Understanding Cash Management and Motives for Holding Cash

Cash management involves the management of both cash and near-cash assets such as marketable securities. Companies hold cash for various motives including transaction, precautionary, speculative, and compensation motives. The objectives of cash management include meeting cash disbursement needs and minimizing cash balances to prevent funds from being locked up unnecessarily.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

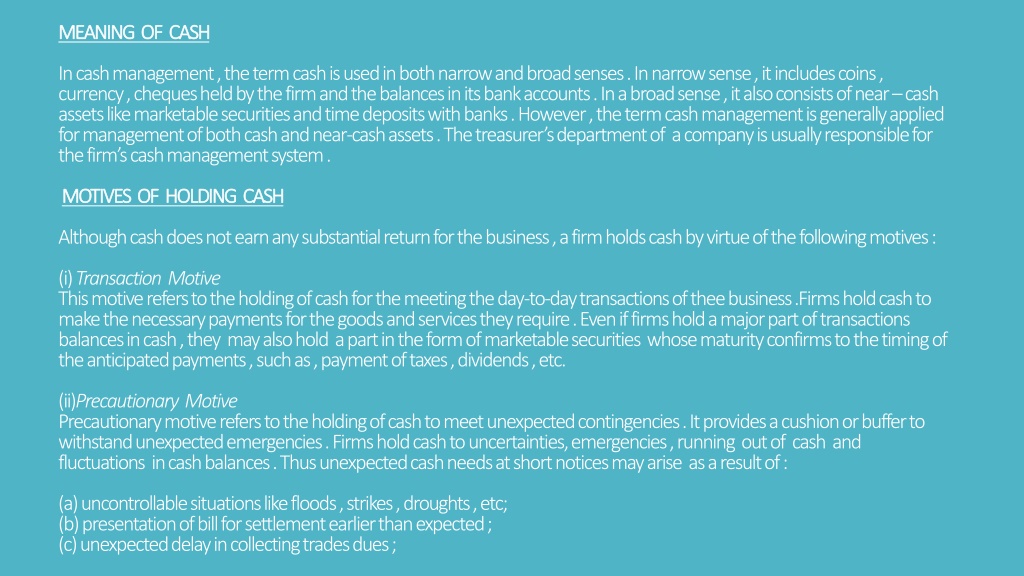

MEANING OF CASH MEANING OF CASH In cash management , the term cash is used in both narrow and broad senses . In narrow sense , it includes coins , currency , cheques held by the firm and the balances in its bank accounts . In a broad sense , it also consists of near cash assets like marketable securities and time deposits with banks . However , the term cash management is generally applied for management of both cash and near-cash assets . The treasurer s department of a company is usually responsible for the firm s cash management system . MOTIVES OF HOLDING CASH MOTIVES OF HOLDING CASH Although cash does not earn any substantial return for the business , a firm holds cash by virtue of the following motives : (i) Transaction Motive This motive refers to the holding of cash for the meeting the day-to-day transactions of thee business .Firms hold cash to make the necessary payments for the goods and services they require . Even if firms hold a major part of transactions balances in cash , they may also hold a part in the form of marketable securities whose maturity confirms to the timing of the anticipated payments , such as , payment of taxes , dividends , etc. (ii)Precautionary Motive Precautionary motive refers to the holding of cash to meet unexpected contingencies . It provides a cushion or buffer to withstand unexpected emergencies . Firms hold cash to uncertainties, emergencies , running out of cash and fluctuations in cash balances . Thus unexpected cash needs at short notices may arise as a result of : (a) uncontrollable situations like floods , strikes , droughts , etc; (b) presentation of bill for settlement earlier than expected ; (c) unexpected delay in collecting trades dues ;

(d) hike in material and labour cost ; and (e) Cancellation of some orders for goods on account of poor quality . The more the possibility of such contingencies , the more is the amount that a firm is required to keep in facing them . Sometimes , a portion of such cash balances may also be held in marketable securities . (iii)Speculative Motive Speculative motive refers to the holding of cash to take advantages of unexpected opportunities as and when they arise. Sometimes firms hold cash balances above the precautionary level of cash balance to : (a) take advantage of speculative investment opportunities (b) exploit discounts for prompt payment ,(c) improve credit rating , etc . Thus speculative motive is positive and aggressive in nature as against the defensive nature of precautionary motive . (iv) Compensation Motive Usually , banks provide some services to their customers free of charge . Thus they require clients to keep a minimum cash balance with them . This helps them to earn interest and thus compensate them for the free services so provided . Normally , business firms do not enter speculative activities . Thus the primary motives behind holding cash/marketable securities are : the transactions and the precautionary motives. Objectives of Cash Management Objectives of Cash Management The basic objectives of cash management are as follows : (i) Meeting cash disbursement , and (ii) Minimising funds locked up as cash balances .

