The House System at Queen Mary's High School - Fostering Collaboration and Leadership Through Engaging Activities

The House system at Queen Mary's High School promotes collaboration, leadership, and community engagement through a variety of activities, competitions, and charitable initiatives. Named after influential female authors, the Houses instill values of sportsmanship, respect, and integrity. Students fr

6 views • 5 slides

Citizenship in the Community Merit Badge Requirements

Explore the Citizenship in the Community Merit Badge requirements focusing on understanding the rights, duties, and obligations of being a good citizen in your community. From discussing what citizenship means to volunteering at charitable organizations, this badge encourages active participation in

0 views • 45 slides

Explore the Generosity of "Your Rotary Foundation

Delve into the impactful initiatives and charitable work carried out by "Your Rotary Foundation." Learn about their mission, projects, and opportunities to contribute to positive change in communities worldwide.

0 views • 17 slides

Transforming Governance Programme by Cause4

Cause4 is a social business specializing in advice, fundraising, training, and programme development. Led by Michelle Wright, they offer expertise in governance and ACE's National Portfolio requirements. The Transforming Governance Programme, delivered in partnership with Arts Council England, focus

0 views • 41 slides

NOT-FOR- PROFIT MAKING CONCERN

Not-for-profit organizations, such as educational institutions, public hospitals, and charitable trusts, operate with the main objective of providing services rather than making profits. These organizations rely on various sources of funding like contributions, donations, and grants. Accounting for

4 views • 4 slides

Sponsorship Dossier for Club Rise Up: Embracing Kindness

Club Rise Up, a charitable organization focusing on community well-being and personal development, presents a sponsorship dossier to seek support for their Ramadan initiative. The dossier highlights the club's mission, the upcoming Ramadan project, reasons for sponsoring, and benefits for corporate

0 views • 15 slides

Strengthening Civil Society in Ukraine: Locally Led Response Initiatives

The civil society sector in Ukraine has seen a significant growth in charitable and public organizations, especially amidst the ongoing war crisis. Efforts are being made to prevent a humanitarian crisis and focus on early recovery and reconstruction. A triangular approach involving the Ukrainian Go

0 views • 10 slides

What are the lists of common problems with the truck tyres

CC Tyres Penrith is a long-standing independent tyre retailer, proudly serving Penrith and the broader western Sydney community for over six decades. Actively involved in supporting local sporting groups, community organizations, and charitable initiatives, CC Tyres has earned a reputation as the go

6 views • 10 slides

New Audit Report Requirements for Charitable Institutions

CBDT has issued a new audit report form, 10B and 10BB, for charitable institutions, demanding extensive requirements from the assesses. The notification applies from April 1, 2023, emphasizing the need for improved accounting practices. The applicability of Form 10B and 10BB differs based on the ins

3 views • 84 slides

Qurbani Donation 2024 How Your Contribution Can Make a Difference

Are you looking to make a meaningful impact this Qurbani season? As Qurbani 2024 approaches, many individuals and families are seeking opportunities to fulfill their religious obligations and help those in need. One powerful way to do this is through Qurbani donations to charitable organizations.

2 views • 3 slides

Thank you for your interest in the post of Director of Care at Rowans Hospice

Rowans Hospice is an independent hospice serving Portsmouth and South East Hampshire since 1994. They provide in-patient care, virtual ward services, care at home, living well services, and bereavement support. Their strategic priorities include expanding clinical services, collaborating with health

0 views • 10 slides

MOOSE LEGION UPDATES

Moose Legion provides insights into its 2023-2024 membership statistics, awards earned, charity contributions, and excellence recognition. Updates include active membership, retention rates, achieved goals, membership awards, charitable giving, and recognition levels for Moose Legions.

