

Understanding GMP Audits in Construction: Navigating Client Expectations

This presentation at the National Association of Construction Auditors' virtual conference focuses on helping clients grasp the key objectives and processes of Guaranteed Maximum Price (GMP) audits. Dave Potak, a seasoned professional, will share insights on managing client expectations, best practi

0 views • 18 slides

Understanding Single Audits for Federal Fund Compliance

Explore the process and requirements of single audits for federal fund compliance, including when they are required, the responsibilities involved, and the importance of OMB Compliance Supplement. Learn how single audits provide assurance to federal agencies about fund usage compliance and the stand

1 views • 33 slides

Internal Audits and Management Review Meetings at European Spallation Source

This content discusses the internal audits and management review meetings conducted at the European Spallation Source. It covers topics such as quality division, ESSMS architecture, development of excellence, ESSMS procedures, and audit programs. The focus is on ensuring compliance, continual improv

0 views • 16 slides

Understanding Post-Election Audits for Registrars of Voters

Post-election audits are essential for ensuring the accuracy and functionality of optical scan voting machines. This process involves randomly selecting voting districts for hand count audits to assess machine performance. The chain of custody must be strictly maintained for ballots and equipment. M

0 views • 18 slides

Understanding Wireless Security Audits and Best Practices

Explore the world of security audits with a focus on wireless networks. Learn about the types of security audits, best practices, and the steps involved. Discover the importance of systematic evaluations, identifying vulnerabilities, establishing baselines, and compliance considerations. Dive into t

0 views • 14 slides

Understanding Departmental Audits in GST

Departmental audits in GST involve the examination of records, returns, and other documents to verify the correctness of turnover declared, taxes paid, refunds claimed, and input tax credit availed. This audit ensures compliance with the provisions of the CGST Act, 2017. Types of audits under GST in

7 views • 27 slides

Guidelines for Social Audits under MGNREGA

The legal mandate for social audits under MGNREGA includes the requirement for conducting audits by Gram Sabhas, setting up independent Social Audit Units, and involving Village Social Audit Facilitators. The process involves collating records, conducting beneficiary and work verification, and prese

1 views • 19 slides

Post Award Fiscal Compliance: Who We Are and What We Do

Post Award Fiscal Compliance (PAFC) assists campus and central administrative units in mitigating non-compliance risks with sponsor terms and conditions by monitoring compliance, interpreting award requirements, providing training, and enhancing internal controls. The team includes Matt Gardner, Ass

0 views • 11 slides

Church Membership Audits in Southern Africa Union Conferences

Detailed information on church membership audits conducted in the Southern Africa Union Conferences, including the audit dimensions, verification stages, audit procedures, and timelines for the years 2018 to 2022. The process involves verifying membership counts, conducting roll calls, correspondenc

0 views • 7 slides

Legislative Requirements for Independent System Audits in Local Government

National legislation mandates the establishment of a National Treasury to ensure transparency and expenditure control in all government spheres, including local government. This involves adherence to Generally Recognized Accounting Practice (GRAP OAG), uniform expenditure classifications, and treasu

0 views • 12 slides

Worried About IRS Audits? Here’s How SAI CPA Services Can Help You Avoid Them!

IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported in

3 views • 2 slides

Understanding Bayesian Audits in Election Processes

Bayesian audits, introduced by Ronald L. Rivest, offer a method to validate election results by sampling and analyzing paper ballots. They address the probability of incorrect winners being accepted and the upset probability of reported winners losing if all ballots were examined. The Bayesian metho

2 views • 7 slides

Understanding and Complying with E-rate Program Audits - Schools and Libraries Fall Applicant Trainings 2013

Explore insights on audits in the E-rate Program for Schools and Libraries Fall Applicant Trainings 2013. Learn about audit processes, common findings, payment quality assurance, and compliance measures to safeguard the Universal Service Fund integrity.

0 views • 23 slides

Understanding Single Audits in Federal Grant Programs

Audits play a crucial role in ensuring accountability in Federal grant programs. Single Audits, being the most common type, combine financial and compliance audits into one report. Learn about threshold determinations, risk-based approaches, and key changes in the Uniform Guidance through this compr

0 views • 26 slides

Safety Management Overview and Audits Report

Explore a detailed report on safety management practices, audits findings, and actionable insights in the BSEE office. Learn about prior audits, SEMS evaluations, CAP verification, and more. Dive into SEMS subpart O audits and API RP 75 guidelines for a comprehensive understanding of safety protocol

0 views • 18 slides

Billing Documentation Guidelines for OSAP Programs

Audits are imminent for OSAP/BHSD programs, emphasizing the importance of proper documentation to ensure compliance and accuracy in billing. Providers must adhere to strict guidelines for submitting audits and desk audits annually, promptly informing OSAP of any staff changes. The documentation cove

0 views • 25 slides

Understanding Auditing: Types, Objects, and Differences Explained

Auditing in the field of commerce involves verifying accounts and statements to ensure accuracy and compliance, with a focus on detecting errors and frauds. This content covers the main and subsidiary objects of auditing, types of audits such as statutory and internal audits, and the differences bet

0 views • 19 slides

Powercor Industry Forum Audit Results and Trends Analysis

Audit results and trends analysis reveal that there were 256 audits completed, with 50 being re-audits. Additional resources were acquired to meet industry demand, but audit volumes in Q4 did not meet forecast. Turnaround times improved with the deployment of more auditor resources. Trends show issu

