Lecture 7-Exercises and Concept for Analysis (Conceptual Frmework)

Explore qualitative characteristics in accounting with exercises on verifiability, comparability, understandability, and timeliness. Recognize accounting assumptions used by Marks and Spencer, such as accrual basis and full disclosure.

0 views • 9 slides

Understanding New Jersey's Earned Sick Leave Law

NJ's paid sick leave law, who it covers, accrual rules, usage, employer obligations, and more. Ensure compliance and access resources. Visit my.sickdays.nj.gov for details. Popular

1 views • 33 slides

Income and Expenditure Account in Accounting

Income and Expenditure Account, similar to the Profit and Loss Account, records revenue items on the credit side and expenses on the debit side. It follows the accrual concept and reflects only the current period's incomes and expenses. Surplus or deficit is shown based on the excess of income over

0 views • 4 slides

Basic Accounting Concepts and Budget Management at USF

This content provides valuable insights into basic accounting concepts such as budgeting, journal entries, accrual accounting, and budget management processes at USF. It covers essential topics like budget checking initiation, expense incurring methods, and budget impact on different financial trans

2 views • 45 slides

Student Loans: Options, Interest Calculation, Daily Interest Formula

Explore the various options available for student loans, learn how to calculate interest in different loan scenarios, and apply the simplified daily interest formula. Discover key terms like FAFSA, EFC, federal loans, private loans, and more. Dive into examples of interest accrual during school and

2 views • 19 slides

Year End Journal Entries

Explore the significance of year-end journal entries, their various categories like expense accruals, revenue deferrals, prepaid expenses, and revenue receivable. Understand the process for submission, key dates, and the difference between accrual and deferral entries. Discover how to handle entries

0 views • 14 slides

Accounting Entries for Hire Purchase Transactions

Different hire purchase transactions are recorded in the books of both the hire vendor/seller and hire purchaser through various accounting methods like the Asset Accrual Method. This method involves gradual capitalization and recording installment payments towards the cash price of the asset. Depre

0 views • 11 slides

Employee Time Tracking Guide for Cleveland State University Hourly Workers

This guide provides step-by-step instructions for hourly employees at Cleveland State University to clock in using Kronos Workforce Timekeeper and access their time records through myTime. It explains how to record timestamps, punch in or out for single or multiple jobs, view timecards, and check ac

0 views • 5 slides

New Jersey Paid Sick Leave Law

New Jersey Paid Sick Leave Law, effective since October 29, 2018, requires employers of all sizes in New Jersey to provide up to 40 hours of paid sick leave per year to covered employees. Employers must comply with accrual and use regulations and allow employees to utilize sick time for various reas

0 views • 27 slides

TCP Manager Module Orientation Overview

The TCP Manager Module Orientation provides an in-depth look at the TimeClock Plus (TCP) system, including employee setup, time tracking, leave requests, and clocking rules. The system allows for seamless management of staff time and schedules, with features such as automatic time adjustments, accru

1 views • 14 slides

Financial Accounting IFRS Learning Objectives

This educational material covers Chapter 3 of the Financial Accounting IFRS 3rd Edition by Weygandt, Kimmel, and Kieso. It delves into topics such as adjusting the accounts, time period assumption, accrual basis of accounting, fiscal and calendar years, accrual versus cash-basis accounting, and more

2 views • 20 slides

Accounting Basis Diagnostic Tool for NPOs and Funders

This diagnostic tool focuses on cash, modified cash, and accrual basis accounting for Non-Profit Organizations (NPOs) and funders. It explains the impact of accounting basis decisions and how to utilize the tool effectively. Designed for NPOs and funders, it helps in understanding, negotiating, and

1 views • 39 slides

Income and Expenditure Account for Non-Trading Organizations

Income and Expenditure Account is crucial for non-trading organizations to monitor revenues, expenses, and financial position. It helps in determining surplus or deficit, providing insights for strategic decisions, and fulfilling reporting requirements for investors and stakeholders. The account is

0 views • 10 slides

Financial Accounting Principles in IFRS

Explore key concepts in financial accounting such as time period assumption, accrual basis, adjusting entries, and types of accounting methods. Learn about fiscal vs. calendar years and accrual versus cash-basis accounting in the context of International Financial Reporting Standards (IFRS).

