The SDG Accelerator Fund

The SDG Accelerator Fund aims to establish a replicable financial facility that links key actors and utilizes blockchain technology to support SMEs in achieving the Sustainable Development Goals. With investments between $100,000 to $2.5 million per venture, the fund promotes cost-effectiveness, tra

1 views • 9 slides

Historic Investments in Climate Action: Inflation Reduction Act May 2023

The Inflation Reduction Act (IRA) of May 2023 focuses on making significant investments in climate action to reduce U.S. emissions by an estimated 40% by 2030. This act supports disadvantaged communities, the clean energy industry, and aims to drive emissions reductions over the next decade while pa

5 views • 14 slides

Widam Food Company Q.P.S.C. Financial Performance FY 2023 Overview

Widam Food Company Q.P.S.C., a Qatari Public Shareholding Company, reported its financial performance for FY 2023. Total revenue grew by 9%, primarily driven by international sales. The company's gross profit margin improved to 19%, with a comprehensive income of QR 33.6 million. However, challenges

1 views • 11 slides

Understanding Investments in the Illinois Bookkeepers Conference

Explore the informative presentation on accounting for investments at the 2023 Bookkeepers Conference in Rolling Meadows, Illinois. The session covers allowable investments, including money market funds, treasury securities, certificates of deposit, and more. Gain insights on investment policies, di

2 views • 24 slides

EU Climate Investment Deficit Report Launch Event

The launch event of the first edition of the EU Climate Investment Deficit Report highlights the importance of climate investments in shaping Europe's future. The report focuses on tracking public and private investments to assess the EU's progress towards the 2030 targets set by the European Green

4 views • 19 slides

Investment Responses to Biophysical Climate Impacts on Water, Energy, and Land in SDGs and Climate Policies

Investment assessments using Integrated Assessment Models (IAMs) are evolving to include biophysical climate impacts, assessing climate uncertainty on investments. The approach involves the MESSAGEix-GLOBIOM IAM, considering climate policy, SDG measures, and impacts under different scenarios. Climat

6 views • 32 slides

Insights into Investments and Convergence in Central Eastern Europe

Explore the dynamics of investments, convergence, and capital inflows in Central Eastern Europe, delving into the role of investment capital in the convergence process, the impact of foreign capital, and the heterogeneity across various countries in the region. Discover how savings, investments, GDP

0 views • 11 slides

Foreign Investments in India: Legal Framework and Investment Routes

Key statutes applicable for foreign investors in India include FEMA, SEBI regulations, and legislations governing securities markets. Foreign investments avenues in India include FDI, FVCI, FPI, NRI investments through SEBI approval or automatic approval route. Foreign Portfolio Investors (FPIs) and

1 views • 54 slides

Capacity Building in Company Law: Loans, Guarantees, and Investments Presentation

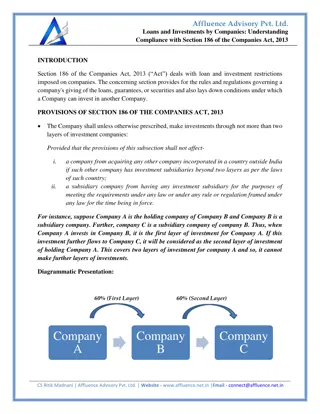

This webinar, conducted by CS (Dr.) D.K. Jain, covers Sections 185 to 187 of the Companies Act, 2013 related to loans, guarantees, security, and investments. It provides insights on restrictions, applicability, and implications for directors and connected persons. The content emphasizes the importan

0 views • 36 slides

CIBELES Company Profile and Leadership Team Overview

CIBELES is a reputable insurance company with multiple branches in the Philippines, led by an experienced Board of Directors and Company Officers. The company offers non-life insurance services and has a strong background in various business interests. The leadership team comprises skilled individua

2 views • 12 slides

Understanding Investments: A Comprehensive Overview by Mr. Vinoth Kumar J, Assistant Professor

Mr. Vinoth Kumar J, an Assistant Professor at St. Joseph's College, dives into the world of investments, explaining the meaning, definition, and classification of investments. He covers financial products like equities, mutual funds, real estate, and more, providing insights into both financial and

0 views • 21 slides

Understanding the Meaning and Nature of Company Law in LL.B 3rd Semester

The concept of a company originates from the Latin words "com" and "panis," denoting a group of people dining together. In legal terms, a company is an artificial person created by law for a common purpose, with its own distinct legal existence. Key features include being a voluntary association, ha

