Best Practices for Cash Handling and Receipt Management

Enhance your cash handling and receipt management practices with essential guidelines such as separation of duties, internal controls, and proper handling of funds and transactions. Discover key insights on authorized departments, standards for receipts and funds handling, and ways to share responsibilities effectively. Explore the comprehensive scope of cash handling beyond currency, including checks, credit/debit card transactions, and various modes of receiving payments.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Receipts & Cash Handling Training CASH AND TREASURY SERVICES

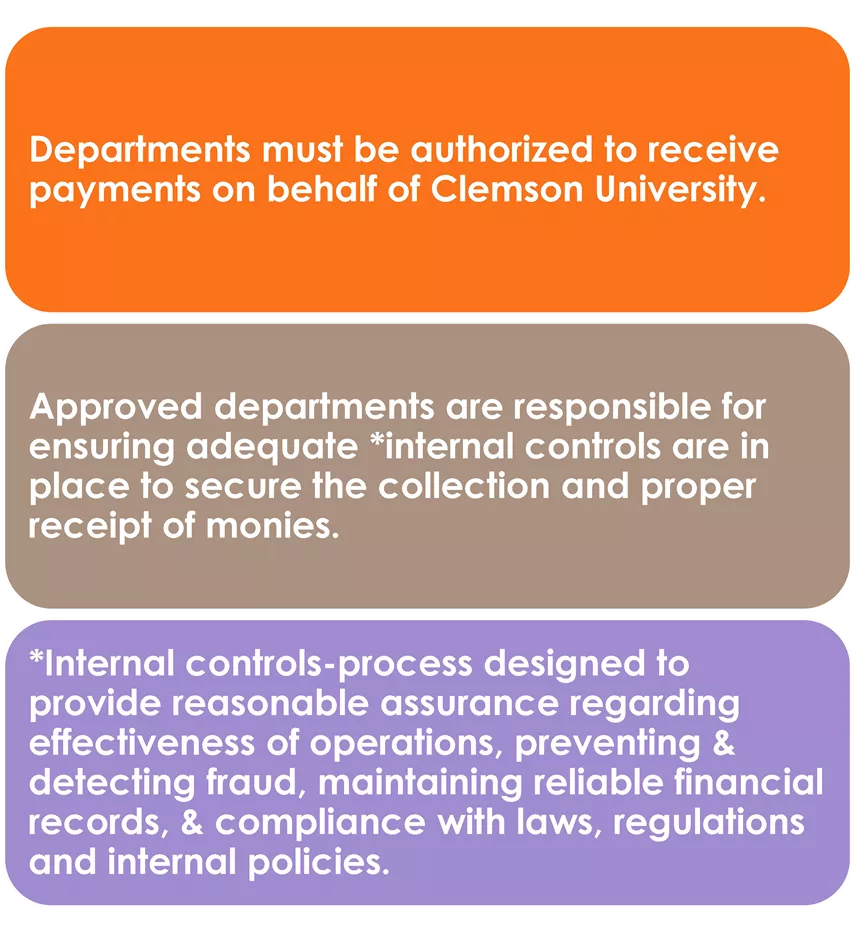

Departments must be authorized to receive payments on behalf of Clemson University. Approved departments are responsible for ensuring adequate *internal controls are in place to secure the collection and proper receipt of monies. Policy *Internal controls-process designed to provide reasonable assurance regarding effectiveness of operations, preventing & detecting fraud, maintaining reliable financial records, & compliance with laws, regulations and internal policies.

