Mississippi Home Corporation - National Housing Trust Fund Program Overview

Mississippi Home Corporation (MHC) administers the National Housing Trust Fund (HTF) Program in Mississippi to address housing needs for low-and-moderate-income residents. The program aims to enhance economic viability by providing safe, decent, and affordable housing options, helping families build wealth. The HTF Program serves extremely low-income and very low-income households, focusing on rental housing production, preservation, rehabilitation, and operation. Freddie Mac and Fannie Mae fund the HTF Program, distributing block grants to states without annual appropriations. Eligible applicants are encouraged to apply for funding through the 2020 HTF Program and can access application resources on MHC's website.

- Mississippi Home Corporation

- National Housing Trust Fund Program

- Affordable Housing

- Low-Income Housing

- Rental Housing

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

MISSISSIPPI HOME CORPORATION National Housing Trust Fund (HTF) Program HTF Application Training 735 Riverside Dr. / Jackson, MS / 601.718.4642 / mshomecorp.com

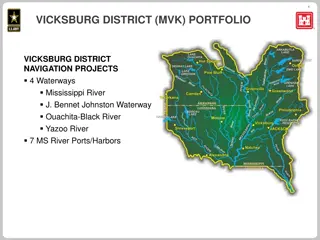

HISTORY The Mississippi Home Corporation (MHC), State Housing Finance Authority. MHC was created by the Mississippi Home Corporation Act of 1989 to address housing needs for low-and-moderate income Mississippians. MHC s mission is to enhance Mississippi s long-term economic viability by financing safe, decent, affordable housing and helping working families build wealth. MHC is responsible for administering the HTF Program

NATIONAL HOUSING TRUST FUND HTF Program 2020 Application Training-Workshop

TRAINING AGENDA TRAINING AGENDA Welcome HTF Program Overview Compliance Overview Notice of Funding Availability Application Process/Timeline Application Source/Documentation Q & A Contact Information

WELCOME WELCOME Welcome to the 2020 HTF Program Application Training. The purpose of this application training is to provide guidance for the 2020 HTF Application Process. The online application, HTF ALLOCATION PLAN & guidelines are available on MHC s website @ www.mshomecorp.com/federal-programs/htf/ MHC encourages all eligible applicants to apply for funding.

HTF PROGRAM OVERVIEW

HTF PROGRAM OVERVIEW Housing and Economic Recovery Act of 2008 (HERA), July 30, 2008 Freddie Mac and Fannie to fund the NHTF Not subject to the annual appropriations process HTF statue requires money to be distributed as block grants to states by formula Each subject to receive a minimum of three (3) million allocation.

PURPOSE Increase and preserve the supply of rental housing for extremely low-income households earning less than 30% of area median income (AMI) and very low-income households earning less than 50% of area median income (AMI) or Federal Poverty guidelines published by the Department of Health and Human Services Funds used for the production, preservation, rehabilitation, or operation of rental housing HTF is primarily a rental housing program

PROGRAM REQUIREMENTS HTF Interim Regulations (24 CFR 93), January 30, 2015 Administered by HUD State s Consolidated (Plan 24 CFR 91) HTF Annual Allocation Plan-(Demonstrate the distribution of NHTF based on priority housing needs)

HTF METHOD OF DISTRIBUTION HTF METHOD OF DISTRIBUTION The distribution of funds to recipients will be based on priority housing needs as determined by the grantee in accordance with the HTF regulations (24 CFR Part 93) and the State s Consolidated (Plan 24 CFR 91).

HTF APPLICATION HTF APPLICATION TRAINING GOALS & OBJECTIVES TRAINING GOALS & OBJECTIVES PROVIDE GUIDANCE IN THE DEVELOPMENT OF APPLICATIONS ENSURE REGULATORY AND PROGRAMMATIC COMPLIANCE DISTRIBUTE FUNDING ACCORDING TO THE METHOD OF DISTRIBUTION ACHIEVE THE GREATEST RETURN BY COMBINING HTF WITH OTHER SOURCES TO PRODUCE AND PRESERVE AFFORDABLE HOUSING INCREASE AND PRESERVE THE SUPPLY OF RENTAL HOUSING FOR INCREASE AND PRESERVE THE SUPPLY OF RENTAL HOUSING FOR EXTREMELY LOW INCOME (ELI) HOUSEHOLDS EXTREMELY LOW INCOME (ELI) HOUSEHOLDS ENCOURAGE SUPPORTIVE SERVICES TO BUILD WEALTH AND ASSETS FOR ENCOURAGE SUPPORTIVE SERVICES TO BUILD WEALTH AND ASSETS FOR BENEFICIARIES BENEFICIARIES ENSURE THAT SUB-RECIPIENTS AFFIRMATIVELY FURTHER FAIR HOUSING DEVELOP AND IMPLEMENT AFFORDABLE HOUSING TAILORED TO LOCAL NEEDS AND PRIORITIES

HTF ALLOCATION PLAN HTF ALLOCATION PLAN The HTF ALLOCATION PLAN is a collection of guidance and instructional materials, relevant information, forms, requirements, and other data necessary for submission of successful & competitive applications.

