Insights on Election Expenditure Monitoring in Indian State Assemblies

This presentation by Ajay Bhadoo, Deputy Election Commissioner, delves into the significance and regulations surrounding election expenditure monitoring in states like Mizoram, Telangana, Chhattisgarh, Rajasthan, and Madhya Pradesh. It covers the impact of money power, legal provisions, types of ele

0 views • 56 slides

Election Expenditure Monitoring in Karnataka State Legislative Assembly Elections

Presentation on the impact of money power in elections, the objective of election expenditure monitoring, legal provisions, machinery involved, role of expenditure observers, and focus areas for monitoring. Details on cases of rescinding elections due to detected money use, types of election expendi

0 views • 59 slides

Virginia ACA Carrier Teleconference - Plan Year 2024 Updates

Get insights on important dates, rate filing info, mental health parity compliance, and more in the Virginia ACA Carrier Teleconference for Plan Year 2024. Key presenters include experts from the Bureau of Insurance and Health Benefit Exchange.

1 views • 25 slides

Level 1/2 Hospitality and Catering

Explore how hospitality and catering provisions operate by meeting the diverse needs of customers, including business and leisure guests. Learn about customer requirements such as catering, equipment, accommodation, and rights in terms of disability inclusion and equality. Discover how residential p

1 views • 20 slides

Important Provisions of Companies Act Regarding Audit

The Companies Act mandates specific provisions related to audit, including the appointment of auditors, consent, certificates, and rotation requirements. Companies need to appoint auditors timely, obtain consent and eligibility certificates before appointment, and adhere to mandatory auditor rotatio

2 views • 22 slides

Proposed Amendments to UN R13 Type II-A Test Provisions

Expert from Germany has proposed amendments to UN R13 Type II-A test provisions at the 17th session of GRVA in September 2023. The current text of paragraph 1.8.1.2 regarding test mass is unclear and subject to interpretation, prompting the need for clarification at the GRVA level. Issues with the t

2 views • 15 slides

Understanding Secure Act 2.0 Key Provisions

In a detailed report by Dee Spivey and Angie Zouhar, key provisions of SECURE Act 2.0 are outlined, including changes in retirement plans like RMD age increase, employee certification of hardship withdrawals, and more. Secure 1.0 and Secure 2.0 differences, effective dates, and necessary actions for

5 views • 12 slides

Understanding ACA Penalty Enforcement Roadmap for Employers

This material provides insights on ACA penalty enforcement for Applicable Large Employers (ALEs) under the Affordable Care Act (ACA). It covers ALE obligations, employer mandates, health coverage reporting, penalties for non-compliance, and potential changes in reporting requirements. Emphasis is pl

0 views • 13 slides

Understanding Information Sharing Provisions in the Oranga Tamariki Act

This resource provides valuable information on the information sharing provisions outlined in the Oranga Tamariki Act 1989, focusing on the stakeholders involved, purposes of sharing, types of information shared, and responsibilities towards consulting with children. It aims to support professionals

0 views • 21 slides

Understanding Redemption of Preference Shares in Companies

Preference shares in companies offer preferential rights in dividend payments and capital repayment during liquidation. Redemption of preference shares involves returning the preference share capital to the shareholders. This process requires adherence to specific provisions under the Companies Act,

0 views • 25 slides

Impact of Affordable Care Act on Healthcare Coverage and Access

The Affordable Care Act (ACA) has led to significant accomplishments since March 19, 2019, with over 20 million people gaining health coverage. The gains are attributed to policies such as subsidies, market reforms, Medicaid expansion, and young adults staying on parents' plans. Evidence indicates r

0 views • 12 slides

Trading Conduct Review Briefing and Discussion Summary

The briefing on Trading Conduct Review, held by the Market Development Advisory Group in July 2019, discussed pivotal pricing and potential changes to trading conduct provisions. The project aims to evaluate and enhance trading conduct provisions to ensure fair competition. Key topics included under

1 views • 32 slides

Tribal Self-Governance ACA/IHCIA Project Update

Presentation to the Tribal Self-Governance Conference Advisory Committee on the Affordable Care Act (ACA) and Indian Health Care Improvement Act (IHCIA) project update, including recent and upcoming project activities, resources, project staff details, and contact information for the project team.

