Understanding SARS Tariff Determination Process

Explore SARS procedures for tariff determination and legislation provisions. Discover key discussions on customs, compliance, and international conventions.

1 views • 47 slides

Ambulatory EHR Market Worth $6.74 Billion by 2028

Ambulatory EHR Market by Delivery Mode (Cloud-based, On-premise), Type, Practice Size (Large, Small-to-medium, Solo), Application (Patient Portals, Practice Management, CDS, Computerized Physician Order Entry, PHM), and End User - Global Forecast to 2028\n

1 views • 4 slides

Ambulatory EHR Market Worth $6.74 Billion by 2028

Ambulatory EHR Market by Delivery Mode (Cloud-based, On-premise), Type, Practice Size (Large, Small-to-medium, Solo), Application (Patient Portals, Practice Management, CDS, Computerized Physician Order Entry, PHM), and End User - Global Forecast to 2028\n

0 views • 4 slides

Summary of Holistic Review of MPEC Tariff

Provide a summary of the holistic review conducted by SPP Staff on the MPEC Tariff, covering both non-substantive and substantive changes made for review and approval by MDWG. The review includes critical dates, tariff outline, updates from working groups/task forces, and a detailed table of content

0 views • 11 slides

Understanding Rules of Origin and Tariff-Free Trading with the EU

Rules of Origin (RoO) determine the economic nationality of a product, impacting tariffs and restrictions. To trade tariff-free with the EU, compliance with RoO is crucial. Specific rules dictate ingredient sourcing, with certification processes ensuring eligibility for tariff reductions. Certain pr

0 views • 19 slides

Special Education Law and Evaluation Process for CDS Eligibility

Understanding special education law and the evaluation process for Children with Disabilities (CDS) is crucial for determining eligibility, developing Individualized Education Programs (IEPs), and monitoring progress. Key steps include IDEA requirements, obtaining informed consent, conducting evalua

0 views • 28 slides

Understanding Trade Barriers and Tariff Classification

Explore the concept of trade barriers, including tariff and non-tariff barriers, their objectives, types, and classification. Learn about the benefits of tariff barriers, like discouraging imports and protecting home industries, and the classification of non-tariff barriers such as the quota system

3 views • 28 slides

Advisory Committee Meeting Summary for BSPTCL, BGCL & SLDC

The meeting discussed various topics including tariff petitions, business plans, network status, capacity additions, and cost optimizations for BSPTCL, BGCL, and SLDC in Bihar. Tariff projections, revenue requirements, transmission charges, and revenue surpluses were also analyzed and carried forwar

0 views • 23 slides

Understanding Error Codes in Customs CDS Tariff Training Module 11

This module focuses on interpreting error messages, identifying issues, and correcting errors in Customs CDS Tariff declarations. Learn about error code reference numbers, error descriptions, error locations, and how to fix common issues. Gain insights into cross-validation errors and protective mar

0 views • 13 slides

CDS Training Summary January 2021: Security Marking Presentation

In the CDS Training Summary for January 2021, the focus is on navigating the CDS Volume 3 Tariff, covering declaration categories, data elements, procedure codes, additional information codes, document codes, and more. The training provides a step-by-step guide on using the CDS Tariff, Volume 3, for

0 views • 69 slides

Understanding Tariff Reform Simulations Using UTAS

This presentation introduces tariff reform simulations using UTAS in the context of the car economy example. It covers how tariffs on imported goods impact production costs and effective protection of domestic industries. Key concepts such as output tariff, upstream tariff, and effective protection

0 views • 15 slides

Understanding Electricity Pricing and Tariff Structure in Pakistan

Electricity pricing involves costs of power plant operations and grid maintenance, impacted by factors like fuel cost, regulations, and consumer demand. Pakistan's tariff structure uses an incremental block tariff system to manage usage, with mechanisms set by regulators for fair pricing and afforda

0 views • 16 slides

Comprehensive Guide to the New Customs Declaration Service (CDS)

Navigating the CDS Tariff, UCC alignment, strategic facilitations for UK business, and essential information on the Customs Declaration Service. Learn about data elements, tariff publications, and key changes under CDS for a comprehensive understanding of the trade environment.

0 views • 27 slides

Technical Soundness of EU-SADC EPA Rules of Origin

The implementation and technical soundness of Rules of Origin under the EU-SADC EPA are crucial for the utilization of trade preferences. Compliance with rules of origin is essential for receiving tariff preferences, but drafting these rules accurately is challenging. Recommendations include specify

4 views • 12 slides

Understanding Tariff Systems in Mathematical Literacy - NQF Level 2

Exploring tariff systems in Mathematical Literacy at NQF Level 2, focusing on phone tariffs, calculations, and understanding bundled deals. Learn about different types of tariffs, their costs, and how to analyze and calculate monthly expenses for various phone plans.

