Best Practices for ARF Reimbursement Process at OSU

Explore the best practices for ARF reimbursement processes at OSU, including payment methods, FX/FG indices utilization, ARF reimbursement steps, and more. Learn how to pull expense data, complete templates, and submit forms efficiently for reimbursement. Clear your FX/FG indices through the reimbursement process and ensure accurate tracking and reconciliation for various ARF accounts.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

OSU Best Practices for ARF Processes

Overview Payment Methods oFX/FG indices oDirect Payment oFA indices Tracking Reconciliation oARF Reconciliation oOSU Reconciliations Questions/Comments

Payment Methods FX/FG Indices FX/FG indices are flow through indices. Think of them like a credit card. You can use them to pay for things but they are not directly linked to a funding source. FX indices are used for expenses that will be charged to ARF contract accounts. ARF accounts ending in an A or a C (ex: 1234C or 5678A) FG indices are used for expenses that will be charged to ARF gift accounts. ARF accounts ending in a G (ex: 1234G)

Payment Methods FX/FG Indices Since FX/FG indices are not directly connected to ARF funding, these accounts need to be cleared using the reimbursement process. Expenses charged to FX/FG Cashiers deposit check to the appropriate index Reimbursement sent to ARF The reimbursement process allows you to tell ARF what expenses need to be charged to which ARF accounts. When ARF receives the reimbursement they post the expenses to the appropriate account and then send a check to OSU to offset the expenses in the FX and/or FG index. ARF posts expenses to ARF accounts ARF sends check to OSU

ARF Reimbursement Process Overview Use Data to Complete ARF AP Invoice Template Complete ARF Payment Request Form Get Pull OSU Expense Data Save Forms in Required Formats Submit to ARF for Payment Business Center Approval

ARF Reimbursement Process Step 1: Pull your expense data. CORE report FIN1922. Gives detailed payroll data. Pulls transaction detail and commodity detail for expenses. Timing is important. We recommend completing reimbursement after the prior month has closed. This allows you to select the posting period you would like to reimburse while capture all expenses.

ARF Reimbursement Process Step 2: Complete the ARF AP Invoice template using the data from FIN1922 The AP Invoice template has two tabs, one for service and supply (S&S) expenses and one for labor expenses. Vendor ID is left blank The AP Invoice template requires you to create an invoice number for each expense. Invoice numbers for service and supply expenses = Index-Activity Code-Doc Code Invoice numbers for labor = Index-Activity Code-Period-Last Name 20 character limit

Labor Invoice Number S&S Invoice Number

ARF Reimbursement Process Step 2 (Continued) Add the Transaction Description or Commodity Description from your FIN1922 data to your Description column for S&S expenses. Labor does not need a description because the invoice number is descriptive. Transaction Description Commodity Description Add the expense total from your FIN1922 data Net column in the Invoice Amount column For labor, you can break labor down as it is listed in FIN1922 or you can add the labor items together.

FIN1922 Data Separate Salary & OPE Add Salary & OPE Together

ARF Reimbursement Process Step 2 (Continued) Add the Transaction Date from your FIN1922 data to the Invoice Date column Labor invoice date is always going to be the last day of the prior month Input the ARF account that the expense should be charged to in the Project ID column

ARF Reimbursement Template Spreadsheet automates step two of the reimbursement process. Formulas pull the relevant data from FIN1922. S&S invoice numbers are created for you. Labor invoice details are prepopulated with the correct number of characters. Two tabs, one for S&S expenses and one for labor.

S&S Formula Cells Labor Formula Cells

ARF Reimbursement Template Pros: Expedites step 2 by pulling S&S data and most of labor data into the needed format. There is a how-to guide to navigate the spreadsheet. Troubleshooting guide provided. Cons: Requires some Excel knowledge to copy and paste data. Formulas are used, so troubleshooting may sometimes be required.

ARF Reimbursement Process Step 2: (Continued) Sum expenses on both the S&S and labor tabs. Sort your expenses by Invoice Amount so that credits are on the top. In the Total positive row sum all expenses. In the Total negative row sum all credits. The Grand total row should add the total positive and total negative amounts together.

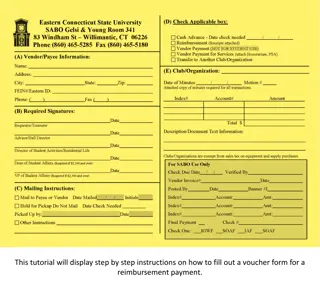

ARF Reimbursement Process Step 4: Complete the Payment Request form Important fields: Transaction Code ** The Index Payment (FG/FX) should always be checked. Department Date Amount ** It is easiest to list the total amount being reimbursed. ** This cell should have two decimal points. Check Payable To ** This should be Oregon State University (Index you want reimbursed). See Payment Request Example Document

ARF Reimbursement Process Step 5: Save Excel copy of your AP Invoice template and combine Payment Request and AP Invoice template to a pdf. The pdf copy is to allow for BC approval signature (see next step). The Excel copy is for Charlene to use when she inputs the reimbursement in the ARF system. Step 6: Business Center Approval signature. This keeps unit accountants in the loop if they are not the ones completing the form. Step 7: Send to ARF. Send both the pdf of the combined forms and Excel version of Invoice form to ARF via e-mail to arf@oregonstate.edu.

