Quest Diagnostics Incorporated: Investment Insights & Company Overview

Quest Diagnostics Incorporated (NYSE: DGX) is recommended as a solid hold due to being undervalued with long-term growth potential. With a focus on industry tailwinds, growth strategies, and operational excellence, Quest is well-positioned to capitalize on market opportunities. Led by CEO Stephen Rusckowski, the company offers diagnostic testing services and has shown steady financial performance and strategic vision.

Uploaded on Sep 30, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Quest Diagnostics Incorporated NYSE: DGX Recommendation: Solid Hold Tom Daly, Chase Kill, Jim Keegan 1

Investment Thesis Recommendation: Quest Diagnostics Incorporated (NYSE: DGX) is undervalued in the market with long-term upside, therefore we recommend a hold with stable growth opportunities, the Investment Club can capitalize on long-term, steady growth and allocate capital better than simply in the market Rationale: Through 1) Industry Tailwinds and its two-point strategy of 2) accelerated growth, which contains five distinct elements, and 3) driving operational excellence, Quest Diagnostics believes it is well- positioned in the market to take advantage of regulation effects that are consolidating the Diagnostics industry and capitalize on opportunities for partnerships with hospitals as well as health plans. Industry Tailwinds 1 Five (5) Accelerated Growth Strategies 2 Driving Operational Efficiency 3 Base Price Target: $122.64 Upside: 9.52% 2

General Overview 4-8 Company Profile & Acquisitions Industry Analysis Situation Assessment Future Outlook 10-14 Industry Tailwinds Accelerated Growth Driving Operational Excellence Appendix 16-24 3

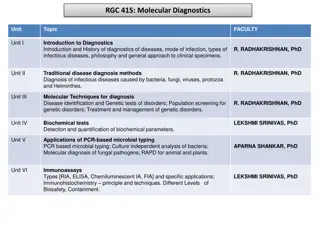

Company Overview Quest has developed itself as a stable company in the Diagnostics Testing Industry, with vision led by Stephen Rusckowski, who has been CEO since 2012 and continually builds on steady growth and success Company Description Summary Financials 2016 2017 2018 Quest Diagnostics Incorporated is the leading provider of diagnostic testing, information, and services that patients and doctors need to make better healthcare decisions Revenue $7,214 $7,402 $7,531 % Growth (3.87%) 2.61% 1.74% Gross Profit 2,638 2,733 2,661 Diagnostic Information Services segment includes clinical testing such as routine testing, gene-based and esoteric testing, anatomic pathology services, as well as related services and insights % Margin 36.6% 36.9% 35.3% EBITDA 1,435 1,486 1,456 % Margin 19.9% 20.1% 19.3% The Diagnostic Solutions segment includes other businesses such as risk assessment services, clinical trials testing, diagnostic products, and healthcare information technology Capital Expenditure 293 252 383 % Margin 4.1% 3.4% 5.1% EBITDA - Capex 1,142 1,234 1,073 % Margin 15.8% 20.1% 14.2% Management Team SWOT Analysis Stephen H. Rusckowski Chairman, President, ad CEO Named CEO and President in May of 2012 Elected Chairman of the Board in December of 2016 Long career in Healthcare industry, previously served as CEO of Philips Healthcare Weaknesses Low barriers to entry limit market share growth Large number of employees escalates operating costs Strengths Industry leading diagnostic test menu Unmatched size, scale, and capabilities Largest private database of patient test results Mark J. Guinan Executive VP and CFO Joined Quest Diagnostics as Executive VP and CFO in January of 2013 Previously served as CFO of Hill-Rom Holdings Inc. from 2010 to 2013 Threats Opportunities Structural changes to the market have created ample opportunity for acquisition New partnerships within the industry willl give Quest access to a larger population Data Breaches Potential litigation related to certain divisions Legislative cuts to revenue. Anticipation of a general economic downturn Manuel O. M ndez Senior VP and COO Named Senior VP and COO effective October 7, 2019 Most recently served as Senior VP, Global Commercial Operations at QIAGEN, a provider of sample and assay technologies for molecular diagnostics, applied testing, and pharmaceutical research. 4