(i) Meeting Cash Disbursement The first and foremost objective of cash management is to meet the payment schedule . In other words , a firm should have enough cash to meet its various requirements such as payment for purchase of raw materials , wages , taxes , purchase of plant , etc . Thus it is needless to say that all the business activities should remain standstill unless proper payment schedule is maintained . Thus cash is aptly described as the oil to lubricate the everturningwheels of the business , and without it , the process grinds to a half . (ii)Minimising Funds Locked Up as Cash Balances Another objective of cash management is to minimise the amount locked up as cash balances. Usually, the financial manager is confronted with two conflicting views while attempting to do so . On one hand , although the higher cash balance ensures proper payment , this will result in a large balance of cash remaining idle . On other hand , if a firm keeps its cash balance at low level , it cannot meet its payment schedule . Thus the financial manager should try to have an optimum cash balance by taking into account the above facts . PROBLEMS OF CASH MANAGEMENT PROBLEMS OF CASH MANAGEMENT The problem of cash management can be examined under four heads . They are : 1. Controlling level of cash 2. Controlling inflow of cash 3. Controlling outflow of cash 4. Optimum investment of surplus cash

1. Controlling level of Cash 1. Controlling level of Cash One of the fundamental objectives of cash management is the minimisation of the level of cash balance with the firm . This goal can be accomplished in the following ways : (i) Preparing cash budget (ii) Providing for unpredictable discrepancies (iii) Availability of other sources of funds (iv) consideration of short costs . (i)Preparing Cash Budget Cash Budget is an important device to forecast the predictable discrepancies between cash inflows and outflows . It reveals the timing and size of net cash flows and the periods during which excess cash may be available for temporary investment . In large firms , the preparation of cash budget is almost a full-time exercise and it is a common practice to delegate this responsibility to the controller or the treasurer . But in the cash of small firms its preparation is relatively a minor job as it does not involve much of complications . (ii) Providing for Unpredictable Discrepancies Although cash budget predicts discrepancies between cash inflows and outflows on the basis of normal business activities , it does not consider discrepancies between cash inflows and outflows through unforeseen situations such as strikes , short-term recession , floods , etc . These unforeseen events can either interrupt cash or cause a sudden outflow . Thus a certain portion of cash balance is to be kept for meeting such contingencies and this amount is fixed on the basis of past experience and some intuition regarding the future .

(iii)Availability of Other Sources of Funds A firm may have external sources to obtain funds on short notice . If a firm has to pay a slightly higher rate of interest than that on a long term debt , it can avoid holding unnecessary large balance of cash . (iv) Consideration of Short Costs The cost which as a result of shortage of cash is called the short cost . Such costs may arise in any of the following forms : (a) If a firm fails to meet its obligation in time , the creditors any file suit against it . In such a situation , the costisincurred in terms of fall in the firm s reputation apart from financial costs to be incurred in defending the suit. (b)Sometimes , a firm may resort to borrowings at high rates of interest . In such a situation , if the firm fails to meet its obligation to bank in time , it is required to pay penalties 2. Controlling Inflows of Cash 2. Controlling Inflows of Cash In order to manage cash effectively , the process of cash inflow can be accelerated by way of systematic planning and refined techniques . Thus an important problem for the financial manager is to control cash inflows . He has to devise action not only to prevent fraudulent diversion of cash receipts but also to speed up collection of cash . However , the proper installation of internal check can minimise the possibility of misuse of cash . Moreover , collection of cash can be expedited through the adoption of various techniques such as (a) concentration banking and (b) lock-box system . These techniques have been found to be very useful and effective in the United States of America .

(a) Concentration Banking It is system of decentralisation collection of accounts receivable in the case of big firms having business spread over a large area . Under this system , the firm establishes a large number of collection centres in different areas selected on geographical basis and opens its bank accounts in local banks of different areas . These collection centres are required to collect and deposit remittances in local banks and from the local banks they are transferred to the firm s head office bank . However, fast movement of funds is effected by , means of wire transfer or telex . The system of concentration banking has the following advantages : ( (i i) Reduction of Mailing Time : ) Reduction of Mailing Time : Under the system of concentration banking , as the collection centres themselves collect cheques from the customers and immediately deposit them in local bank account , the mailing time is reduced . Further , the mailing time is sending bills to the customers can also be declined if the local collection centres are also used to prepare and send bills to customers in their areas . (ii) Reduction Of Time Required to collect Cheques : (ii) Reduction Of Time Required to collect Cheques : As the cheques deposited in the local bank accounts are usually drawn on banks in that area , the required to collect cheques also comes down . (iii) Expediting Collection of Cash : (iii) Expediting Collection of Cash : The system of concentration banking also helps in quicker collection of cash . (b) Lock Box System Lock box is a post office box maintained by a firm s bank that is used as a receiving point for customer remittance . Lock- box system is another step in expediting collection of cash . This system is developed to eliminate the time gap between actual receipt of cheques by a collection centre and its actual depositing in the local bank account under concentration banking . Under lock-box system , the firm hires a post office box and instructs its customers to mail their remittances to the box .

