Understanding Risk Factors in Building Asset Valuation and Damage Assessment

Explore various aspects of risk assessment in building asset valuation and damage prediction, covering topics such as stage-damage relationships, risk equations, sources of uncertainty, and first floor elevation considerations. Gain insights into the complexities of assessing and mitigating risks in

1 views • 24 slides

Strategic Infrastructure Asset Management Plan (SIAMP) Overview

Strategic Infrastructure Asset Management Plan (SIAMP) Module 6 focuses on portfolio management principles for effective infrastructure asset management. Portfolio managers are guided on planning, managing work portfolios, and collaborating with other delivery management modules. The SIAMP outlines

6 views • 32 slides

Expert Report on Valuation of Land for Logipol SA

Paul Sanderson, an experienced valuation expert, has been asked to prepare an expert report for Logipol SA regarding the valuation of land to be acquired for an extension of Metropolis Airport. His extensive experience includes advising on land acquisitions, negotiating compensation for rail systems

4 views • 20 slides

Challenges in Asset Valuation Using CAPM

Analysis of the Capital Asset Pricing Model (CAPM) for listed companies demonstrates significant discrepancies between the model's results and actual returns. Various factors contributing to this deviation are discussed, including the limitations of the model and potential modifications to enhance i

0 views • 21 slides

Distribution of Income and Expense Document Overview

This document provides detailed information on the Distribution of Income and Expense (DI) process within Kuali Capital Asset Management (CAM). It explains the purpose of DI documents, their use in capitalizing Work-In-Progress (WIP) assets, and the various scenarios in which DI documents are utiliz

3 views • 29 slides

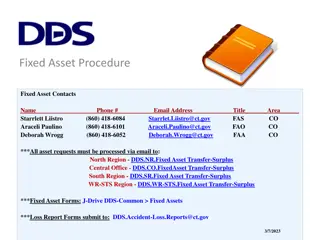

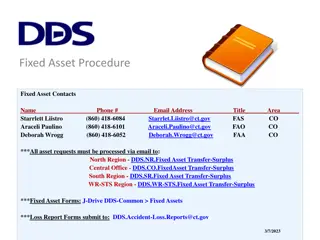

Fixed Asset Management Procedures and Contacts Overview

Comprehensive overview of fixed asset management procedures, contact information, asset categories, receiving new assets guidelines, inventory audits, responsibilities, and related forms. Includes details on controllable and capital equipment, asset definitions, categories, and the roles involved in

1 views • 15 slides

Understanding the Valuation of Goodwill in Business

Goodwill in business refers to the intangible value derived from the reputation, customer connections, and other advantages of a company that contribute to higher profits. Valuation of goodwill is crucial when selling a business, admitting new partners, amalgamating firms, or determining share value

2 views • 32 slides

Understanding Asset Recovery: Importance, Processes, Tools, and Global Impact

Asset recovery involves the retrieval of assets wrongfully taken through theft, fraud, or criminal acts. This process is crucial in combating financial crimes, such as money laundering and corruption. The content discusses the significance of asset recovery, various processes involved, tools used, a

0 views • 34 slides

Fixed Asset Management Procedures and Contacts Overview

This document provides an overview of fixed asset management procedures, contacts, categories, and responsibilities within the State of Connecticut. It covers the definition of fixed assets, capital vs. controllable equipment, receiving new assets, inventory audits, asset management responsibilities

0 views • 15 slides

Understanding Suits Valuation Act 1887 and Its Purpose

The Suits Valuation Act 1887 serves to determine the jurisdiction of courts by valuing specific suits. Its purpose includes ensuring the proper forum, expediting justice, protecting rights, rectifying jurisdictional issues, and assigning relevant courts to each case. The act distinguishes between va

0 views • 24 slides

Understanding Asset Shares and Estate Management in Insurance: Insights from the 35th India Fellowship Webinar

Delve into the complexities of asset shares and estate management in the insurance industry through the lens of the insightful 35th India Fellowship Webinar. Learn about historical paradigms, regulatory shifts, and available alternatives for insurers in managing asset shares and estate growth. Explo

3 views • 30 slides

Legal Infrastructure for Asset Finance in Civil Law Jurisdictions

The Civil Code outlines obligations and guarantees in asset finance, with specific qualifications like lawful causes of preference and security trusts. Privileges and hypotecas play key roles in the legal system. Title transfer by way of security fosters integrated asset finance systems. The aviatio