Multiple Brands and Services Quest is mainly focused on diagnostic testing services, but is also involved in Healthcare IT and Wellness and Risk Management, building all three divisions and spurring volume growth in part through its brands Diagnostics Testing Services Healthcare IT Wellness and Risk Management Helps employers and insurers improve the health of their workers and reduce illegal drug use in the workplace Over 200,000 physicians rely on Quest s technology and analytics to order lab tests, receive timely test results, share clinical information quickly and securely, and prescribe drugs Quest Diagnostics Inc. is the world s leading provider of diagnostic testing, information, and services that patients and doctors need to make better healthcare decisions Conduct lab testing-based health assessments for common conditions such as diabetes and heart disease, enabling people to better manage their health Services Perform medical tests that aid in the diagnosis or detection of diseases, measure the progress or recovery from a disease or confirm that an individual is free from disease Quantum technology is used to process over 1 million transactions every day, forming a vital part of the national healthcare information infrastructure Quest is the leading provider of risk assessment services to the life insurance industry Brands 5

Recent Acquisitions Quest stays on the cutting-edge of diagnostic testing through multiple acquisitions, which help the company become more viable options for healthcare providers and hospitals to partner with for their technology and cost efficiencies Blueprint Genetics (January 22, 2020) PhenoPath Laboratories (September 27, 2018) Description: PhenoPath Laboratories is a national provider of specialized anatomic pathology an related services Description: Blueprint Genetics is a leading specialty genetic testing company with deep expertise gene variant interpretation Key Facts Key Facts Founded in 1998 Founded in 2012 HQ: Seattle, WA HQ: Helsinki, Finland Rationale: Rationale: Accelerates growth in advanced diagnostics and deepens Broadens access to actionable insights in genetic and rare presence in the Pacific Northwest diseases improving patient care & drug R&D MedXM (January 26, 2018) ReproSource (October 22, 2018) Description: ReproSource is a national leader in specialty fertility diagnostic services, helping patients in fertility Key Facts Description: MedXM is a leading national provider of home-based health risk assessments and related services Key Facts Founded in 2008 Founded in 2006 HQ: Marlborough, MA HQ: Secaucus, NJ Rationale: Rationale: Accelerates growth in advanced diagnostics and broadens Expands scale and reach in the mobile/home segment and diagnostic test base bolsters its overall capabilities in extended care 6

Diagnostics & Medical Labs Industry The diagnostics and medical labs industry lacks competition and incentives companies to merge with or acquire competitors in an attempt to lower the extremely high fixed costs General Overview Major Players Quest Laboratory Corp. of America Holdings 20.4% Other 66.1% The primary drivers of the industry include the increasing number of people with private health insurance, aging population, and scientific innovation Diagnostics Inc. 13.5% Competition within the industry is low the two primary firms are Quest Diagnostics and Laboratory Corp of America, which account for over a third of total revenue Fixed costs are extremely high, so building a large corporation through mergers and acquisitions is key to surviving Government regulation majorly affects the industry, as it attempts to drive the price of diagnostics down Revenue Performance and Projections (in $mm) Industry Outlook 62,000 With Laboratory Corp of America expanding into drug development, Quest has major opportunity to dominate diagnostics testing 60,000 Opportunities 58,000 56,000 PAMA and additional government regulation continues to threaten & decrease the revenue and drive down the price Quest can charge 54,000 Threats 52,000 50,000 In it s outlook, Quest emphasizes they are set on acquiring more companies to decrease fixed costs and develop new diagnostics tests 48,000 M&A Activity 46,000 7

Situation Assessment Quest Diagnostics is focused on expanding its business through frequent acquisitions of health systems laboratories and partnerships with hospitals to run their diagnostic testing at to 1/5 of the cost to hospitals General Overview Data Breach Shortly after being appointed CEO in 2012, Steve Rusckowski identified a need for Quest to refocus on core diagnostic information services and take advantage of Quest s scale and expertise to offer cheaper services In June of 2019, Quest announced American Medical Collection Agency, a third-party billing company associated with Quest, had been hit by a data breach affecting 11.9 million patients The unauthorized user siphoned off credit card numbers, medical information, and personal data from roughly August 1, 2018 to March 30, 2019 When hospitals are reluctant to partner with Quest, it focus on acquiring health systems laboratory outreach businesses, which are labs that perform services for customers outside of health system, often for patients seeking a lab order from a personal physician or a provider at a different health system This has become a common threat for many credit card skimming companies. Ticketmaster and British Airways are notable companies that suffered similar attacks Return on Invested Capital Annual Net Acquisitions/Divestitures ($ in Millions) 14.0% 12.0% $200 $- 10.0% $(200) 8.0% $(400) $(600) 6.0% $(800) $(1,000) 4.0% $(1,200) 2.0% $(1,400) $(1,600) 0.0% $(1,800) 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 8