1 views • 5 slides

AHCCCS Update and Impact: Arizona's Comprehensive Healthcare Initiatives

AHCCCS is dedicated to providing quality healthcare services to those in need across Arizona. Through various initiatives such as Value Based Purchasing and Justice System transitions, AHCCCS aims to improve access and quality of care. The potential impact of ACA changes on the economy and funding s

0 views • 15 slides

IP Licensing and Settlements: Key Provisions and Case Studies

Explore important provisions like forum selection and bankruptcy in IP licensing agreements, along with settlement provisions through recent case studies. Learn about enforcing arbitral awards globally and the significance of the New York Convention. Dive into real-world scenarios involving NDA clau

1 views • 11 slides

Comparison of Old and New Reassessment Provisions in Finance Bill 2021

The Finance Bill 2021 introduces new reassessment provisions impacting the assessment of income chargeable to tax. Key changes include the amendment of Section 147 and the addition of Section 148, affecting the Assessing Officer's powers and procedures. These modifications aim to streamline the asse

0 views • 15 slides

Expanding Medicaid: West Virginia's Healthcare Landscape

The Affordable Care Act (ACA) and its impact on Medicaid expansion in West Virginia is examined, focusing on benefits for low-income individuals. The Supreme Court's ruling on the ACA and Medicaid extension options for the state are discussed, emphasizing the need for careful consideration in light

0 views • 43 slides

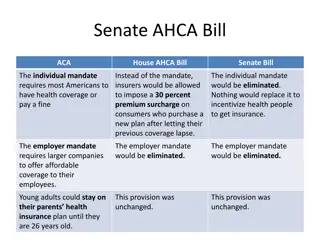

Comparison of Healthcare Provisions in Senate and House AHCA Bills

The Senate AHCA bill proposes major changes to healthcare provisions compared to the current ACA, such as removing the individual mandate and employer mandate. Tax credits would be based primarily on age rather than income, and cost-sharing subsidies may end in 2020. Insurers could charge older cust

0 views • 5 slides

Bipartisan Infrastructure Law - Overview of Highway Provisions

This presentation provides an overview of the highway provisions in the Bipartisan Infrastructure Law (BIL), also known as the Infrastructure Investment and Jobs Act. It focuses on significant programs and provisions related to highways, offering insight into budget authority, contract authority, ob

0 views • 73 slides

Key Tax Ballot Measures for November 2024 in California

Three key tax-related measures are set for the November 2024 statewide ballot in California. ACA 1 focuses on amending the state constitution to allow local governments with 55% voter approval to incur general obligation bonds or impose special taxes for affordable housing and public infrastructure.

0 views • 5 slides

Affordable Care Act (ACA) 1094/1095 Reporting Guidelines

Affordable Care Act (ACA) requires employers to report information to the IRS regarding individual and employer responsibilities under the ACA. The reporting includes details on individual responsibility, employer responsibility, exemptions, and reporting requirements for different types of employer

0 views • 52 slides

Virginia ACA Filing Season 2022 Carrier Teleconference: Important Updates

Explore key topics discussed during the Virginia ACA filing season teleconference, including important dates, rate filing template changes, health care savings programs, mental health parity compliance, and more. Stay informed about crucial deadlines and regulatory requirements for carriers in Virgi

0 views • 19 slides

Bermuda Economic Balance Sheet (EBS) Technical Provisions Overview

Detailed presentation on Bermuda Economic Balance Sheet Technical Provisions as presented at CAMAR Fall 2017. The contents cover the purpose, outline, evolution, components of Bermuda technical provisions, new requirements, actuarial methodology, and conclusion. It provides insights into the regulat

0 views • 23 slides

Overview of the Federal Structure in the Constitution of India

The Constitution of India showcases a quasi-federal system with a strong centralizing tendency, as discussed by scholars like Kenneth C. Wheare, Sir Ivor Jennings, and Dr. B. R. Ambedkar. The essential features of a federal constitution, such as division of power, supremacy of law, and distribution

0 views • 4 slides

Trends in Health Insurance Among Workers with Disabilities, 2001-2017 Analysis

Study conducted on health insurance trends for workers with disabilities from 2001 to 2017 reveals significant changes, with limited options in the past evolving into improved coverage post the Affordable Care Act (ACA). The shift includes removal of pre-existing conditions limits, Medicaid expansio

0 views • 26 slides

Early Observations on Health Insurance Exchanges: Market Trends and Enrollment Data

Observations from 2014 and 2015 indicate increased competition and enrollment in health insurance exchanges post-ACA implementation. Market concentration pre-ACA was high, hindering competition. Insights include buyer demographics, state-specific enrollment rates, and insurer participation growth.