Payment Methods Direct Pay Direct pay request allows you to pay expenses directly from the ARF account. This method is typically used for expenses that are not allowable by OSU fiscal policy (ex: Alcohol included with a dinner). This process can be initiated and completed by the unit/department.

Direct Pay Process Step 1: Complete Payment Request form. Transaction Code Select the most appropriate code for the expense. Department Date Invoice Date The date of the expense. Invoice number If there is one. ARF account ARF account being charged. Amount Total of the expense. Check Payable to Who should receive the payment. Reason for Expense Why was the expense incurred. See Direct Pay Example

Direct Pay Process Step 2: Add any backup (receipt, invoice, etc.). Step 3: Send Payment Request form out for signing. Signatures needed: The person in charge of the ARF account being charged The unit/department head The unit accountant Step 4: Submit signed Payment Request to ARF for payment via e-mail (arf@oregonstate.edu).

Payment Methods FA indices FA indices are created and monitored by OSRAA. To request an FA index the faculty member must be receiving at least $50k in ARF funding over a period of five years. To apply for an FA index a proposal must be submitted through Cayuse with a five year projected budget and justification. Funding for the index is transferred from the faculty s ARF account using a FA Budget Increase form and the faculty member charges ARF related expenses to their FA index.

Payment Methods FA indices FA index setup tips: When helping your faculty set their five year budget include as many expenditures scenarios as possible. Foreign travel Equipment GRA s Testing incentives FA budgets during the index setup process act as a ceiling, so make sure to set a ceiling that is high enough to accommodate five years of research.

FA Budget Increase Process Step 1: Talk to your faculty about their future plans FA index and check current FA index balance. Step 2: Complete the FA Budget Increase Request form. Required fields: Date Department OSU Index Number PI Name Funding Source Budget Contract End Date Step 3: Send completed form to ARF using ARFFARequests@oregonstate.edu. See FA Budget Increase Example

FA Budget Increase Process Items to keep in mind: The intention of FA indices is that budget is added to the index before spending occurs and that the faculty member has let you know what they intend to use the funding on before they spend it. Remember to talk to your faculty member before completing an FA Budget Increase Request. The faculty member needs to tell you where they want to pull funding from and what they intend to use the funding on, so you can do your part. It is a good idea to keep a record of the transfers that have gone to the FA index. A basic table is sufficient for this process.

Tracking We need to be keeping our own record of ARF transactions so that we can complete an accurate reconciliation. Having a tracking log allows you to give faculty more accurate balances. A tracking log can take many forms. There are two types of tracking templates used at the College of Ag. ARF Tracking Template Includes pivot tables and Vlookup functions. No how-to currently but happy to give a training. Tracking Spreadsheet Basic tracking tool.

Reconciliation Both the OSU and ARF records must be reconciled on a regular basis. Reconciliation of ARF records At least once per quarter Run ARF Financial Edge report and reconcile to tracking sheet Reconciliation to OSU records At least semi annually Run FIN1909 in CORE to check that FA transfers have been completed. Run FIN1922 in CORE to check that FX/FG reimbursements have been received.

ARF Reconciliation Use the Financial Edge ARF Month End Statement report. You can use multiple filters with this report. Filter account information by faculty member, department, or account number. Filter dates by fiscal year, period, or specific time frame. Choose to look at accounts totals or account detail. Filter out projects that have no activity and/or zero balances. If you find discrepancies between your tracking log and the ARF records: Double check the last month ARF posted. It could be that ARF has not posted the month that your transaction took place. Contact Charlene Wilkinson (Charlene.Wilkinson@oregonstate.edu).

OSU Reconciliation FA Budget Reconciliation To check all budget entries that have been made to an FA index, use CORE report FIN1909. Budget total should match the FA budget total listed in GRS. If it does not, check the transfer was made by ARF using the Month End Statement report. Check with OSRAA about whether the FA budget increase is in process.

OSU Reconciliation FX/FG Reconciliation To check that reimbursements have been posted accurately to your FX and FG indices run CORE report FIN1922.

OSU Reconciliation FX/FG Reconciliation tips: Due to year end expenses posting to the prior fiscal year into the beginning of July and cash/check deposit cut off being June 30th, your FX/FG index balances will never equal zero in the FIN1922 report. August Early September Late July Early August Early-Mid July Late June Before June 30th ARF sends check to OSU Prior year expenses stop posting Send reimbursement to ARF for prior year expense ARF sends check to OSU Last day to submit ARF reimbursements

Contact Information Natasha Gaspar, Financial Services Manager for College of Agricultural Sciences Natasha.gaspar@oregonstate.edu Also available on Teams, Zoom, and on campus meetings as needed.