General Overview 4-8 Company Profile & Acquisitions Industry Analysis Situation Assessment Future Outlook 10-14 Industry Tailwinds Accelerated Growth Driving Operational Excellence Appendix 16-24 9

Industry Tailwinds 1 The Diagnostics Industry has some tailwinds including aging population requiring diagnostics testing (logic behind the PAMA Act) and total health expenditures in general continuously growing YOY. Aging Population U.S. Health Spending (% of GDP) Over the next five years to 2025, the number of adults aged 50 and older is expected to increase at an annualized rate of 1.1% to 126.3 million 20% 18% 16% 14% From 2020 to 2060 the percentage of the US population over the age of 50 is expected increase from 35.9% to 41.4%, with the largest increase coming between 2020 and 2030 12% 10% 8% An older US population presents an obvious boon for the diagnostic industry as older individuals are more likely to require medical attention and diagnosis 6% 4% 2% 0% 1970 1980 1990 2000 2010 2020 2030 Total Health Expenditures (in $T) 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 10

Accelerated Growth Elements 2 2) Expand relationships with health plans and hospital health systems 3) Offer the broadest access to diagnostic innovation Grow more than 2% per year through accretive, strategically aligned acquisitions 4) Be recognized as the consumer friendly provider of diagnostic information services 5) Support population health with data analytics and extended care services 11

Consolidating Industry 2 With Lab Corp exploring realms outside of diagnostic services testing, PAMA reimbursement rates foreclosing small lab and diagnostic operations, and strong volume growth, Quest has positioned itself nicely to see steady growth in the future General Overview (Lab Corp) Volume Growth (%) 6.0% Although Laboratory Corporation of America technically holds 7% more market share in the Diagnostics Industry than Quest, the company sees the future differently from Quest, and is refocusing itself on drug development vs. expanding diagnostics testing 5.1% 5.0% 4.4% 4.1% 3.6% 4.0% 3.0% Lab Corp is focused on acquisitions that shore up its technology and sophistication of diagnostic services, steering the company toward a future beyond clinical labs 2.0% 1.0% LabCorp has spent about $5.8 billion in cash and equity of $1.8 billion on acquisitions since 2010 0.0% 2019 Q1 2019 Q2 2019 Q3 2019 Q4 LAB Act PAMA According to a Medical Laboratory Observer article in 2018, On average, Medicare beneficiaries receive some 16 lab tests annually, accounting for more than 400 million tests administered each year. The Laboratory Access for Benefits Act (LAB) was introduced in the House of Representatives in June of 2019 The LAB Act was intended to act as the first legislative step in ensuring that clinical lab service rates are sustainable under PAMA Seeing this need and recognizing the importance of diagnostics testing, Congress passed the Protecting Access to Medicare Act (PAMA) It is was also intended to ensure that Medicare beneficiaries have adequate access to crucial lab services Health and Human Services collected a market rate which represented less than one percent of the market, focusing on the lowest cost labs The bill will delay the reporting of lab payment data required by PAMA by one year 12

Building Relationships 2 By building healthy relationships with healthcare providers and multiple hospitals in the future through its diagnostic innovation and great reputation, Quest hopes to gain many partnerships in the future Health Plans and Hospitals Public Image and Transparency Consumers are becoming increasingly focused on driving better value in their lab spend, allowing Quest to win contracts with major health plans, allowing them to increase their market share In Q2 of 2019, the White House released a Healthcare Executive Order designed to bring more transparency to the health care system. As a result of PAMA revenue cuts, it is no longer sustainable for many hospitals and health systems to run their own diagnostics Massachusetts has taken a lead among other states to build a website for consumers and residents to understand the wide variation sin health care costs This has lead many hospitals systems to outsource to Quest for their diagnostics, and has the door for Quest to acquire small regional labs In 2019, Quest announced a collaboration with Memorial Hermann Health System Governor Charlie Baker visited the Marlborough lab, where Quest pledged to continue to help consumers understand the true cost Partnerships Diagnostic Innovation Many of Quest s recent acquisitions are centered around maintaining this advantage through acquiring companies that are the leaders within their diagnostic niche Recent acquisitions such as BluePrint Genetics and Reprosource have bolstered Quest s capabilities in advanced diagnostics Quest became a UnitedHealthcare Preferred Lab Network provider in Q1 of 2019, effective July 1, 2019. Quest and its subsidiary Ameripath are two of seven companies to participate in the Preferred Lab Network Quest is now participating as a designated laboratory in the National Cancer Institute s MATCH precision medicine trial, the largest of its kind. The trial seeks to provide better outcomes for rare cancer types Looking towards the future, Quest hopes to enhance diagnosis and treatment of cancer, rare disorders, cardiovascular health, and women s reproductive health 13

