Expenditure Transfers in Research

Understand the key concepts and procedures for managing cost transfers in research programs. Explore topics such as salary transfers, inter-program transfers, reimbursements, and toxic exposure fund requirements. Gain insights on executing financial tasks effectively and access resources for financi

2 views • 36 slides

CAPITAL STRUCTURE

Capital structure refers to the mix of a firm's capitalization, including debt, preference share capital, equity share capital, and retained earnings. Choosing the right components of capital is crucial based on the organization's function and risk level. Different patterns/forms of capital structur

1 views • 6 slides

Enhancing Cost Forecasting in Major Capital Projects: Key Findings and Recommendations

This study analyses cost forecasting in major capital projects, identifying causes of cost underestimation and proposing measures to improve accuracy. Key findings highlight optimism bias, strategic misrepresentation, and the importance of data quality for accurate forecasts. Recommendations include

0 views • 4 slides

Theories of Capital Structure and their Applications

The theories of capital structure explore the relationship between debt and equity in a firm's financing decisions. By optimizing the mix of debt and equity, a company can minimize its cost of capital and maximize its value. The Net Income Approach highlights the benefits of using debt to lower the

1 views • 7 slides

Dynamic Transfer Types and Reporting: Enhancing Financial Operations

Explore the various types of dynamic transfers such as ODP, Sweep, ZBA, and more, enabling seamless movement of funds across accounts. Learn about excess balance transfers, maintain minimum transfers, and the intricacies of dynamic transfer reporting. Discover key strategies for efficient financial

1 views • 12 slides

Factors Influencing Economic Growth: Human Capital and Capital Goods

Factors such as investment in human capital, capital goods, natural resources, and entrepreneurship play a crucial role in determining a country's economic growth. Human capital encompasses the skills and abilities of workers, while capital goods are the tools and equipment used to produce goods and

2 views • 28 slides

Understanding Energy Stores and Transfers

Explore the concept of energy stores and transfers through various types such as gravitational potential, chemical, kinetic, and more. Learn about different energy transfer processes and how energy can be stored in various forms. Engage in tasks to enhance understanding and self-assessment of differ

7 views • 12 slides

Understanding Cost Transfers in Research Operations Training

This training session covers various aspects of cost transfers in research operations, including different types, executing salary transfers, inter-program transfers, reimbursements, toxic exposure fund requirements, and financial updates for FY 23. Participants will gain insights into when and how

1 views • 36 slides

Guidelines for Student Transfers and IEPs in Oklahoma Schools

This document outlines procedures for student transfers in Oklahoma schools, specifically focusing on transfers for students with disabilities. It covers aspects such as transferring students with expired IEPs, revocation of disability recognition, and the process for move-in students within the sta

0 views • 7 slides

Mutual Capital Investment Fund: Addressing Capital Needs in the Insurance Community

Mutual Capital Investment Fund, LLC, aims to provide capital to mutual insurance companies facing capital needs without converting to stock form or selling minority interests. Led by Mutual Capital Group, the Fund seeks commitments up to $100 million and offers a unique investment opportunity for mu

0 views • 8 slides

Comprehensive Cost Management Training Objectives

This detailed training agenda outlines a comprehensive program focusing on cost management, including an overview of cost management importance, cost object definition, cost assignment, analysis, and reporting. It covers topics such as understanding cost models, cost allocations, various types of an

2 views • 41 slides

Exploring Energy Stores and Transfers in Science Lessons

Dive into the fascinating world of energy stores and transfers through engaging science lessons. Recall different energy stores, common energy transfers, and create flow diagrams to illustrate energy transfers in various scenarios. Explore gravitational, elastic, magnetic, electrostatic potential en

5 views • 9 slides

Understanding Cost Transfers in Sponsored Projects

Cost transfers, also known as expenditure transfers, are the process of moving expenses from one project to another. It is crucial to follow guidelines to ensure proper documentation and approval to avoid audit issues. Learn when cost transfers are acceptable or unacceptable, how to complete the nec

