Understanding Debentures and Charges in Company Law

Debentures play a significant role in company law, representing various types of securities issued by a company. They are defined under the Companies Act and have specific characteristics, such as being under common seal, repayment terms, interest payments, and charges on movable property. Debentures can be categorized based on negotiability, security, redeemability, convertibility, and priority. Additionally, the differences between shares and debentures lie in voting rights, profit-sharing, issuance regulations, repayment schemes, and creditor status. Issuing debenture certificates and creating debenture trust deeds are essential processes that provide legal security for creditors.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Welcome COMPANY LAW

DEBENTURES AND CHARGES.

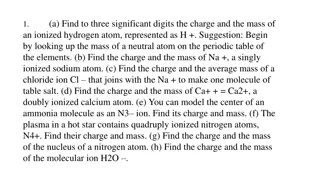

MEANING AND NATURE. The debenture is defined in companies Act as; debenture includes debenture stock, bonds and any other securities of a company whether constituting a charge on assets of the company or not . [sec.2(30)]. [chitty.j.] debenture means a document which either creates a debt or acknowledges it and any document which fulfils either of those conditions is a debenture .

CHARACTERISTICS; Debenture certificate. Under common seal. Debenture in a series. Repayment. Payment of Interest. Creation of charge. Movable property. No voting rights.

5 KINDS OF DEBENTURE; Registered Bearer 1. Based on negotiability. Secured Unsecured 2.Based on security. Redeemable Irredeemable 3.Redeemability .

KINDS : 4. Based on convertibility. 5. Based on priority. 1st convertible debenture. Non 2nd convertible. debenture.

DIFFERENCE B/W SHARES & DEBENTURES. A shareholder is a member of company. A share holder has a voting rights. Dividend on shares is to be paid only when the company has earned profits. Share holders can not be issued at a discount. Share holders can not be paid back their amount. A debenture-holder is only a creditor of the company. A debenture-holder has no such rights. Interest on debenture is payable whether there are profits or not. Debentures can be issued at discount. Debentures are normally redeemable. Debenture- holder Share-holder

Debenture certificates. CONDITIONS FOR ISSUANCE OF SECURED DEBENTURES.

DEBENTURE TRUST DEED Debenture trust deed is a written instrument legally conveying property of a trustee for the purpose of securing a loan mortgage. A trust deed shall be executed in the form No.SH-12. it contains the following: 1. Description of debenture issue. 2. Details of charge created. 3. Particulars of the appointment of debenture trustee. 4. Events of defaults. 5. Obligations of company. 6. Miscellanrous.

DEBENTURE TRUSTEE. Debenture trustee is a person or group of persons appointed for the supervision of the common interest of debenture-holder.

DUTIES OF DEBENTURE TRUSTEE. Ensures sufficiency of assets of the company. Ensures correctness of letter of offer. To protect of interest of debenture-holder. To prevent any breach of the terms of issue. Appoints a nominee director oh the board of the company. Provides information. Convening of meetings. Call for reports.

REMEDIES OF DEBENTURE HOLDER. 2.Debenture holders action. 1.Sale 3.Appointment of receiver. 4. Foreclosure. 5.Proof of balance.

NOMINATION OF SECURITIES. Sec.72.of companies Act 2013, provides that a holder of securities may at any time nominate a person. Documents for the purpose of identification. a. True copy of death certificate of security holder. b. Proof of D.O.B of nominee. c. An affidauit. d. The original sec

PRIORITY OF CHARGES. A fixed charge is already existing at the time when the floating charge can became fixed will have priority over it. A company cannot create a fixed charge in priority to the charge after it has crystallised. A company cannot however , created a further floating charge on the same assets to rank in priority . A debenture creating charge, whether floating or fixed , over any immovable property, is required to be registered u/s 77 of the Companies Act & sec.17 of the registration Act.

DISTINCTION B/W FIXED & FLOATING CHARGE. Fixed charge is a charge created on specified assets of permanent nature.. The company cannot sell property charged without the consent of the charge holder A specific charge prevails over a floating charge even if created later . It is usually created on current assets . The company can deal with the property subject to a floating charge in any manner it likes. Subject to any contrary agreement with the charge holder holding the floating charge. Fixed Floating

REGISTERATION OF CHARGES A charge for securing any issue of debentures. A charge on uncalled share capital of the company. A charge on any immovable property wherever situated or any interest there in. A charge on any book debt of the company. A charge on a ship or any share in a ship . A charge on a calls made but not paid .

PROCEDURE OF REGISTRATION OF CHARGES Particulars to be fixed with the registrar . who should effect registration? Time of registration . Extension of time by central govt . Certificate of registration . provisions relating to registration of charges to apply to modification of charges. Date of notice of charge. Time limits for registration of charge. With in 30 days of creation of charge . After 3o days and with in 3oo days . after 300 days.

REGISTER OF CHARGES Register to be kept by the registrar (sec.81). Company s register of charges (sec.85). Index to register of charges. Right to inspect copies of instrument creating charges and company s register to charges.[sec.82(2)].

THE MEMORANDUM OF SATISFACTION SECTION 82. The company shall give notice to the registrar for payment in full of any charge registered with him with in 30 days of such payment. On receipt of such information the registrar shall send a notice to the holder of the charge to show cause with in 14 days. The registrar may also record memorandum of satisfaction even if no intimation has been received by him from the company.provided he has received satisfactory evidence of satisfaction

RECTIFICATION OF THE REGISTER OF CHARGES MAINTAINTED BUY THE ROC/CONDONATION OF DELAY/POWER OF THE CENTRAL GOVT .TO GRANT EXTENTION OF TIME.(SEC.87). Central govt .may on application made by the company in form CHg -8, extend the time limit . Omission to file the registrar the particulars of any charge subject to which any property has been acquired by a company. On any other grounds its just and equitable to grant relief.

THANK You