1 views • 20 slides

Intermediate University Accounting Basics

Explore the fundamental concepts of accounting in an intermediate university course, including the general ledger, journal entries, double-entry system, GL accounts, T-accounts, and accrual accounting. Gain insights into creating financial statements and recording transactions accurately.

0 views • 40 slides

NCI-MATCH Trial Interim Analysis Results and Status Update

NCI-MATCH is a groundbreaking clinical trial aiming to match tumor gene alterations with targeted therapies. The interim analysis results revealed impressive patient enrollment and site participation exceeding expectations. Despite challenges with pausing new patient registrations for the analysis,

0 views • 26 slides

Employee Benefits Overview

Explore the comprehensive employee benefits package offered, including sick leave accrual, compensation details, health insurance coverage with various plan options, and associated costs. Discover the benefits of Magnolia Open Access and Magnolia Local Plus plans for employees and their families. Ga

0 views • 33 slides

Structuration Analysis of Central Government Accounting Practices and Reforms in Emerging Economies: A Study from Nepal

Delve into the nuances of central government accounting practices and reforms in emerging economies, focusing on Nepal. The study explores why key stakeholders resist externally-driven changes, investigates the unintended consequences of reforms, and highlights the role of organizational actors in s

1 views • 21 slides

Carry-Forwards and Encumbrances Training Manual Overview

This manual provides detailed insight into the carry-forwards and encumbrances process for fiscal year 2021 at Oakland University, covering key definitions, general funds, controllable accounts, unexpended controllable budget, encumbrances, process purposes, deadlines, and submissions. It emphasizes

0 views • 18 slides

Stock Prices and Future Earnings: A Study on Accruals and Cash Flows

This study by Richard G. Sloan and Zhengying (Vivien) Fan explores whether stock prices fully reflect information in accruals and cash flows concerning future earnings. The research develops hypotheses, examines sample data, and conducts empirical analysis to assess the relationship between earnings

1 views • 19 slides

Year-End Journal Entry Accrual Process Overview

Gain insights into the year-end journal entry accrual process in Workday. Understand the submission and approval processes, find journals, review checklists, and learn how to create reversing accrual entries for the upcoming fiscal year.

0 views • 13 slides

Managing Vacation and Sick Leave Balances in Banner

Learn how to maintain vacation and sick leave balances for employees in Banner's Human Resource System. Understand the accrual processes, leave categories, and codes for different employee positions. Ensure accurate recording and tracking of paid leave benefits in the system for seamless management.

0 views • 14 slides

Important Updates and Announcements for October 2022

Stay informed with upcoming transaction deadlines, UCPath notices, ACA webinar recap, and more in these quick announcements for October 2022. Don't miss out on key information regarding training tips, fax number changes, off-boarding processes, and vacation accrual limits for academic employees.

0 views • 36 slides

Airline Industry Work Regulations and Benefits Overview

This data provides insights into various aspects of the airline industry, including flight attendant pay increments, duty day restrictions, days off, duty period credits, vacation accrual, and sick leave accrual. Details cover different carriers such as Southwest, Alaska, US Airways, Virgin, America

0 views • 9 slides

Financial Accounting Concepts and Standards Explained

This content provides detailed explanations of key financial accounting concepts such as accrual accounting, matching concept, FASB standards, and revenue recognition guide. It also presents questions related to income per crocodile, revenue timing rules, and methods of revenue recognition based on

0 views • 11 slides

The Firefighters Pension Scheme 2015

Explore the details of the Firefighters Pension Scheme 2015, including how you may be affected, membership categories, levels of protection, and the main elements of the scheme design. Learn about contribution rates, access to pensions, and benefits for ill health, death, and survivors. Discover if

0 views • 36 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Research Upgrade Training Presentation: Epic Version Feb/May 2023 Preview

Explore the upcoming Research Upgrade Training Presentation for Epic Version Feb/May 2023, scheduled for release in October 2023. Enhancements include recording clinical significance for adverse events, tracking participant accrual, and new Medicare qualifying buttons in Billing Setup. Discover the