Driving Operational Excellence 3 Driving operational excellent and efficiency is core to Quest out-performing competitors and outlast them in the face of PAMA reimbursement cuts and troubles General Overview Quote In optimizing operations Quest aims to enhance customer experience, improve quality and competitiveness, strengthen their foundation for growth, and increase employee engagement and shareholder value Quest Diagnostics is laser-focused on accelerating growth and driving operational excellence to continue building shareholder value. Our increasing number of partnerships with other health care leaders are creating promising opportunities for top and bottom line growth while improving the patient experience and reducing the overall cost of care. Through this optimization, Quest is looking to build a superior experience, at an unmatched cost for patients, health plans, and clinicians - President and Chief Executive Officer Steve Rusckowski Quest s major themes to drive operational excellence are reducing denials and patient concessions, standardizing and automating, digitizing the customer experience Digital Technology Flagship Lab In November of 2018, Quest announced plans to construct a 250,000 square foot flagship Laboratory in Clifton, NJ Improved electronic order rates, which improves lab productivity Eliminated paper documentation for certain Medicare beneficiaries Launched MyQuest digital platform used by nearly 9 million which enables them to make appointments and receive results Consumers registered with the MyQuest platform receive reminders via email and text message which has reduced no-shows and the number of lab orders that go unfulfilled The facility is expected to be operational in early 2021 The lab will enhance the diagnostic testing services it provides to over 40 million people the northeast The Lab is expected to consolidate 3 regional hub labs, double Quest s average throughput, and provide 30% more capacity 14

General Overview 4-8 Company Profile & Acquisitions Industry Analysis Situation Assessment Future Outlook 10-14 Industry Tailwinds Accelerated Growth Driving Operational Excellence Appendix 16-24 15

Valuation Comparable Companies Analysis Enterprise Value Included in Average Calculations? Projected 1-Year Growth Margins Turnover Company Name Net Income 9.3% 7.2% (0.1%) 6.5% (USDmm) 25,417 2,094 2,285 24,974 Revenue 3.2% 1.7% 7.7% 4.7% EBITDA 23.3% 6.5% 35.1% 11.8% EPS 89.3% 101.0% (1,987.7%) 59.4% Gross 81.2% 69.7% 21.3% 28.1% EBIT 14.4% 32.0% 4.8% 12.5% EBITDA 26.5% 43.9% 11.9% 16.7% Asset 0.8x 0.5x 0.9x 0.7x Inv. 44.4x 6.1x - - 35.0x Cerner Corporation Premier, Inc. RadNet, Inc. No No No Yes Laboratory Corporation of America Holdings Quest Diagnostics Incorporated $19,029 2.1% 6.0% 37.8% 35.3% 15.7% 20.0% 8.4% 0.6x 45.1x Included in Average Calculations? No No No Yes EV / Revenue EV / EBIT EV / EBITDA P/E Company Name ROE 11.5% - - 25.0% 10.4% ROC 7.7% - - 3.2% 5.3% LTM FY'20 4.3x 1.7x 1.9x 2.1x LTM 30.9x 5.3x 42.7x 17.5x FY'20 20.8x 5.3x 28.1x 14.1x LTM 16.8x 3.9x 17.3x 13.2x FY'20 13.6x 3.6x 12.8x 11.8x LTM 47.3x 22.4x (838.9x) 24.6x FY'20 25.0x 11.1x 44.4x 15.4x Cerner Corporation Premier, Inc. RadNet, Inc. 4.5x 1.7x 2.1x 2.2x Laboratory Corporation of America Holdings Quest Diagnostics Incorporated 16.0% 5.6% 2.5x 2.4x 15.7x 15.7x 12.3x 11.6x 23.1x 16.8x Implied EV Implied Share Price 16,942 $96.53 16,511 $93.28 21,243 $128.95 17,171 $98.25 20,318 $121.97 $19,256 $113.97 $119.02 $102.89 16

