Harnessing Carbon Markets for Sustainable Development in Pakistan

Understanding the significance of carbon markets, this content delves into the interplay between economic growth and environmental sustainability, emphasizing the urgency to limit unsustainable practices. It explores mechanisms such as carbon pricing and cap-and-trade systems in the context of clima

0 views • 17 slides

Carbon Pricing Overview and EU Green Deal Agenda

The overview of carbon pricing inside the EU highlights key aspects such as the EU Green Deal, revision of the EU ETS, and the Carbon Border Adjustment Mechanism. The EU aims for carbon neutrality by 2050 with a 55% reduction target. The Fit for 55 initiative emphasizes relevance for the Energy Comm

4 views • 16 slides

2023 Tax Legislation Overview

The presentation by National Treasury and SARS outlines the 2023 tax bills and legislative process. It covers adjustments in values, updates on tax rates, implementation of carbon tax, incentive reviews, and more. The content details various tax bills, including the Rates Bill, Revenue Laws Amendmen

2 views • 80 slides

Understanding Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

Graduation Requirements and Credits Overview at Grafton High School

Grafton High School's Class of 2027 graduation requirements and credit details are outlined in this comprehensive guide. Adv. Studies and Standard Diplomas, subject credits, verified credits, and specialty programs like Honors are explained. Emphasis is placed on the need for verified credits alongs

2 views • 17 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Understanding the Carbon Cycle: Reservoirs, Dynamics, and Importance

Earth's carbon cycle plays a crucial role in sustaining life, with carbon moving through various reservoirs and processes. This cycle involves short-term terrestrial and marine cycles, as well as long-term cycles influenced by volcanic activity and rock weathering. Understanding carbon reservoir dyn

6 views • 45 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Understanding Carbon-Based Nanomaterials and Their Technical Applications

Carbon-based nanomaterials, including fullerenes and carbon nanotubes, have revolutionized various industries with their unique properties. These materials, classified based on their geometrical structure, have applications in fields such as electronics, gas storage, biotechnology, and more. Fullere

0 views • 12 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Understanding the Carbon Scenario Tool for Climate Change Management

The Carbon Scenario Tool (CST) is a valuable resource developed by the University of Edinburgh and the Scottish Funding Council to manage, report, and forecast carbon emissions for university estates and operations. It enables the calculation of the impact of carbon reduction projects and the develo

2 views • 18 slides

Understanding Carbon Movement in the Environment

Explore the intricate processes of carbon movement in the biosphere, atmosphere, oceans, and geosphere. Learn how plants absorb carbon dioxide, animals utilize carbon for tissue building, and the impacts of human activities like burning fossil fuels on carbon distribution. Discover the critical role

0 views • 6 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Understanding Organic Chemistry: Carbon Atoms and Molecular Diversity

In organic chemistry, carbon atoms can form diverse molecules by bonding to four other atoms, leading to molecular complexity and diversity. The versatile nature of carbon allows for the formation of various carbon skeletons, contributing to the vast array of organic compounds. Hydrocarbons, consist

0 views • 12 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

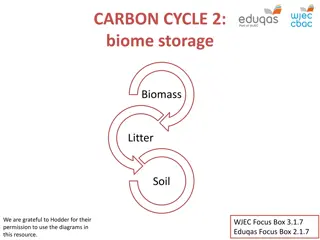

Understanding Carbon Storage in Biomes and Ecosystems

Explore the intricate carbon cycle within terrestrial ecosystems, focusing on carbon storage in biomass, litter, and soil. Delve into the differences in plant characteristics among various biomes and their impact on carbon sequestration. Gain insights into the distribution of tropical rainforests an

0 views • 13 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

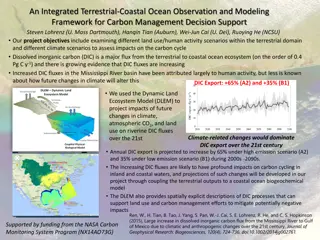

Integrated Terrestrial-Coastal Ocean Framework for Carbon Management

An advanced framework integrating terrestrial and coastal ocean observations and modeling is developed to support carbon management decisions. The study focuses on assessing the impacts of land use, human activities, and climate scenarios on the carbon cycle, particularly dissolved inorganic carbon

0 views • 5 slides

Overview of PATH Act of 2015: Depreciation and R&D Tax Credit

The PATH Act of 2015 focuses on depreciation and the R&D Tax Credit, extending approximately 50 taxpayer-favorable tax extenders. It includes enhancements such as 15-year improvement property rules, new bonus depreciation rules, and Section 179 expensing. The Act incorporates permanent provisions li

