Armenia Nation of Innovation

Armenia is a nation of innovation, offering new perspectives in the global value chain. With successful investments and acquisitions, it caters to R&D needs with its creative workforce. It has strong infrastructural and educational models, including the Armenian National Supercomputing Center and En

0 views • 17 slides

A Comprehensive Approach to Assessing Organizational Worth

Business valuation entails determining the financial value of an organization through assessing various factors to estimate its worth in the marketplace. Understanding a business's value is crucial for purposes such as mergers and acquisitions, capital raising, taxation, financial reporting, and est

0 views • 2 slides

A Comprehensive Approach to Assessing Organizational Worth

Business valuation entails determining the financial value of an organization through assessing various factors to estimate its worth in the marketplace. Understanding a business\u2019s value is crucial for purposes such as mergers and acquisitions, capital raising, taxation, financial reporting, an

0 views • 2 slides

CORPORATE PRESENTATION

Austrian-based Austriacard Group, a leading provider of secure payment solutions with a track record spanning 125 years, showcases robust financial performance and strong market presence. The company excels in offering innovative payment products and secure data management services, positioning itse

1 views • 27 slides

Overview of U.S. General Services Administration's Office of Small and Disadvantaged Business Utilization (OSDBU)

This overview discusses the role of the Office of Small and Disadvantaged Business Utilization (OSDBU) within the U.S. General Services Administration (GSA). It highlights the advocacy for small businesses in federal acquisitions, inclusion of small businesses as contractors, and management of small

3 views • 51 slides

Dell Financial Services

Dell Financial Services offers flexible consumption payment solutions that enable customers to align technology expenses with actual usage. The portfolio includes growth solutions, variable usage options, software financing, and transformational license agreements. Customers can adopt better solutio

3 views • 30 slides

SEWP Program at a Glance

The Solutions for Enterprise-Wide Procurement (SEWP) program is a multi-award suite of Government-Wide Acquisition Contracts utilized by every government agency for IT and AV solutions. With over 140 contract holders, 100 small businesses, and an annual obligated value exceeding $12.2 billion, SEWP

1 views • 30 slides

Understanding Manufacturing Readiness Levels (MRLs) in Defense Technology

Manufacturing Readiness Levels (MRLs) are a vital tool in assessing the manufacturing maturity and associated risks of technology and products in defense acquisitions. They provide decision-makers with a common understanding of the maturity levels to support informed decisions throughout the acquisi

1 views • 12 slides

Understanding Strategic Alliances vs. Mergers & Acquisitions in Corporate Dynamics

Exploring the concepts of strategic alliances and M&As in the corporate world. Strategic alliances involve formal relationships between companies with shared goals, while M&As combine companies to varying degrees. Motivations for entering alliances include technology development, market access, and

0 views • 24 slides

NASA Industry Forum on Organizational Conflicts of Interest

Join the JSC Industry Forum for an informational session on Organizational Conflicts of Interest (OCI) at the JSC Gilruth Conference Center on August 30, 2023. The session will cover NASA's OCI policy framework, interactive innovation sessions, and industry input on OCI recommendations to assist wit

1 views • 22 slides

Comparison of Business Entities and Collaboration Forms

Various forms of business entities such as sole proprietorship, partnership, limited liability company, state-owned enterprises, cooperatives, etc., each come with their own advantages and disadvantages. Additionally, collaboration forms like joint ventures, mergers, acquisitions, etc., allow busine

0 views • 8 slides

Importance of Financial Reporting as a Catalyst for Growth

Financial reporting frameworks such as International Financial Reporting Standards (IFRS), Generally Accepted Accounting Principles (GAAP), and the role of financial statements play a crucial role in enhancing trust in financial information, reducing information asymmetry, promoting investment, faci

1 views • 90 slides

Expert Report on Valuation of Land for Logipol SA

Paul Sanderson, an experienced valuation expert, has been asked to prepare an expert report for Logipol SA regarding the valuation of land to be acquired for an extension of Metropolis Airport. His extensive experience includes advising on land acquisitions, negotiating compensation for rail systems

4 views • 20 slides

Innovative Technologies Drive Expansion in Steel Rebar Industry

The Steel Rebar Market comprises major players such as Nippon Steel Corporation (Japan), ArcelorMittal (Luxembourg), Tata Steel Limited (India), Nucor Corporation (US), NLMK Group (Russia), Gerdau SA (Brazil), Commercial Metals Company (US), Steel Authority of India Limited (India), Mechel PAO (Russ