1 views • 13 slides

JM Sethia Merit Scholarship Scheme

JM Sethia Merit Scholarship Scheme\nThe JM Sethia Merit Scholarship Scheme, provided by the JM Sethia Charitable Trust (NGO), is an opportunity for students in Class 9 to 12, as well as those pursuing graduation, postgraduation, and professional courses. This scheme aims to assist deserving students

0 views • 5 slides

Evolution of Charitable Practices in Medieval England

In medieval England, the concept of charity evolved from a focus on spiritual salvation to encompass helping the destitute. Initially undertaken by religious institutions and guilds, relief efforts eventually involved the state through laws like the Statute of Laborers in response to societal change

0 views • 11 slides

Understanding the 40% Retention Rule for Charitable Organizations in Kentucky

The 40% Retention Rule in Kentucky mandates that a charitable organization must retain at least 40% of the adjusted gross receipts from charitable gaming for its charitable purposes. This rule ensures that funds generated from gaming activities are primarily used for the organization's intended char

0 views • 16 slides

Understanding Mental Illness among People on Probation

Explore the prevalence of mental illnesses among individuals on probation, the challenges in supervising them, various approaches to address mental health issues, policy implications, and key study findings. Acknowledgments to state and local probation agencies for their involvement and funding from

0 views • 35 slides

Understanding Criminal Law and Procedure: Greenvisor's Case

A case study involving embezzlement by Joe Greenvisor, the chief accountant of Nobreath Corporation, sheds light on criminal acts, duties, intent, and societal perspectives on crime. Despite Greenvisor's charitable intentions, his actions constituted a crime under the law. The elements of criminal a

0 views • 47 slides

Importance of Taking Care of Orphans in Islam

The lesson emphasizes learning and understanding the significance of caring for orphans in Islam as directed by the noble Hadith and teachings from the Quran. It explores the rewards promised by Allah for those who take care of orphans, the impact of kindness on society, and the importance of soften

0 views • 8 slides

Understanding Charitable Giving: Strategies and Tools

Explore different ways to give effectively, beyond cash donations. Learn about appreciated asset donations, donor-advised funds, and qualified charitable distributions to maximize your impact while optimizing tax benefits for charitable giving.

0 views • 23 slides

Understanding Charitable Initiatives: A Call to Action

Explore the concepts of charity and responsibility, delving into ways individuals can make a positive impact. The content prompts reflection on global issues, listening skills, and fostering philanthropy. Dive into starting your own charity, discussing successful models, unmet needs, and actionable

0 views • 9 slides

Understanding Taxation and Assessment of Charitable Trusts

Explore the complexities and nuances of taxation and assessment for charitable trusts and institutions. Learn about key issues such as tax rates, income computation, tax audits, capital gains, registration surrender, and more. Discover the basic rules to follow, including exemptions, income categori

0 views • 46 slides

Recent Amendments in Charitable Trusts: A Comprehensive Overview

Recent amendments to charitable trusts, as outlined by CA Sudhir Baheti, cover important aspects such as registration sections, creating new trusts, and changes in Section 10(23C) of the Income Tax Act, 1961. The amendments impact income exemptions for educational institutions, application procedure

0 views • 40 slides

Trust Income Computation and Application Guidelines

Learn about income computation of trusts using ITR-5 vs. ITR-7, types of institutions, components of income, application of income, and important guidelines including amendments by FA2022 for charitable and religious trusts.

0 views • 47 slides

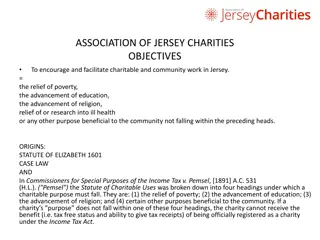

The Association of Jersey Charities: Objectives and Future Outlook

The Association of Jersey Charities aims at the relief of poverty, advancement of education and religion, and other beneficial community purposes. The Charities (Jersey) Law 2014 expanded the charitable purposes, including improving life conditions, promoting equality, and advancing environmental pr

0 views • 8 slides

Good Governance in Parochial Ministry: Church Representation Rules and Churchwardens Measure

Explore the key legislation and the roles of Parochial Church Councils (PCCs) in promoting charitable objectives and supporting the mission of the Church. Understand the significance of Church Representation Rules, including the Electoral Roll and the Annual Parochial Church Meeting, emphasizing acc

0 views • 14 slides

Understanding Charitable Giving Trends in the U.S.