Valuation Historical Comparison P/E Ratio EV/EBITDA 30x 16x 14x 25x 12x 20x 10x 15x 8x 6x 10x 4x 5x 2x 0x 0x Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 Feb-20 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 Oct-15 Oct-16 Oct-17 Oct-18 Oct-19 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 Feb-20 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 Oct-15 Oct-16 Oct-17 Oct-18 Oct-19 DGX EV/EBITDA LH EV/EBITDA DGX P/E LH P/E 17

Valuation WACC Capital Structure Interest rate 4.750% 2.500% 4.700% 4.250% 3.500% 3.450% 4.200% 6.950% 5.750% 4.700% 2.950% 8.700% Debt-to-Total Capitalization Equity-to-Total Capitalization 26.55% 73.45% Debt Outstanding Senior Note Jan 2020 Senior Note March 2020 Senior Note April 2021 Senior Note April 2024 Senior Note March 2025 Senior Note June 2026 Senior Note June 2029 Senior Note July 2037 Senior Note January 2040 Senior Note March 2045 Senior Note June 2030 Finance Leases Operating Leases Amount % of Total Weighted 9.3% 5.6% 10.3% 5.8% 11.2% 9.2% 9.3% 3.3% 4.5% 5.6% 14.9% 0.6% $501 300 554 310 600 494 499 175 244 300 800 34 0.4% 0.1% 0.5% 0.2% 0.4% 0.3% 0.4% 0.2% 0.3% 0.3% 0.4% 0.1% Cost of Debt Cost of Debt Tax Rate After-tax Cost of Debt 4.00% 21.10% 3.16% 552 3.300% 10.3% 0.3% 4.0% Total Debt $5,363 Cost of Equity Risk-free Rate(1) Market Risk Premium(2) Levered Beta 2.00% 6.00% 0.90 Current Share Price Current Shares Outstanding $111.83 132.67 Equity Value Total Debt Total Equity $14,836.49 $5,363 $14,836.49 Cost of Equity 7.40% WACC 6.27% 18

Valuation DCF Base FYE December 31, 2017A $7,402.0 2.6% FYE December 31, 2022E $8,488.3 3.0% ($ in millions) Total Revenue Revenue Growth 2016A $7,214.0 2018A $7,531.0 1.7% 2019A $7,726.0 2.6% 2020E $8,000.5 3.6% 2021E $8,245.0 3.1% 2023E $8,723.3 2.8% 2024E $8,932.6 2.4% 2025E $9,092.7 1.8% 2024E $9,255.2 1.8% -- Expenses COGS Gross Profit Gross Margin SG&A R&D Operating Expenses Operating Income (EBIT) EBIT Margin Income Tax Expense (24%) EBIAT 4,576.0 $2,638.0 36.6% 1,380.0 72.0 1,452.0 $1,186.0 16.4% 429.0 $757.0 4,669.0 $2,733.0 36.9% 1,443.0 74.0 1,517.0 $1,216.0 16.4% 241.0 $975.0 4,870.0 $2,661.0 35.3% 1,424.0 90.0 1,514.0 $1,147.0 15.2% 182.0 $965.0 5,002.0 $2,724.0 35.3% 1,457.0 96.0 1,553.0 $1,171.0 15.2% 247.0 $924.0 5,160.3 $2,840.2 35.5% 1,480.1 104.0 1,584.1 $1,256.1 15.7% 263.8 $992.3 5,318.0 $2,927.0 35.5% 1,525.3 107.2 1,632.5 $1,294.5 15.7% 271.8 $1,022.6 5,432.5 $3,055.8 36.0% 1,527.9 110.3 1,638.2 $1,417.5 16.7% 297.7 $1,119.9 5,539.3 $3,184.0 36.5% 1,570.2 113.4 1,683.6 $1,500.4 17.2% 315.1 $1,185.3 5,672.2 $3,260.4 36.5% 1,563.2 116.1 1,679.3 $1,581.1 17.7% 332.0 $1,249.0 5,728.4 $3,364.3 37.0% 1,591.2 118.2 1,709.4 $1,654.9 18.2% 347.5 $1,307.4 5,830.8 $3,424.4 37.0% 1,619.7 120.3 1,740.0 $1,684.5 18.2% 353.7 $1,330.7 Cash Flow Plus: D&A Discretionary Cash Flow Less: Increase in NWC Less: CapEx Less: Acquisitions Free Cash Flow Free Cash Flow Growth 249.0 1,006.0 270.0 1,245.0 40.0 (252.0) (581.0) $452.0 (21.3%) 309.0 1,274.0 (86.0) (383.0) (421.0) $384.0 (15.0%) 329.0 1,253.0 (23.0) (400.0) (58.0) $772.0 101.0% 320.0 1,312.3 (54.2) (480.0) (200.0) $578.1 (25.1%) 329.8 1,352.4 (36.1) (577.1) (200.0) $539.2 (6.7%) 339.5 1,459.4 (17.7) (466.9) (150.0) $824.9 53.0% 348.9 1,534.3 (17.7) (479.8) (125.0) $911.7 10.5% 357.3 1,606.4 (9.2) (491.3) (100.0) $1,005.9 10.3% 363.7 1,671.1 (15.0) (500.1) (50.0) $1,106.0 10.0% 370.2 1,700.9 (7.3) (509.0) (50.0) $1,134.6 2.6% 0.0 (293.0) (139.0) $574.0 -- Unlevered Free Cash Flow WACC Discount Period Discount Factor Present Value of Free Cash Flow 6.27% 0.5 0.97 1.5 0.91 2.5 0.86 3.5 0.81 4.5 0.76 5.5 0.72 6.5 0.67 $560.7 $492.1 $708.5 $736.9 $764.9 $791.4 $764.0 19