0 views • 13 slides

ACA.SAS.SIG Meeting - July 13, 2022 - Overview and Nominations

The ACA.SAS.SIG Meeting on July 13, 2022, includes an introduction of SIG officers, nominations for upcoming officers, activities review, and planning for future workshops and sessions. The current SAS SIG officers and their roles are detailed, along with the responsibilities of the Chair-Elect and

0 views • 12 slides

Advancing the African Cashew Industry: ACA Partnership and Activities

Established in 2006, the African Cashew Alliance (ACA) is a collaboration between public and private partners aiming to promote a globally competitive African cashew industry. With a focus on all aspects of the cashew value chain, ACA's mission includes providing technical assistance, promoting mark

0 views • 15 slides

Understanding ACA Policies and Market Outcomes

Exploring the impact of ACA policies on rating regions, age-rating, APTC, and market outcomes. Insights on coverage, costs, insurer responses, and market determinants like rating regions. Analysis of state variations and comparisons in carrier premiums in rural counties.

0 views • 19 slides

Virginia ACA Carrier Teleconference 2023 - Important Updates

Virginia ACA Carrier Teleconference for 2023 covers significant topics such as important dates, rate filing information, shared savings programs, mental health parity compliance, and more. Key presenters from the Bureau of Insurance will discuss vital deadlines, legislative updates, reinsurance prog

0 views • 21 slides

ACA Reporting: Preparing for 2016 Deadlines Overview

Learn about the key components of ACA reporting for 2016 deadlines, including employer and individual mandates, subsidies, workflow administration, and form filing requirements. Stay informed about important updates and understand the significance of Forms 1094-C and 1095-C in demonstrating complian

0 views • 42 slides

Understanding the Status of ACA and Cost Mitigation Practices

Brief overview of the current state of the Affordable Care Act (ACA) and cost mitigation practices, including implications of the Trump executive order. Discussion on health care reform considerations under the new administration, focusing on employer-sponsored plans, Medicare, and potential changes

0 views • 17 slides

Understanding Employer Mandate & Full-Time Employment Status under ACA for 2016

This document presented at the Delaware Tax Institute in 2015 by Timothy J. Snyder covers essential aspects of the Affordable Care Act relevant for employers in 2016. It delves into the Employer Mandate's Shared Responsibility and provides detailed information on determining Full-Time Employment Sta

0 views • 45 slides

Federal-Aid Construction Contract Provisions Overview

This agreement outlines the procedures and responsibilities for material testing and construction inspection for Federal-Aid construction projects. It includes provisions for compliance with Department Instruction Memorandums, billing for testing services, and mandatory contract provisions related t

0 views • 20 slides

Understanding Accidental Death and Injury Provisions in Insurance Policies

Accidental death and injury provisions in insurance policies cover unexpected events such as accidents leading to death, dismemberment, disability, or hospitalization. These provisions define accidents as sudden, unforeseen occurrences with external causes, not related to natural processes. The term

0 views • 16 slides

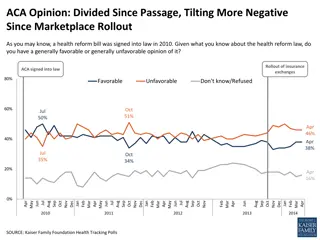

Current Public Opinion on the Affordable Care Act (ACA)

Public opinion on the Affordable Care Act (ACA) remains divided since its passage, with increasing negativity seen after the Marketplace rollout. While some favor the law, there are deep partisan divisions on its favorability. A majority prefers that Congress work to improve the ACA rather than repe

0 views • 6 slides

Understanding Make-Whole Provisions in Chapter 11 Bankruptcy Cases

Make-whole provisions are contractual clauses allowing borrowers to repay debts before maturity, while requiring payment based on future coupon values. This article explores the purpose, definitions, and examples of make-whole provisions in bankruptcy cases, with specific references to relevant lega

0 views • 32 slides

Compliance and Challenges Under ERISA and ACA Audits

Explore the roles, responsibilities, and compliance highlights related to ERISA and ACA audits. Learn about various provisions, requirements, notices, and reporting associated with ensuring compliance, such as HIPAA, COBRA, and more.

0 views • 32 slides

Understanding ACA Regulations and Compliance at University of Montana

University of Montana's Human Resource Services manages ACA compliance for its self-funded benefits plan, covering thousands of employees and dependents. The ACA aims to provide insurance coverage to uninsured Americans, with employers playing a crucial role in ensuring compliance with regulations s

0 views • 17 slides

Overview of Prescription Drug Provisions in Inflation Reduction Act

The Inflation Reduction Act includes significant prescription drug provisions aimed at reducing costs and improving coverage. Key provisions involve government negotiation of drug prices, rebates for price increases, capping out-of-pocket expenses, limiting premium growth, enhancing access to insuli

0 views • 18 slides