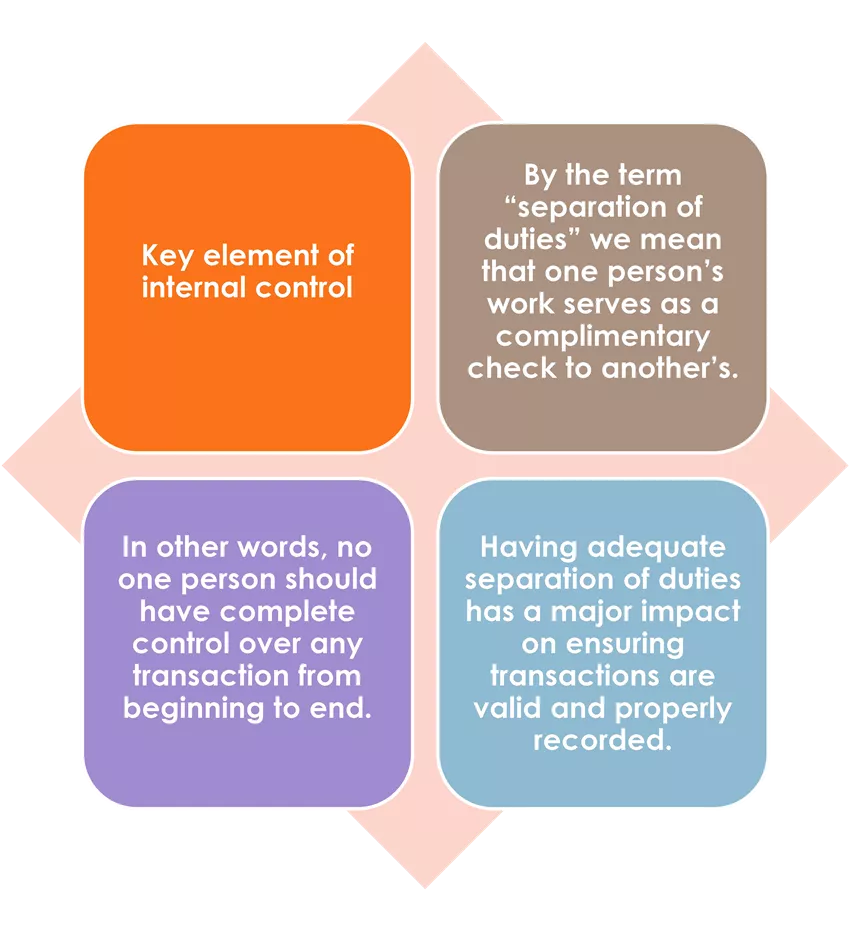

By the term separation of duties we mean that one person s work serves as a complimentary check to another s. Key element of internal control Separation of Duties In other words, no one person should have complete control over any transaction from beginning to end. Having adequate separation of duties has a major impact on ensuring transactions are valid and properly recorded.

Standards of separation of duties should be applied to the maximum degree possible. Separation of Duties for Receipt & Handling of Funds Clear lines of authority and responsibility should be established in order to segregate the various steps in the transaction. Specifically, the person who accepts funds (in person & thru mail) and issues receipts must not prepare the deposit. Additionally, the person who prepares the deposit must not reconcile the CUBS account.

If you dont think that you have enough people to separate the collecting, depositing, and reconciling functions then your department will have to develop mitigation controls . Separation of Duties for Receipt & Handling of Funds Is there a way to share responsibilities with another department? If the separation of duties is a problem for your department, please contact Cash and Treasury Services or Internal Audit.

What is included in Cash Handling? It's not just cash . It includes the following: Coins Currency Cash Handling Checks (Cashier s Check s, Travelers Checks) Money Orders Credit & Debit Card Transactions

Ways to Receive Money In person/walk-in traffic Mail

Walk-in Payments RECEIPT REQUIRED! Departments must record each transaction by submitting a receipt in the online Clemson Receipting System (CRS), pre-numbered receipt book, a cash register, or other pre-approved receipting method in the presence of the customer or payer. A receipt must be delivered to the payer either electronically or in printed form. **Receipt books are for use when an employee does not have access to a computer. Generic receipt books are not permitted. Receipt books can be purchased online for $10.00 each. To order receipt books from Cash & Treasury Services go to: http://www.clemson.edu/finance/cash-treasury/cash- receipting/supplies.html

To access the CRS system: https://receipts.app.clemson.edu /login/sign-in.php Employees will log in with their CU user name and password. Receipts may only be voided by supervisors. For this reason, only supervisors will see the option to Void Receipts Clemson Receipting System (CRS) Operation instructions for the CRS system (under receipts) https://www.clemson.edu/financ e/business-manual/as37proc.html

Receipts-(Book) Department name Purpose of Payment Name of payer Signature of person accepting payment Date Form of payment (cash, check, money order, or credit card) Amount of Payment

Receipts (Book) Receipts are pre-numbered Most receipt books contain two-part receipts. The original receipt (white copy) is issued to the individual from whom the fee is collected. Retain one copy of the receipt in the receipt book (yellow copy).

Because each receipt is pre- numbered, all receipts must be accounted for at all times. Receipt Book Voiding a Receipt When voiding a receipt, write VOID, the reason, and have a supervisor sign the receipt. Keep all copies of voided items in the receipt book.

If payments are received in the mail, the person opening the mail should receipt each check in the CRS system. After entry of each check, the employee may pull a report for that day and download the report to an excel spreadsheet and print a copy of the report. Payments Received in the Mail If a computer is not accessible, the employee may prepare a handwritten log or use a pre- approved method of recording the items. An Excel spreadsheet may be used if the log is printed and signed each day by the responsible employee. The log should be kept in a designated notebook.