The firms local bank is given the authority to pick up the remittances to the box . The firms local bank is given the authority to pick up day . It deposits the cheques , clears them locally and credits the cash in the firm s account . Local banks are given standing instructions to transfer funds to the Head office when they exceed a particular limit . The following are the advantages of lock-box system . (i) It helps to eliminate the time lag between the receipt of cheques by a firm and their deposit into the bank . (ii) This system helps to reduce the overhead expenses . (iii) It facilitates control by separating remittance from the accounts section . (iv) It also helps to reduce the credit losses by speeding up the time at which data are posted to the ledger . Apart from the above systems , the firm adopt other systems also for prompt collection . 3. Control Over Cash Outflows 3. Control Over Cash Outflows In order to conserve cash and reduce financial requirements , the firm should have strong control over its cash outflows or disbursements . It aims at slowing down disbursements as much as possible as against the maximum acceleration of collection in the case of control over inflows . However , the combination of fast collections and slow disbursements will result in the maximum availability of funds . A firm can beneficially control outflows if thee following points are considered : (i) The firm should follow the centralised system for disbursements as against decentralised system for collections . Under centralised system , as all payments are made from a single control account , there will be delay in presentation of cheques for payment by parties who are away from the place of control account . (ii) The financial manager should generally stress on the value of maintaining careful controls over the timing of payments

so as to ensure that bills are paid only as they become due . When a firm makes payment on due dates , it should neither lose cash discount nor its prestige on account of delay in payments . Thus all payments should be made on due dates , neither before nor after . (iii) The firm should adopt the technique of playing float for the maximising the availability of funds . The term float refers to the amount tied up in cheques that have been drawn but have not been presented for payment . Usually , there is a time gap between the issue of cheque by the firm and its actual presentation for payment . Consequently , the firm s actual balance at bank is greater than the balance as shown by its books . The longer the float period , the higher the benefit to the firm . If the financial manager can accurately estimate the dates on which the cheques will be actually presented for payment , the remittance shall be made by issue of cheques even if there is no balance in the firm s bank account in accordance with the books . In the course of time , he has to arrange funds so as to meet the payment of cheques the dates on which they are presented . For instance , a company issues cheques for Rs.5 lakhs to various creditors on a certain day after banking hours . On the next day itself , all these cheques will not be presented for payment. Some of them may be presented the next day while others may be presented in the next four-five days . But in the case of outstation cheques , even longer time may be taken . Thus a prudent finance manager should keep in his bank account only the amount required to clear the cheques likely to be presented for payment on that day . If he expects that only cheques for Rs . 2 lakhs and no excess will be arranged in the firm s bank account . Moreover, playing float is all the more essential when a firm does not get any return on idle cash lying in its current account with the Bank . Playing float is a risky game and the firm should play it very cautiously . However , the finance manager should have a close contact with the bank to ensure that no cheques issued by the firm are dishonoured due to insufficiency of funds as it may adversely affect the firm s goodwill .

4. Investing Surplus Cash 4. Investing Surplus Cash Cashin excess of the firm s normal cash requirement is surplus cash. It may be temporary or it may exist more or less on permanent basis . Temporary cash surplus is composed of funds that are available for investment on a short-term basis as they are required to meet regular obligations such as dividend and tax liabilities . Cash surplus may also be maintained more or less permanently as a hedge against unforeseen heavy expenses . Cash may also be accumulated over several years as a measure of a long-term plan . The basic problems regarding the investment of surplus cash as follows : (i) Determining the amount of surplus cash (ii) Determining the channels of investment . (i) Determining the amount of Surplus Cash Cashkept by the firm in excess of its normal needs is called the surplus cash . Thus the finance manager is required to consider the minimum cash balance that the firm should keep to avoid the cost of running out of funds , while determining the amount of surplus cash . Such minimum level may be termed as the Safety level for cash . Determination of Safety Level of Cash : Determination of Safety Level of Cash : While determining the safety level of cash , the finance manager should consider both normal and peak periods . In these cases , he should decide the desired days of cash ,i.e., the number of days for which cash balance should be sufficient to cover payments and the average daily ash outflows i.e., the average amount of disbursements which will have to be made daily . Having determined both the desired days of cash and the average daily cash outlaws , the finance manager can compute the safety level of costs as under : During Normal Periods : During Normal Periods : Safety level of cash = Desired days of cash x Average daily Cash Outlaws For instance in case it is felt that a safety level should provide sufficient cash to cover cash payments for ten days and the

firms average daily cash outflows are Rs. 10,000 , the safety level of cash is Rs. 1,00,000 (i.e., 10 x 10,000) . During Peak Periods : During Peak Periods : Safety level of cash = Desired days of cash at the peak period x Average of highest daily cash outflows . For instance , during the four peak days in the month of January , the firm s cash outflows were Rs. 7,000 , Rs. 8,000 , Rs. 10,000 and Rs. 11,000 . The average cash outflows come to Rs. 9,000 . In case the manager likes to have enough cash for covering cash payments for six days during the peak periods , the safety level should be Rs. 54,000 . These ratios are highly useful in monitoring the level of cash balances . The finance manager of a firm should compare the actual cash balance with the daily cash outflows to find out the number of days for which cash is available . He should then compare such number of days with the desired days of cash to determine whether the firm is below or above the safety level.