NATIONAL HOUSING TRUST FUND NATIONAL HOUSING TRUST FUND (HTF) PROGRAM (HTF) PROGRAM 24 CFR Part 93 24 CFR Part 93

NATIONAL HOUSING TRUST FUND (NHTF) NATIONAL HOUSING TRUST FUND (NHTF) ELIGIBILITY Non-Profit Organizations and For-Profit Organizations Construction, Rehabilitation Rental Housing Income Restrictions/Targeting Extremely low-income households @ 30% AMI Must adhere to Priority Housing Needs

HTF ELIGIBLE APPLICANTS HTF ELIGIBLE APPLICANTS Must have demonstrated development experience and capacity with creating, rehabilitating or preserving affordable housing.

F HTF RENTAL DEVELOPMENT HTF RENTAL DEVELOPMENT Provide rental housing for EXTREMELY LOW INCOME households. Eligible activities: 1) New construction/acquisition of rental housing 2) Substantial rehabilitation of rental housing

F HTF RENTAL DEVELOPMENT HTF RENTAL DEVELOPMENT Eligible Property Type: Eligible Property Type: Single Family Housing Developments Multi-Family Housing Developments

HTF RENTAL DEVELOPMENT MAXIMUM AWARD Maximum Award per applicant is $1.5 million Funds serve as GAP Financing Funds serve as GAP Financing SUBSIDY LAYERING ANALYSIS Determine costs are reasonable Verifiable sources and uses of funds Amounts requested are necessary Uses are determined feasible.

HTF RENTAL DEVELOPMENT HTF RENTAL DEVELOPMENT Funds distributed through a competitive process. Structured as Cash Flow Loan.

VHTF HTF PROCESS/CRITERIA PROCESS/CRITERIA Awards structured as a loan which will mitigate risk to eligible basis in developments also using LIHTC. Structured as payable from available cash flow to minimize project debt and maximize affordability to ELI households. Terms of loans will be set by MHC underwriting and designed to ensure that the use of HTF dollars ae maximized; the project will maintain viability; and the greatest possible return on investment.

FEDERAL REQUIREMENTS Federally funded projects must adhere to a broad base of federal regulations. Application & Implementation of HTF Program. Located 2020 HTF Allocation Plan & Federal Register.

ELIGIBLE & INELIGIBLE PROJECT COST

PROJECT COST Costs funded with HTF funds must be eligible according to 2020 HTF Allocation Plan. All project costs must be reasonable and necessary.

ELIGIBLE PROJECT COST HTF funds awarded to an eligible project as a result of this application may be used for the following associated project costs: Acquisition of Property: Acquisition of an existing standard property, or a substandard property in need of rehabilitation. Acquisition of Vacant Land: Acquisition of vacant land to be used for the new construction of rental and/or homebuyer housing. Note: Applicant must demonstrate that construction will begin on the HTF project within (12) months of the purchase. New Construction: New construction of rental housing. Rehabilitation: The alteration, improvement, or modification of an existing structure. Note: If additional housing units are added to an existing structure, it is then considered new construction.

ELIGIBLE PROJECT COST On-Site Improvements: This can include sidewalks, utility connections, sewer and water line connections where none are present. Note: Off- site infrastructure is not eligible as a HTF expense but may be a part of the overall project. Demolition: Demolition of an existing structure only if construction will begin on the HTF project within twelve (12) months. Project Related Soft Costs: Reasonable and necessary project related costs, including but not limited to: Financing costs, architectural, engineering and related professional services, audit costs, affirmative marketing, insurance, legal fees, market studies, permits, environmental studies, and other related soft costs approved by MHC.

INELIGIBLE PROJECT COST HTF funds awarded to an eligible project as a result of this application shall not be used to support or pay for the following: Off-site infrastructure costs not related to utility hookups. Ongoing operating and maintenance funding. Rental assistance (project or tenant-based) Delinquent taxes or fees. Equipment purchases. Refinancing (payoff of bridge financing is allowable if costs are eligible). A project already assisted with HTF funds. Capitalization of operating or replacement reserves. Relocation payments. Other ineligible costs as defined by the HTF guidelines.

CITIZEN PARTICIPATION For-profit, Non-profit organizations and developers seeking HTF funding in conjunction with Low Income Housing Tax Credits (LIHTC) will satisfy the Citizen Participation requirement with the Public Hearing held for the Qualified Allocation Plan (QAP). Citizen participation requirements must be met prior to submittal of an application for HTF funding.