2 views • 12 slides

Understanding Foreign Capital and Its Implications on Development

Foreign capital plays a significant role in the development of a country through investments from foreign governments, institutions, and individuals. It encompasses various forms such as foreign aid, commercial borrowings, and investments that contribute to capital formation, technology utilization,

0 views • 19 slides

Understanding Foreign Capital and Its Impact on Development

Foreign capital encompasses investments from foreign governments, private individuals, and international organizations in a country, including aid, commercial borrowings, and foreign investments. It plays a crucial role in capital formation, technology utilization, and development across various sec

0 views • 19 slides

Understanding Syndicated Mortgage Investments: Key Information and Regulations

Syndicated Mortgage Investments (SMIs) involve multiple lenders participating in a mortgage, with distinctions between Qualified SMIs (QSMIs) and Non-Qualified SMIs (NQSMIs). The presentation covers the definition of SMIs, requirements for QSMIs, registration processes, compliance obligations, and c

0 views • 22 slides

The Five Stages of Investing Explained

In the journey of investing, there are five stages to progress through. The stages involve understanding the types of investments, assessing risk levels, setting up financial accounts, and gradually moving towards higher-risk investments. Starting with a put-and-take account for daily expenses, tran

0 views • 10 slides

Key Strategies for Startups Success: Insights from a Seasoned Company Secretary

Offering valuable insights, a seasoned Company Secretary and startup consultant, CS Rajiv Bajaj, discusses the main challenges faced by startups such as financial struggles, inability to attract investments, and planning issues. He emphasizes the role of Company Secretaries in providing affordable a

0 views • 66 slides

Choosing the Right Legal Entity for Company Formation in Egypt

Sadany & Khalifa Law Firm offers guidance on selecting the suitable legal structures for company formation in Egypt according to Egyptian law and investment regulations. Options include Joint Stock Company, Limited Liability Company, and One Person Company, each with specific requirements and benefi

2 views • 24 slides

Smarter Europe: Cohesion Policy for Innovation and Economic Transformation

The Cohesion Policy aims to create a smarter Europe by promoting innovative economic transformation through digitization, enhancing R&I capacities, and supporting the growth and competitiveness of SMEs. It focuses on developing skills, fostering interregional innovation investments, and enabling sma

0 views • 5 slides

The Case for Private Credit Investments in the Global Market

Private credit investments are gaining significance in the global market, offering innovative financing solutions outside traditional avenues like public markets. With a focus on innovation, independence, and integrity, private credit investments cater to diverse sectors such as real estate, natural

1 views • 9 slides

Overview of Company Law in Bon Secours Arts & Science College for Women

The content provides an introduction to company law, exploring the nature of a company, its formation, characteristics, kinds of companies, and stages of company formation. It discusses the legal definition of a company, its structure, and key aspects such as separate legal entity, liability, and pe

0 views • 20 slides

Loans and Investments by Companies -Understanding Compliance with Section 186

Section 186 of the Companies Act, 2013, outlines strict rules for company loans and investments. This section ensures companies adhere to legal limits, obtain necessary approvals, and maintain transparency in financial dealings. Understanding these c

0 views • 5 slides

Understanding Bonds and Stocks for Investments

Your company can raise funds for new investments by selling additional shares of stock or issuing bonds. Stocks represent ownership in a corporation, while bonds are long-term loans. Valuing bonds involves calculating present value based on coupon payments and face value. Examples with French and Ge

0 views • 30 slides

Understanding Internal Rate of Return (IRR) in Investments

Internal Rate of Return (IRR) is a method used to assess the profitability of potential investments by calculating the discount rate that makes the net present value of an investment zero. It considers the time value of money and helps in comparing projects based on their returns relative to costs.

0 views • 5 slides

Nuancing Narratives on Large-Scale Agriculture Investments' Labor Market Effects in Sub-Saharan Africa

Exploring the impacts of Large Scale Agriculture Investments (LAI) on job creation in Sub-Saharan Africa, focusing on labor market dynamics, supply and demand sides analysis, and case studies from Kenya, Mozambique, and Madagascar. The research delves into the quantity and quality of jobs created, i

0 views • 17 slides

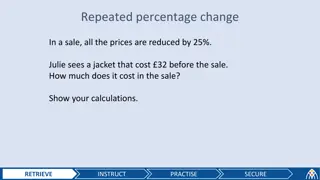

Understanding Repeated Percentage Changes in Sales and Investments

This content covers examples and calculations related to repeated percentage changes in sales and compound interest investments. It explains how prices are affected when all items are reduced by a certain percentage in sales, as well as scenarios involving compound interest investments over multiple