0 views • 6 slides

Understanding International Capital Structure and Cost of Capital

Explore the concept of international capital structure and its impact on the cost of capital, including discussions on cost of equity, investment decisions, market segmentation, and cross-border financing. Learn how firms can lower their cost of capital through internationalization strategies, such

0 views • 19 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

2 views • 5 slides

Understanding Capital Structure: Concepts, Planning, and Importance

Capital structure is crucial for maximizing shareholders' wealth through an optimal mix of equity and debt. Planning involves balancing risk, returns, and financial requirements, considering factors like return, cost, risk, control, flexibility, and capacity. The value of a firm is linked to earning

3 views • 20 slides

Understanding Risk, Cost of Capital, and Capital Budgeting in Corporate Finance

Explore the concepts of risk, cost of capital, and capital budgeting in corporate finance, including the Capital Asset Pricing Model (CAPM), cost of equity, beta estimation, and cost of capital. Learn how to reduce the cost of capital and understand the impact of reducing the Weighted Average Cost o

0 views • 20 slides

Understanding Multinational Capital Structural Decision

Multinational corporations rely on capital to fund their expansion and projects. Capital structure decisions impact the cost of capital, profitability, and overall value. MNCs face complexities in balancing debt and equity for financing operations, choosing markets and currencies, and internationali

1 views • 37 slides

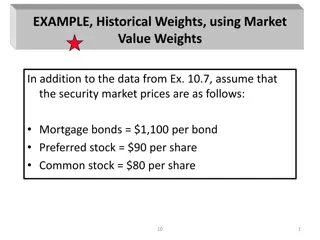

Historical Weights and Cost of Capital Analysis

The content discusses historical weights using market value weights for different securities like mortgage bonds, preferred stock, and common stock. It also delves into determining the overall cost of capital based on market value weights, including debt, preferred stock, common stock, and retained

0 views • 36 slides

Understanding the Classification and Importance of Capital in Business

Capital is crucial for businesses, whether for promotion, functioning, growth, or expansion. It can be classified as promotional, long-term, short-term, or development capital. Factors influencing capital requirements include business activity, size, product nature, technology, business cycle, and l

2 views • 13 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

Understanding Activity-Based Costing (ABC) in Cost Management

Activity-Based Costing (ABC) is a strategic costing method that allocates overhead costs to products based on activities. It offers benefits such as accurate cost allocation and identifying cost drivers but also has challenges due to increased complexity and customization. ABC differs from tradition

1 views • 15 slides

Managing Inter-Departmental Transfers in Financial Accounting

Inter-departmental transfers involve recording and charging costs from one department to another, with different pricing bases like cost-based and market-based transfers. Unrealized profits in transfers are adjusted using stock reserves. Entries are made at the selling price to include costs and pro

1 views • 7 slides

Modigliani and Miller Approach: Refinement of Net Operating Income Approach

The Modigliani and Miller approach refines the net operating income approach by assuming that the cost of debt is always less than the cost of equity. The overall cost of capital remains constant regardless of the debt-equity mix, as the market capitalizes the firm as a whole. This approach suggests

0 views • 5 slides

Understanding the Cost of Capital in Finance

The cost of capital is crucial for businesses to determine the average cost of their finance. The Weighted Average Cost of Capital (WACC) is used as a discount rate in financial calculations. It involves estimating the cost of each source of finance and calculating a weighted average. Additionally,

0 views • 14 slides

Understanding Multinational Cost of Capital

Multinational corporations determine their cost of capital based on the cost of debt and equity. The cost of debt includes the interest rate and credit risk premium, while the cost of equity reflects the risk premium investors demand. Estimating an MNC's cost of capital involves assessing these comp

0 views • 24 slides

Fiscal Year 2022 Capital Budget Presentation Overview

In the presentation to the Board of Finance, the Capital Committee outlines the Fiscal Year 2022 draft capital budget, emphasizing the importance of the Capital Improvement Program and the history of the capital program investments. The proposed budget addresses the critical need for reinvestment in

