The Case for Central Bank Digital Currency (CBDC) by G. Venkatesh

Central Bank Digital Currency (CBDC) offers numerous advantages such as scalability, safety, and potential for financial inclusion. India introduced its CBDC a year ago with goals of digitizing the economy and simplifying cross-border trade settlement. However, CBDC penetration is currently low, and

0 views • 22 slides

Update on Central Bank Digital Currency Research Worldwide

This update discusses the rise of Central Bank Digital Currencies (CBDCs) globally. It covers updates on CBDC research and pilots in various countries, the increasing number of central banks with CBDC projects, the varying attributes of retail CBDC projects, and the positive shift in speeches regard

0 views • 5 slides

Bank of India

Bank of India (BOI), established in 1906, is a vulnerable and important public sector bank in India that plays a vital role in the nation\u2019s economic growth. With a widespread network of branches and a global presence, BOI offers a diverse range of banking and financial services, embracing digit

3 views • 5 slides

State Bank of India

State Bank of India (SBI) is one of the largest and pioneer public sector banks in India. It was established in 1806 as the Bank of Calcutta, making it one of the oldest commercial banks in the Indian subcontinent. It later merged with the Bank of Bombay and the Bank of Madras in 1921 to form the Im

4 views • 5 slides

Bank of Maharashtra

Bank of Maharashtra(BOM), which was founded in 1935 and is based in Pune, India, operates as a well-known government-owned bank with branches throughout the country. The bank offers various banking services, including digital options for customer convenience. It actively dedicates itself to assistin

1 views • 5 slides

Canara Bank - Probationary Officer recruitment process

Canara Bank is one of the prominent public sector banks in India. Established in 1906. It has a significant presence in the Indian Banking and financial sector. Canara Bank provides a wide range of banking and financial services to its customers, including savings and current accounts, loans, credit

1 views • 5 slides

CBI- Central Bank of India apprentice recruitment process.

Central Bank of India (CBI) holds the distinction of being among the most established and sizable commercial banks in India. It was established in 1911. It has a significant presence in the Indian banking sector. \nTo Know more: \/\/obcrights.org\/blog\/jobs\/government-jobs\/central\/exams\/banking

9 views • 5 slides

Union Bank of India

Union Bank of India was established on November 11, 1919, as a limited company with its headquarters located in Mumbai. Union Bank of India stands as a prominent public sector bank, with 76.99 percent of its total share capital held by the Government of India.\nOrganisation of Union Bank of India\nU

1 views • 5 slides

Punjab and SInd Bank

]Punjab and Sind Bank was founded in 1908 and headquartered in New Delhi, is a government-owned bank primarily serving in northern India, especially Punjab. It offers a range of banking services, has a social focus, and actively participates in financial inclusion initiatives.\nOrganization of Punja

2 views • 5 slides

The Ultimate Guide to Currency Exchange in Everything You Need to Know

The Ultimate Guide to Currency Exchange: equips readers with the knowledge and tools needed to navigate the complex world of currency exchange confidently and effectively. To know more in details, visit our website today: \/\/unipayforex.com

2 views • 7 slides

Expert Strategies for Currency Exchange in 2024

In 2024, expert currency traders are employing advanced strategies like algorithmic trading, sentiment analysis, cross-currency arbitrage, carry trades, and macroeconomic forecasting. By leveraging technology and market insights, these strategies aim to capitalize on opportunities and mitigate risks

1 views • 7 slides

How to Resolve QuickBooks Bank Feed Issues_ A Comprehensive Guide

Resolve QuickBooks Bank Feed issues effortlessly with our expert guide. Learn step-by-step solutions to tackle common problems such as missing transactions, connection errors, and incorrect data imports. Whether you're using QuickBooks Desktop or Online, our comprehensive resource covers everything

2 views • 4 slides

Counterfeit Detection Techniques in Currency to Combat Financial Fraud

Currency counterfeiting poses a significant challenge to the financial systems of countries worldwide, impacting economic growth. This study explores various counterfeit detection techniques, emphasizing machine learning and image processing, to enhance accuracy rates in identifying counterfeit curr

0 views • 15 slides

Functions of the Reserve Bank of India

The Reserve Bank of India plays a crucial role in regulating the monetary system to achieve economic growth and stability. It performs traditional functions, including central banking functions like issuing currency, regulating credit, and acting as the banker's bank. The RBI's functions are categor