Valuation DCF Base Enterprise Value DCF Sensitivity Analysis Cumulative Present Value of FCF Terminal Value Terminal Year EBITDA Exit Multiple Terminal Value Discount Factor Present Value of Terminal Value % of Enterprise Value Enterprise Value $4,818.6 WACC 124.80 9.5x 10.5x 11.5x 12.5x 13.5x 4.3% 5.3% 6.3% 7.3% $96.85 $106.66 $116.47 $126.28 $136.09 8.3% $90.20 $99.44 $108.68 $117.92 $127.16 $2,054.7 11.5x $23,628.6 67.33% $15,910.3 76.8% $20,728.8 $119.69 $131.49 $143.29 $155.08 $166.88 $111.55 $122.64 $133.73 $144.82 $155.91 $103.95 $114.38 $124.80 $135.23 $145.66 EV/EBITDA Method Comparable Companies DCF Fair Value Estimate Weight 20% 80% Price $114.0 $124.8 $122.64 DCF Implied Equity Value and Share Price Enterprise Value Less: Total Debt Plus: Cash & Cash Equivalents Implied Equity Value $20,728.8 $5,363.0 $1,192.0 $16,557.8 Implied Share Price Shares Outstanding $124.80 133 Comps Implied Equity Value and Share Price Enterprise Value Less: Total Debt Plus: Cash & Cash Equivalents Implied Equity Value Implied Share Price Shares Outstanding $20,318.0 $5,363.0 $1,192.0 $16,147.0 $121.71 133 20