Check Log Information The following information should be recorded in a check log: Date mail was received in the department Check date Payer Amount Check number

Handling Cash, Checks, Money Orders & Credit Card Payments All funds must be properly secured prior to making the deposit. Access to the funds should be restricted to one person to ensure proper accountability. Checks and money orders must be payable to Clemson University- not department name, employee name or event name. Credit Card Information such as the signed merchant copies and Batch Settlements must be properly secured. Clemson University prohibits the storage of any cardholder data. Never store whole credit card numbers or a card s security code.

Endorsing Checks All checks and money orders should be restrictively endorsed upon receipt. Authorized receipting areas are responsible for obtaining the necessary restrictive endorsement stamps. To order these stamps, contact Cathy Freeman in Cash and Treasury Services at cdorfne@clemson.edu.

Restrictive Endorsement Stamp YOUR DEPARTMENT NAME FOR DEPOSIT ONLY CLEMSON UNIVERSITY DEPOSIT SWEEP ACCOUNT

Timeliness of Deposits Departments receiving cash, money orders, credit cards, and/or checks daily must deposit funds no later than the next business day after the day the funds are received. Departments receiving cash, money orders, credit cards, and/or checks less frequently than daily must deposit funds no later than 3 business days after the day the funds are received.

Timeliness of Deposits Any instances in which it appears deposits are not being made in accordance with the receipts policy will be reported to the appropriate department/division personnel. Internal Audit will also be notified.

Preparing Deposit Deposits must be made intact. No deductions should be taken from the funds collected prior to the deposit. Remember, deposits should always equal the amount collected. All funds deposited must be documented in the online CRS system, receipt book, cash register, or mail log.

Preparing a Deposit These are the steps you should follow when preparing your deposit to go to the bank. Prepare the deposit slip. List currency and coin at the top of the slip. Coin should be limited to $10.00 or less. If you have more than $10.00 in coin, you must prepare a separate deposit. You should have two adding machine tapes for your checks, one to include with your checks to the bank and one to attach to your web deposit print out (for your dept records). Over $50 in coin, prepare a separate deposit and take the deposit inside for processing. You must wait for a receipt. Enter deposit in TouchNet as a web deposit.

Preparing a Deposit (Cont.) Write down the total amount of the checks on the deposit slip. PLEASE DO NOT LIST EACH INDIVIDUAL CHECK ON THE DEPOSIT SLIP. PLEASE DO NOT USE MORE THAN ONE DEPOSIT SLIP FOR A DEPOSIT. The adding machine tape is the list. ***NOTE: For all departments that accept credit cards, please make sure that you do not include your credit card total with your bank deposit. The credit card deposit amount is only included when entering the web deposit.

Deposit Slip Bag # WD#

Preparing a Deposit (Cont.) You will put the deposit slip in the bottom pocket of the Wells Fargo disposable bank bag with all checks and/or money orders & adding machine tape. You should write your bag number and your web deposit number on the bank deposit slip. Any cash or coin will go in the top pocket of the bag. Please make sure both pockets are sealed. You will not receive a receipt from Cash and Treasury Services. In order to verify that your deposit has been received, you should pull up the following query in PeopleSoft daily: CASH_RECEIPTS_DEPT. Note: There is a two day delay with the query. 2.

Preparing a Deposit (Cont.) You will take the prepared disposable night drop bag to Wells Fargo Bank on 123 By Pass in Clemson. The bag must be dropped in the night drop, not taken into the branch. The night drop is located on the brick wall of the bank, through the first drive through window. Credit Card Only Deposit: Enter the deposit in TouchNet as a web deposit. You will keep the credit card batch and slips in your office for safekeeping. You will complete and submit the Deposit Information Form (DIF). The DIF is submitted for credit cards only. Click here Click here to view our online Deposit Procedures page

Transporting the Deposit If you have the responsibility for taking the deposit to the bank, for your safety: Put the Wells Fargo bank bag in a book bag or tote bag in order to disguise the deposit. You do not want to advertise that you have a deposit. Do not take the same route or go exactly at the same time every day.

Web Deposits In order for your department to receive credit for deposits, in addition to the bank deposit, a web deposit must be entered online through the Touchnet system. The deposit at the bank gives Clemson University credit for the funds, however, by entering the web deposit online through Touchnet, this claims the funds accepted by your office (gives credit to your dept). You will enter the deposit in Touchnet with your desired department 23 digit account string. **Instructions for web deposit entry are found at: https://www.clemson.edu/finance/cash-treasury/cash- receipting/deposits.html You may request in person training if needed. Contact Gail Winchester to set up a meeting.

