Dual-Fuel Vehicles Return Model Analysis

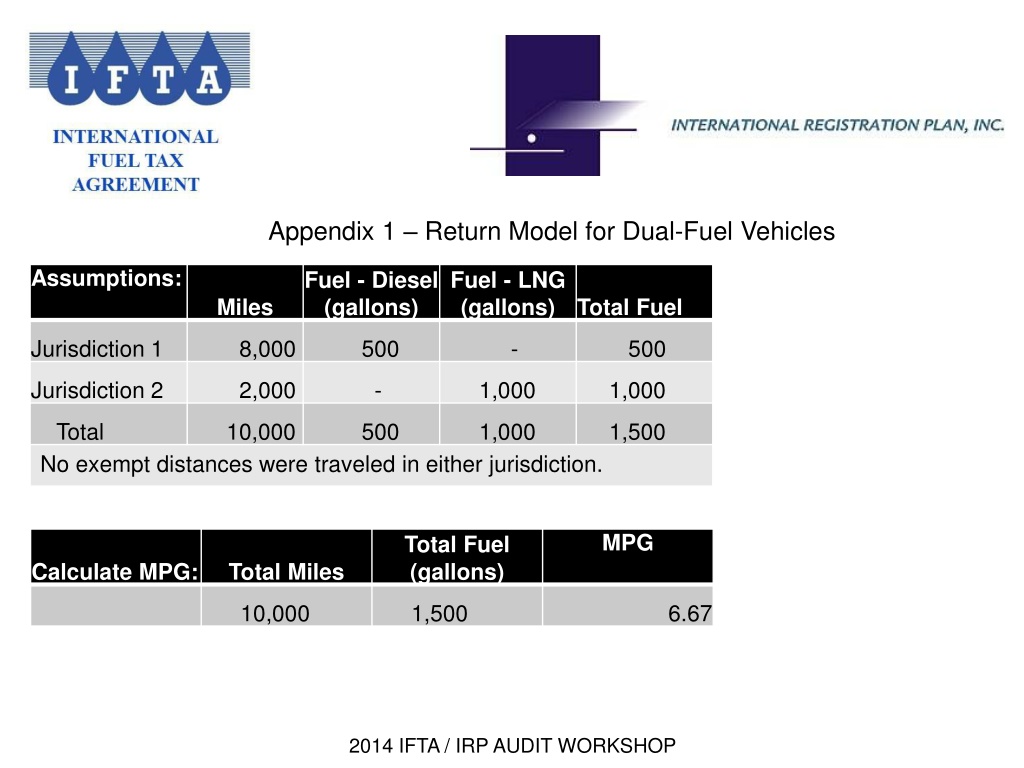

The analysis focuses on a return model for dual-fuel vehicles, considering the fuel consumption, miles traveled, MPG, prorating of miles by jurisdiction between fuel types, and tax calculations for diesel and LNG fuels. It emphasizes the importance of accurately showing miles by state to avoid confusion in calculations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Appendix 1 Return Model for Dual-Fuel Vehicles Assumptions: Fuel - Diesel (gallons) Fuel - LNG (gallons) Miles Total Fuel Jurisdiction 1 8,000 500 - 500 Jurisdiction 2 2,000 - 1,000 1,000 Total No exempt distances were traveled in either jurisdiction. 10,000 500 1,000 1,500 MPG Total Fuel (gallons) Calculate MPG: Total Miles 10,000 1,500 6.67 2014 IFTA / IRP AUDIT WORKSHOP

Prorate the Miles by Jurisdiction Between Fuel Types Total Fuel Fuel by Type Ratio Diesel 1,500 500 0.3333 LNG 1,500 1,000 0.6667 2014 IFTA / IRP AUDIT WORKSHOP

Diesel Form A B C D E F G H I Taxable Fuel Volume Net Fuel Type Total Distance Fuel Ratio Taxable Distance Tax Paid Volume Tax Rate (Diesel)Tax Due Juris. Taxable Volume dD J1 8,000 0.3333 2,666 400 500 (100) 0.2000 (20.00) dD J2 2,000 0.3333 667 100 0 100 0.1000 10.00 Subtotal 10,000 3,333 500 500 0 (10.00) 2014 IFTA / IRP AUDIT WORKSHOP

LNG Form A B C D E F G H I Taxable Fuel Volume Net Fuel Type Total Distance Fuel Ratio Taxable Distance Tax Paid Volume Tax Rate (LNG) Juris. Taxable Volume Tax Due dLNG J1 8,000 0.6667 5,334 800 0 800 0.0500 40.00 dLNG J2 2,000 0.6667 1,333 200 1000 (800) 0.1000 (80.00) Subtotal 10,000 6,667 1,000 1000 0 (40.00) TOTAL FOR BOTH FUELS 10,000 1,500 1500 0 (50.00) 2014 IFTA / IRP AUDIT WORKSHOP

Note: Although states don't want to see double miles, the miles by state has to be shown somewhere on the return or you lose a step in the calculation and preparers get confused. The calculation to allocate taxable distance could be made on a schedule separate from the return. 2014 IFTA / IRP AUDIT WORKSHOP