0 views • 23 slides

Achieving UK Net-Zero: Strategies for Carbon Capture and Low-Carbon Fuels

Explore the pathways to achieving UK net-zero carbon emissions through carbon capture, low-carbon alternative fuels like hydrogen and bioenergy, and sustainable bioenergy practices. Learn about the importance of zero-carbon hydrogen production and the challenges and benefits of utilizing bioenergy f

0 views • 12 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Overview of Oregon Affordable Housing Tax Credit Program

The Oregon Affordable Housing Tax Credit (OAHTC) Program was established in 1989 by the Oregon Legislature, enabling lending institutions to claim tax credits against Oregon taxes for affordable housing projects. Recent rule changes and proposed revisions, such as HB 2315, impact how tax credits are

0 views • 35 slides

Mapping Soil Organic Carbon Fractions in Australia: Stocks and Uncertainty

This study by Mercedes Román Dobarco et al. focuses on mapping soil organic carbon fractions across Australia, including mineral-associated organic carbon, particulate organic carbon, and pyrogenic organic carbon. The research involves prediction of soil organic carbon fractions using spectral libr

0 views • 17 slides

Carbon Forestry and Poverty Alleviation: The Case of REDD in Nigeria

Global carbon forestry programs like REDD aim to alleviate poverty but face challenges in empowering forest-dependent communities. The paper discusses the role of key actors in maintaining the status quo, presenting research findings from a REDD program in Nigeria. Carbon forestry involves market-ba

0 views • 15 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Insights from Orbiting Carbon Observatory-2 (OCO-2) on Global Carbon Cycle

Orbiting Carbon Observatory-2 (OCO-2) offers precise measurements to understand sources and sinks of CO2 in the atmosphere, providing valuable data on carbon uptake by plants and global carbon emissions. OCO-2's findings shed light on the impact of extreme climate events like droughts and fires on t

0 views • 8 slides

Understanding Input Tax Credit Provisions in Taxation

This content provides a comprehensive overview of Input Tax Credit (ITC) provisions in taxation, covering eligibility criteria, conditions for claiming ITC, issues related to excess or wrong tax charged by vendors, receipt of goods/services, blocked credits, apportioned credits, and more. It discuss

0 views • 16 slides

U.S. Bancorp Community Development Corporation Overview

U.S. Bancorp Community Development Corporation is dedicated to closing the gap between people and possibility through various programs like affordable housing, new markets tax credits, historic tax credits, and renewable energy tax credits. They offer key customer benefits such as industry expertise

0 views • 13 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

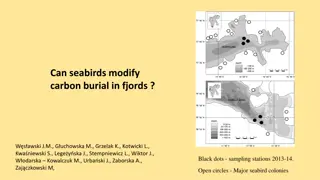

Carbon Modification by Seabirds in Fjords: Implications and Patterns

The study investigates the impact of seabirds on carbon burial in fjords, showcasing factors such as wind stress patterns, terrestrial vegetation biomass, and various carbon sources in the ecosystem. It delves into the distribution and fate of carbon in two fjords, Hornsund and Kongsfjorden, sheddin

0 views • 7 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Legislative and Form Updates for Taxpayers in Virginia

Reporting and paying consumer use tax, conformity to IRC, electronic income tax payments, historic rehabilitation tax credit limitations, land preservation tax credit, and neighborhood assistance tax credit changes are among the legislative and form highlights affecting taxpayers in Virginia. These

1 views • 7 slides

Graduation Requirements for Class of 2022 - Overview

Graduation requirements for the Class of 2022 include core subjects like English, Math, Social Studies, Science, and Other Requirements. Specific credit breakdowns are provided for each subject area, such as 4 credits for English with multiple pathways, 4 credits for Math covering various courses, 4

0 views • 11 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

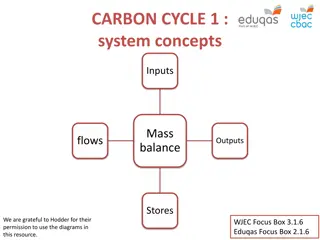

Understanding the Carbon Cycle: System Concepts and Pathways

The carbon cycle involves the movement of carbon between different stores in the global system, such as the atmosphere, oceans, and biosphere. Flows, inputs, and outputs play crucial roles in this cycle, with processes like photosynthesis and respiration impacting carbon levels. Explore how mass bal

0 views • 13 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)