Deposit Information Form (DIF)

Verification of Deposits For verification of your deposits, you should run the below query in PeopleSoft. Since there is a 2-day delay with the query, you will see your deposits 2 days after Cash and Treasury Services submits your deposit.

Over/Short Deposits Deposits processed by Wells Fargo are Post Verify. This means they give you a temporary credit for the deposit amount written on the deposit slip. During nightly processing, Wells Fargo back office will verify the actual deposit and provide Cash and Treasury Services notice of any deposit error(s). The responsible department will be contacted by Cash and Treasury Services to discuss any discrepancies.

Items Returned Unpaid Cash and Treasury Services will automatically resubmit a check twice. Should the check be returned the second time, it will be deemed uncollectable & charged back to the department that accepted the check. Cash and Treasury will process a journal debiting the account originally credited by the department. Cash and Treasury will provide a copy of the journal to the department. The department must attempt to collect reimbursement from their customer. The check amount plus the returned check fee ($30.00) should be collected. The returned check fee must be credited to account #4755. Returned check policy may be found at: https://www.clemson.edu/finance/documents/business- manual/return-procedure.pdf

Department revenue transactions are to be reconciled monthly. Reconciliation must include a comparison of the source documents (CRS receipts, receipt book copies, check log) to the transactions listed on the monthly Revenue Report. Adequate separation of duties must be maintained. Reconciliation Employees should be adequately trained to complete the reconciliation process.

Documentation of the reconciliation including notations of any outstanding/unidentified items must be maintained. Reconciliation (Cont.) Reconciliation must be signed & dated by the reconciler.

Print Print the Revenue Detail Report from data warehouse. Verify that all receipts from the Clemson Receipting System (CRS) and/or pre-numbered receipts from receipt books, and/or daily mail logs are accounted for including any voided items. Reconciliation Steps Verify Trace original documents (CRS receipts, pre- numbered receipts, cash register reports, mail log) for each deposit to the web deposit and then to the Revenue report. Trace

Reconciliation Steps (Cont.) Inquire about items on the revenue report for which there is no documentation or items that have documentation but no accounting entry on the Revenue Detail Report. Clear all reconciling items ASAP. Sign and date reconciliation

Security and Confidential Information Confidential information generally consists of non-public information about a person. Confidential information includes but is not limited to: Social security numbers, driver s license numbers, credit and debit card information, and financial account information. All employees with job duties that require them to handle confidential information are required to safeguard such information. Do not make copies of checks or keep credit card numbers on file

Separation of duties is a must. Receipts are required for walk-in payments. Mail-in payments must be recorded. THINGS TO REMEMBER!!! Source documents = On line CRS Receipt, receipt book copies, mail log, and or cash register reports Reconciliation must include comparing source documents to the revenue detail reports. Comparing Cash Receipts Dept Query to the revenue detail report is not a true reconciliation.

Audit Findings Not creating receipts or maintaining a mail log Disbursements made from cash receipts prior to deposit No reconciliation of revenue going back to the source documents. Timeliness of deposits Receipt numbers not included with the web deposit description Separation of Duties No A/R follow up-follow up on bad debts Reconciliation not signed and dated Voided receipts not approved by supervisor

Services Offered by Cash and Treasury E-Commerce/CU Marketplace Merchant Card Services Banking Services Petty Cash/Change Funds Travel Advances

Ethics/Safety Line The Ethics/Safety Line is a confidential service hosted by Lighthouse Services, a third-party vendor. Concerns may be anonymously reported via the web or by phone. www.clemson.edu/administration/internalaudit/ethicsline.html Toll Free: 1-877-503-7283 http://www.lighthouse-services.com/clemson Available 24 hours a day, seven days a week.

Points of Contact Gail Winchester Cash Management Analyst Cash and Treasury Services 864-656-5601 gailg@clemson.edu http://www.clemson.edu/cfo/cash-treasury/cash- receipting/index.html

Internal Audit OFFICE OF INTERNAL AUDITING 391 College Avenue, Suite 402 Clemson, SC 29634 864-656-2387 STAFF Adam Fisher Director fishera@clemson.edu 864-656-4897 Arthur Leonard Assistant Director ajleona@clemson.edu 864-656-4899 Jeff Rosenberger Audit Manager rjeffre@clemson.edu 864-656-4896 Megan Brooks Audit Manager mbrook8@clemson.edu 864-656-4895 Neil Owens IT Audit Manager owensn@clemson.edu 864-656-4903 Valis Fleming Senior Auditor vflemin@clemson.edu 864-656-4900 Eric Stanley Senior Auditor estanl2@clemson.edu 864-656-4901 Janet Lollis Administrative Coordinator janetl@clemson.edu 864-656-2387

undefined

undefined