0 views • 17 slides

Understanding the Memorandum of Association (MOA) in Company Formation

The Memorandum of Association (MOA) is a crucial document that serves as the constitution of a company, determining its powers and limitations. It outlines essential clauses such as the registered office, objects, liability, capital, subscription, and the name clause. Compliance with the MOA is mand

0 views • 14 slides

Northamptonshire Pension Fund Investments Overview

The Northamptonshire Pension Fund Investments, managed by Richard Perry, follows regulations like the Local Government Pension Scheme Regulations. The fund structure includes investments in equities, bonds, diversified growth funds, private equity, and property. Investments are managed by profession

0 views • 10 slides

Understanding Company Relations and Contractual Capacity

In this detailed text, various aspects of a company's relations with outsiders and its capacity to enter into contracts are explored. The discussion includes the legal concept of a company as a separate legal entity, its ability to contract directly, the mind and will of the company, the role of dir

0 views • 29 slides

Understanding Alternative Investments and Equity Compensation

Explore the world of alternative investments including private equity, venture capital, and hedge funds with a focus on equity compensation. Learn about complex income calculations, vesting, timing, and tax considerations. Discover how these unconventional assets with high return potential differ fr

0 views • 61 slides

Understanding Investments of Dental Materials

Dental investments are ceramic materials used to create molds for casting metal alloys in dentistry. These investments must accurately reproduce wax patterns, have suitable setting times, withstand high temperatures, and exhibit controlled expansion. Components include refractory materials, binder m

0 views • 30 slides

Understanding Investments: Objectives, Decision Making, and Goals

Investments involve committing money for future benefits, balancing risk and return. The nature, scope, and objectives of investments guide decision-making processes, considering factors like time, risk, and diversification. Investment goals range from short-term to long-term priorities, aiming to i

0 views • 35 slides

Snapshot of Chinese Overseas Investments: Trends and Insights

China's non-financial overseas direct investment (ODI) reached $77.2 billion in 2012, showing impressive growth despite global financial crises. A significant portion was allocated to acquiring mineral resources for domestic economic expansion. The geographical distribution of investments by Chinese

0 views • 11 slides

Understanding FEMA Regulations for Foreign Investments

This presentation by CA Sunil Jain provides a comprehensive overview of the Foreign Exchange Management Act (FEMA) including topics such as overseas direct investments, immovable property transactions, commercial borrowings, and regulations governing investments in Joint Ventures/Wholly Owned Subsid

0 views • 73 slides

Overview of Company Conversion, Incorporation, and Certificate Issuance

The process of converting a company from public to private or vice versa, incorporating a new company, and obtaining a Certificate of Incorporation involves following specific procedures and fulfilling statutory requirements. From filing a petition to the central government for conversion to providi

0 views • 15 slides

Indian Private Equity Landscape 2016: Insights and Trends

The state of Indian private equity in 2016 reflected significant activity and growth across various industries. Key highlights include the dominance of PE/VC over IPOs, consistent PE investments over 2 years, industry-wise distribution of deals, investment stages, and top PE investments centered aro

0 views • 27 slides

Conflict in VGI Themes: Advancing VGI vs Future-Proofing Utility Investments

Conflicting themes within VGI Working Group include advancing VGI in California and future-proofing utility investments. The clash lies in risk-taking versus risk-minimizing approaches, highlighting the importance of value and connection to EV adoption. Recommendations focus on defining long-term ob

0 views • 7 slides

Navigating Governance Structures for Specific Investments

This study delves into the role of governance structures in incentivizing specific investments in interfirm relationships. It explores how contractual price terms affect suppliers' motivations to undertake investments, considering factors like haggling and risks of appropriation. The research highli

0 views • 14 slides

Empowering Individuals for Sustainable Prosperity: Saratoza Investments Overview

Saratoza Investments, led by CEO Sipho Spogter, focuses on enterprise development and investment through collaborations with Ceprotech. Sipho, an entrepreneur with diverse experience, aims to empower individuals in South Africa for lasting prosperity. The company's vision emphasizes quality, excelle

0 views • 12 slides

Optima Nutrition: Maximizing Efficiency of Nutrition Investments in Tajikistan

Preliminary analysis on the allocative efficiency of nutrition investments in Tajikistan reveals the potential impact of Optima Nutrition in optimizing resource allocation for various interventions. The tool aims to enhance the cost-effectiveness and effectiveness of public health investments in nut

0 views • 23 slides