0 views • 11 slides

RHD Cost Sharing Review Update 2010: Capital Planning Horizons and Funding Strategies

The RHD Cost Sharing Review Update in 2010 focuses on the status of implementing recommendations from previous reviews regarding capital planning and funding cycles for health authorities and Regional Hospital Districts. It discusses the impact of economic conditions on capital funding, availability

0 views • 11 slides

Introduction to Industrial Costing: Understanding Cost Types and Accounting Systems

Explore the fundamentals of industrial costing, including different cost types and accounting systems such as actual cost accounting, normal cost accounting, and standard cost accounting. Learn about cost data control, tasks of cost accounting, and the integration of cost type accounting in cost and

1 views • 24 slides

Development of Methodologically Robust Agricultural Capital Stock Statistics by FAO

In November 2015, the Food and Agriculture Organization of the United Nations (FAO) initiated a project to enhance Agricultural Capital Stock statistics, focusing on inclusive and efficient agricultural and food systems. The project involves developing methodologies for measuring capital stock and m

0 views • 38 slides

Estimating the Cost of Capital in Corporate Finance

Explore the process of estimating the cost of capital essential for discounted cash flows models in corporate finance. Learn how to determine the cost of debt, equity capital, and the Weighted Average Cost of Capital (WACC) by combining different sources of financing. Gain insights into capital stru

0 views • 59 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Overview of Cost Transfers in Sponsored Research Accounting

Cost transfers involve the reassignment of expenses from one account to another in sponsored research accounting. Timely, supported, and properly documented transfers are essential to ensure compliance with federal requirements and internal controls. This overview highlights the definition, purpose,

0 views • 14 slides

Approval Process for Capital Cost Transfers provided by the Property Management Office

Explore the step-by-step process for approving Capital Cost Transfers (CCT) via the Property Management Office's online portal. Learn how to access the CCT application through SPARC, manage transactions on your personal dashboard, approve pending requests, and ensure successful processing through th

0 views • 6 slides

Understanding Partial Land Transfers in Alberta

The module explains the process of submitting a Partial Land Transfer through the ETS system in Alberta. It covers initiating and submitting transfers, concurring to transfers, and retrieving final documents. It also includes steps for logging in to ETS, searching agreements, and more. Prior knowled

0 views • 26 slides

Understanding Venture Capital: Key Concepts and Regulations

Venture capital is a form of financing provided to startup companies with high growth potential. It involves high risk and requires a long-term horizon, often coming in various forms like equity, conditional loans, and participation in management. The process includes stages such as seed capital, ex

0 views • 10 slides

Understanding Capital Adequacy Ratio (CAR) in Banking

Capital Adequacy Ratio (CAR) is a crucial metric in banking that measures a bank's capital against its risk. Also known as CRAR, it enhances depositor protection and financial system stability worldwide. The CAR formula involves dividing a bank's capital by its risk-weighted assets, comprising tier

0 views • 7 slides

Asymmetric Socialization and Resource Transfers in Welfare States

Exploring intergenerational resource transfers in the context of welfare states, this study examines three main channels: families, the government, and markets. It delves into different institutional arrangements governing asset-based reallocations, public transfers, and familial transfers. The leve

0 views • 12 slides

Financing Decision and Cost of Capital in Business

Explore the interdependence and inter-relationship between investment and financing decisions, including managing the debt-equity mix for optimal capital structure. Learn about the concepts and measurement of cost of capital, operating and financial leverage, and planning capital structure. Delve in

0 views • 51 slides

Understanding Wealth Accounts: Challenges and Models in NTA

Wealth accounts in National Transfer Accounts (NTA) are vital for classifying wealth by sector and age group. Challenges in constructing wealth accounts include data availability and modeling transfers. Public and private asset transfers, revaluations, and capital transfers are crucial components to

0 views • 14 slides