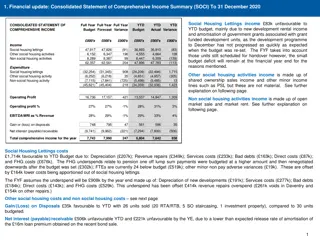

Modigliani and Miller Approach: Refinement of Net Operating Income Approach

The Modigliani and Miller approach refines the net operating income approach by assuming that the cost of debt is always less than the cost of equity. The overall cost of capital remains constant regardless of the debt-equity mix, as the market capitalizes the firm as a whole. This approach suggests that there is no optimal capital structure, and the market values the firm based on its net operating income at a constant overall cost of capital.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Modigliani and Miller Approach Modigliani and Miller Approach This approach is a refinement of the net operating income approach. Assumptions Assumptions The Cost of Debt (Kd) is always less than Cost of Equity (Ke). The debt capitalization rate remains constant at various level of debt equity mix. Keincreases as debt content increases due to higher financial risk and higher expectation of equity investors.

The market capitalizes the value of the firm as a whole without giving importance to the debt equity mix. Hence, overall cost of capital is constant. The capital markets are perfect. Investors are free to buy and sell securities. They are well informed about the risk and return on all type of securities. There are transaction cost. Firms can be classified into homogenous risk class . They belong to this class, if their expected earnings have identical risk characteristics.

Theory Theory Debt may be cheaper than equity. Increases in financial risk causes the equity capitalization rate to increase. Thus, the advantage of using low-cost debt is set off exactly by the increase in equity capitalization rate. Therefore, the overall cost of capital remains constant for all degree of debt equity mix.

The market capitalizes the value of firm as a whole. The market value of the firm is ascertained by capitalizing the net operating income at the overall cost of capital, which is constant. The market value is not affected by changes in debt-equity mix. Since, WACC is constant at all levels, every debt-equity mix is as good as any other mix. There is no optimum capital structure. Since, WACC is constant, WACC at 0% debt should be same as WACC at any other percentage of debt. Hence, WACC=Kewhen the firm is financed purely by equity.