0 views • 11 slides

Currency Risk Management Strategies for Impact Investment Funds in Frontier Markets

Small Foundation (SF) commissioned ISF Advisors to analyze foreign currency risk management strategies for impact investment funds in African early-stage MSMEs. The report highlights the challenges faced and provides recommendations for effective currency risk management strategies to achieve commer

0 views • 14 slides

Understanding the Uniform Bank Performance Report (UBPR)

The Uniform Bank Performance Report (UBPR) is a crucial tool used by regulatory agencies, the public, and bank management to evaluate a bank's performance in areas such as capital, asset quality, earnings, liquidity, and market risk sensitivity. This report provides detailed data on a bank's financi

1 views • 24 slides

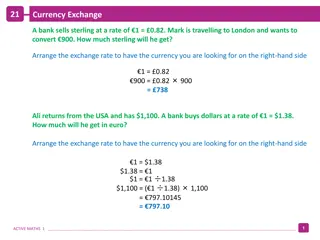

Currency Exchange Calculations and Comparison

Learn about currency exchange rates through various scenarios involving the conversion of different currencies like sterling, dollars, Australian dollars, Japanese yen, pounds, and euros. Explore how much currency you can get for a certain amount in each scenario and compare the values to determine

1 views • 4 slides

Understanding Foreign Exchange Rate Systems and Their Impact on Economies

Foreign exchange plays a crucial role in the global economy, representing all currencies other than a country's domestic currency. Different exchange rate systems like fixed, flexible, and managed floating rates have distinct features and implications for trade, capital flows, and macroeconomic stab

1 views • 49 slides

Banking Regulations in Bangladesh: A Comprehensive Overview

The Bangladesh Bank Order of 1972 established the central bank, Bangladesh Bank, which regulates banking activities under the Bank Companies Act of 1991. This legislation, along with the Financial Institutions Act of 1993, sets the framework for overseeing bank companies and non-banking financial in

2 views • 27 slides

Overview of Deendayal Antyodaya Yojana National Rural Livelihoods Mission

Deendayal Antyodaya Yojana is a national rural livelihoods mission under the Ministry of Rural Development, Government of India. It focuses on Self-Help Group (SHG) Bank Linkage and Interest Subvention to support rural development. The NRLM SHG Bank Linkage Portal facilitates the monitoring of SHG B

2 views • 39 slides

Presentation of South African Reserve Bank Amendment Bill to Joint Committee

The Economic Freedom Fighters (EFF) presented the South African Reserve Bank Amendment Bill to amend the current ownership structure allowing private individuals, including foreigners, to own shares in the South African Reserve Bank. The presentation emphasizes the need for legislative actions withi

0 views • 19 slides

Arithmetic Practice Questions and Currency Conversions

Practice questions involving currency conversions and arithmetic calculations are provided in the content. Various scenarios are presented, such as determining costs in different currencies, finding exchange rates, and comparing prices in different countries based on exchange rates. The questions re

1 views • 25 slides

Best Foreign Currency Exchange in Tanglin

If you\u2019re looking for a Foreign Currency Exchange in Tanglin, contact Classic Exchange. Their foreign currency exchange company provides reliable, efficient, and competitive foreign exchange services tailored to meet the diverse needs of travele

0 views • 6 slides

Experienced Bank Executives in Wisconsin

Mr. Spitz and Mr. Fink are experienced bank executives in Wisconsin with extensive backgrounds in the banking industry. Mr. Spitz, the Founder & CEO of Settlers Bank, has over 30 years of experience ranging from community banking to corporate commercial lending. He is actively involved in his commun

0 views • 7 slides

Exploring Digital Currency and Blockchain Technology

Delve into the world of digital currency and blockchain technology, from the inception of DigiCash to the concept of digital work measured through hashing. Discover the potential of all-digital currency and the importance of work verification in the blockchain ecosystem.