0 views • 5 slides

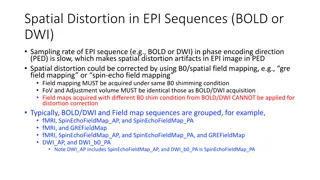

Spatial Distortion Correction in EPI Sequences: Field Mapping Examples

Spatial distortion artifacts in EPI sequences (BOLD or DWI) due to slow sampling rates in the phase encoding direction can be corrected using B0/spatial field mapping techniques. This correction requires obtaining field maps under the same B0 shimming conditions and with identical FoV and adjustment

0 views • 4 slides

Pharma Giants on the Move Top 5 M&A Deals of 2024

Discover the transformative deals reshaping the landscape in 2024. From innovative treatments to market expansions, these acquisitions are making waves.

3 views • 9 slides

Acquisition Strategy Under Financial Constraints: Shelving or Developing Potential Competitors?

Analysis of the acquisition of potential competitors under financial restraints, emphasizing the prevention of anti-competitive deals through a proposed merger policy. The discussion includes evaluating acquisition prices, determining fair value under uncertainty, and the informative value of purcha

0 views • 7 slides

Structuring Mergers, Acquisitions, and Private Equity Recaps: Tax Implications for S Corporations

Explore the tax implications for S Corporations in mergers, acquisitions, and private equity recaps, focusing on changes brought by the Tax Cuts and Jobs Act of 2017. Topics include income tax rate changes, dividends received deduction, and the Corporate AMT.

0 views • 95 slides

Maximizing Efficiency with the PALT Tracker in Procurement

The Procurement Administrative Lead Time (PALT) Tracker enables monitoring and streamlining of procurement processes for high-value acquisitions. This web-based tool provides visibility into PALT timelines, allowing contracting offices to track milestones leading to awards efficiently. Users can acc

1 views • 21 slides

Understanding CMS IT Governance Training Life Cycle ID (LCID)

CMS IT Governance Training Life Cycle ID (LCID) is a crucial aspect of IT project management within the CMS organization, ensuring proper approval and tracking of IT activities. This ID is not a funding approval but signifies evaluation for feasibility, standards, and cost-effectiveness. It is essen

0 views • 11 slides

Overview of CMMC 2.0 Cybersecurity Maturity Model Certification

The CMMC 2.0 introduces a streamlined model with three levels, focusing on protecting controlled unclassified information (CUI) with requirements aligned with NIST standards. Assessments vary for each level, including self-assessments for Level 1 and third-party assessments for Level 2. Government o

3 views • 8 slides

The Kill Zone Impact on Venture Capital Investments

Venture capitalists are hesitant to fund startups near large digital platforms due to the Kill Zone effect. Acquisitions by giants like Google and Facebook have significant implications on innovation and investment in the digital platform world. The data reveals insights into the dynamics of early-s

0 views • 19 slides

NASA SEWP Solutions for Enterprise-Wide Procurement

Providing the latest in commercial ICT/AV products and services, the NASA SEWP contract vehicle is a multi-award suite of contracts with over 140 Prime Contract Holders, including 108 Small Businesses and 9000+ Original Manufacturers and Service Providers. With an annual obligated value exceeding $1

2 views • 18 slides

Understanding Integrated Acquisition System (IAS) and Treasury's Invoice Processing Platform (IPP)

This presentation provides an overview of how the Integrated Acquisition System (IAS), Invoice Processing Platform (IPP), and Federal Financial Management Modernization Initiative (FMMI) interact to process acquisitions. It covers the role of the Procurement Systems Division (PSD), the purpose of th

0 views • 27 slides

Understanding Mergers, Acquisitions, Affiliations, and Collaborations in Nonprofit Organizations

Explore the definitions of mergers, acquisitions, affiliations, and collaborations in the nonprofit sector along with reasons for merging. Delve into the history of successful nonprofit mergers like the IBS-FWI merger and gain insights from a video showcasing nonprofit mergers and acquisitions. Disc

1 views • 23 slides

Enhancing Decision-Making with Location Intelligence in Water Industry Acquisitions

Delve into the pivotal role of location intelligence in the decision-making process for water industry acquisitions. Discover how accurate prediction of investment outcomes is achieved through the integration of environmental, geographic, census, and financial data. Explore the significance of data

0 views • 16 slides

American Imperialism in the Late 19th Century

Perception of manifest destiny, economic motives, and racial theories drove American expansionism in the 1890s, leading to overseas markets, acquisitions after the Spanish-American War, and debates over imperialism. Key figures, events, and ideologies shaped America's rise as a global power, includi