0 views • 106 slides

Understanding the Wide Scope of Valuation in Business

Valuation is a complex process that involves various aspects such as economics, laws, human dimensions, and more. It goes beyond just numbers, incorporating knowledge from different disciplines to provide a comprehensive evaluation. This article delves into the key terms, domains, and importance of

1 views • 50 slides

Understanding Goodwill Valuation in Business

Goodwill in business represents the intangible value of a company beyond its tangible assets. This article covers the meaning of goodwill, factors affecting its valuation, methods of valuation such as simple average profit method, and considerations before calculating average profits. An illustrativ

0 views • 13 slides

Global Framework for Efficient Asset Recovery Guidelines

The Global Framework for Asset Recovery, guided by the UNCAC, emphasizes returning stolen assets to combat corruption effectively. The UNCAC obligates signatory countries to return funds under specific conditions, promoting transparency and accountability in the asset return process. Stakeholders ad

5 views • 9 slides

Factors Affecting the Amount of Depreciation in Asset Valuation

Depreciation in asset valuation depends on the cost, estimated useful life, and probable salvage value. The cost of an asset includes various expenses incurred to put it in working condition. Estimated net residual value is the expected sale value of the asset at the end of its useful life after ded

2 views • 5 slides

University Asset Management Procedures and Responsibilities

This presentation outlines the processes and responsibilities related to maintaining and controlling the university's capital assets. It covers tasks such as updating asset records, conducting audits, and serving as a liaison between units and the Fixed Assets Accountant. The slides detail the Fixed

2 views • 67 slides

Understanding Ecosystem Valuation and Non-Market Techniques

Ecosystem valuation aims to assess user preferences for ecosystem goods and services, determining the economic value attached to nature's benefits. Ecosystems offer provisioning, regulating, cultural, and supporting services crucial for human well-being. Various non-market valuation techniques like

0 views • 5 slides

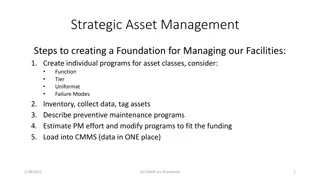

Strategic Asset Management for Facilities Optimization

Establish a solid foundation for managing facilities by creating individual asset programs, conducting inventory and data collection, implementing preventive maintenance strategies, estimating effort, and loading data into a centralized CMMS. Asset management is crucial for project managers as it im

1 views • 7 slides

The Importance of Asset Stock Accumulation for Sustainable Competitive Advantage

Strategy literature often overlooks the crucial role of building and accumulating non-tradeable asset stocks for achieving and safeguarding competitive advantage. The concept of asset stock accumulation provides a complementary framework to evaluate the sustainability of a firm's competitive edge, e

1 views • 7 slides

PAMAV Report 2022: Advancing Mineral Asset Valuation in Europe

Polish Association of Mineral Asset Valuators (PAMAV) has been actively involved in the harmonization of Polish and international mineral resource reporting and valuation systems. The association's main activities in 2021/2022 include updating the POLVAL Mineral Resources Valuation Code, expanding t

0 views • 5 slides

Understanding Digital Asset Management (DAM) on AEM Platform

Digital Asset Management (DAM) is an essential application on the AEM Platform that enables users to effectively organize and manage various digital assets like images, videos, documents, and audio files. It offers features such as metadata support, renditions, asset finder, and administration UI. L

0 views • 20 slides

Asset Recovery Practices in England and Wales: Criminal vs. Civil Proceedings

Asset recovery in England and Wales involves a combination of criminal and civil proceedings to secure justice and return funds to victims of crime. The CPS's Proceeds of Crime Division plays a crucial role in obtaining Restraint Orders and Confiscation Orders. Civil recovery, focusing on illicit fi

0 views • 11 slides

Introduction to Valuation with Chris Young, Ph.D.

Join Chris Young, Ph.D., a leading expert in valuation, for an insightful session on the fundamentals of valuation, major components, and practical exercises. Explore topics ranging from economic consulting to recent industry activity and learn from Chris Young's extensive experience as a partner at

0 views • 52 slides

Northamptonshire Pension Fund 2013 Valuation Overview

The Northamptonshire Pension Fund 2013 Valuation Report discusses the implications for Academy employers, focusing on aspects like the triennial valuation, covenant, risks, DCLG/DfE guidance, and annual accounts. The report provides insights into the pensions landscape, fund details, and the valuati