PERIOD OF AFFORDABILITY REQUIREMENT

AFFORDABILITY PERIODS Minimum Term of Affordability 30 years Monitoring/On-Site Inspections HTF Assisted Units Tenants Subject to Recapture

UNDERWRITING & SUBSIDY LAYERING REVIEW

SUBSIDY LAYERING REVIEW MHC is required per HUD regulations to conduct a subsidy layering review on all projects applying for HTF funding. The purpose of the layering review is to determine if more government funds (federal, state, or local) than necessary are going into the project. Projects deemed to be over subsidized by government funds will either not receive HTF funding or will have the HTF funding reduced. The layering review must be completed prior to any commitment of HTF funds to a project. All layering reviews will include a review of the per unit HTF subsidy requirements and a review to ensure that all costs being funded by the HTF Program are eligible and reasonable. Rental Projects-The layering review includes a review of the development budget with the sources and uses of all the project funding and a review of operating budget (pro forma) that is provided in the funding application.

HUD/HTF PER UNIT SUBSIDY LIMITS The amount of HTF funds requested cannot exceed the HUD/HTF per unit subsidy limits. Sources/uses of funds: Sources/uses of funds: As part of the application process, applicants should submit a sources/uses of funds statement for the project with supportive documentation. This should reflect the project development budget and list all proposed sources and uses of funds. Maximum Subsidy Limits: www.mshomecorp.com/federal- programs/htf

PROPERTY & REHABILITATION STANDARDS HTF-funded properties must meet certain property standards as specified below: State and Local Codes: State and local codes and ordinances apply to any HTF funded project regardless of the project type. Projects involving construction and/or rehabilitation must address applicable local building codes. Projects involving rehabilitation must also meet local written rehabilitation standards

PROPERTY & REHABILITATION STANDARDS Model Codes: New construction projects must meet local building codes, model energy codes, Section 504 accessibility requirements and neighborhood standards requirements. For rehabilitation projects, the property must meet local building codes, handicapped accessibility requirements, and rehabilitation standards. Construction and rehabilitation: Housing that is being constructed or rehabilitated with HOME funds must meet all applicable state and local codes, rehabilitation standards and ordinances. If no state and local codes apply, the property must meet one of the national standards.

HTF FUNDED UNIT ALLOCATION The minimum number of HTF assisted units and the unit designations (fixed vs. floating for rental) must be determined prior to the execution of any HTF written agreement. The number of HTF units is determined by the percentage of the HTF investment in the project. The total HTF investment is divided by the total HTF eligible project costs to determine the percentage of HTF funds in the project.

SITE & NEIGHBORHOOD STANDARDS Requirements of 24 CFR Part 8 (which implement section 504 of the Rehabilitation Act of 1973) apply to HOME and specifically address the site selection with respect to accessibility for persons with disabilities. HTF assisted new construction projects must comply with standards.

INCOME & RENT RESTRICTIONS

INCOME & RENT RESTRICTIONS To qualify as affordable housing, HTF- Assisted units must be applicable to households with certain incomes at regulated rents.

INCOME LIMITS Extremely Low-Income Families: Families whose annual incomes do not exceed 30 percent of the median income for the area (adjusted for family size). Income limits are published by HUD on an annual basis. Income limits are posted on MHC s website at www.mshomecorp.com/federal-programs/htf/

RENT LIMITS Rents should be in line with the target population served. Rents should represent 30% of the gross income of the target population, but not to exceed maximum HTF rents. Rent limits are published by HUD on an annual basis. Rent limits are posted to MHC s website at www.mshomecorp.com/federal-programs/htf/

CONFLICT OF INTEREST To comply with HTF Requirements and to maintain a high standard of accountability to the public, conflicts of interest and perceived conflicts of interest must be avoided. Owners shall maintain compliance with all HUD conflict of interest provisions as stated in HTF ALLOCATION PLAN & federal regulations.

CONFLICT OF INTEREST No person who is an employee, agent, consultant, officer, elected or appointed official of the Recipient or Sub- Recipient who exercises any functions or responsibilities with respect to HTF activities, is in a position to participate in the decision making process, or gains inside information with regard to such activities may: obtain a financial interest or benefit from a HTF activity; have a financial interest in any contract with respect to a HTF activity or its proceeds for themselves or those they have business or immediately family ties (relatives).

FAIR HOUSING ACT FAIR HOUSING ACT

FAIR HOUSING ACT FAIR HOUSING ACT The Fair Housing Act declares that it is the policy of the United States to provide constitutional limitations for fair housing throughout the United States . As a requirement for participating in HUD s housing and community development programs, agencies receiving federal funding shall utilize affirmative marketing procedures to ensure non-discrimination in housing or service directly or indirectly HUD oversees, administers, and enforces the federal Fair Housing Act

FAIR HOUSING ACT FAIR HOUSING ACT All assisted housing must meet the accessibility requirements of the Fair Housing Act and Section 504 of the Rehabilitation Act of 1973. Accessibility: All assisted housing must meet the accessibility requirements of the Fair Housing Act and Section 504 of the Rehabilitation Act of 1973