Explore the trends and statistics of charitable giving in the U.S., covering topics such as individual giving, foundation contributions, bequest giving, corporate donations, and where the money flows. Delve into historical and current statistics to understand the factors influencing philanthropy in

1 views • 40 slides

JCFGM Executive Committee Meeting Summary and Reports April 25, 2022

The JCFGM Executive Committee meeting on April 25, 2022, covered various aspects including the mission statement, agenda items, funds and assets report, Life & Legacy Plus program details, Treasurer's report, and resolution related to Life & Legacy program participation. The meeting highlighted the

0 views • 11 slides

Public-Private Partnership in Water Conservation by Rhino Ark Charitable Trust

Established in 1989, Rhino Ark Charitable Trust focuses on sustainable solutions for mountain forest ecosystems and biodiversity conservation through public-private partnerships. With a key emphasis on water towers like Aberdare Range and Mt. Kenya, they aim to mitigate human-wildlife conflicts and

0 views • 11 slides

Understanding Ramadan: Importance, Practices, and Benefits

Ramadan is a sacred month observed by over 1 billion Muslims worldwide, involving fasting from dawn till sunset, charitable acts, and spiritual reflection. This period of devotion is a time for self-discipline, gratitude, and seeking closeness to God through fasting, prayer, and contemplation. The Q

1 views • 11 slides

Unveiling the Significance of Gifts in Wills and Pursuit of Immortality

Explore the profound impact of charitable gifts in wills on global legacies and the quest for eternal remembrance. Delve into the underlying motivations, the essence of legacy, and the critical need for greater awareness and action to encourage more people to leave charitable bequests in their wills

0 views • 24 slides

Overview of Association of Fundraising Professionals (AFP) and Charitable Act Impact

AFP comprises 27,000+ members across 180 chapters globally who raise over $115 billion annually for charitable causes. Members must adhere strictly to the AFP Code of Ethics, promoting honesty, integrity, and transparency in fundraising efforts. The Charitable Act (S.566/H.R.3435) aims to renew the

0 views • 5 slides

The Impact of Donor Advised Funds on American Philanthropy

The rise of Donor Advised Funds (DAFs) has reshaped charitable giving in America, with organizations like Fidelity Charitable dominating the landscape. DAFs play a significant role in charitable donations, accounting for over 10% of all giving. This growth has sparked discussions on the effectivenes

0 views • 57 slides

JCFGM Board of Trustees Meeting Summary - September 19, 2022

The JCFGM Board of Trustees Meeting on September 19, 2022, focused on promoting philanthropy and addressing charitable needs in the Jewish community and other charitable institutions. The agenda included reports from various committees, updates on funds and assets, a new Mitzvah Match Fund, contribu

0 views • 18 slides

Improving DNS Security with KINDNS Best Practices

Best practices for improving DNS resilience and security are crucial for protecting billions of Internet users. Initiatives like KINDNS aim to establish global norms to enhance DNS security by codifying these practices. The KINDNS group focuses on practices for authoritative and recursive nameserver

0 views • 17 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Woodland Rotary Endowment - A Pillar of Service in Community

The Woodland Rotary Endowment is a charitable organization closely affiliated with the Rotary Club of Woodland, operating as a pillar of service within the community. Governed by a board of directors, it offers scholarships and charitable contributions while upholding the values of the Rotary Club.

0 views • 12 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

JAGA Charitable Trust Inc. Financial Overview

JAGA Charitable Trust, Inc. has seen an increase in member contributions in 2023 YTD compared to 2022. The trust's income sources include community foundations, PGA Tour contributions, and various events. Investment strategy focuses on earning returns above 0.37% with low risk and liquidity. To incr

0 views • 5 slides

Requirements and Challenges for Charitable Incorporated Organisation (CIO) Status in the UK

UKNG has evolved from a travelling club to a professional organization focusing on promoting high standards in neurointerventional clinical practice. The challenges for this informal organization include defining professional roles, complying with sponsorship regulations, managing conflicts of inter

0 views • 15 slides

FPUA Charitable Contributions Overview

FPUA's Charitable Contributions Utility Advisory Committee focuses on supporting various organizations and initiatives that benefit the community. The process involves receiving sponsorship requests, evaluating impact potential, and providing financial support to organizations like Boys & Girls Club

0 views • 9 slides