Valuation DCF Upside FYE December 31, 2017A $7,402.0 2.6% FYE December 31, 2022E $8,620.9 3.7% ($ in millions) Total Revenue Revenue Growth 2016A $7,214.0 2018A $7,531.0 1.7% 2019A $7,726.0 2.6% 2020E $8,035.3 4.0% 2021E $8,315.3 3.5% 2023E $8,863.0 2.8% 2024E $9,092.2 2.6% 2025E $9,321.0 2.5% 2024E $9,495.6 1.9% -- Expenses COGS Gross Profit Gross Margin SG&A R&D Operating Expenses Operating Income (EBIT) EBIT Margin Income Tax Expense (24%) EBIAT 4,576.0 $2,638.0 36.6% 1,380.0 72.0 1,452.0 $1,186.0 16.4% 429.0 $757.0 4,669.0 $2,733.0 36.9% 1,443.0 74.0 1,517.0 $1,216.0 16.4% 241.0 $975.0 4,870.0 $2,661.0 35.3% 1,424.0 90.0 1,514.0 $1,147.0 15.2% 182.0 $965.0 5,002.0 $2,724.0 35.3% 1,457.0 96.0 1,553.0 $1,171.0 15.2% 247.0 $924.0 5,182.8 $2,852.5 35.5% 1,486.5 104.5 1,591.0 $1,261.5 15.7% 264.9 $996.6 5,321.8 $2,993.5 36.0% 1,496.7 108.1 1,604.8 $1,388.6 16.7% 291.6 $1,097.0 5,474.3 $3,146.6 36.5% 1,551.8 112.1 1,663.8 $1,482.8 17.2% 311.4 $1,171.4 5,583.7 $3,279.3 37.0% 1,595.3 115.2 1,710.6 $1,568.7 17.7% 329.4 $1,239.3 5,728.1 $3,364.1 37.0% 1,591.1 118.2 1,709.3 $1,654.8 18.2% 347.5 $1,307.3 5,872.2 $3,448.8 37.0% 1,631.2 121.2 1,752.3 $1,696.4 18.2% 356.2 $1,340.2 5,982.2 $3,513.4 37.0% 1,661.7 123.4 1,785.2 $1,728.2 18.2% 362.9 $1,365.3 Cash Flow Plus: D&A Discretionary Cash Flow Less: Increase in NWC Less: CapEx Less: Acquisitions Free Cash Flow Free Cash Flow Growth 249.0 1,006.0 270.0 1,245.0 40.0 (252.0) (581.0) $452.0 (21.3%) 309.0 1,274.0 (86.0) (383.0) (421.0) $384.0 (15.0%) 329.0 1,253.0 (23.0) (400.0) (58.0) $772.0 101.0% 321.4 1,318.0 (55.6) (482.1) (200.0) $580.3 (24.8%) 332.6 1,429.6 (45.0) (582.1) (200.0) $602.6 3.8% 344.8 1,516.2 (20.7) (517.3) (200.0) $778.3 29.2% 354.5 1,593.8 (18.4) (443.1) (100.0) $1,032.3 32.6% 363.7 1,671.0 (10.3) (454.6) (100.0) $1,106.1 7.1% 372.8 1,713.0 (10.2) (466.0) (100.0) $1,136.7 2.8% 379.8 1,745.1 (7.8) (474.8) (50.0) $1,212.5 6.7% 0.0 (293.0) (139.0) $574.0 -- Unlevered Free Cash Flow WACC Discount Period Discount Factor Present Value of Free Cash Flow 6.27% 0.5 0.97 1.5 0.91 2.5 0.86 3.5 0.81 4.5 0.76 5.5 0.72 6.5 0.67 $562.9 $550.0 $668.5 $834.3 $841.2 $813.4 $816.4 21

Valuation DCF Upside Enterprise Value DCF Sensitivity Analysis Cumulative Present Value of FCF Terminal Value Terminal Year EBITDA Exit Multiple Terminal Value Discount Factor Present Value of Terminal Value % of Enterprise Value $5,086.8 WACC 135.29 10.0x 11.0x 12.0x 13.0x 14.0x 4.3% 5.3% 6.3% 7.3% 8.3% $2,108.0 12.0x $25,296.3 67.33% $17,033.2 77.0% $130.84 $118.74 $118.74 $130.84 $155.05 $140.24 $127.35 $127.35 $140.24 $166.01 $140.24 $127.35 $127.35 $140.24 $166.01 $130.84 $118.74 $118.74 $130.84 $155.05 $113.89 $103.19 $103.19 $113.89 $135.29 EV/EBITDA Enterprise Value $22,120.0 Method Comparable Companies DCF Weight 20% 80% Price $114.0 $135.3 Implied Equity Value and Share Price Enterprise Value Less: Total Debt Plus: Cash & Cash Equivalents Implied Equity Value Implied Share Price Shares Outstanding $22,120.0 $5,363.0 $1,192.0 $17,949.0 $135.29 $131.03 Fair Value Estimate 133 Comps Implied Equity Value and Share Price Enterprise Value Less: Total Debt Implied Equity Value Implied Share Price Shares Outstanding $20,318.0 $5,363.0 $14,955.0 $112.72 133 22