0 views • 4 slides

Analysis of Prepaid Pension Assets in Oregon Regulatory Settings

The article delves into the complexities of Prepaid Pension Asset (PPA) inclusion in utility rates in Oregon. Issues such as incomplete records, inconsistent policies, and customer implications are discussed. The challenges faced by companies in shifting to accrual accounting and the varying treatme

0 views • 10 slides

Challenges in Oncology Clinical Trials: Balancing Surgical and Radiation Therapies

Comparison between sublobar resection and stereotactic ablative radiotherapy (SAbR) in high-risk patients with stage I non-small cell lung cancer has faced challenges like poor accrual, equipoise concerns among surgeons, and complex eligibility criteria. Traditional phase III trials struggle due to

0 views • 35 slides

European Developments in Public Sector Accounting: Lessons Learned

This presentation delves into the sovereign debt crisis in Europe, highlighting its causes and lessons learned. It discusses the role of the public sector in relation to the private sector's performance, the impact of political systems on public sector accounting reforms, and the need for a harmoniz

0 views • 18 slides

Paid Sick Leave Policy Overview under Healthy Workplace Healthy Families Act (AB 1522)

This overview provides details on the Paid Sick Leave policy effective from 07/01/15 under the Healthy Workplace Healthy Families Act (AB 1522). It covers eligibility criteria, accrual rates, usage limits, allowable reasons for leave, and prohibitions against employer actions that infringe on this b

0 views • 11 slides

NYC's Paid Sick Leave Law

NYC's Paid Sick Leave Law ensures employees have access to sick leave for themselves or family members, impacting businesses and customers positively. Learn about law overview, compliance, accrual rates, and more. Employers must provide paid or unpaid sick leave based on the number of employees. Cal

0 views • 49 slides

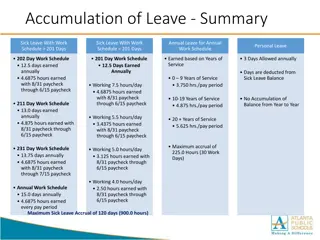

Leave Accumulation Summary for Employees

Detailed information on the accumulation of various types of leave (sick, annual, personal) based on different work schedules and years of service. The summary covers accrual rates, maximum accrual limits, days earned annually, and deductions from leave balances.

0 views • 6 slides

Understanding Federal Leave Programs Overview

This overview provides insight into various federal leave programs, including annual, sick, and family leave, as well as programs like FMLA and LWOP. It discusses accrual rates, approval processes, usage limits, and requirements for sick leave. The overview aims to enhance understanding and complian

0 views • 18 slides

Evolution of Survival Sample Size Methods and Considerations in Survival Analysis

Survival analysis sample size determination is crucial for estimating the expected duration of time to an event accurately. Over time, methods have evolved from simple approximations to more complex models, offering greater flexibility and accuracy in study design. Considerations such as expected su

0 views • 9 slides

Clause 41 of Listing Agreement

Listing Agreement outlines the terms for securities to be traded on a stock exchange. Clause 41 mandates listed companies to provide detailed financial results periodically, promoting transparency for investors' informed decisions and safeguarding their interests. The results must adhere to accrual

0 views • 15 slides

Furloughs in Government Employment: Overview and Guidelines

Furloughs in government employment can be discontinuous or continuous, impacting leave benefits and pay. This overview covers different furlough types, accrual of annual/sick leave, approval authorities, and restrictions on paid leave use during furlough periods.

0 views • 29 slides

Accruals and Prepayments in Accounting

Accruals and prepayments are essential concepts in accounting that ensure accurate financial reporting. Accrual basis of accounting requires recognizing income and expenses when earned or incurred, regardless of cash flow timing. Accrued expenditure represents unpaid expenses at year-end, impacting

0 views • 13 slides

Audit of the U.S. Government's Consolidated Financial Statements

This audit report pertains to the Consolidated Financial Statements (CFS) of the U.S. Government and covers topics such as background information, results of the FY 2021 CFS audit, and details on how the CFS is audited. The audit includes an analysis of accrual-based financial statements and sustain

0 views • 25 slides