0 views • 8 slides

Local Government Audit Outcomes Analysis as of February 2013

The Auditor-General of South Africa plays a crucial role in ensuring oversight, accountability, and governance in the public sector by conducting audits. This analysis reveals varying audit outcomes across provinces, highlighting the need for focused actions to improve audit results and promote clea

0 views • 22 slides

Essentials of Site Audits for Global HIV & TB Programs

Understanding the purpose, stages, and requirements of site audits is vital for ensuring accuracy and reliability in test results for Global HIV & TB programs. From identifying improvement areas to implementing corrective actions, this content provides a comprehensive guide for conducting effective

0 views • 14 slides

Occupational Hygiene Practice & Legal Compliance in Health and Safety Auditing

ERM Southern Africa, a global Environmental and Health & Safety consultancy, conducts numerous audits focusing on occupational hygiene. This presentation by Mike Valentine highlights key findings from audits conducted from 2009 to 2015 in non-mining industries, emphasizing the responsibilities of oc

0 views • 20 slides

Conducting Surveillance of CNS Providers

Conducting surveillance of CNS providers involves audits and inspections to ensure compliance with regulatory requirements and maintain safety standards. Various types of audits, such as pre-certification and post-certification audits, are conducted by qualified CNS oversight inspectors to identify

0 views • 48 slides

Regulatory Compliance and Audit Operations Overview

Rosemary Carter, Associate Director of Regulatory Compliance, leads the Regulatory Compliance team at Ofqual. The team focuses on conducting audits, investigations, and recognizing awarding organizations to support AS and A-level reform. The Audit team ensures independence and impartiality in assess

0 views • 14 slides

Academic Audit and Importance in the Commerce Department at Shankarlal Khandelwal Arts, Science and Commerce College, Akola

The Department of Commerce (English Medium) at Shankarlal Khandelwal Arts, Science and Commerce College in Akola conducts academic audits to enhance academic standards. These audits analyze faculty and student performance, costs, and outcomes, aiding in continual improvement. The department focuses

0 views • 29 slides

Understanding the Impact of Audits on Post-Audit Tax Compliance

Audits have direct and indirect effects on taxpayers, influencing compliance behaviors. While more audits generally lead to increased compliance, outcomes can be ambiguous, with some studies showing a decline in post-audit compliance. Behavioral responses to tax audits are driven by perceived risks

0 views • 15 slides

Impact of Audits on Tax Compliance: Insights from Research Studies

Studies conducted by researchers such as Erich Kirchler have explored the impact of audits on tax compliance. While audits generally have a positive effect on compliance, there are cases where they can backfire, leading to unintended consequences. High auditing levels may not always deter tax evasio

0 views • 14 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Guide to Accessing and Creating Degree Audits for Doctoral Students

Learn how to access and create degree audits as a doctoral student using the online platform. Follow step-by-step instructions to view course history, set academic goals, create audits, and add goals to your audit list. Understand the different components of the current audit page and how to navigat

0 views • 26 slides

Performance Review 2018/2019 Auditor General's Department, Jamaica

The performance review of Auditor General's Department, Jamaica for 2018/2019 showcases various audits such as financial statements, compliance, and information technology. It includes details on targets achieved, audits executed, certificates issued, and ongoing work. The reports indicate the progr

0 views • 17 slides

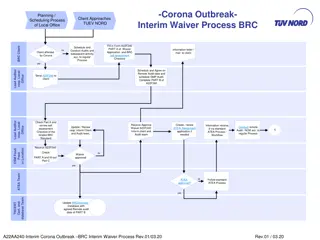

Interim Waiver Process for BRC Audits During Corona Outbreak

This content outlines the interim waiver process and scheduling procedures for local office client audits during the Corona outbreak. It includes steps for completing waiver applications, conducting remote audits, and handling certification extensions. The document also provides guidelines for remot

0 views • 11 slides

Supporting SAIs in Auditing SDGs: Reflections and Plans

SAIs play a crucial role in auditing SDGs to ensure high-quality audits of partnerships. Various SAIs and funding partners are actively involved in supporting this initiative. The story so far includes audits of preparedness and implementation of SDGs, with performance audits supporting 73 SAIs and

0 views • 14 slides

Compliance Testing by ERA for IT Systems Developed and Deployed for TAF TSI

Compliance testing for IT systems developed and deployed for TAF TSI involves checking if messages comply with TAF XSD and basic parameters, assessing compliance of IT tools against TSI requirements, and issuing compliance assessment reports. The process includes testing messages for mandatory eleme

0 views • 4 slides

Compliance and Challenges Under ERISA and ACA Audits

Explore the roles, responsibilities, and compliance highlights related to ERISA and ACA audits. Learn about various provisions, requirements, notices, and reporting associated with ensuring compliance, such as HIPAA, COBRA, and more.

0 views • 32 slides

Food Industry Perspective on 3rd Party Audits and Regulatory Inspections

Overview of regulatory inspections and 3rd party audits in the food industry from the perspective of Tim Ahn, Global Director of Quality & Food Safety at Mars Chocolate. The content covers the importance of inspections, differences between inspections and audits, and the role of audits in driving qu

0 views • 12 slides