Valuation DCF Downside FYE December 31, 2017A $7,402.0 2.6% FYE December 31, 2022E $8,389.6 2.8% ($ in millions) Total Revenue Revenue Growth 2016A $7,214.0 2018A $7,531.0 1.7% 2019A $7,726.0 2.6% 2020E $7,960.2 3.0% 2021E $8,163.2 2.6% 2023E $8,557.3 2.0% 2024E $8,727.4 2.0% 2025E $8,856.5 1.5% 2024E $8,966.0 1.2% -- Expenses COGS Gross Profit Gross Margin SG&A R&D Operating Expenses Operating Income (EBIT) EBIT Margin Income Tax Expense (24%) EBIAT 4,576.0 $2,638.0 36.6% 1,380.0 72.0 1,452.0 $1,186.0 16.4% 429.0 $757.0 4,669.0 $2,733.0 36.9% 1,443.0 74.0 1,517.0 $1,216.0 16.4% 241.0 $975.0 4,870.0 $2,661.0 35.3% 1,424.0 90.0 1,514.0 $1,147.0 15.2% 182.0 $965.0 5,002.0 $2,724.0 35.3% 1,457.0 96.0 1,553.0 $1,171.0 15.2% 247.0 $924.0 5,174.1 $2,786.1 35.0% 1,512.4 103.5 1,615.9 $1,170.1 14.7% 245.7 $924.4 5,306.1 $2,857.1 35.0% 1,551.0 106.1 1,657.1 $1,200.0 14.7% 252.0 $948.0 5,411.3 $2,978.3 35.5% 1,552.1 109.1 1,661.1 $1,317.2 15.7% 276.6 $1,040.6 5,519.4 $3,037.8 35.5% 1,583.1 111.2 1,694.3 $1,343.5 15.7% 282.1 $1,061.4 5,629.2 $3,098.2 35.5% 1,614.6 113.5 1,728.0 $1,370.2 15.7% 287.7 $1,082.5 5,668.2 $3,188.3 36.0% 1,682.7 115.1 1,797.9 $1,390.5 15.7% 292.0 $1,098.5 5,738.2 $3,227.8 36.0% 1,703.5 116.6 1,820.1 $1,407.7 15.7% 295.6 $1,112.0 Cash Flow Plus: D&A Discretionary Cash Flow Less: Increase in NWC Less: CapEx Less: Acquisitions Free Cash Flow Free Cash Flow Growth 249.0 1,006.0 270.0 1,245.0 40.0 (252.0) (581.0) $452.0 (21.3%) 309.0 1,274.0 (86.0) (383.0) (421.0) $384.0 (15.0%) 329.0 1,253.0 (23.0) (400.0) (58.0) $772.0 101.0% 318.4 1,242.8 (45.5) (398.0) (200.0) $599.3 (22.4%) 326.5 1,274.5 (34.2) (489.8) (200.0) $550.5 (8.1%) 335.6 1,376.2 (43.7) (503.4) (200.0) $629.0 14.3% 342.3 1,403.6 (7.6) (513.4) (100.0) $782.6 24.4% 349.1 1,431.6 (7.7) (436.4) (100.0) $887.5 13.4% 354.3 1,452.7 (13.4) (442.8) (100.0) $896.5 1.0% 358.6 1,470.7 (5.1) (448.3) (50.0) $967.3 7.9% 0.0 (293.0) (139.0) $574.0 -- Unlevered Free Cash Flow WACC Discount Period Discount Factor Present Value of Free Cash Flow 6.27% 0.5 0.97 1.5 0.91 2.5 0.86 3.5 0.81 4.5 0.76 5.5 0.72 6.5 0.67 $581.4 $502.5 $540.3 $632.5 $674.9 $641.5 $651.4 23

Valuation DCF Downside Enterprise Value DCF Sensitivity Analysis Cumulative Present Value of FCF Terminal Value Terminal Year EBITDA Exit Multiple Terminal Value Discount Factor Present Value of Terminal Value % of Enterprise Value $4,224.4 WACC 99.01 9.0x 10.0x 11.0x 12.0x 13.0x 4.3% $94.00 $83.85 $83.85 $94.00 $114.28 5.3% 6.3% 7.3% $94.00 $83.85 $83.85 $94.00 $114.28 8.3% $81.08 $72.12 $72.12 $81.08 $99.01 $1,766.3 11.0x $19,429.3 67.33% $13,082.6 75.6% $101.15 $90.35 $90.35 $101.15 $122.75 $101.15 $90.35 $90.35 $101.15 $122.75 EV/EBITDA Method Comparable Companies DCF Weight 20% 80% Price $114.0 $99.0 Enterprise Value $17,307.1 Implied Equity Value and Share Price Enterprise Value Less: Total Debt Plus: Cash & Cash Equivalents Implied Equity Value Implied Share Price Shares Outstanding $17,307.1 $5,363.0 $1,192.0 $13,136.1 $99.01 $102.00 Fair Value Estimate 133 Comps Implied Equity Value and Share Price Enterprise Value Less: Total Debt Implied Equity Value Implied Share Price Shares Outstanding $20,318.0 $5,363.0 $14,955.0 $112.72 133 24