0 views • 24 slides

Proposed Changes to Monthly Regional Network Load Calculation and Tariff Language

This proposal outlines changes to the Monthly Regional Network Load (RNL) calculation and tariff language for Avangrid, Eversource, National Grid, VELCO, and Versant. It emphasizes the usage of Monthly RNL in the Open Access Transmission Tariff (OATT) and its impact on Network Customers. The propose

0 views • 7 slides

FERC Order 844 Compliance: Uplift Cost Allocation and Transparency

FERC Order 844, issued in April 2018, mandates reporting on uplift payments and unit commitments, along with revising tariff language for compliance. ISO-NE is proposing new reports and tariff revisions to adhere to the Order, enhancing transparency in operational practices. The Order aims to improv

1 views • 30 slides

New UCAS Tariff for Higher Education Entry Overview

UCAS has introduced a new Tariff for higher education entry starting from September 2017. This toolkit is designed to assist teachers and advisers in understanding the changes, timeline, points system, university examples, myth debunking, and available resources. The aim is to prepare educators and

0 views • 32 slides

Changes Introduced by Customs Declaration Service (CDS)

The Customs Declaration Service (CDS) brings significant changes, shifting from EDIFACT to XML format, enhancing technical communication methods, transitioning to digital reporting, and updating tariff publication guidelines. It requires completion using data elements instead of box numbers, allowin

0 views • 32 slides

Understanding Diffraction and Determination of Track Spacing on CDs and DVDs

Explore the phenomena of diffraction and how it relates to the colorful patterns on CDs and DVDs. Learn about diffraction gratings, He-Ne lasers, and the technology behind Compact Discs. Discover how to determine track spacing using principles of diffraction.

0 views • 10 slides

Overview of LAO's Tariff Consultations for Family and Child Protection Modernization Program

LAO is seeking input on tariff reform as part of its modernization program to enhance Ontario's legal aid system. The focus is on immediate, cost-neutral updates and future potential increases. Feedback will help simplify billing rules, improve online services, and streamline access to information,

0 views • 15 slides

Understanding LJMU Penalty Tariff for Academic Misconduct

The LJMU Penalty Tariff, implemented from September 2011, ensures fair and consistent penalties for academic misconduct at LJMU. Points are allocated based on criteria, with penalties ranging from allowing new work submissions to expulsion. AMP outcomes are recorded using Service Indicators that rem

0 views • 17 slides

Understanding Special Education Law for Children with Disabilities (CDS)

Special Education Law for Children with Disabilities (CDS) emphasizes the FAPE standard, IDEA process, and FAPE requirements such as procedural aspects, substantive standards, and the provision of meaningful educational benefits. Court cases like Rowley (1982) and Endrew F. (2017) have shaped the im

0 views • 27 slides

HMRC Exports CHIEF/CDS Cut-Over Strategy

This document outlines the proposed IT cut-over strategy from customers' use of CHIEF to a dual running system of CDS and CHIEF Exports. The strategy includes migration milestones, phases, CSP involvement, traders' migration processes, declarations, consolidations, movements, and milestones. It deta

0 views • 5 slides

Preparing Energy Storage Systems for Public Safety Power Shutoff Events

Modernizing the NEM tariff to allow pre-PSPS charging involves utilities proposing modifications to allow energy storage systems to temporarily import energy from the grid upon advanced notification of a PSPS event. This process includes coordination with developers/aggregators and consultation with

0 views • 7 slides

Understanding Rules of Origin in EU-UK Trade

Rules of Origin (RoO) are essential in determining the economic nationality of products for tariff classification in EU-UK trade. Compliance with RoO is necessary for accessing preferential tariff rates under free trade agreements. This guidance outlines the principles, conditions, and requirements

0 views • 19 slides

Kentucky Public Service Commission Overview

Kentucky Public Service Commission (PSC) is responsible for regulating non-recurring charges, purchased water adjustments, and ensuring utilities adhere to tariff regulations. The PSC provides forms and guidelines for cost justifications and filings, along with information on utility regulations. Th

0 views • 40 slides

Stakeholders Presentation on 2022/23 Tariff Structure

Consultation with stakeholders on the proposed Water Resource Management Charges for the 2022/23 financial year by the Breede-Gouritz Catchment Management Agency. The presentation covers operational capacity, strategic priorities, tariff process, and budget planning processes aligned with National T