0 views • 67 slides

Valuation Practices in Bangladesh: Insights and Guidelines

Exploring the valuation practices in Bangladesh, this article covers the use of valuations by banks, insurance companies, government entities, and more. It highlights the guidelines set by the Bangladesh Securities and Exchange Commission and the role of International Valuation Standards in asset va

0 views • 28 slides

Understanding PeopleSoft Asset Management at Georgia University System Summit

Explore key questions surrounding PeopleSoft Asset Management at Georgia University System Summit, including processes for adding and capitalizing assets, handling open transactions, and differentiating between open and pending transactions. Gain insights into updating tables, managing asset details

0 views • 33 slides

Understanding Asset Allocation and Portfolio Management

Explore the process of asset allocation, which involves distributing wealth among different countries and asset classes for investment purposes. Learn about asset classes, the components of structured portfolio management processes, and the individual investor life cycle stages. Dive into strategies

0 views • 46 slides

Understanding Environmental Asset Accounting and Valuation

Delve into the intricacies of environmental asset accounting and valuation, exploring the definition and scope of environmental assets, the connection between environmental and economic assets, asset account structures, resource depletion definitions, varied valuation approaches, and practical appli

1 views • 62 slides

Financial Management: Valuation of Long-Term Securities and Stock

This content covers various aspects of financial management, including bond valuation, preferred stock valuation, common stock valuation, dividend valuation models, and dividend growth patterns. It discusses topics such as face value, coupon rates, types of bonds, semiannual compounding, and factors

0 views • 21 slides

Understanding Market Analysis and Valuation in Real Estate

Explore essential concepts in real estate market analysis and valuation, including the unitary valuation principle, net lease drugstore market trends, the importance of location, fee simple ownership, and leased fee valuations. Gain insights into the economic principles governing highest and best us

0 views • 65 slides

Understanding Valuation Principles for Natural Resource Assets

Valuation of natural resource assets involves linking physical and monetary accounts, considering factors like economic value, extraction costs, market prices, and alternative valuation approaches. Economic theory emphasizes market prices as a means of measurement, but natural resources often requir

0 views • 25 slides

Transformation of Valuation Services Office at DOI

In the process of appraisal, consolidation, and implementation overview at the Valuation Services Office within the Department of Interior (DOI), significant changes have been made to enhance efficiency and effectiveness. This includes the consolidation of appraisal services under a single entity, r

0 views • 15 slides

International Merchandise Trade Statistics (IMTS) Valuation Recommendations

IMTS provides key recommendations for valuing goods in international trade, emphasizing the adoption of the WTO Agreement on Customs Valuation. The use of FOB and CIF valuation methods, along with specific guidelines for special categories of goods, ensures a standardized basis for valuation that is

0 views • 8 slides

Facility Asset Management and Building Life Cycle: A Comprehensive Guide

Explore the framework of Facility Asset Management and Building Life Cycle, focusing on proactive asset management strategies, total cost of ownership, asset lifecycle management, and asset management system components. Understand the importance of defining assets, setting objectives, creating plans

0 views • 23 slides

Update and Review of FY23 Physical Inventory Process

This production by Stan Alderson provides essential information on updating the physical inventory process for capital assets. It includes details on new or updated forms, such as the Capital Asset Manual Addition Request and Capital Asset Reinstatement Request. The importance of conducting a physic

0 views • 14 slides

Transportation Asset Management Strategic Action Plan

Transportation Asset Management (TAM) is crucial for state transportation departments to operate, maintain, and improve physical assets efficiently. The TAM Strategic Action Plan aims to enhance TAM practices by emphasizing sustained asset condition, accountability, efficiency, and effectiveness. Th

0 views • 4 slides

Understanding Asset Management and its Importance in Community Development

Asset management is crucial for organizations to track what they own, determine their value, monitor their condition, and plan for their maintenance or replacement. This process allows for informed decision-making, ultimately aiming for sustainable service delivery. Practicing asset management invol

0 views • 15 slides

Effective Asset Allocation Strategies for Investment Success

Investment professionals emphasize the critical importance of the asset allocation decision in shaping investor outcomes. Strategic Asset Allocation (SAA) focuses on long-term goals, while Tactical Asset Allocation (TAA) addresses short-term objectives. Proper navigation through economic cycles invo

0 views • 18 slides

Valuation of Companies in Distress: Insights on IBC & Fair Valuation

This document delves into the intricacies of valuing distressed companies, focusing on the challenges, reasons for distress, impacts, and the valuation process under the IBC framework. It emphasizes the importance of specialized knowledge and adjustments required in valuations of distressed firms, h

0 views • 37 slides