0 views • 43 slides

Benefits of Invoice Currency in International Trade: Analysis and Implications

Explore the benefits of using invoice currency in international trade, focusing on the implications for importers. The study presents a model of endogenous choice of import frequency and invoice currency, revealing how Home Currency Invoicing (HCI) can help mitigate exchange-rate risks and reduce im

0 views • 35 slides

Exploring Concepts in Commerce and Finance at Annamalai University

Join Annamalai University's Department of Commerce for a presentation on currency, including general vs. digital/crypto currency, virtual currency, demonetization, and remonetization. Delve into the impact of artificial intelligence in banks, and learn about essential financial networks like SWIFT,

0 views • 67 slides

Understanding Endogenous Optimum Currency Areas

Mundell's Optimum Currency Area Criteria and the concept of setting the endogeneity stage are discussed in relation to business cycles and trade integration. Approaches to empirically test business cycle synchronization and the theoretical ambiguity with empirical clarity are examined in the context

0 views • 35 slides

The Resurgence of the US Dollar in Cuba: Implications and Challenges

The return of the US dollar to Cuba after 15 years has significant implications on the economy and the Cuban Peso. This resurgence, exacerbated by the COVID-19 crisis, has highlighted the weaknesses of the Cuban monetary system and the challenges it faces in unifying its currency. The distrust in lo

0 views • 21 slides

Overview of Reserve Bank of India Functions and Responsibilities

The Reserve Bank of India serves as the central bank in India, responsible for functions such as issuing bank notes, acting as banker to the government, and serving as the banker's bank. It manages currency chests, handles government finances, and ensures the stability and soundness of the banking s

0 views • 15 slides

Insights into Long-Term Local Currency Hedging in Latin America

Explore the regional share of total TCX hedging, trends in LATAM local currency hedges over time, country-wise LATAM hedges, sector shares in LATAM production, and a case study on renewable energy in Costa Rica. Gain valuable information on managing currency risks and enhancing financial stability i

0 views • 8 slides

Understanding Currency Exchange Rates in Financial Institutions

Explore the concept of currency exchange rates with a practical example involving Euro to US dollar exchange rates at a bank. Learn how to calculate the amount received or paid in different currencies, understand the bank's profit margins, and grasp the rationale behind financial institutions having

0 views • 6 slides

Overview of Reserve Bank of India (RBI) Functions and Responsibilities

The Reserve Bank of India (RBI) plays a crucial role in the country's financial system as the central bank. Established in 1935, its key functions include monetary management, regulating the financial system, managing foreign exchange reserves, issuing currency, and promoting national objectives thr

0 views • 27 slides

State Bank of India - Annual Convention and Functions Overview

State Bank of India, the largest commercial bank in India, recently held its annual convention to review progress under the RTI Act. The bank, being a central figure in the country's financial sector, engages in various functions including central banking and general banking operations. With an exte

0 views • 14 slides

Understanding Currency Derivatives and Exchange Rate Movements

Explore the history and significance of currency derivatives in global and Indian markets. Learn about currency appreciation, depreciation, and the impact on foreign exchange rates. Discover how to interpret changes in currency values and their implications for trading. Gain insights into the functi

0 views • 85 slides

Introduction of Currency Board in Bulgaria: Historical Insights and Policy Implications

The introduction of the currency board in Bulgaria in the late 1990s marked a significant departure from past economic policies. The move aimed to restore economic stability by implementing measures to curb inflation, reduce debt burden, and enhance the attractiveness of the national currency. Despi

0 views • 27 slides

Understanding Stablecoins and Synthetic Assets

Stablecoins are cryptocurrencies designed to minimize price volatility by pegging their value to another stable asset like fiat currency. They provide stability and are used in various price stabilization mechanisms. Central Bank Digital Currencies (CBDCs), fiat-collateralized stablecoins, crypto-co

0 views • 19 slides

Understanding Currency Evolution: From Physical to Electronic

Explore the evolution of currency from physical to electronic forms, covering the history of currency, the role of trust, advantages and disadvantages of physical currency, and insights into electronic currency systems like credit cards and PayPal. Discover how centralized and decentralized systems

0 views • 50 slides

The Role of Export-Import Bank of India in Promoting International Trade

The Export-Import Bank of India, known as EXIM Bank, is a specialized financial institution wholly owned by the Government of India. It was established in 1981 to provide financial assistance to exporters and importers, promote international trade and investment, and offer various financing programs

0 views • 16 slides

Strategies for Resolving Non-Performing Loans in African Central Banks

Central Bank of Nigeria's Banking Supervision Department addresses the evolution, causes, and strategies for managing non-performing loans (NPLs) in the Nigerian banking sector to ensure financial stability. The Central Bank regularly monitors NPL ratios and implements reforms to prevent bank failur

0 views • 14 slides