0 views • 15 slides

Use of Credit Default Swaps (CDS) by Investment Funds

Presentation at the ESMA workshop discussed the potential benefits and costs of using Credit Default Swaps (CDS) by investment funds. It highlighted the various uses of CDS, including risk management, alternative liquidity, and investment strategies. Evidence shows that a small percentage of UCITS f

0 views • 6 slides

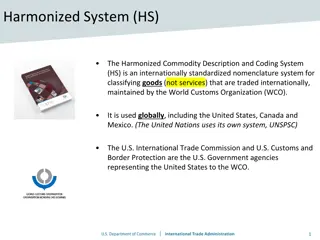

Understanding the Harmonized System (HS) for International Trade

The Harmonized System (HS) is an internationally standardized nomenclature system for classifying goods traded internationally, managed by the World Customs Organization (WCO). It organizes goods into categories down to the 6-digit level, providing a common set of descriptive categories for global t

0 views • 10 slides

Understanding Tariff Rate Quotas (TRQs) in International Trade

Tariff Rate Quotas (TRQs) are commonly used in global trade, particularly in agricultural imports. They involve lower tariff rates on imports up to a specified quantity per year, with higher rates applied to any excess imports. This system aims to regulate trade and protect domestic producers. TRQ l

0 views • 10 slides

Legal Aid Ontario's Tariff Consultations and Modernization Program

Legal Aid Ontario (LAO) is modernizing its legal aid system to better serve the community by seeking input on tariff reforms, improving access to information, and redesigning Legal Aid Online. Through cost-neutral updates, LAO aims to enhance efficiency and accountability while ensuring fair payment

0 views • 16 slides

Customs Brokers Licensing Training Program Module V: HS Classification Overview

Enhance your knowledge and skills in customs brokerage to pass the licensing uniform examination successfully. This module covers the evolution of customs nomenclature, reasons for tariff classification, HS structure, and more essential topics. Participants will learn to define technical terms, comp

0 views • 38 slides

Understanding Non-Tariff Barriers in International Trade

Explore the types of Non-Tariff Barriers (NTBs) and Non-Tariff Measures (NTMs) such as quotas, Tariff-Rate Quotas (TRQs), Voluntary Export Restraints (VERs), and more. Learn about Administered Protection, Safeguards tariffs, Anti-dumping duties, Countervailing duties, and their implications on trade

0 views • 57 slides

Electrical Engineering: Overvoltage Protection and Tariff Concepts

In the field of electrical engineering, it is crucial to understand overvoltage protection mechanisms to safeguard against electrical surges caused by internal and external factors like switching surges and lightning. Various protection methods such as ground wires, earthing screens, and lightning a

0 views • 12 slides

Understanding Tariff of Electricity and Principles of Calculation

Electrical energy production involves costs that are shared by consumers based on the amount and nature of electricity consumed. This includes fixed costs for setting up power plants and variable costs for generating electricity, which covers fuel expenses. The calculation of electricity costs is ba

0 views • 18 slides

Dafili Socio-Economic & Tariff Study Presentation Summary

Presentation delivered by Mike Wood at a CMP meeting in Dukem on June 19, 2013, focused on a socio-economic and tariff study for the Dafili community. The study aimed to gather demographic data, assess the community's ability and willingness to pay for water, recommend affordable tariffs, and evalua

0 views • 29 slides

Lubbock Retail Integration Task Force Updates and Resolutions

Lubbock Retail Integration Task Force (LRITF) discusses key implementation issues for LP&L entering competition, including Retail Access Tariff, CSA & Mass Transition Transaction Workflows, Customer Data, and Customer Choice Billing. Updates on resolving existing tariff restrictions and ERCOT functi

0 views • 10 slides

Pseudo-Tie Business Procedure Tariff Administration, August 2017

Pseudo-tie business procedure tariff administration from August 2017 outlines the purpose, implementation, and types of pseudo-ties in the energy industry. It covers dynamic transfers, pseudo-tie procedures, and various stakeholder involvements. The document details the process of implementing pseud

0 views • 11 slides

Analysis of Lesser Known Tariff Fuel Surcharges in Indian States by Prayas Energy Group

This report by Prayas Energy Group delves into the lesser-known tariff fuel surcharges levied in 15 Indian states, highlighting the processes, practices, and policy implications. Fuel surcharges are crucial for addressing power procurement cost deviations and play a significant role in DISCOM viabil

0 views • 26 slides