0 views • 13 slides

Tax Strategies for Corporate Acquisitions - Hedging FX Purchase Price of Target

Explore the intricacies of hedging foreign exchange purchase prices in corporate acquisitions, including forward contracts, integration rules, and IRS-initiated adjustments. The presentation delves into potential consequences, key requirements for taxpayers, and regulatory considerations. Gain insig

0 views • 28 slides

Effective Acquisitions Strategies for Libraries

Explore key insights from a meeting at the Fox River Valley Public Library District, focusing on handling duplicate records, potential causes of duplicates, vendor interactions, and fiscal year rollovers in libraries. Understand best practices for merging duplicates without disrupting acquisitions p

0 views • 15 slides

Polled Device Data Acquisitions Using SOIS on MIL-STD-1553B

Communicating and scheduling data acquisitions using the MIL-STD-1553B protocol has evolved from the old approach with no hardware support to the current implementation with hardware support. The process involves time synchronization, communication cycles, frames, pre-allocated bandwidth, and polled

0 views • 11 slides

Understanding Tax Aspects in Mergers & Acquisitions

This content provides an overview of recent M&A transactions, modes of M&A, taxation and regulatory aspects, as well as case studies in the field of mergers and acquisitions. It covers the need for M&A, various modes of M&A such as amalgamation, acquisitions, and restructuring, and key consideration

0 views • 40 slides

Water Utilities Update - Low-Income Oversight Board Summary

Water Utilities Update Low-Income Oversight Board on June 24, 2019 discussed topics such as low-income OIR workshop, school lead testing, conservation, proposed legislation, acquisitions, and human right to water. The workshop focused on water rate design for a basic amount of water at a low quantit

0 views • 9 slides

Understanding Cross-Border Mergers & Acquisitions: Strategies and Opportunities

Explore the world of cross-border mergers and acquisitions with a focus on managerial strategies, global growth opportunities, regulatory frameworks, financial and operational strategies, drivers of M&A, and the natural progression for growth companies. Discover the benefits and challenges of M&A in

0 views • 22 slides

Defensive Tactics Against Hostile Takeovers in Mergers and Acquisitions

Hostile takeovers in mergers and acquisitions involve one company acquiring another directly from shareholders without board approval. Tactics include tender offers, proxy fights, poison pills, crown jewels defense, golden parachutes, and Pac-Man defense to deter or resist takeovers.

0 views • 15 slides

Understanding Mergers and Acquisitions: Price, Definitions, Tax, Synergy & Valuation

Explore the world of mergers and acquisitions through definitions, tax implications, synergy benefits, and valuation methods. Learn about different types of mergers, tax considerations for a merger to be tax-free, the concept of synergy in mergers, and how to value mergers and acquisitions.

0 views • 24 slides

Increasing SDVOSB Participation in Defense Contracting through Simplified Acquisitions

Research identifies a paradox in achieving SDVOSB goals despite predicted malfunction factors. It explores questions on program understanding, Contracting Officer discretion, and the impact of Simplified Acquisitions. Methodology involves reviewing academic assessments and applying a performance mod

0 views • 34 slides

Overview of Mergers and Acquisitions in Corporate Finance

Mergers and acquisitions (M&A) involve one company taking over or merging with another, with value creation achievable through synergies. The buying company is the bidder/acquirer, while the selling company is the target/acquired. M&A deals can be friendly or hostile and involve extensive due dilige

0 views • 28 slides

Operations and Technology Due Diligence in Mergers & Acquisitions

This article discusses the critical role of operations and technology in the success of mergers and acquisitions (M&A) transactions. It emphasizes the importance of conducting thorough due diligence in these areas to identify challenges, opportunities, and potential synergies that can impact the out

0 views • 21 slides

Overview of Mergers and Acquisitions: Types and Examples

Explore the types of mergers and acquisitions, including mergers, acquisitions, consolidations, tender offers, acquisition of assets, and management acquisitions, with real-life examples such as Compaq and Hewlett-Packard, Manulife Financial, Citigroup, Johnson & Johnson, and more.

0 views • 16 slides

Latest Mergers and Acquisitions Updates in 2020

Explore the recent acquisitions and mergers in the business world of 2020, including notable deals involving companies like VWash, WhiteHat Jr, TikTok, and Bharti AXA General Insurance. Gain insights into the strategic moves and key players shaping the business landscape.

0 views • 25 slides